The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Women will be the largest beneficiaries of Australia’s $3.5 trillion intergenerational wealth transfer. The transfer isn’t something that’s 20 years away either. Much of it will happen this decade.

There hasn’t been enough discussion about how this could transform markets as well as the wealth management and financial advice industries. This article is an attempt to right that wrong.

The future is female

There’s been a lot of overseas research into the issue of how women will soon inherit much of the largest wealth transfer in history.

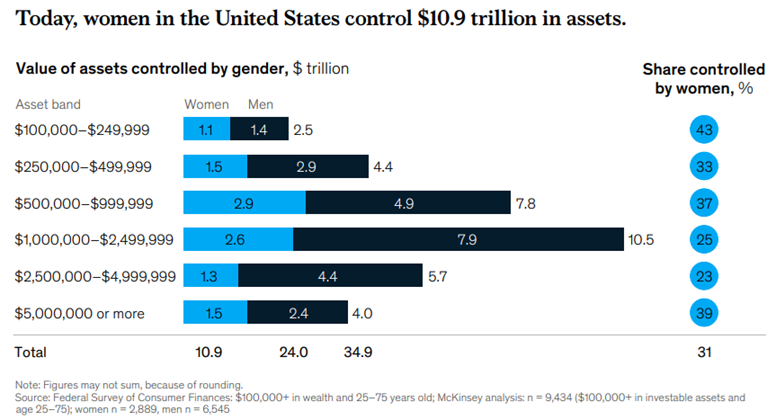

Several years ago, McKinsey did a report on how women control about a third of the $35 trillion in US household assets, and that could increase by another third by 2030. It says the biggest driver of the shift is demographics. About 70% of investable assets are controlled by Baby Boomers in the US. And two-thirds of those assets are held by joint households.

Source: McKinsey

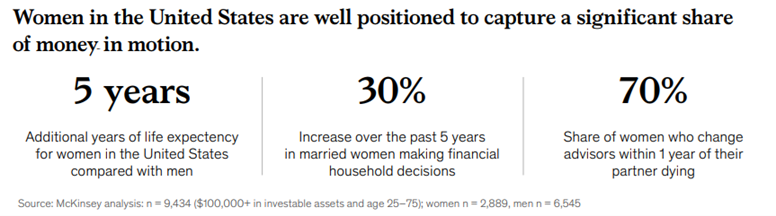

Source: McKinsey

As men pass, many will cede control of these assets to their wives, who tend to be both younger and longer lived. In fact, women outlive men in the US by an average of five years.

McKinsey says that by the end of the decade, women are expected to control the majority of the $35 trillion in household assets, and that it’s a potential wealth transfer of such magnitude that it approaches the annual GDP of the US.

Schroders has published similar findings in the UK. However, the wealth transfer would appear to be more imminent there, as it estimates that women will control 60% of Britain’s wealth by next year!

In Australia, the research has been sparser. Recently, JB Were investigated the issue in a report entitled ‘The Growth of Women and Wealth’. The report estimates that the potential wealth transfer in Australia isn’t $3.5 trillion as suggested by the Productivity Commission, but closer to $5 trillion. And of that money, women are set to inherit 65%, or $3.2 trillion in the next decade.

