The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Recently, a friend of mine went for a job at an ASX 200 company. Towards the end of the interview, my friend asked about remote work, and the recruiter said that “if you want a job, you can work from home, but if you want a career, you’ll go to the office.”

Another story comes from my own company: Morningstar. A few weeks ago, we had a conference call and a colleague rocked up sporting a nice-looking shirt. Everyone gave him a quizzical look as he’s normally dressed quite casually, and when questioned on it, he said: “Didn’t you read the company email the other day about office attire?” Everyone looked blank though I did recall an email reiterating company policy for full-time employees to work three days in the office each week (office attire must have been further down the email!)

A final anecdote comes from a work client who told me that his firm had recently implemented a policy that working in the office would be factored into bonuses.

All these stories are the latest battlegrounds in the work from home debate. Two years after Covid ended, there doesn’t seem to be any definite conclusions about what is best for both businesses and individuals.

New studies are emerging though that may shed some light.

Study 1 – Work from home brings higher productivity and lower wage growth

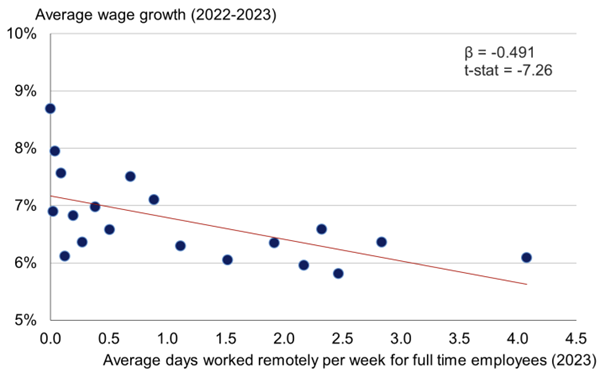

The latest study out this month comes from the Bank of England, which teamed with universities to survey 2,500 firms in the UK. It found that businesses with higher numbers of employees working from home had lower wage growth. For every extra day of remote work, there’s 0.5% lower growth.

Average wage growth between 2022-2023 and number of working days done remotely

Source: Decision Maker Panel

The obvious question is why this has happened. One theory is that remote work expands the potential labor pool, which puts pressure on wages.

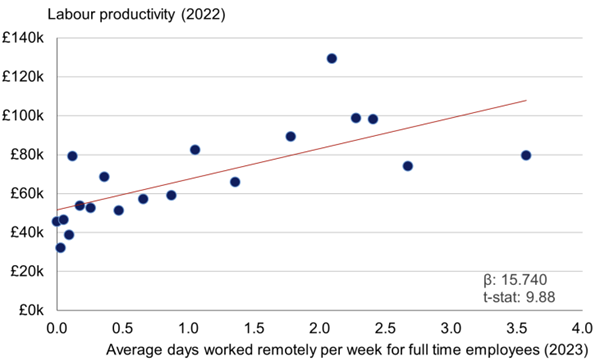

The study also found that there’s a link between work from home and higher productivity. The research suggests that for every extra day that an employee works outside the office, their productivity increases by £15,000 a year.

Firm productivity and the number of working days done remotely

Source: Decision Maker Panel

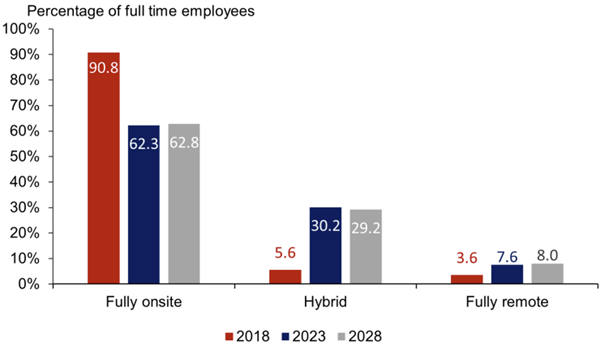

The study reveals 8% of UK employees are fully remote working, 30% are doing hybrid work, while 62% are in the office. Of the bosses surveyed, most believe these numbers won’t change over the next five years.

Proportion of full-time employees based fully onsite, hybrid or fully remote in 2018, 2023 and expected in 2028

Source: Decision Maker Panel

Study 2: Return to office doesn’t result in better profitability or market value

Last month, University of Pittsburgh researchers released a study which looked at return-to-office policies in S&P 500 companies. The researchers analysed the change in employee job satisfaction, company performance, and share market valuation at 137 companies from the S&P 500 that introduced return-to-office mandates. It then compared the changes to those experienced at other S&P 500 firms.

The study found that return-to-office orders had almost no impact on company profitability or market value. However, these orders did result in a significant drop in worker satisfaction.

The study also found companies were more likely to introduce a return-to-office policy if their CEO was male or they’d suffered a prior period of poor share market performance.

Study 3: Remote work may increase short-term productivity but reduce long-term output

A further study came out late last year from the National Bureau of Economic Research in the US. Researchers there studied software engineers at a Fortune 500 firm. They found that working from home increases productivity in the short term, because experienced staff spend more time producing their own work and less time reviewing the work of junior employees. However, the study also suggests that less collaboration and mentorship between senior and junior staff due to remote work may reduce productivity in the long term.

