The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

The guessing game with U.S. Federal Reserve moves continues. After Jerome Powell's speech this week, the consensus seems to be that while the size of interest rate hikes may fall, rates will peak higher than expected.

Of course, the key remains inflation. On that front, Amit Nath, believes the next U.S. CPI print may be an inflexion point for both inflation and consequently rates. Due to so-called base effects, he sees U.S. inflation growth moderating, which should be good news for investors.

While Fed machinations dominate headlines, more long-term issues continue to be the focus here at Firstlinks. And a big issue continues to be that of demographics.

In Australia, Millennials are about to overtake Baby Boomers as the largest generational group. The implications of this are detailed in a new report by the Australian Bureau of Statistics (ABS).

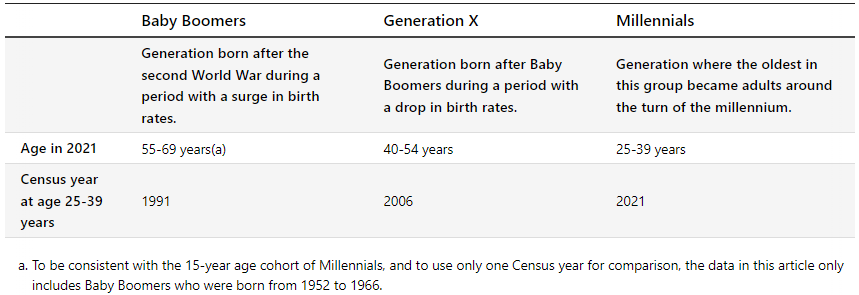

The report acknowledges that there isn't universal agreement on the names or data ranges of generations, but defines the generations per the chart below.

As can be seen in the chart, Millennials were aged 25-39 in 2021. The report goes on to compare Australians aged 25 to 39 years at three different time points - 1991 (Baby Boomers), 2006 (Generation X) and 2021 (Millennials).

The report finds Millennials are more mobile, much more likely to be overseas-born and are much less likely to attend church than previous generations.

The top countries of birth for Millennials, ex-Australia, are India and China. That compares with England and New Zealand for the Baby Boomers and Generation X in 1991 and 2006 respectively.

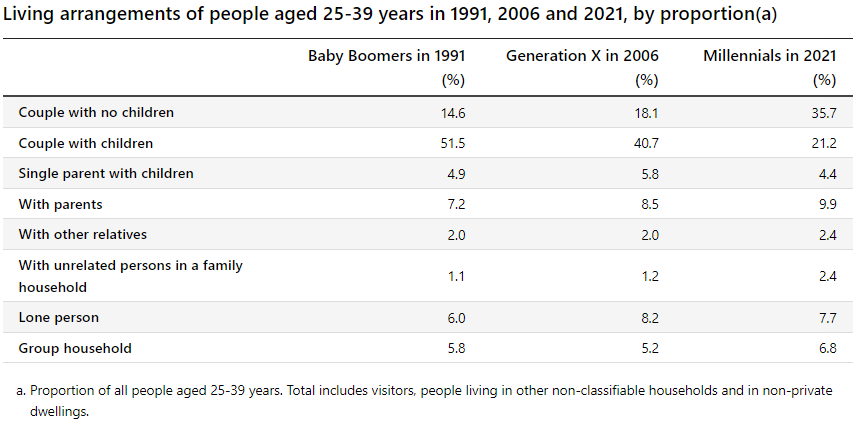

The living arrangements for the different generations are also markedly different. Millennials are less likely to have married or had children compared with Generation X and Baby Boomers back in their day. 53% of Millennials have never married, versus 44% of Generation X in 2006 and 26% of Baby Boomers in 1991.

It's also stark how many Millennial couples live together and don't have children, compared with previous generations.

Millennials having less children may have something to do with the price of houses. More of them are renting and living in apartments than prior generations.

Millennials are studying more too. Almost 80% of them have a non-school qualification (certificates, diplomas, degrees and postgraduate qualifications) compared with nearly two-thirds for Generation X in 2006 and less than half of Baby Boomers in 1991.

The modern-day thirst for higher education is understandable given that high-income earners invariably come from the university educated. Looking at the top 15% of income earners (high earners), almost two-thirds of high earning Millennials had a bachelor degree or higher, a much larger number than previous generations.

How Millennials fare in the coming decades will be a fascinating watch. They may get lucky given expectations that they could inherit up to $3.5 trillion over the next 15 years. Whereas financial advisers used to spend much of their time helping clients accumulate money, they appear to be dedicating more hours nowadays to helping Baby Boomers preserve and spend their wealth, as the chart from Russell Investments shows below. And soon Millennials will need advice on the assets they're going to inherit. It could be a busy time for the wealth advisory industry.

