(Editor's introduction: Peter Thornhill is well-known to many of our readers, mainly for advocating a multi-decade investment strategy based on the long-term merits of industrial companies for income versus nearly every other asset class. For example, two of his previous articles in Firstlinks are here and here. In this new piece, he checks what he calls his 'mothership' chart, which shows the long-term return from industrial shares versus term deposits. It's his way of explaining that for investors with the right stockmarket risk capacity and investment horizon, the poor returns on term deposits represent a greater risk).

***

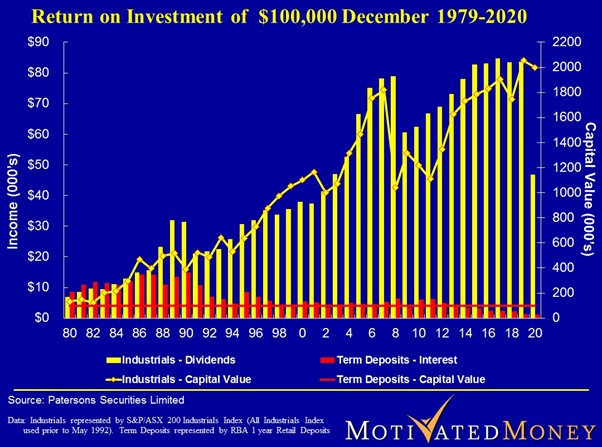

It was with bated breath that I waited for the year-end results and now that they are in, I can only say how pleased I am and how affirming they are. Let us begin with the ‘Mothership’ chart, the S&P/ASX200 Industrials Index compared to term deposits, which I have monitored since 1979 (when obviously interest rates were much higher).

Although the ASX200 Industrials Index fell by 35% to March 2020, by year-end it was only down 2%. Thus, at first sight, the large drop in the dividends of the index, -44%, is a bit daunting. Quite understandable though as every business was facing an uncertain near term with the impact of COVID.

But remember, we have been here before in 1991 and 2008, and we will go there again.

Massive opportunity cost of cash

It is also worth noting that whilst media commentary is dominated by shares, we should not ignore the other asset class, cash, the bolt hole for all frightened potential investors.

Whilst I acknowledge that cash doesn’t go up and down, the opportunity cost of holding it is large and often totally discounted in most people’s minds. If you thought the dividend drop above was hard to swallow, the income returns from deposits (the red) have fallen from their peak in the late 1980s by 80%. Not many headlines about the cash crash and death by a thousand cuts for investors.

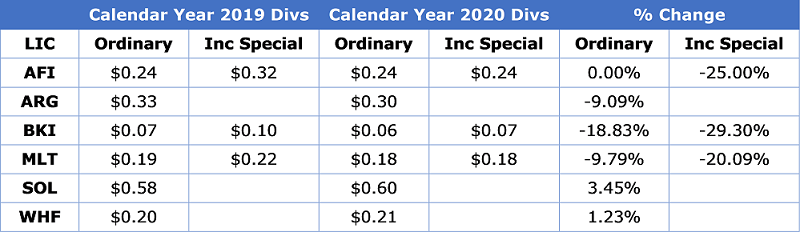

I have a personal preference for Listed Investment Companies (LICs) over managed funds, i.e., the difference between a corporate structure and a trust structure. The flexibility of the corporate structure enables LICs to retain income and capital gains for reinvestment and reserves, whilst trusts (managed funds and ETFs) must distribute all gains and income.

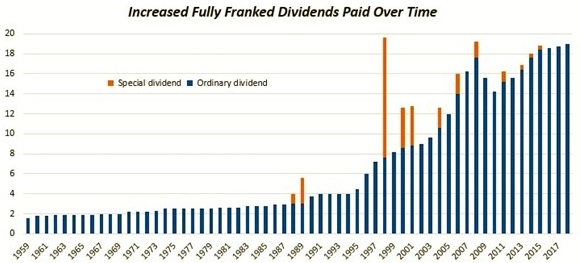

You can see below how the ability to retain profits provides flexibility and has enabled some of the major, long-established LICs to not only soften the dividend blow for their shareholders by using those retained profits but, in some cases, increase their dividends to shareholders this year.