Research takeaways

Though the studies point to the benefits of working from home outweighing the costs, it’s too soon to draw conclusions. The research looks over relatively short time frames. Further research is needed on the impact of remote work in the long term.

The studies also have some obvious drawbacks. For instance, the third study focuses on software engineers at one firm in the US. These engineers are hardly representative of the broader workforce, and making broad generalisations from that study is questionable.

But there is one, definite takeaway from the studies: most workers prefer the flexibility of being able to work from home. If that’s right, businesses which insist on employees being in the office at all times are likely to lose out on hiring and keeping talented workers. All things being equal, if the choice is between a company offering flexibility and one that’s not, workers will likely go for the former over the latter.

The irony of the current debate

It’s important to step back from the minutiae of the debate and look at the long-term forces that are driving the remote work trend.

Management guru, Charles Handy, nailed many of the changes taking place today, more than 30 years ago. In his book, The Age of Unreason, published in 1989, Handy recognized a shift in the structure of workplaces. He identified the rise of what he called ‘shamrock’ organisations. Essentially, these were businesses based around a core group of executives and workers, supported by outside contractors and part-time help. These types of organizations had existed before, in the form of builders and newspapers, but it was being adopted by more and more businesses.

What was behind the change? Handy said it was growing because it was cheaper:

“Organisations have realised that while it may be convenient to have everyone around all the time, with their time at your command because you have bought all their time, it is a luxurious way of marshalling the necessary resources. It is cheaper to keep them outside the organization, employed by themselves or by specialist contractors, and to buy their services when you need them.

This is a sensible strategy when labor is plentiful, when you can pick and choose between suppliers. It is a sensible strategy when your work ebbs and flows as it tends to do in service industries. When you are manufacturing things any surplus resources of people or equipment can always be turned to good advantage by producing things for stock for the weeks of peak demand, but the service industries cannot, or at least should not, stockpile their customers, and therefore must flex their workforce.”

In the book, Handy said the age of workers staying in the one job for a long time was over. In later works, he urged people to develop ‘portfolio careers’ that comprise a variety of roles rather than one job at a single firm. He realised that because of the way that businesses were moving, people would need to develop portable skillsets to meet the needs of the modern workplace.

Handy foresaw many of today’s trends including the gig economy. I’d argue that remote work too is an extension of his theories.

How so? Since Handy first published his thoughts, the advent of technology and specifically the Internet has accelerated the changes to the workplace that he identified. It’s allowed more individuals to have so-called portfolio careers.

I’d argue the other big change that’s driven the push for greater remote work is the higher cost of living. That’s resulted in more families where both parents are having to work. For example, in Australia, the proportion of parents both working has risen from 40% in 1991 to around 60% now. Consequently, having flexible work has become more important.

It’s ironic that the challenges many businesses face from remote work today were brought about by changes that businesses themselves made more than 30 years ago.

The broad, long-term forces driving remote work seem unstoppable and businesses enforcing strict back-to-office mandates may be fighting a losing battle.

***

My article this week looks at recent comments from renowned investor David Einhorn that passive investing has broken markets, and how he's changed his investing style to stay in business. I investigate Einhorn's claims, how passive investing has transformed markets, and what happens next.

***

For those interested, I was interviewed for Morningstar's Investing Compass podcast this week, and talked about how to set up a lazy, 3 ETF portfolio. You can catch it here.

James Gruber

Also in this week's edition...

Stage 3 tax cuts have generated a lot of debate and this week we have former Treasury Department Secretary Ken Henry's thoughts on the issue. Dr. Henry suggests the tax system distortions that he's talked about for a long time are coming to the fore. He says younger workers are shouldering the burden as their taxes are essentially funding the lifestyles of older people. And he believes radical action is needed on tax, including negative gearing, to prevent an even greater intergenerational tragedy.

The Treasury Department's review of superannuation in retirement is well underway and decumulation is on the agenda. Financial advisers have been dealing with this issue for years, and Morningstar's Annika Bradley thinks super funds can learn a lot from how they've handled it.

Meanwhile, Vanguard's Tony Kaye reports on a super free kick that's about to run out. For some people, there’s a concessionally taxed superannuation investment opportunity dating back to the 2018-19 financial year that will expire on 30 June this year. Tony details what you may be entitled to.

What are some of the best long-term themes in markets? Montaka's Andrew Macken selects five that he thinks could be big winners, including luxury goods, alternative assets, AI, and mission-critical financial firms.

It's easy to get caught up in the noise of the market and invest in a way that doesn't suit you. Joe Wiggins says that to have any chance of success, it's critical to avoid playing somebody else’s game. He looks at the best way to do this.

The S&P 500 has become an increasingly concentrated index over the past decade, with the returns of the top seven stocks far outpacing the average stock in the index. Ben Inker thinks this explains a large part of why active managers have underperformed indices. If history is a guide, Inker says the next decade will see US megacaps underperforming the average index stock and active managers mounting a comeback.