Also in this week's edition ...

Former Co-Chair of global consulting at Russell Investments, Don Ezra, looks at what those saving for retirement should do after a miserable year in markets. He has practical advice, particularly for those nearing retirement and for retirees.

Meanwhile, Noel Whittaker examines an innovative, new retirement income product. AMP has devised a product which combines an account-based pension with an annuity, and Noel believes it has merit.

Meg Heffron is back, this time summarising the Federal Budget's implications for superannuation. She says there wasn't a lot to get excited about, but then goes on to list a plethora of changes which will impact the sector.

We also investigate how recency bias, or extrapolating recent events into the future, has undone many investors, especially this year. The big issue is how investors can mitigate this common error and build a durable portfolio that can perform through market cycles.

While most investors are down in the dumps, Andrew Lockhart is more optimistic, specifically on private debt as an asset class. He thinks private debt can offer both capital preservation and attractive risk-adjusted returns in a rising interest rate environment.

Lastly, Christine Brown and her academic colleagues, Chloe Ho, Hue Hwa Au Yong, Chander Shekhar, delve deeper into the regulatory changes for capital raisings during the COVID-19 pandemic. They find that though these changes were temporary, they've impacted company behaviour on raisings ever since. And that's been to the benefit of retail investors.

In the weekend update by Morningstar, Nicola Chand highlights three undervalued Australian companies, while Brian Han sees upside in Nine Entertainment.

This week's White Paper from Perpetual Investments looks at the long and short of investing in volatile markets.

James Gruber

***

Weekend market update

On Friday in the US, stocks caught a decent bid to wrap up a rough week, with the S&P 500 rebounding 1.4% to narrow its year-to-date loss to 21%. The US Treasury curve steepened with the two-year yield dropping five basis points to 4.66% while the long bond settled at 4.27% from 4.18% yesterday, while pronounced US dollar weakness helped gold and WTI crude rip to $1,685 an ounce and $93 per barrel, respectively.

From AAP Netdesk: The local share market finished the week on a high note on Friday. The benchmark S&P/ASX200 index finished up 34.6 points, or 0.5%, to 6892.5. The ASX200 rose 106.8 points, or 1.57%, its second winning week in a row.

The energy sector was the biggest mover on Friday, finishing 3.4% higher in its best performance in three weeks. The heavyweight mining sector climbed 1.8%, with BHP up 1.5% to $38.56, Rio Tinto adding 2.5% to $92.80 and Fortescue Metals climbing 3.9% to $15.87.

In the financial sector, alternative investment manager Regal Partners tried to tank the $2.5 billion merger between fund managers Pendal and Perpetual with its own bid for Perpetual. Regal floated a figure of $30 a share. Perpetual shares gained 1% to $29.12, while Pendal dipped 0.2% to $4.51, and Regal climbed 1.8% to $2.85.

Among the big banks on Friday, CBA fell 1.4% to $103.05, Westpac retreated 0.7% to $25.50 and NAB declined 0.1% to $32.12. ANZ was the outlier, rising 1% to $24.14.

Looking forward, the US mid-term elections are on Tuesday, and then closely watched monthly US inflation data will be released overnight hours between Thursday and Friday, Australia time.

From Shane Oliver, AMP:

Shares saw another week of big swings, particularly with the Fed signalling that the peak in interest rates may be higher than previously expected. This saw US shares fall 3.3% for the week, but Eurozone shares rose 1.6% and Japanese shares rose 0.3%. Chinese shares rose 6.4% helped by talk of a relaxation in China’s zero Covid policy.

Central banks are slowing, or moving towards slowing, their rate hikes, but they are still hawkish and signalling we are not at the top yet. This started with the RBA dropping back to 0.25% hikes a month ago, the BoC dropping back to a 0.5% hike, the ECB sounding a bit less hawkish a week ago and in the past week the Fed opening the door to slowing down in December and the Bank of England pushing back against market expectations for how high it will raise rates.

The RBA is at the least aggressive end of the major central banks likely reflecting the higher sensitivity of Australian households to higher interest rates (due to high debt levels and short dated mortgages) along with slower wages growth compared to other countries. It hiked again in the past week citing high and still rising inflation (with it revising up its inflation forecasts to peak this year at 8% for headline and 6.5% for underlying) and its commitment to returning it to target. By the time the RBA meets in February there is likely to be enough evidence demand is slowing which will slow inflation for it to remain on hold, or if not just raise rates once more with 3.35% becoming the peak.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website