The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

History was made this week. The Reserve Bank of Australia (RBA) held its first extended two-day meeting to set interest rates. Previously, it was just one day. For the first time, the RBA Governor also held a news conference an hour after the rates decision.

The changes are part of a suite of reforms introduced after an independent review of the central bank last year. No doubt, the changes will increase the transparency of rate decisions from the RBA. Whether they influence the substance of the decision making remains to be seen.

The cynic in me thinks the previous RBA Governor Philip Lowe was simply the fall guy for a global inflationary spike that led to rising interest rates, which highly indebted Australians didn’t like, and our politicians needed to do something to assuage their concerns. So, there was a review and these changes followed.

While all the focus is on the RBA, the Government is failing to address deeper structural issues holding back our economy. The key problem is what economists’ term, productivity. It’s a fancy word for doing more with less.

I’m not a trained economist but I have run several businesses, so perhaps I have a different take on the problem. My view is that businesses, not governments, are the primary drivers of economies and economic growth. And businesses here aren’t thriving, domestically or on the global stage, because costs are high.

The three largest costs for businesses are wages, rent, and energy. All these costs in Australia are at nose-bleed levels, both in historical terms and compared to other countries.

For example, if you want to start a restaurant business in one of the larger capital city CBDs, my guess is you’d have to be turning over at least $700,000 to cover costs. To do that in year one of a business is very difficult.

High costs ultimately mean fewer businesses are getting off the ground. And that results in less competition and innovation.

The issue not only affects small businesses but larger ones too. Everyone knows that electric vehicles are the future, and Australia has much of the critical minerals to power this revolution. Yet, business bosses in battery metals say that Australia won’t be able to compete with other nations in this space until high costs are addressed.

The RBA doesn’t have much influence over wages, rent, or energy. The government does, and it’s doing little to fix the cost issues.

Until it does, innovation and competition will be stifled, and economic growth subdued. It will prevent Australia moving from being principally a resources producer to one producing more valuable and sophisticated goods and services.

***

You may be surprised by one country that is showing signs of moving up the value chain: China. You wouldn’t know it by looking at their economy and stock market. The Chinese and Hong Kong stock markets fell through the floor in January. Hong Kong is now below levels reached in 1997.

Source: Trading Economics

The Chinese economy is in the middle of a deflationary bust, after an investment-driven, debt-fueled economic bubble. In an article for Firstlinks this week, Andrew Swan from Man GLG, suggests the investment-driven model is dead and China needs to find a new one. He says China needs to help its exporters and a large one-off devaluation of the currency could do that. And he believes China must drive consumption. The best way would be to provide a better social safety net for people, which would give more certainty around retirement finances and encourage them to consume more before they stop working.

While China has significant problems, it remains a formidable force. Not enough attention is being paid to some of its companies becoming global leaders. And these companies are posing serious threats to the likes of Tesla and Apple.

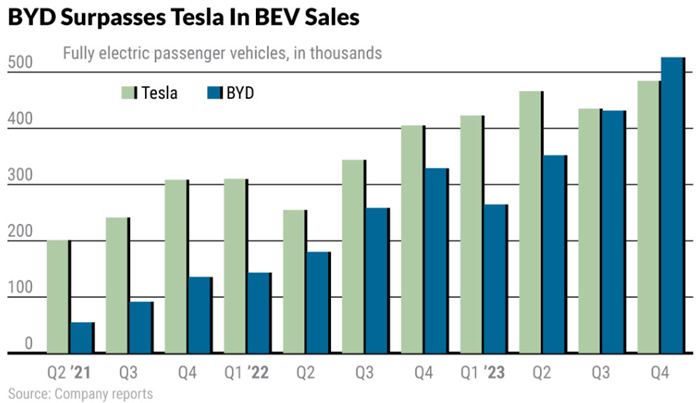

For instance, BYD Auto recently overtook Tesla to become the number one seller of electric vehicles. The company has grown revenues by 25% per annum over the past decade. For most of that time, it concentrated on selling into the domestic market. But in 2020, it started selling its own cars overseas. First in Norway. Then in 2022, it added France, Germany, and the Netherlands. And it entered the UK market early last year.

Guess where Tesla decided to cut prices last month? In Norway, France, Germany, and the Netherlands.

BYD is posing a global threat to Tesla with the production of lower priced, competitive EVs.

Another Chinese company making serious inroads is Huawei Technologies. In September last year, it introduced its Mate 60 Pro smartphone. The phone has a 5G chip that is competitive with Apple’s A17 chip. And customer reviews suggest it has all the functionality of the iPhone 15 Pro.

The US technology community has been taken aback by how advanced the Huawei phone is. After all, the US placed sanctions on China’s access to semiconductor manufacturing technology more than four years ago. Historically, China had reverse engineered Western technology and with these sanctions, the US thought China would be less competitive. Yet, here is Huawei developing proprietary technology from its own chip designs and foundries.

iPhone sales in China have struggled of late and Apple reduced their prices on the iPhone 15 Pro and iPhone Pro Max by 16%.