Two extra articles from Morningstar for the weekend. Shani Jayamanne looks at three of the best ASX growth stocks for the long-term, while Shane Ponraj believes Ansell is poised to return to growth.

Lastly, for this week's whitepaper, we have Vanguard Australia's submission to the Federal Government's Superannuation in Retirement consultation.

***

Weekend market update

On Friday in the US, a strong rebound in Treasurys headlined the day’s proceedings, as the long bond dove 10 basis points to 4.37%, while stocks finished little changed on the S&P 500 and Nasdaq 100 to wrap up another banner week for the bulls. WTI crude retreated nearly 3% after logging multi-month highs Thursday, gold rallied to US$2,035 per ounce and the VIX settled south of 14, more than two points below Wednesday’s intraday peak.

From AAP Netdesk:

The local share market on Friday finished higher, with the tech sector leading the way.

The benchmark S&P/ASX200 index on Friday finished up 32.4 points, or 0.43%, to 7,643.6, while the broader All Ordinaries had added 33.9 points, or 0.43%, to 7,899.2.

For the week the ASX200 finished down 0.2%, basically reversing its gains from the week before, as a global AI-fuelled rally in equities bypassed Australian shores.

Unfortunately for Australian investors the local bourse does not have much exposure to AI companies. Brainchip did add 14% to 49c, with shares up threefold in the past three weeks even though its "neuromorphic" AI chip has yet to catch on. Appen climbed 13% to 43.5c, with the AI dataset company's shares up by a third this week despite last month losing a major contract with Google.

The ASX's tech sector was the biggest gainer on Friday, rising 1.5% as Xero added 2.8% and Audinate climbed 3.8% to a fresh all-time high of $21.30.

Aussie Broadband rose 18.6% to a nearly two-year high of $4.53 after the internet provider announced operating cash flow was up 57.8% to $40.7 million in the first half.

Afterpay owner Block was the biggest gainer in the ASX200, climbing 16.5% to a seven-month high of $117.94 after Jack Dorsey's company reported its gross profit rose 22% to $US2.03 billion in the fourth quarter.

Telix Pharmaceuticals dipped 4.1% to $10.52 despite the Melbourne-headquartered radiation oncology business posting its first profit, $5.2 million, compared to a $104 million net loss a year previous.

In the heavyweight mining sector, Newmont dropped 8.1% to $46.62 after the gold giant announced it generated $US2.8 billion in cash in the fourth quarter. Newmont announced it would sell six gold mines, including Telfer and its majority stake in Havieron, both in WA, which it inherited from its acquisition of Newcrest Mining late last year.

Fortescue climbed 1.4% to $28.21, Rio Tinto was flat at $124.40 and BHP added 0.6% to $44.55.

The Big Four banks were all higher, with NAB gaining 1.1% to $33.86, ANZ adding 1% to $28.29 and CBA and Westpac both finishing up 0.3% at $114.83 and $25.94 respectively.

PEXA Group rose 5.7% to a two-month high of $12.16 after the property settlement platform announced its half-year operating earnings were up 12% to $59 million, beating guidance.

From Shane Oliver, AMP:

- Australian business conditions PMIs for February rose with strength in services (possibly driven by optimism regarding a boost from Swiftonomics this month) but for the last 18 months they have been range bound around zero. While work backlogs continue to fall, a concern though is that the fall in input and output prices appears to have stabilised for now at higher than pre-pandemic levels particularly for services input prices. This likely reflects the pick-up in wages growth.

- Annual wages growth in the December quarter at 4.2%yoy rose to its fastest pace since 2009 resulting in the first rise in real wages since 2021. The rise in real wages was only just 0.1% but with inflation likely to slow further relative to wages growth we expect real wage growth to be running around +0.5% by year end. Thanks to revisions to past data this was slightly stronger than RBA and market expectations for a 4.1%yoy increase.

- However, this is likely to be the peak in wages growth: the quarterly pace slowed to 0.9%qoq which was in line with expectations; while public wages growth picked up owing to changes to state government wage policies and a pay rise for aged care workers, private wages growth slowed; wage increases including bonuses which led on the way up look to have peaked; wage increases under enterprise bargaining agreements look to have peaked (see the first chart below); and the cooling jobs market points to slowing wages growth ahead (second chart below). Wages growth in Australia also remains below that in the US, UK and Europe. All up we don’t see the latest wages data altering the outlook for interest rates in Australia.

- The Australian December half earnings reporting season is nearly 80% complete and its now looking rather average. After the usual run of better results to start with its now tailed off a bit with the level of companies beating earnings expectations falling over the last week although it’s still fractionally better than average. Consensus expectations remain for a -5.5% fall in profits this financial year (down from -4.9% a month ago) with a big fall in energy sector profits on the back of lower oil, coal and gas prices and small fall in bank profits but most other sectors seeing flat to up profits. The bad news has been that revenue growth is slowing and high interest expenses are a problem, but the good news has been that the peak in cost growth may be near, labour market pressure appears to be starting to normalise, cost control remains strong and guidance has been stable.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website