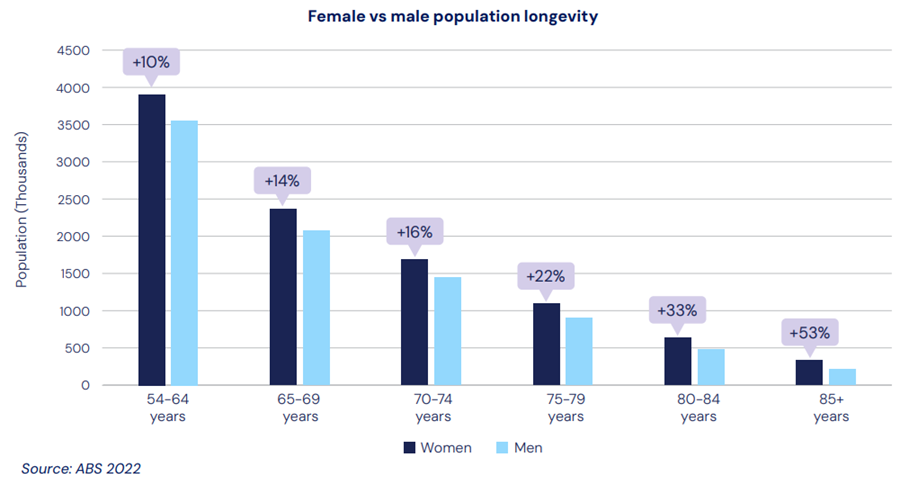

Like McKinsey, JB Were believes demographics will be the main driver, with women outliving their partners. It cites statistics that in the 70-plus age group, there are 16% more women than men, and this widens to 33% for those aged over 80.

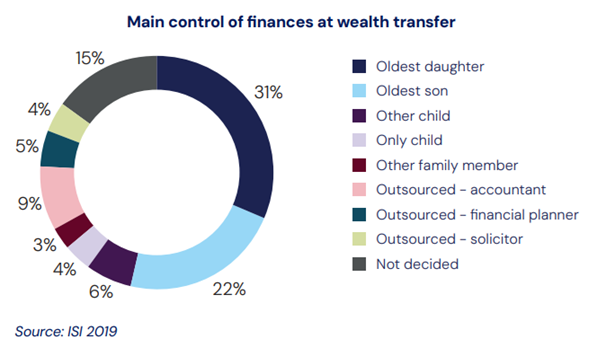

It isn’t just demographics, though. The research found that control of the family finances at the point of wealth transfer is most likely to be managed by the oldest daughter in the family.

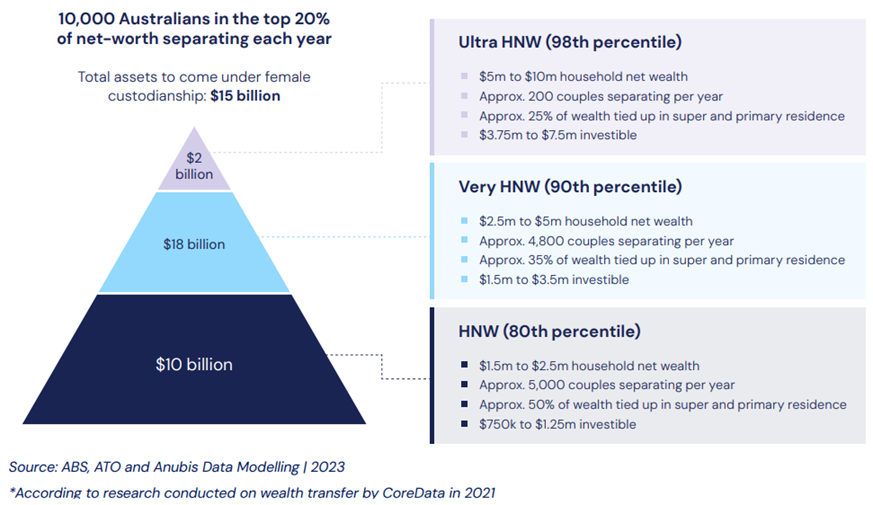

Women won’t just be the beneficiaries of the wealth transfer. They’ll also claim billions in existing wealth via divorce and separation. There are more than 50,000 divorces in Australia each year, with couples aged 50 and over being one of the fastest growing cohorts.

The children may not get as much as they expect

While women may inherit more, children may get less than they expect. A report from AMP this week suggests most retirees believe their children face similar or harder financial challenges than they did growing up, amid rising housing unaffordability and rents. Though they’re keen to support their children, 70% of them are reluctant to compromise their lifestyle to provide financial assistance.

Also, four out of five of retirees aren’t prepared to downsize to release funds to their children, according to the report. However, about half of them will consider passing home equity value to their children if they can stay in the family home.