So, it’s not all doom and gloom for China. There are companies that are becoming global players and threatening to upend the likes of Tesla and Apple.

***

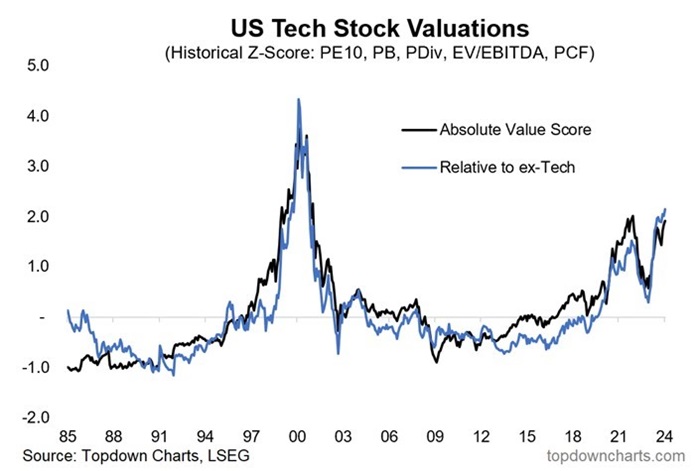

With Tesla and Apple facing stiffer competition, the ‘Magnificent Seven’ may soon have to be renamed the ‘Magnificent Five’. Yet, the remaining five Big Tech companies are doing exceedingly well. Of recent results:

- Alphabet’s (aka Google’s) fourth quarter revenues increased 13.5% over the last year to US$86 billion. Net income increased 52% year-on-year (YoY) to a record US$20.69 billion.

- Microsoft’s fourth quarter revenues increased 17.6% over the last year to $62 billion. Net income grew 33% YoY to $21.9 billion (2nd highest quarter ever).

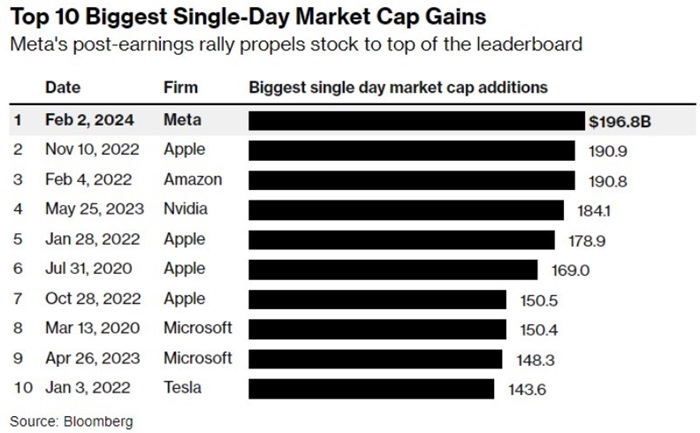

- Meta’s revenues increased 25% YoY to US$40 billion in the fourth quarter. Net income rose 201% YoY to a record US$14 billion.

Meta’s results beat expectations and the stock rose 22% on the day. It was the largest one-day gain in history in dollar terms.

And Meta’s stock is up 445% from the lows of October 2022.

The remaining five of the ‘Magnificent Seven’ are flying and it may justify the undoubtedly rich valuations that many of the stocks sport.

James Gruber

Also in this week's edition...

Labor's stage 3 tax cuts have provoked plenty of debate and questions are being raised about what other promises the Government may break. Superannuation has been targeted before, and may be targeted again. Though, Jon Kalkman says the case for further taxes on super is weak.

Meanwhile, Rodney Brown, says Labor didn't really have any choice but to amend the Coalition's tax cuts. He says economic circumstances are different now to what they were when the tax cuts were enacted in 2019. He believes Labor's package is fair, though it could have gone further to simplify the taxation system.

Lawrence Lam has a cracking story on his interview with legendary Flight Centre founder, Graham Turner. Turner details his 50-year entrepreneurial journey and the obstacles he's had to overcome along the way. They include a tour business that Turner owned before Flight Centre that almost went bust, yet gave him valuable lessons which endure to this day.

When is the right time to sell a stock? Of all the questions facing an investor, it's perhaps the hardest. Unlike with the decision to make an investment, selling it requires you to undo something you have invested intellectual, emotional and financial capital in. Fidelity's Tom Stevenson offers a guide on good and bad reasons to pull the plug on an investment.

Build to Rent is one of the hottest property segments in Australia. Stuart Cartledge went on a tour of some of the newest Build to Rent properties to gauge the prospects for the sector. He thinks there's a lot of room for growth.

US Presidential elections are due in November and it should be both exciting and terrifying to watch Donald Trump run for office for a second time. But when it comes to investing, do elections really matter all that much? Capital Group has the answers.

Two extra articles from Morningstar for the weekend. Adrian Atkins analyses Transurban's results and whether the company's dividend is sustainable, while Mark Taylor looks at the outlooks for Woodside and Santos after merger talks collapsed.