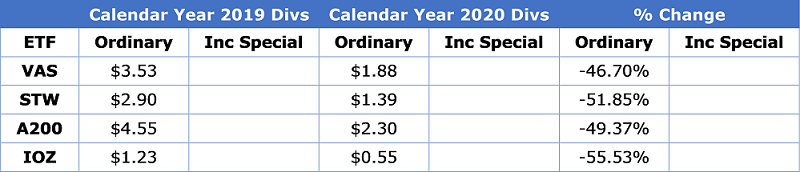

Now let’s look at some of the major index ETFs and their dividends.

With no ability to retain income in ETFs, their dividends reflect the full brunt of the actual dividend reductions.

Our personal portfolio

Now consider our personal portfolio. Our super fund has 27 holdings and roughly a quarter of them are LICs. Aided by the resilience of the LIC dividends, our total dividend income dropped by only 15% in 2020. I intend to go on winding down individual stock holdings, under advice from my financial adviser, and moving the proceeds into older-style LICs. The structure is a blessing as it increases our diversification and requires less involvement on my part.

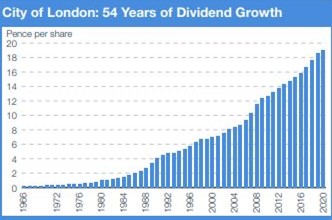

A purer example is my personal fund in the UK, a legacy of our 18 years there. It has only four holdings and all are LICs. I’m talking ‘hardcore’. Most of them are very old and two of them over 100 years old. Of this pair, one maintained its dividend whilst the other, founded in 1861, increased its dividend. This happens to be its 54th consecutive year of dividend increase and here’s what that looks like. It's a sight for sore eyes and minds ravaged by senseless media commentary.

In the midst of all this carnage, the result for us, from old blighty, was a small overall increase in our income for the full year.

Comfort from a simple strategy

I put my comfortable feelings down to several things.

First and foremost, we hold sufficient cash in our super fund to meet the next three years of Government-mandated minimum pension withdrawals. This ensures we are never forced sellers and provides dry powder for bargain-hunting on market dips.

Secondly, my investment philosophy is ‘benign neglect’, that is, stick to doing only what I am good at and outsourcing the rest.

Thirdly, my two golden rules: SPEND LESS THAN YOU EARN and BORROW LESS THAN YOU CAN AFFORD.

Finally is the consistency of the objective of the old LICs I invest in. For example, Milton’s Investment Philosophy is clear:

“Milton is predominantly a long-term investor in companies listed on the ASX that are well managed, with a profitable history and an expectation of increasing dividends and distributions. Turnover of investments is low and capital gains arising from disposals are reinvested.”

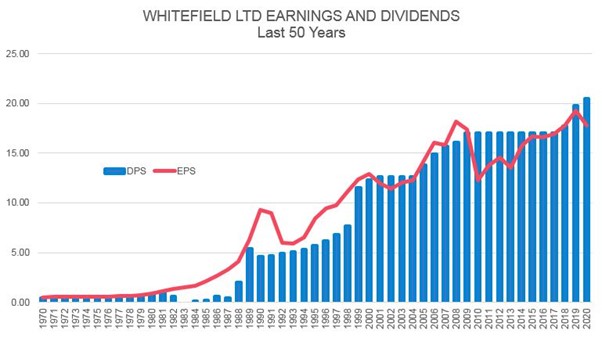

Another of my domestic favourites is Whitefield, particularly as it is industrial shares only, no resources:

“Whitefield Ltd is an ASX-listed investment company holding a diversified portfolio of ASX-listed Industrial (non-resource) shares. An investment in WHF Ordinary shares provides an investor with a stream of fully franked dividends as well as the potential to benefit from growth in the underlying value of the investment portfolio over time. The company was founded and listed on the ASX in 1923.”

None of the "we are a value, top down, bottom up, thematic" etc, etc.

The investment objective of City of London is a pearl:

“The Company’s objective is to provide long-term growth in income and capital, principally by investment in equities listed on the London Stock Exchange. The Board continues to recognise the importance of dividend income to shareholders.”

City of London as been around for over 160 years, with a simple investment discipline. How comforting that umpteen changes of staff over the decades have dedicated themselves to maintaining the discipline, unlike much of the fluff that has entered the market in recent decades.

A Happy New Year to all.

Peter Thornhill is a financial commentator, author, public speaker and Principal of Motivated Money. This article is general in nature and does not constitute or convey specific or professional advice. Share markets can be volatile in the short term and investors holding a portfolio of shares will need to tolerate short-term losses and focus on a long-term horizon, and consider financial advice.