Women will manage their money differently to men

How will women manage all their money? The McKinsey US research suggests they’ll do it in a very different manner to men, with four key attributes:

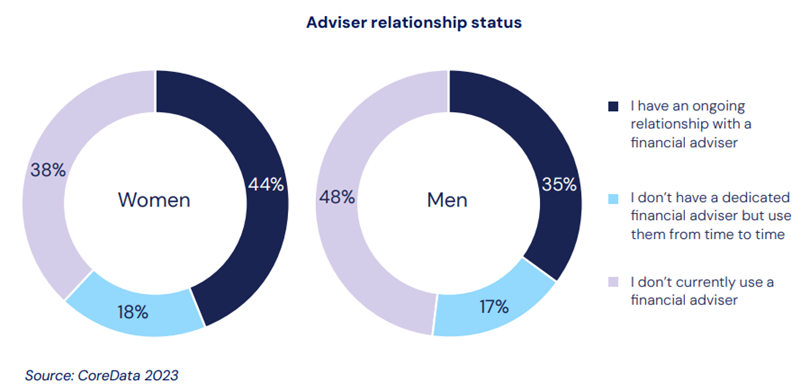

- Greater demand for advice. Female financial decision makers are more likely to have an adviser than men. And they’ll be more willing to pay a premium for in-person financial advice. These findings are consistent with the JB Were report, which highlights that high-net-worth women already seek more advice than men, as the chart below shows.

- Lower financial self-confidence. McKinsey’s survey found many women report lower confidence in their own financial decision making and investment acumen. Only 25% are comfortable making investment and savings-related decisions on their own – 15% lower than their male counterparts.

- Less risk tolerance. Women are less likely to take big investment risks for the potential of high returns, says McKinsey. And there much more likely to manage their money through passive instead of active management strategies.

- Greater focus on real-life goals. Women are less concerned with outperforming the stock market and more worried about having enough savings for retirement.

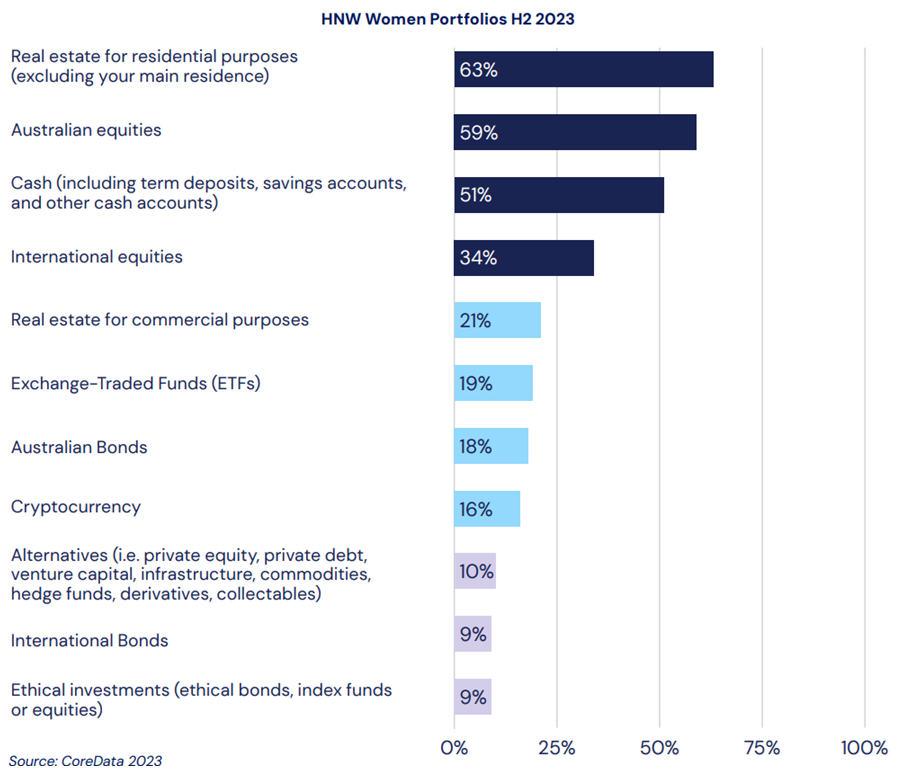

The JB Were report in Australia gets more granular on current high-net-worth women’s portfolios and what pointers they may have for the future. Most of the women surveyed invest their money in Australian residential property, Australian equities and cash. They’re less enamoured with bonds and alternative assets.

