Introduction: Jonathan Gregory runs UBS fixed income portfolios from the UK with a global perspective. In the first point below, he discusses US TIPS (Treasury Inflation Protected Securities) which in Australia are more commonly called Treasury Indexed Bonds (TIBs). They are listed on the ASX like any other security but they do not trade actively, mainly due to the low yields. See, for example, ASX code GSIQ30 for a 2030 TIB. Information sheets and available securities are listed on this link, which also covers normal listed government bonds, including this statement:

“A financial adviser recommending to a retail client that they invest in this Treasury Indexed Bond via an Exchange-traded Treasury Indexed Bond must provide a copy of this Term Sheet and the current version of the Investor Information Statement for Exchange-traded Treasury Indexed Bonds to the client.”

There are also inflation-linked bonds from issuers such as Sydney Airport and Australian Gas Networks available through some fixed interest brokers for ‘retail’ investors who qualify as ‘sophisticated’. Therefore, most investors who want a ‘TIP-style’ investment to protect against inflation can source a security in Australia.

Which four steps can bond investors take now to reflect the current fixed income outlook? As COVID-19 wreaks havoc around the world, we look at how investors could be well positioned in bond markets to succeed in the new global economy.

If humans are ever to explore distant planets and the vast outreaches of space, scientists must decide how to keep people alive (and sane) through enormous journey times. Astronauts must arrive at their strange new destinations rested and ready to work, even after years of travel. Current thinking points to a form of hibernation where, at the outset, astronauts are chilled and metabolisms depressed to a fraction of their typical rate – so called ‘hypothermic torpor’.

So far, so much science fiction. But now governments, policy makers and economists around the world wrestle with a similar problem. How to safely put economies into hibernation so that companies and workers emerge from their sleep pods of isolation fit and raring to go when the COVID-19 crisis has passed?

Previous hibernation techniques will not work

Tried and tested techniques are of no use. In past downturns, policy makers have relied on approaches that supported current spending, for example, lower mortgage rates and tax cuts. But clearly these will not work today when consumers and business are in lockdown. If more direct life support was not provided, then productive capacity (both capital and labour) would be so damaged that a full recovery from the crisis would take years.

Instead, most countries have rightly taken a far more interventionist approach, and one that just a few weeks ago would have read like economic science fiction for many capitalist and market led economies, such as:

- an unprecedented peacetime expansion of fiscal spending

- tax and mortgage holidays

- corporate bailouts

- wage subsidies

- corporate loan guarantees

- unlimited quantitative easing

- extensive support for financial markets.

The numbers are staggering, with packages in many countries easily reaching 10-20% of GDP if fully exercised. And that is before we can be sure how the crisis will evolve and how the global economy will cope. We should not imagine we have seen the end of the life support.

The new global economy

The immediate problem is dealing with the havoc wreaked by COVID-19 to the demand and supply side. But so large are the numbers, and so frequent the announcements, that it is easy to become blasé about how extraordinary these government programmes are and how uncertain the long-term consequences will be. As every sci-fi movie-goer knows, when the sleep pods open and astronauts emerge bleary eyed into a new world, that is usually when the monsters appear.

It is too early to draw real conclusions about how the new global economy will look, but two things are at least are clear.

First, free spending by governments today, while necessary, risks unsustainably higher debt levels, higher borrowing costs and higher inflation in the future. Ultimately, deficits do matter and must be paid for.

Second, central banks must provide immense ongoing support for bond markets. A sharp move higher in government bond yields will undermine the fiscal policy response and therefore central banks will need to keep yields low to support its effectiveness. It is not hard to see some central bank mandates evolving away from today’s inflation targeting towards something that is much more explicit in keeping nominal yields low across the yield curve.

We see four steps bond investors should take today to reflect this changing outlook:

1. Get real

(Editor's note: See introduction for more Australian context).

Given the enormous rise in government spending, and our expectation that periods of higher inflation in many countries will follow, it makes sense to own securities with some in-built inflation protection. These are generally known as ‘real’, rather than ‘nominal’, bonds.

