The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

There's never a dull moment at the Australian Securities and Investments Commission (ASIC) but the regulator is lax in allowing the exemptions from consumer protections in financial services to operate unchanged for 22 years. I was reminded of the risks when someone I know forwarded to me a transaction which is totally inappropriate for them as an inexperienced investor. The offer from a licenced dealer is a complicated transaction designed to fund the dealer's own company. The only relationship my acquaintance holds with the dealer is signing up for a newsletter but with no other 'Know Your Client' knowledge.

ASIC's role is to promote "a fair, transparent and efficient financial system for all" which covers a lot of ground. ASIC is often criticised when it loses a court case or fails to identify poor behaviour quickly. Regulating companies, banks, insurers, superannuation funds, financial advisers and credit providers is a never-ending whirlwind but it should also recommend updates to rules enshrined in legislation.

The ASIC Media Unit is a busy place. Consider these four recent announcements on consecutive days against AustralianSuper, PayPal, OTC derivatives and Westpac. Each of these projects would involve an enormous amount of background work before ASIC was confident enough to commence proceedings.

With all this work performed with meticulous care and an obligation to protect investors, it is surprising that ASIC does nothing to address the obvious shortcomings in the definitions of 'Sophisticated' investors, sometimes called 'Wholesale' or 'Experienced'. The definitions determine who needs to receive regulated disclosure documents, who can invest in complex transactions and who benefits from consumer protections.

Under section 708 (8) of the Corporations Act 2001(Cth.), a Sophisticated Investor is defined as having:

- Gross personal income over the last two years of at least $250,000, or

- Net assets of over $2.5 million

As proof, a Qualified Accountant must provide a certificate.

There are three obvious weaknesses:

1. Net assets includes the family home, and millions of Australians are now eligible as 'sophisticated' due to the rise in the value of their home. That makes them more like gullible targets than sophisticated in their investing.

2. The dollar limits have not been reviewed since they were set in 2001, and if values had been indexed to CPI, the net assets would be about $4.5 million.

3. Family accountants are accommodating when it comes to the wishes of their valued clients and anecdotally, the certificates are not hard to obtain.

The second exemption as 'Experienced' is as bad. In the Corps Act Section 708 (10), offers can be made by a licenced dealer following an assessment of merits and risks and information needs of the investor. This leaves it to the judgement of the dealer to market securities to almost anyone in order to make a sale and generate a commission.

ASIC needs to review these definitions as the door is wide open for unscrupulous activity, and at least remove the family home from the assets definition.

Anyone who believes all brokers and advisers and other financial services licensees only have the best interests of their clients at heart should be reminded of why selling commissions on capital raisings were banned. The finance industry loves the exemptions and it makes marketing easier but clients are giving up the consumer protections which exist for a reason.

***

Warren Buffett has warned many times not to underestimate Corporate America and its ability to generate profits in difficult markets. He said:

"I have yet to see a time when it made sense to make a long-term bet against America. And I doubt very much that any reader of this letter will have a different experience in the future. We count on the American tailwind and, though it has been becalmed from time to time, its propelling force has always returned."

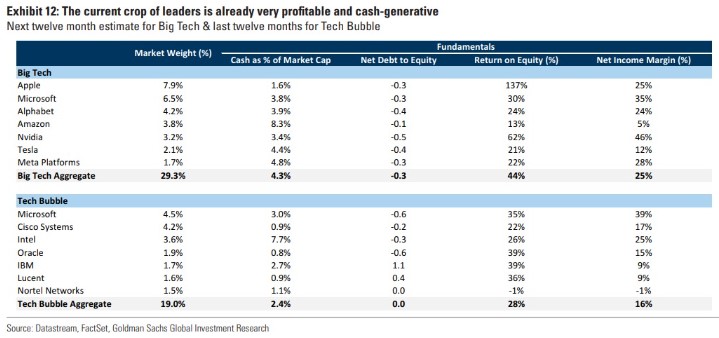

The Magnificent Seven companies that have driven the US S&P index higher in 2023 look expensive but they are much healthier than the leading companies in the Tech Bubble of 2000. The S&P 500 has risen 22% in 2023 but NASDAQ is up over 30%. Berkshire Hathaway recently announced a record quarterly profit of US$36 billion and cash of US$147 billion. Buffett's biggest problem is finding a way to invest it but at least he is earning a decent rate on short-term US cash and bonds.

