The current crisis has divided investors and commentators largely into two camps:

The bull camp – The bulls see Trump backing down from his extreme tariff demands and carrying out ‘the art of the deal’ with friend and foes. Though there might be a brief economic impact, inflation won’t spike, interest rates will come down, and that will spur economic growth and a renewed bull market in equities, the bulls believe.

The bear camp – The bears see an imminent US and global recession and stock markets not yet adapting to that reality. Even if Trump backs down from the large tariffs in place, it won’t be enough to prevent the shock that’s coming. And the bears think it mightn’t be a short and sharp downturn either, as moving away from globalisation will do long term damage to global growth and corporate margins and earnings.

The truth probably lies somewhere between these two extremes, though it’s impossible to tell.

Economists tell us with certainty that tariffs are always bad news and point to the 1930 Smoot-Hawley legislation that supposedly caused the Great Depression. The problem is that it didn’t cause the Depression and there’s genuine debate about how much it contributed to the depth and length of the depression that took place. The same economists also don’t talk about how the US and many other countries thrived in the second half of the 19th century when tariffs were consistently very high.

Some historians find Trump’s tariffs analogous to the Nixon shock of 1971 when the then US President took the dollar off the gold standard, implemented a 10 per cent import tariff, and introduced temporary price controls.

Others find parallels between Trump and China’s famous post-World War Two leader, Mao Zedong. Mao celebrated conflict and ‘permanent revolution’. His ‘Great Leap Forward’ to collective agriculture in 1957 resulted in more than 30 million deaths from starvation and famine-related illness. And later, in the 1960s, he launched a ‘Great Proletarian Cultural Revolution’ to fight bureaucratic resistance (the deep state) to his absolute power.

The problem with these views is that they try to find patterns from the past to make sense of the present and to forecast the future. The reality is that economies are infinitely complex and it’s difficult to determine the future with certainty. Also, though history makes for great stories and reading, the past is always different from current circumstances. Today’s world is nothing like the 1930s or the 1970s.

4 types of investors in crises

Because bear markets bring heightened uncertainty and emotion, investors often act in less than rational ways, and this downturn has been no different. Broadly, investors in crises fit into four categories:

The panickers. These investors sell out at the first sign of market trouble. It might be because they are young or novice investors. Or they’ve speculated and are horrified at the losses that they are enduring. Or they’ve read all the negative news and taken it to heart.

The buy the defensives. These investors switch from growth stocks to defensive shares, as well as bonds and cash, after the market has melted down. You can look at the amount of money going into Woolworth and Coles of late to see this phenomenon in action.

The buy the dippers. Ah, there are plenty of these investors! They’ve used the recent market turmoil to top up existing positions or buy new ones, because ‘the market is down 15% (or whatever it is) and that is an opportunity to buy’. Problems arise when these investors buy stocks just because prices are down. There’s a big difference between price and value, and just because a company’s shares have gone down in price, it doesn’t necessarily make them great value.

The procrastinators. These are the investors that are waiting for the bottom in markets ie. the ‘perfect time’ to buy stocks. The issue is that the market never announces when that time comes, and often these investors freeze and end up never buying, while consoling themselves that another time in future will be the ‘perfect time’ to invest.

What do these investors have in common? They’re generally not long-term investors and they don’t have a financial plan.

The benefit of being long term and having a plan is that you’re less likely to make rash decisions when crises happen. You’ll have the building blocks in place that you’ll largely be able to ignore what the market is doing.

As the late John Bogle said:

“My rule — and it’s good only about 99% of the time, so I have to be careful here — when these crises come along, the best rule you can possible follow is not “Don’t stand there, do something,” but “Don’t do something, stand there!”

Strategies to take advantage of this market meltdown

That said, there are tweaks that you can make to take advantage of market corrections and bear markets. Here are four ideas:

1. Rebalance or overbalance your portfolio.

This is an obvious one. If your 60/40 equities/bond portfolio has become 50/50, it makes sense to increase the equities allocation back to 60%.

A strategy for those who want to get a little more aggressive without going ‘all in’ on the market is to overbalance the portfolio. This means that instead of just rebalancing the portfolio from 50/50 back to 60/40 stocks/bonds, you could instead go 65/35 stock/bonds in anticipation of better long-term performance from equities given the lower prices on offer.