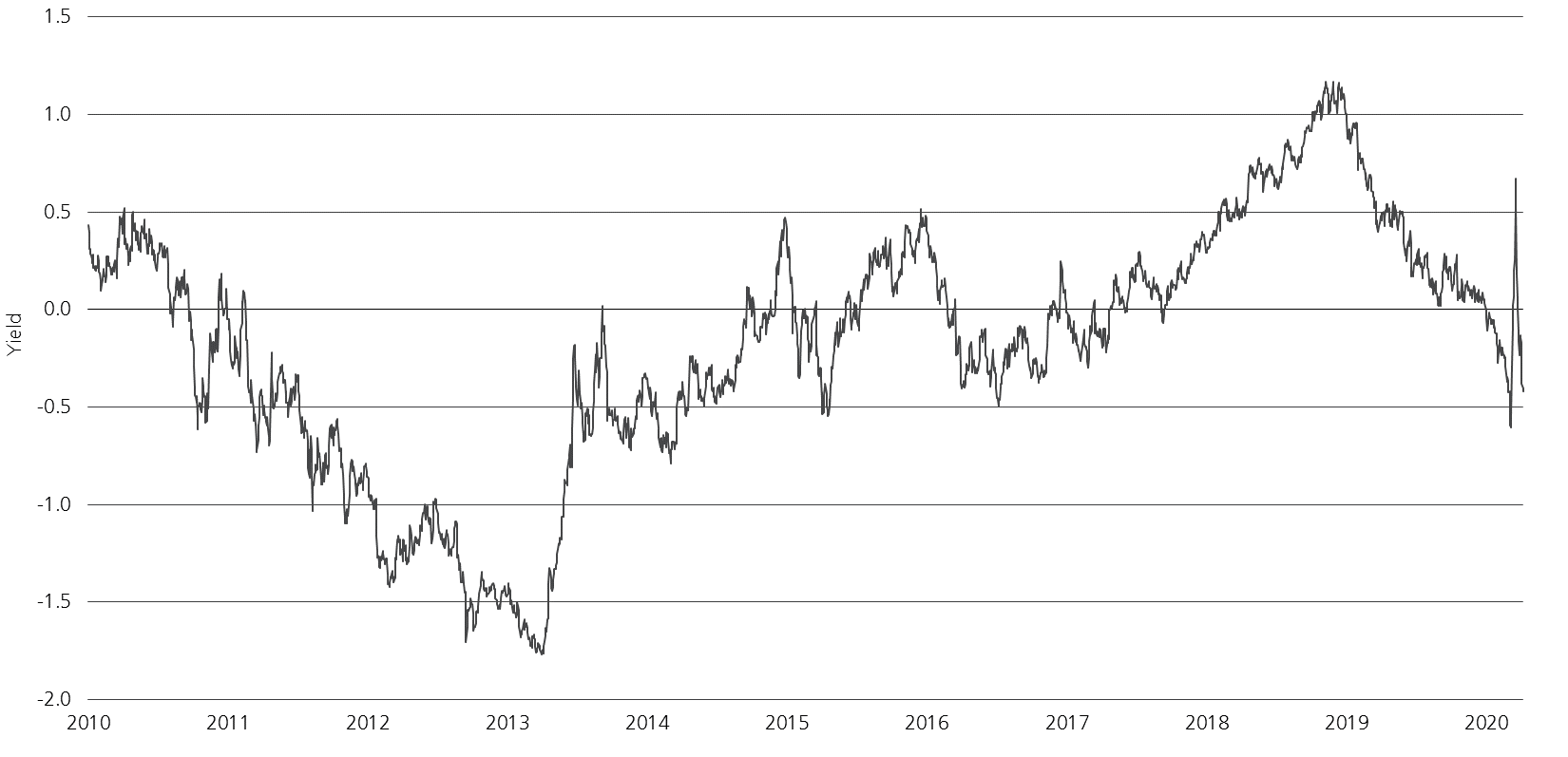

In the US, as the Federal Reserve keeps the policy rate at zero and Treasury yields low, higher inflation means that real yields will probably fall much lower, so real bonds will outperform nominal counterparts. US 5-year TIPS (Treasury Inflation Protected Securities) have a yield of about -0.40% as of 6 April. Back in 2013 the yield was around -1.7% and we anticipate those levels could be reached again. So our global bond portfolios maintain an allocation to inflation protected securities.

Evolution of 5-year US TIPS real yields

Source: Bloomberg, data as at 6 April 2020.

2. Buy what the central bank buys

Many central banks have eased recent market stresses by expanding asset purchases, becoming the buyer of last resort where liquidity was otherwise absent. For example, the Federal Reserve and the European Central Bank (ECB) launched programmes specifically targeting the investment grade corporate bond markets, bringing much needed stability.

For most of 2019 we had been cautious towards credit. But since the dramatic repricing of credit risk in March and now the Federal Reserve is providing almost unlimited support for parts of the market, we have become more constructive and selectively adding exposure, especially in the primary market.