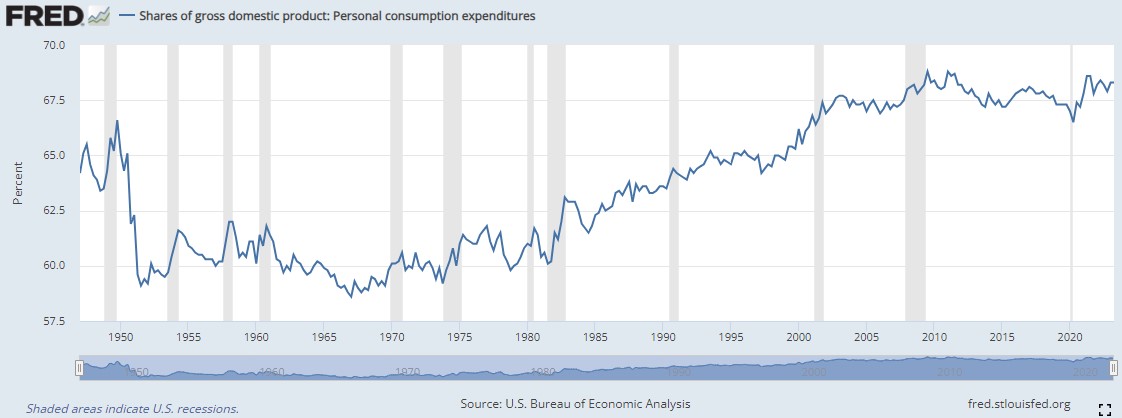

Bear in mind that the US economy is substantially self contained, with personal consumption expenditures by Americans as a percentage of GDP rising steadily over the last 50 years to about 70%.

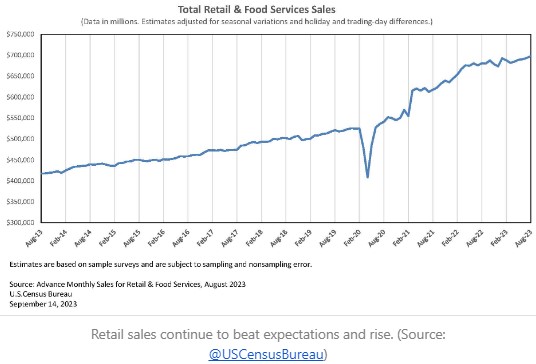

Confirming the resilience of the US consumer, despite rising rates and the threat of a recession, retail and food services continue to rise. So the big question for markets is whether rising oil prices and depleted savings will rein in spending. As usual, investors benefit from taking a long-term view, even if prospects for late 2023 and 2024 look rocky.

This is why the long run matters. Over a day or two or even a week, the chances of the market rising or falling is close to 50%, but the longer the time period, the more likely the market will rise. As Bespoke Investment Group in the US says:

“Historically, the odds of the S&P 500 being up over any one-month time frame have been 62.6%. Over a year, the odds of being up jump to 74.6%, and over eight years, they jump to 97%. Since 1928, all 16+ year time frames have seen positive returns.“

***

This week, we check the reasons why some managers of Listed Investment Companies (LICs) and Trusts (LITs) are winding up the structures in favour of listed or unlisted alternatives. Many other fund managers should do the same if they have the best interests of their investors prioritised but they will hang on to retain the fees.

Still on LICs and LITs, Claire Aitchison of Independent Investment Research gives a comprehensive review of the performance of many asset categories over FY23 and the dividends or distributions paid. It demonstrates how much of the total return is dependent on movements in the share price in and out of discount and premium, and even a good portfolio performance can be undermined by a heavy slip into a wider discount.

Graham Hand

Also in this week's edition...

Retiring means your salary stops and you need to fund your lifestyle using savings plus any social security entitlements. Jim Hennington from Apricot Actuaries looks at the best ways to maximise income so that it lasts through retirement.

Schroders says BHP and Rio Tinto have eerily similar mining exposures and they've never been more alike than they are now. Yet, it prefers one stock over the other. And analyst Sally Warneford also delves into ASX healthcare stocks and why the best days of CSL are likely behind it.

Some investors seeing the explosive share price performance of Nvidia are comparing it to Cisco in the 1990s. It raises the question about what your returns would have been like holding Cisco from its heyday in the mid 1990s to now, compared to a more staid stock such as a bank. Geoff Saab from Low Risk Rules has the answer.