Finally, in this week's whitepaper, The World Gold Council gives us the latest trends in demand for the yellow metal.

***

Weekend market update

On Friday in the US, stocks made it 14 weeks in the green out of the last 15, as the S&P 500 advanced 0.6% to extend its year-to-date gains to just over 6% with the Nasdaq 100 gaining 1% to sit higher by 8.6% for 2024. Treasury prices dropped again but finished off their worst levels as the 10-year yield settled at 4.17% after testing a two-month high at 4.19% in the morning. WTI crude held above US$76 a barrel, gold ticked lower to US$2,025 per ounce, and the VIX stayed south of 13.

From AAP Netdesk:

On Friday, the local share market closed marginally higher in quiet trading, while losing ground for the week despite three straight days of gains. The benchmark S&P/ASX200 index on Friday finished up 5.6 points, or 0.07%, while the broader All Ordinaries rose 9.5 points, or 0.12%, at 7,884.7. For the week the ASX200 lost 0.7%.

Six of the ASX's 11 sectors finished higher on Friday, industrials were flat and four finished lower.

Energy was the biggest mover, dropping 1.3% amid a selloff in the uranium space after the world's second-largest yellowcake miner, Canada's Cameco, announced it would boost production to take advantage of surging prices. Boss Energy, Deep Yellow and Bannerman Energy dropped by between 9.9 and 12.7%, with Paladin and Peninsula Energy falling by 7%. Also, Woodside fell 1.5% and Santos dipped 0.3% in the wake of this week's failed merger talks between the two big LNG producers.

In the heavyweight materials sector, Fortescue dropped 0.8% to $28.26 and BHP dipped 0.3% to $46.30, while Rio Tinto added 0.5% to $129.87.

Boral jumped 8.3% to an all-time high of $5.86 after the building products company said its operating cash flow nearly tripled to $348.6 million in the six months to December 31. Chief executive Vik Bansal said Boral had been able to reduce costs while raising prices, lifting its earning margin to 10.9%, almost double that of a year ago. The company also hiked its full-year guidance, saying it expects to make as much as $350 million, $20 million more than previously forecast.

The Big Four banks were mixed, with CBA up 0.3% to $116.24 and ANZ adding 0.1% to $27.68, while Westpac dipped 0.2% to $24.37 and NAB dropped 0.3% to $32.37.

REA Group and Cochlear both rose 5.9%, to $186.88 and $322.73, respectively, as traders digested Thursday's earnings reports from both companies.

From Shane Oliver, AMP:

RBA leaves rates on hold and is still cautious but has further dialled backed its hawkishness. In leaving rates on hold, the RBA acknowledged faster progress in reducing inflation and bringing demand back into line with supply and it reduced its growth and inflation forecasts. It also further moderated its already mild tightening bias to “a further increase in interest rates cannot be ruled out.”

Governor Bullock appeared to soften this a bit further in her Tuesday press conference saying that things are “broadly balanced.” But then she seemed a bit more hawkish in testimony before the House Economics Committee on Friday saying that “the Board hasn’t ruled out a further increase in interest rates but neither has it ruled it in”. Putting aside the perception of a slightly different tone in the messaging between Tuesday’s press conference and Friday’s testimony (which is inevitable with so many forums close together) the overall message is that while things are going in the right direction, inflation is still too high and demand still too strong and the RBA remains cautious wanting to see further evidence in order to be confident that inflation is sustainably heading back to target. In this sense its lagging behind the US which has already dropped its tightening bias and is signalling rate cuts this year – but this is not really surprising as US inflation led on the way up and is now further advanced in falling.

Our assessment remains that rates have peaked and that weaker growth and inflation than the RBA is expecting will drive rate cuts starting around mid-year with three 0.25% rate cuts by year end. We see inflation falling just below 3%yoy by September, which is a year earlier than the RBA is forecasting, and back to the mid-point of the target range by the June quarter next year, which is also a year earlier than the RBA is forecasting. However, several things are worth noting.

- First, the road to rate cuts will likely be bumpy (as it is in other countries at present) as the RBA waits for more evidence in order to be confident as economic data waxes and wanes.

- Second, the RBA won’t necessarily wait until the 12-month ended inflation rate is at target but will likely move ahead of that. Governor Bullock has said “no, I don’t believe we ... have to be in the band at 2.5%...before we think about” cutting the cash rate “but we do need to be very confident that we’re going to get there”. This could come if say the six-month annualised rate of inflation is back at the mid-point and other indicators line up.

- Third, absent an imminent crisis the risk is that the start of rate cuts is delayed to say August, possibly due to supply side shocks or the RBA wanting to see the impact of the Stage 3 tax cuts on demand.

- Three rate cuts this year will still leave mortgage rates well up on their 2021-22 lows. The money market is now pricing in an 60% chance of a cut by June and two cuts by year end.

A risk for the RBA in waiting too long for evidence that inflation will be sustained at target is that it ends up making the same mistake but in the opposite direction as it made two years ago when it was too slow to start raising rates.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website