Offense sells tickets, but defense wins championships.

- Paul 'Bear' Bryant

The momentum of Nvidia's stock price seems unstoppable. Many are comparing Nvidia’s historic run to a certain stock from the late 90’s, Cisco Systems (I drew the same comparison back in May). And so I thought this would be a good time to revisit a section from my book, Low Risk Rules that compares an early-90s investment in Cisco to a more conservative alternative.

The results might surprise you. With the benefit of this hindsight, how might you build your portfolio today?

In the late 1990s, while the whole world was on offense, seemingly getting rich on the promise of this amazing new thing called the ‘internet’, I debated a friend who refused to play the growth stock game. Steady and stoic, he invested defensively in Canadian bank stocks. “Bank stocks never go down for long” he told me. I mocked his conservatism in what I perceived as stocks more well suited for a retiree’s account. “You go ahead and wait for your measly little dividends,” I told him, “while I get rich".

History, of course, has been very kind to the Canadian banks—a government-protected oligopoly who have just become more entrenched into the economic fabric over time. And not so kind to the internet stocks of the 1990s.

Does boring pay off?

So I became curious. What if, instead of chasing internet stocks back in the 1990s, one had just stuck to this boring approach that the younger me looked down upon?

I ran some numbers—keeping it simple with two very high profile and successful companies.

In the low-risk corner… Toronto Dominion Bank (now known as TD Bank)—a Canadian banking powerhouse that also built a strong US presence with retail branches and discount brokerage.

In the growth corner… Cisco Systems. One of the hottest stocks of the 1990s, and the most valuable company in the world for a brief period of time. It would have been too easy to pit TD Bank against Pets.com, so let’s go with Cisco. An undeniably great company, Cisco is still around (and thriving) today.

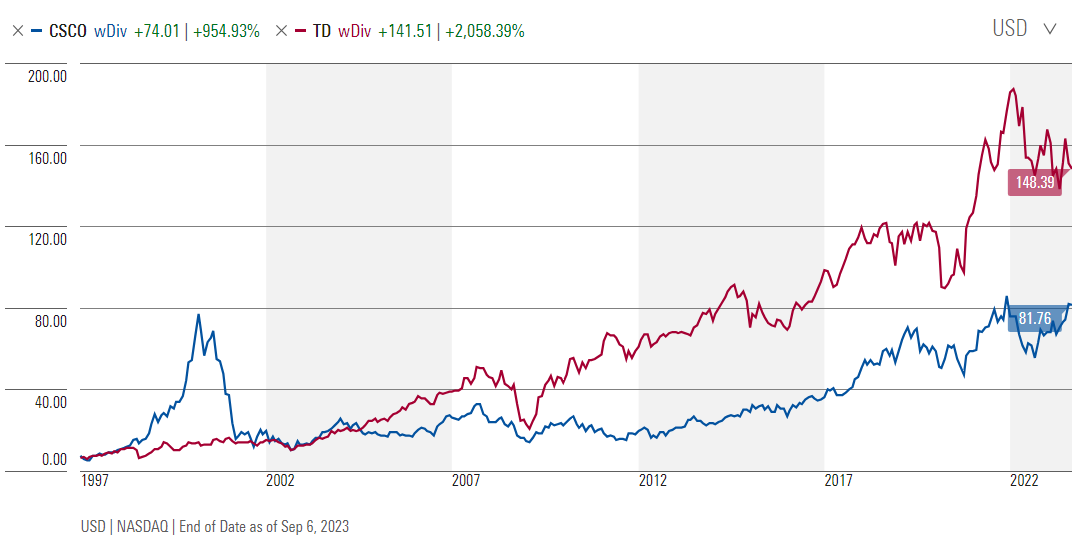

I started keeping track in mid-1996, just as the internet bubble really began to pick up steam. This allows us to take fully into account Cisco’s meteoric rise. As you can see in the chart below, in early 2000 the investment in Cisco would have been about 8x as valuable as your investment in the boring, old, plodding TD Bank.

Source: Morningstar.com

However, the subsequent crash wasn’t kind to Cisco at all. It was dead money for a decade, only starting to recover well into the middle of the 2010s. Meanwhile, like the Tortoise to Cisco’s hare, TD Bank plodded along and, except for a scary episode in the 2008-09 global banking crisis, has generally outperformed the faster grower.

There's more to it though

But here’s the thing with the chart above—it’s not quite accurate. It completely ignores the dividends you would have earned on the TD shares. When we take those dividends into account, and reinvest them in TD shares, the picture looks very different.

Source: Morningstar.com

This isn’t even close. Your investment in the ‘boring’ bank shares has outperformed the exciting, high-growth company by more than 2x, and it’s done it with a lot less drama.

My friend who refused to take part in the internet stock craze, who I openly mocked, had the last laugh. He has experienced decades of steady growth in his portfolio of safe, dividend-paying stocks. And meanwhile, I spent far too much time in search of the next great growth company, completely ignoring these massive wealth creation machines because I perceived them as ‘too boring’.

Lest you think I’m cherry-picking, the reality is that I actually gave the growth stocks the benefit of the doubt here. I could have chosen any number of optical equipment makers who languished post-crash, but instead I chose Cisco, a company that since the turn of the century has grown revenue at 4.9% per year and earnings at 8.5% annually for 20 years. That’s a solid track record through several economic cycles, including a crash that laid waste to the industry that Cisco sat at the core of. The problem, and the reason for the underperformance of Cisco, is that expectations were so high, that the odds were stacked against anyone betting that growth would continue.

It took me a few market cycles to finally learn that the simple investment strategy I had mocked is actually far superior to more elaborate, exciting, and seemingly intelligent strategies.

Most amazing of all is that it’s surprisingly easy to follow, as long as you don’t let your biases and weakness get in the way of doing what’s best. Always remember, as the old sports saying goes, defence wins championships.

Geoff Saab is the author of Low Risk Rules: A Wealth Preservation Manifesto, and writes a free newsletter at lowriskrules.substack.com.