From this, it appears that women are investing in mostly what they know well versus what they don’t. Whether that changes with inheriting greater sums of money remains to be seen.

Switching financial advisers may be on the cards

While women wanting greater advice would seem positive for the financial advice industry, it doesn’t tell the whole story.

The biggest shock comes from Schroders UK research which says that 70% of Baby Boomer widows will leave their partner’s adviser within a year of their death. There’s been no comparable research on this in Australia, though if it’s true here too, then it means that hundreds of billions of dollars might be up for grabs during the remainder of this decade.

What it does highlight is that women often don’t have close relationships with their partner’s advisers. The overseas research also emphasises that women want a different type of advice to their partners. They prefer hyper-personalised, outcome-based financial advice that meets their real-goals.

Implications

The implications for funds managers, super funds, financial advisers and wealth managers are obvious – they had better get to know their female clients (or partners of their clients as it may be), and quickly. Because the needs of women are likely to soon reshape the entire financial industry.

----

In my article this week, I look at the secrets behind the extraordinary track record of Australia's equivalent to Berkshire Hathaway - Washington H. Soul Pattinson.

James Gruber

Also in this week's edition...

Aidan Geysen of Vanguard says there’s an epidemic in Australia that has nothing to do with COVID-19, the flu, or the respiratory syncytial virus. This one is called FORO, or the fear of running out of money. And it mostly afflicts people aged from their mid-50s onwards who are either approaching retirement or are already retired.

Retiring now is more complicated than it was five years ago, as uncertainty around inflation has made the amount retirees need to save less certain. Investors Mutual's Michael O'Neill thinks retirees should focus on income to make future planning easier.

With high inflation and the increased cost of living, most of us are looking at ways to save money. New research from The University of Adelaide's Lachlan Schomburgk and colleagues shows that paying by cash rather than card, even if inconvenient, can be a valuable tool in controlling expenses.

Obesity wonder drugs have taken the world by storm, and Capital Group's Matt Reynolds believes other health care breakthroughs are coming. He's especially positive on scientific work which manipulates human DNA to find new ways to treat a wide range of diseases. It's an open-eyeing article...

There's been extensive talk about large super funds shifting from public to private assets, though new data suggests that the change hasn't been dramatic. However, Elstree's Campbell Dawson says that there are other things that may challenge the long-term performance of Big Super.

Many investors, including Warren Buffett, are believers in concentrated portfolios. After all, if you don't have conviction in positions, what's the point? Joe Wiggins has gone from being a fellow believer to a sceptic, and here he details why.

Two extra articles from Morningstar this weekend. Joseph Taylor looks at three cheap ASX stocks with sound balance sheets, while Shane Ponraj presents a positive view on IDP Education depsite a poor trading update.

Lastly, in this week's whitepaper, The World Gold Council surveys Australian investors and finds that they generally want an allocation to gold, and believe their superannuation fund has exposure to the yellow metal, even though it may not.

***

Weekend market update

On Friday in the US, a hotter-than-expected headline payrolls print for May stoked a major selloff in Treasurys, as 2- and 30-year yields jumped 15 and 12 basis points respectively to 4.87% and 4.55%. Stocks again finished little changed on the S&P, leaving the broad average higher by a bit less than 1% for the week against the cacophonous backdrop of the Gamestonk circus. WTI crude edged lower towards US$75 a barrel, gold tumbled nearly 4% to US$2,288 per ounce, bitcoin slipped 2% to US$69,100 and the VIX wrapped up the day just north of 12.