3. Don’t write-off emerging markets

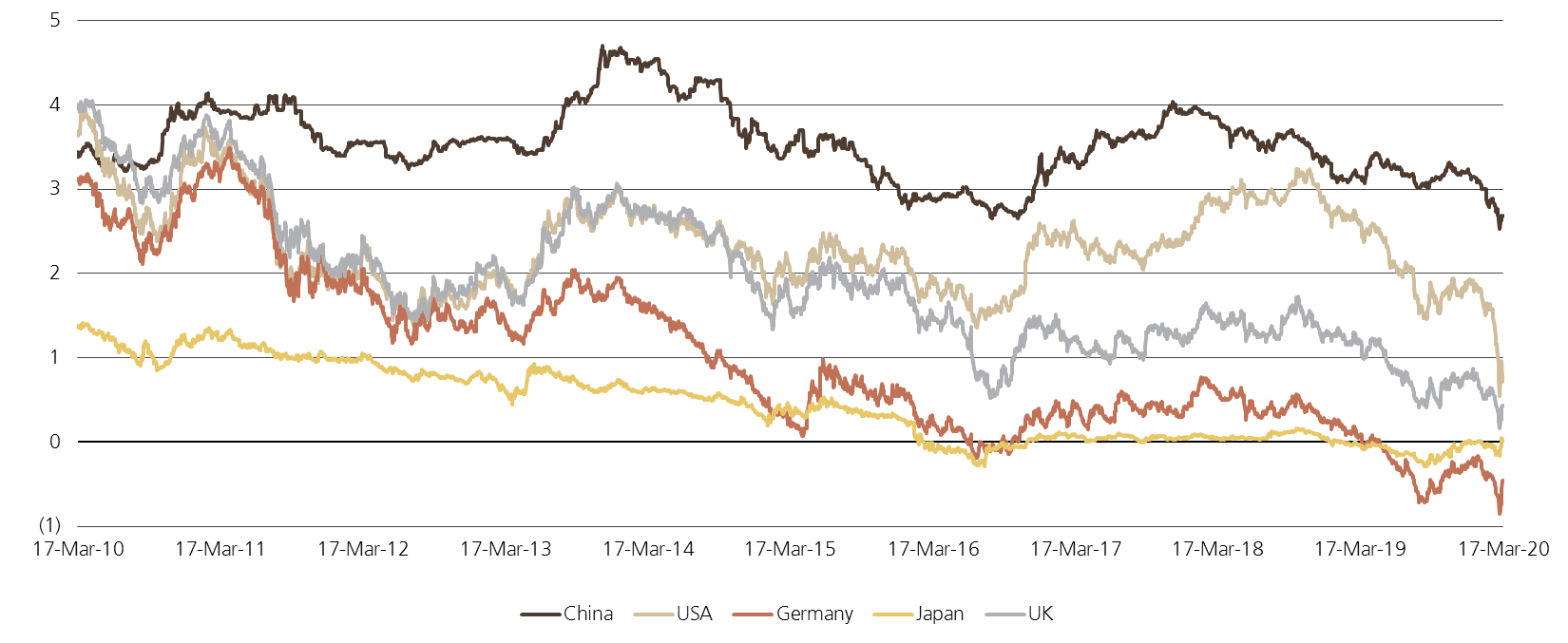

In the market panic of March, it seemed asset classes were sold down indiscriminately in a global flight-to-quality. Emerging market countries were among the worst performers, especially as the oil price shock hit oil exporters doubly hard. However, we have mentioned before how emerging countries claim an increasing share of global GDP and are underrepresented in global portfolios. The fact that developed market central banks’ have recently moved policy rates to zero does give further room to fall for policy rates and real yields in some emerging countries. China remains one of our top picks in global bond strategies.

10-year government bonds

Source: Bloomberg, data as at 17 March 2020

4. Think and act global

COVID-19 is the great leveler globally, affecting both rich and poor nations. So far, the responses to offset the economic shock, while varying in speed of delivery, have been remarkably similar: creative and dramatic fiscal and monetary interventions. The long-term impacts though are hard to gauge and will affect different countries in different ways. For example, the squabble between European countries on how to share the enormous costs of fighting the virus has opened old divisions around debt mutualisation. This could make an already difficult challenge even harder to negotiate. Investors must accept that the true impact of this crisis will be felt in different ways and evolve at different speeds around the world. The best option when facing this challenge is to keep a wide opportunity set available and be flexible and nimble in investment strategy.

COVID-19 is at first order a global public health crisis with extremely serious second order economic and financial market effects for the global economy. Governments and central banks do their best to ease the economic shock, but we are in totally uncharted territory when thinking about the longer-term effects. Bond investors must take steps now, at least to protect themselves against the more obvious longer-term risks, such as higher inflation, while looking for more tactical opportunities in assets that have repriced recently. We believe our flexible bond strategies are well placed to succeed in this environment.

Jonathan Gregory is Head of Fixed Income at UBS Asset Management in the UK and the lead Portfolio Manager on all Global Aggregate, Global Credit and UK Fixed Income Strategies. UBS is a sponsor of Firstlinks. For more information visit here.

Additional background is in this paper written in January 2020.