The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Ageing is a horror show, right? Our mental capacities decline, health deteriorates, we have fewer friends, and eventually it all ends. It sounds depressing, and yet more scientific studies are indicating that older people are much happier than younger ones. How can this be, and what are the implications for other areas of our lives, including our financial wellbeing?

The pitfalls of ageing

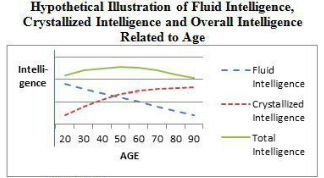

I’ve written previously about when our cognitive abilities decline and how it impacts financial decision making. People have two types of intelligences: fluid intelligence and crystallised intelligence. Fluid intelligence is the ability to think abstractly and deal with complex information. Psychologists have long known that fluid intelligence peaks about age 20 and declines by 1% each year thereafter.

As we age, however, we also gain experience to help us make better decisions. This is called crystallised intelligence. Thus, while fluid intelligence decreases with age, crystallised intelligence increases.

Source: What to do when I get stupid: A radically safe approach to a difficult financial era, Lewis Mandell Ph.D.

When you combine the two types of intelligences and apply them to financial decisions, research indicates that we peak around age 53 and decline thereafter at a rapid rate.

Of course, it’s not only cognitive abilities – including memory, language, perception, and attention - which decline with age. Our health tends to deteriorate during our 50s, though some things start much earlier. For instance, muscles and endurance start a steady decline after age 30, which speeds up after we hit 60.

It’s not all bad

Yet as early as the 1980s, scientific studies started to question other aspects of ageing. Before then, it was assumed that getting older wasn’t fun, and therefore older people were less happy.

The National Institute of Mental Health in the US did a study in the early 1980s that found almost every form of psychopathology - mental health problems including depression and anxiety – was less prevalent in older people than middle-aged or younger people.

This shocked the scientific community at the time. Some scientists pushed back, suggesting that these older people had lost their marbles and that’s why they were reporting themselves to be happier. Others in the psychiatry profession hypothesized that they must have had a form of hidden depression.

Yet, subsequent research has confirmed the findings and expanded on them.

Why are older people happier?

Psychology Professor, Laura Carstensen, and her colleagues at Stanford University’s Center on Longevity have been at the forefront of the latest research. Carstensen’s studies have focused on why older people are happier.

She’s found that as we age, our social networks get smaller. But rather than being a bad thing, it’s a positive. Carstensen’s research suggests that as we get older, we retain those in our social network who are most important in our lives. Meanwhile, more distant acquaintances fade away. It means that we focus on who and what really matters. Valuable friends and family become even more valuable.

Carstensen’s studies have also revealed that how we view ourselves and our lives impacts the way we remember things. She’s conducted research where positive, negative, and neutral stimuli were presented to a range of age groups. The people being studied had to sit in front of a computer screen and go through images and tell researchers which images they remembered. Younger people remembered about the same number of positive and negative images. By middle age, the preference is to remember positive images, and when older, it’s overwhelmingly in favour of the positive images.

What’s behind this positivity? Carstensen’s more recent studies offer more clues. She’s found that older people view time differently from the young. When you’re young, time is essentially infinite. You’re constantly thinking about the future. A brighter future. In this context, it’s important when young to be curious, explore new things, travel, meet new friends, get a great job with career prospects etc.

When we age, we become more presented focused rather than future focused. That’s because we’re faced with our own mortality. Time becomes compressed. And that results in us becoming laser focused on what is important. Carstensen believes that laser focus and present mindedness is behind much of the happiness as we age.

As Carstensen recently told the Hidden Forces podcast:

“…younger people are rarely in a present focused mode. They’re almost always thinking about the future. Older people can actually be in the present, and that tends to be very good for mental health. There are lots of meditations now, Buddhist meditations, that are intended to help people get to that present focus because living in the moment tends to take people’s attention to positive aspects of the world.

… in some ways, ageing relieves us of the burden of the future. We can be in the moment.”