This week's Wealth of Experience podcast features First Sentier's Rudi Minbatiwala explaining the best strategies for growing ASX dividend income, Graham Hand on investing for free (ish), and MFS' Anne Marie Bernard on incentivising fund managers and preventing stars from jumping ship.

Australian investors have fallen in love with bonds again as they now offer yields that haven't been there for a decade or more. But Jeremy De Pessemier and Ray Jia from The World Gold Council suggest a resurgence in inflation remains a key risk for bonds, and that's where gold can play a key diversifying role within an investment portfolio.

Two extra articles from Morningstar for the weekend. Analyst Shane Ponraj explains why he thinkgs ResMed's share price fall has been overdone, and Shani Jayamanne looks at Morningstar's favourable initiation report on PEXA.

Lastly, in this week's White Paper, Schroders looks at the advantages of private debt as an asset class in a slowing economic environment.

***

Weekend market update

On Friday in the US, it was a quiet session after broad-based losses the day before. Treasurys managed a modest bounce across the curve with 2- and 30-year yields dropping two and three basis points, respectively, to 5.1% and 4.53%, while the S&P 500 settled slightly below unchanged. Gold edged higher to US$1,925 per ounce, WTI crude rebounded above US$90 a barrel and the VIX stayed above 17.

From AAP Netdesk:

On Friday on Australia, the share market staged a remarkable recovery, bouncing off six month lows in early trading to rebound in the afternoon to finish the day flat. After falling 1.5% in the first 10 minutes of trading, the benchmark S&P/ASX200 index steadily clawed back its losses to finish Friday up 3.6 points or 0.05%, at 7,068.8. The broader All Ordinaries closed up 3.4 points, or 0.05%, to 7,270. For the week, the ASX200 lost 2.9% - its worst week in a year - but the rebound at least provided a ray of hope after the index dipped briefly into the red for the year.

Six of the ASX's 11 sectors finished in the green on Friday, and five in the red.

The interest-rate-sensitive property sector was the biggest mover, falling 1.5% as Goodman Group dropped 2.2% and Mirvac fell 2.3%.

The heavyweight mining sector gained 0.6%, with BHP up 0.5% to $44.34, Fortescue climbing 1.5% to $20.81 and Rio Tinto falling 1.2% to $114.57.

Among the Big Four banks, CBA was flat at $100.06, ANZ edged 0.1% lower at $25.03, NAB climbed 0.5% to $28.88 and Westpac gained 0.7% at $21.14.

From Shane Oliver, AMP:

- Global share markets mostly fell over the last week as “higher for longer” interest rate signals from the Fed and some other central banks pushed bond yields higher. A 2.9% fall for the week took the key direction setting US share market below its August lows establishing a downtrend from July. Eurozone shares lost 2% and Japanese shares fell 3.4% but the Chinese share market rose 0.8%. Bond yields rose on the back of higher for longer interest rate expectations, with the US 10-year bond yield rising to its highest since 2007. Oil prices rose but metal and iron ore prices fell. The $A rose slightly, despite a slight rise in the $US.

- Central banks at or near the top - but many signalling higher for longer. A key reason why we are concerned about a further correction in shares is that central banks whilst likely at or near the top are still leaning hawkish, particularly in terms of staying restrictive for longer, which is maintaining upwards pressure on bond yields. More central banks left rates on hold over the last week (the Fed, BoE and central banks in Switzerland, Taiwan, the Philippines, Indonesia, South Africa and Japan) than hiked (central banks in Norway, Sweden and Turkey) but most retain a tightening bias with several signalling higher for longer rates. In particular:

- The Fed left interest rates on hold but is still allowing for one more rate hike in its median “dot plot” of Fed officials interest rate expectations and raised its median “dot plot” expectations by 0.5% for each of the next two years on the back of upgraded growth and lower unemployment forecasts and despite still seeing inflation return to target by 2026. So, its expected pace of rate cuts over the next few years is substantially reduced. Our assessment is that the Fed’s growth forecasts are too optimistic and recession risk for next year remains high particularly as still rising bond yields will weigh even more on growth. But for now, the “higher for longer” rates message is serving to push bond yields up even higher.

- In Australia, the minutes from the last RBA meeting noted that while it left rates on hold it did consider hiking again and reminded that some further tightening may be required. Our view remains that the cash rate has peaked but the risks are skewed to another rate hike in the months ahead particularly given the risks of a near term uptick in inflation from higher fuel prices and the upside risks to wages growth. Given these risks we have decided to push out our expectation for the first rate cut from around March next year to around June.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website