From AAP Netdesk:

The local share market on Friday climbed for a fifth time out of the past six sessions to post its best weekly gains for the year. The S&P/ASX200 on Friday accelerated its gains in the afternoon to finish up 38.2 points, or 0.49%, to 7,860.0, its highest close since May 20. The broader All Ordinaries finished up 38.5 points, or 0.48%, at 8,112.8.

Ten of the ASX's 11 sectors finished higher on Friday, all except tech, which was down marginally.

Consumer discretionaries were the biggest mover, rising 1.2% as Aristocrat Leisure added 1.9% and Domino's Pizza Enterprises climbed 2.3%.

The gold sub-sector also did well. Newmont added 2.9%, Resolute Mining climbed 7.3% and West Africa Resources advanced 2%.

Elsewhere in the mining sector, BHP increased 1.1% to $44.53, Fortescue added 1.3% to $24.37 and Rio Tinto rose 0.6% to $125.31.

After morning losses the Big Four banks mostly finished the day higher, with CBA up 0.6% to an all-time closing high of $125.55, ANZ rising 0.4% to $29.18 and NAB advancing 0.7% to $35.23. Westpac was the outlier, flat at $26.97.

In the tech sector, Life360 dropped 6.1% to $13.80 as shares in the US location-tracking company began trading on the Nasdaq as part of a secondary listing.

In small caps, LTR Pharma soared 25.9% to an all-time high of 80.5c after the company announced "extremely positive" initial results from a clinical trial of its nasal spray designed to treat erectile dysfunction.

From Shane Oliver, AMP:

- Major global share markets rose over the last week as the ECB and Canada cut interest rates and bond yields fell with strength in tech stocks pushing the US share market to a new record high. Despite slight falls on Friday in response to stronger than expected payroll data for May, US shares rose 1.3% for the week and Eurozone shares rose 0.9%. Japanese shares rose 0.5% for the week, but Chinese shares fell 0.2%. Helped along by the positive US lead and with weaker economic growth boosting confidence in prospects for RBA rate cuts, the Australian share market rose 2.1% over the last week leaving it just 0.5% below its record high reached in March with financial, consumer and property shares leading the rise. 10-year bond yields fell, although falls in the US and Europe were partially reversed after the strong US payrolls report. Oil, metal and iron ore prices fell. The $A also fell after the strong payrolls report pushed the $US back up.

- More central banks start easing. Both the Bank of Canada and the ECB cut their policy rates by 0.25% in the last week on the back of easing inflation and foreshadowed further cuts if inflation continues to improve, although the ECB was a bit more cautious than the BoC. This follows central banks in Switzerland and Sweden that have already started to cut. Money markets are allowing for another two rate 0.25% cuts this year in Canada and another 1.7 in Europe. Around 25% of global central banks have now started to cut interest rates.

- While stronger than expected growth in payrolls in the US for May added to uncertainty about the outlook for Fed interest rate cuts, the jobs data was actually quite messy with payrolls and earnings growth coming in stronger than expected but unemployment unexpectedly rising to 4% on the back of a sharp fall in the household survey measure of employment and temporary employment continuing to fall which is a sign of weakness. Meanwhile, job openings and quits are continuing to point to weaker jobs and wages growth ahead. While the strong rise in payrolls in May will keep the Fed cautious for now, we remain of the view that it will start to cut rates in September, providing we continue to see cooler inflation between now and then.

- The Australian economy is close to stalling with GDP up just 0.1%qoq in the March quarter. Revisions muddied the water a bit with the level of consumer spending being revised up 2% for last year reflecting a new higher measure of overseas travel spending but since this was all offset by higher imports (also resulting in a downwards revision to the current account balance) it had little impact on overall GDP so there is no significant impact on domestic spending or estimates of spare capacity in the economy so there should be no significant implications for inflation or the RBA.

- Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website