Should we mirror the aged?

The obvious question then is: should the young become more present focused like older people to become happier? Carstensen says younger people should still focus on the future and explore the world. However, getting them to occasionally shift their focus to the present might be a good thing.

As for the aged, Carstensen says having them focus occasionally on the future may also be positive. For instance, climate change may not impact them in their lifetimes, though it would be nice if they also focused on it. In short, Carstensen thinks there needs to be a balance between time perspectives.

She’s run an experiment on whether older people can change time perspectives. The experiment involved asking people to choose from among an array of social partners. It said to the participants: imagine if you got a phone call from your doctor who told you that a new medical advance means you’ll live 20 years longer than expected. Which social partners would you choose? And the results showed that older people didn’t just express preferences for well-known friends and family. They were curious to broaden their social circle.

The paradox of ageing

The findings on greater happiness among older people has led the scientific community to label it ‘the paradox of ageing’. Ageing has negative features, as I’ve mentioned. And yet, we’re happier as we age.

It also challenges the basis of happiness. Having lots of friends and a bright future isn’t necessarily supported by the science.

Balance and money

What implications does this research have for other aspects of our lives, such as our financial wellbeing? In investing, we’re taught to be predominately focused on the future. We’re told to budget and save, to invest for the long-term so compounding can work its magic. Carstensen would say that there needs to be a balance – and she has a point.

For instance, I can’t help thinking that the debate about retirees and ‘decumulation’ is one about time perspectives. The government wants the elderly to spend more so they consume and lift economic growth. Yet, the statistics show that older people are afraid to run out of money and that’s why they’re reluctant to spend more.

Part of the issue may be that we’re taught from a young age to defer spending and save money. This can become ingrained, and it requires a mindset shift for people to change the habits they’ve had for a lifetime and to spend more money. If they did spend more, it mightn’t just benefit the economy, but themselves. We previously written of how other scientific research shows how leisure spending can increase happiness in retirement.

***

I have two articles this week. The first looks at 16 ASX-listed stocks that investors can buy and hold forever.

The second article is a transcribed interview I had with quantitative fund managers, Realindex. The company is celebrating its 15-year anniversary and has announced a name change to RQI Investors. I caught up with CEO Andrew Francis and Head of Investment Dr. David Walsh to discuss their latest views on markets and how passive investing may impact quant investing going forwards.

***

Lastly, I'd like to give a shoutout to Peter Warnes, the long-time editor of Morningstar's Your Money Weekly newsletter, who's retiring. Peter started in finance in 1963, some 61 years ago. He's had a remarkable career and has been a great colleague. All the best for the future, Peter, and many thanks.

James Gruber

Also in this week's edition...

Clime's John Abernethy has 10 charts on the outlook for major asset classes. The charts show the average mortgage holder is under financial stress, which means interest rates can't rise much further from here, how stage three tax cuts should benefit the major banks, while bond markets remain in flux as central banks globally continue to manipulate yields.

Noel Whittaker is back with feedback from a recent meeting with retirees. Noel says cheques and bank service were major topics. Many in the audience had questions about the government's phasing out of cheques, and what that might mean for cash too. In his article, Noel answers these queries.

The Treasury Department's consultation into the retirement phase of superannuation has generated a lot of interest. Harry Chemay sent a submission into the consultation and has an abridged version for us, which outlines the key financial risks to an individual’s standard of living in retirement.

Markets see a US recession as a low risk event. Yet Talaria Capital's Chad Padowitz says that history shows US economic downturns have happened more often than not following interest rate tightening cycles. He believes investors should prepare their portfolios accordingly.

While investors pile into the Magnificent Seven, Antipodes' Vihari Ross says there's plenty of growth to be found elsewhere, at a fraction of the cost. She looks at how cyclical, structural, and macroeconomic changes are providing tailwinds to three stocks, and opportunities for astute investors.

Two extra articles from Morningstar for the weekend. Johannes Faul asks whether bad press is paving the way for buying opportunities in Coles and Woolworths, while Lauren Solberg looks at 5 ways that Nvidia is living up to the AI hype.