2. Buy listed investment companies at NAV discounts.

At times of market stress, LICs typically get whacked. First because of portfolio drawdowns. Second, because they trade at sometimes extreme discounts to their net asset values (NAVs). The current crisis is no different, and many good LICs are trading at +10% discounts to NAV, with some closer to 20%.

When markets eventually recover, you can benefit from increases to NAVs as well as a narrowing of the price discounts to NAVs (or they could trade at premiums).

3. Buy coiled-spring stocks.

While many investors hide out in defensive stocks and assets, a better strategy is to buy quality companies in cyclically challenged sectors. Think of retailers in Australia that are getting priced for the possibility of softer economic growth. Or stocks with US exposure like Aristocrat, where investors are thinking that the consumer there may soon be in trouble.

Source: Morningstar

4. Buying bombed out sectors.

The old saying is to buy when there’s blood in the streets. This requires guts and skill and is not for the faint hearted.

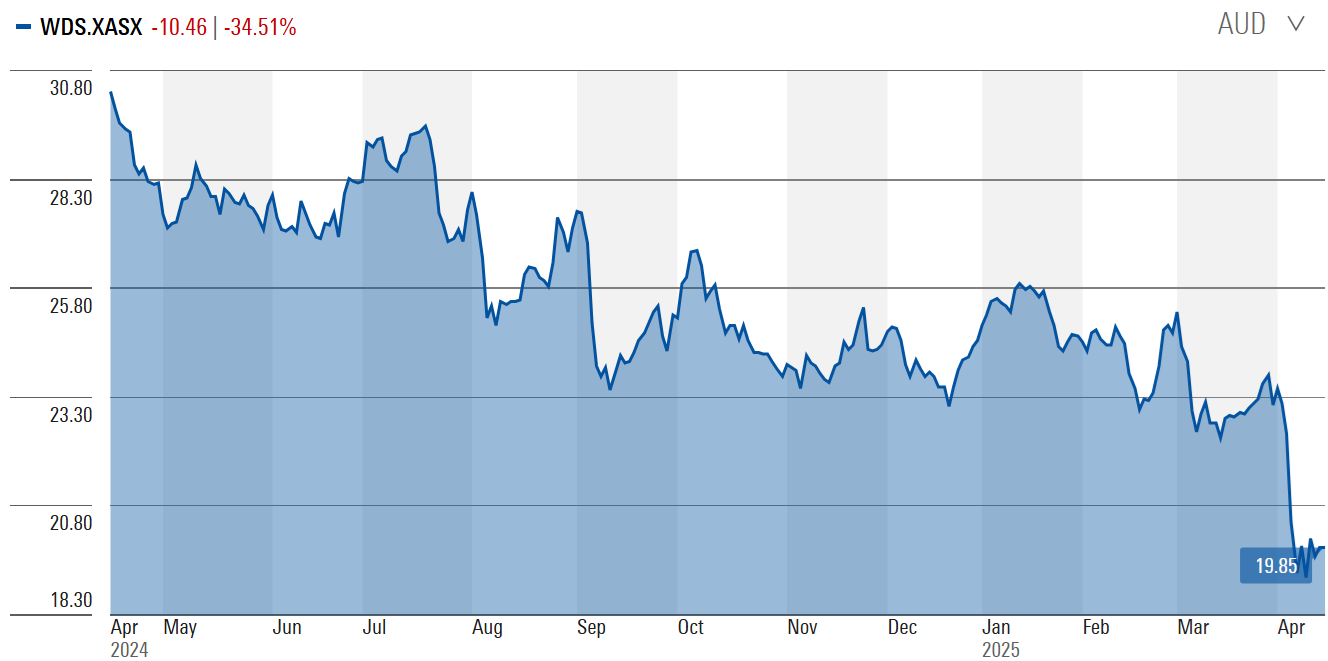

One sector that’s undoubtedly bombed out right now is oil and gas. Like in 2020, this sector is completely unloved, and yet the fundamentals of supply and demand don’t look as bad as current prices suggest.

Woodside share price

Source: Morningstar

James Gruber is Editor at Morningstar.