Lastly, in this week's whitepaper, Schroders examines the intense competition for deals at the larger end of the private equity (PE) market, and how smaller may be better when it comes to PE.

***

Weekend market update

On Friday in the US, it was green across the board as the S&P 500 rose nearly 1% and the Nasdaq 100 enjoyed a 1.5% rally to kick off March in appropriate fashion, while 2- and 30-year Treasurys settled at 4.54% and 4.33%, respectively, down 10 and 5 basis points on the day. WTI crude tested US$80 a barrel to approach four-month highs, gold jumped 2% to US$2,083 per ounce and the VIX retreated to near 13.

From AAP Netdesk:

The local share market on Friday closed at an all-time high amid a wave of optimism over a positive earnings season and hopes for interest rate cuts within the next few months.

The benchmark S&P/ASX200 index on Friday finished up 46.9 points, or 0.61%, to 7,745.6, its first close above 7,700. It's the third time this year the ASX200 has finished at a record high following new marks on January 31 and February 2. The broader All Ordinaries finished above 8,000 for the first time, gaining 47.6 points, or 0.6%, to close at 8,007.1. For the week both the ASX200 and All Ordinaries rose 1.4%, after slightly losing ground last week.

The last company to report its earnings this season was the biggest gainer on Friday, with Life360 soaring 38.5% to a more than two-year high of $11.30 after the tech company blew out operating earnings guidance by 47%. The company, which makes an ecosystem of location-tracking devices and smartphone apps, also announced plans to monetise its 61 million users through a new advertising service.

In the materials sector, lithium companies were showing signs of life, with Core Lithium rising 14% and Arcadium Lithium climbing 10.3%. Elsewhere in the sector, BHP gained 2.3% to $44.92, Fortescue added 1.1% to $26.21 and Rio Tinto gained 0.9% to $124.87.

The Big Four banks finished up, with ANZ rising 1.1% to $28.75, NAB climbing 0.6% to $28.75, NAB adding 0.6% to $34.04 and Westpac rising 0.2% to $26.41.

From Shane Oliver, AMP:

Australian inflation still looks like its falling faster than the RBA expects. The January monthly CPI came in weaker than expected, managing to hold at 3.4%yoy with underlying measures of inflation also falling slightly.

Even with a likely bounce in inflation to around 3.7%yoy in February - owing partly to higher prices for fuel and updated prices for various services like education and insurance – inflation looks on track to come in just below the RBA’s March quarter forecast for 3.5%yoy, with a quarterly rise around 0.6%qoq which will mean two quarters in a row of annualised inflation around 2.5%, ie, in line with target! However, while the lower-than-expected January outcome is good news for the RBA its likely to remain cautious and retain its mild tightening bias at its March meeting as: it will still see inflation as too high; the underlying measures are still higher than headline inflation; services inflation has come down by less; and many services prices were not updated in January. In short, it’s unlikely that by the March meeting the RBA will have “sufficient confidence that inflation would return to target within a reasonable timeframe.” We continue to see the RBA cutting from around mid-year and expect three 0.25% cuts this year.

US core private consumption inflation picked up to 0.4% in January as foreshadowed by the CPI but fell to 2.8%yoy from 2.9%. As it was no worse than expected investment markets were happy as it leaves the Fed on track to start cutting rates around June. Of course a run of higher monthly inflation could delay that.

Eurozone inflation slowed to 2.6%yoy in February with core inflation falling to 3.1%yoy. Both were a bit higher than expected but disinflation is continuing. Economic confidence remained soft in February and bank lending continued to contract in January. Unemployment fell to 6.4% in January from 6.5% in December (but this was revised up from 6.4%). The combination of falling inflation and stalled growth keeps the ECB on track to start cutting by June.

Japanese economic data was mixed with industrial production down sharply in January, unemployment flat and retail sales & consumer confidence up. Japanese inflation fell in January but by less than expected to 2.2%yoy with core inflation at 2.6%yoy.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website