Last year, I wrote of ASX stocks that have stood the test of time. It included some of our oldest businesses and how they’ve managed to not only endure but thrive.

I followed up with a piece, 16 ASX stocks to buy and hold forever. Only three stocks featured in both of these articles, and one of them was Washington H. Soul Pattinson (ASX: SOL), or Soul Patts as it’s known.

Thinking of Australia’s greatest ever investors, names like Greg Perry, Erik Metanomski, David Paradice, and Kerr Neilson naturally spring to mind. Yet, Soul Patts’ Robert Millner and his uncle, Jim, should be in the conversation too.

It’s true that Soul Patts isn’t a pure investor. It’s a business operator as well. In that, it’s more like an investment conglomerate, not dissimilar from Warren Buffett’s Berkshire Hathaway.

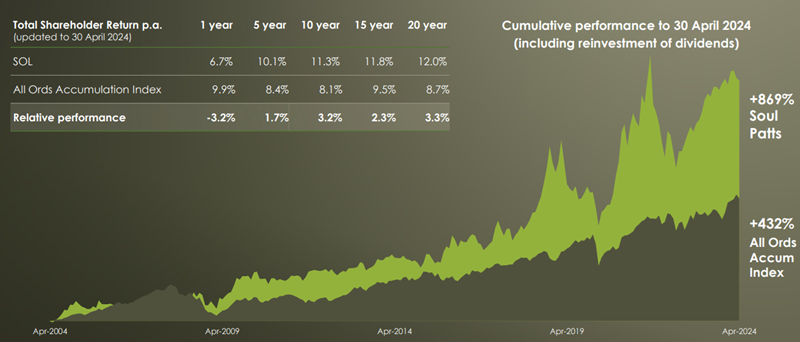

Soul Patts’ track record is outstanding. Over the past 20 years, it’s returned 12% per annum (p.a.), easily beating the All Ordinaries Index. $100,000 invested in the company in 2004 would have turned into $869,000 today, more than double the amount you would have earned from investing in the All Ordinaries over that period.

Source: Soul Patts’ investor presentation

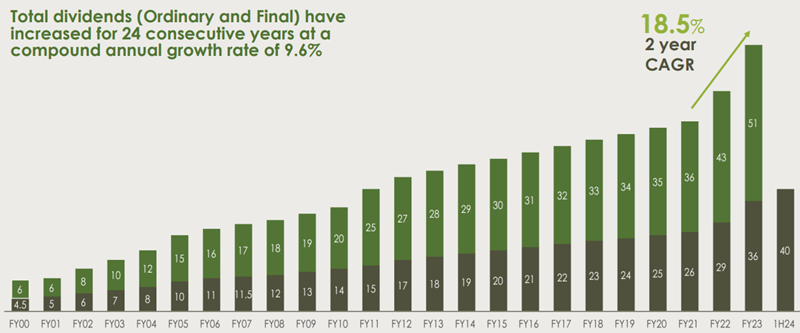

Soul Patts has paid a dividend in every year that it’s been listed, going back to 1903. It’s also increased its dividend for 24 consecutive years. If the company increases its dividend again this year, it will become Australia’s first-ever Dividend Aristocrat – a term from the US given to companies that lift their dividends each year for 25 consecutive years or more.

Source: Soul Patts’ investor presentation

Exactly, who is Soul Patts?

The company began life as a pharmacy in 1872. It’s then that Caleb Soul opened the chemist in Pitt Street, Sydney. In 1886, Lewy Pattinson opened a pharmacy in Balmain. Caleb and Lewy became friends and in 1902, Washington Soul bought out Pattinson and a year later, listed on the Sydney Stock Exchange.

In 1903, Soul Patts had 21 pharmacy stores. By the time of World War Two, it dominated the retail pharmacy market and it also had manufacturing and warehouse facilities.

Jim Millner, who’d been a prisoner of war in Singapore, transformed the business from a pharmacy into an investment powerhouse in the 1960s and 1970s. He made numerous mining investments, which eventually culminated in the purchase of New Hope Collieries, now known as New Hope Corporation (ASX: NHC). He also bought a cross shareholding in building materials company, Brickworks (ASX: BKW). In the 1980s, the company bought NBN Television Station, which eventually turned into TPG Telecom (ASX: TPG).

In 2021, Soul Patts made its biggest play in financial services via a merger with listed investment company, Milton Corporation.

Robert Millner has been Chairman of the company since 1998, and as Lewy Pattinson’s great grandson, is the fourth generation of the family to manage Soul Patts.

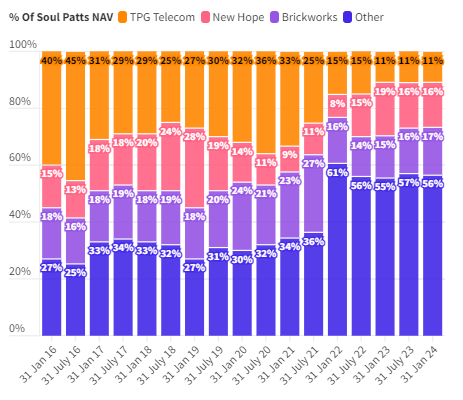

Today, the company is an $11 billion giant with a diverse portfolio of assets. About 40% of the net asset value is in three listed companies, Brickworks, TPG Telecom, and New Hope. The company has a 43% stake in Brickworks, which in turn owns 26% of Soul Patts. It also has a 13% interest in TPG and 39% interest in New Hope.

Source: Company, Flourish

Besides these long-term strategic holdings, Soul Patts also has close to $3.2 billion in private equity, credit and ‘emerging companies’. Among its more interesting private holdings, it continues to build out luxury aged care accommodation, partnering with the Moran family. It’s also endeavouring to roll up swimming schools across the country through a business called Aquatic Achievers.

Ingredients to its success

I think there are six secrets to Soul Patts’ success since listing 121 years ago:

Be opportunistic. If I had to describe the company and Soul Patts in one word, it would be opportunistic. It invests where it sees opportunity and where the odds are stacked in its favour. And it’ll look at any asset, even overseas, if it makes sense.

Always have cash on hand. To be opportunistic, it’s important to not take on too much debt and to always have cash on hand, so you can move when the time is right. This is a guiding philosophy of Soul Patts and it’s a key reason why it's been able to quickly move on acquisitions.

Partner with great people. Soul Patts seems to choose business partners better than most. It recognizes it’s often not an expert in a field, and it’s not afraid to partner with someone who is. A classic example of this is the partnership with David Teoh and TPG, which has been immensely profitable for both parties.

Don’t be afraid to be unpopular. There have been two major controversies for the company. The first is the cross shareholding with Brickworks. The company has had to fight off the likes of Ron Brierley and Perpetual to retain this arrangement. The second controversy has been with its ownership of New Hope. Anti-coal advocates have targeted Robert Millner, who’s held steadfast on the continued need for coal to help meet the world’s electricity needs.

An investor and operator. Robert Millner considers himself an investor first, and an operator second. Both have been important to his success. Soul Patts has board positions on most of the companies in which it invests, and provides advice, and capital for acquisitions when needed.

Luck. Yes, everyone needs a slice of luck, and Soul Patts has had its share. The property that it owned via Brickworks has turned into a bonanza. As has the agriculture holdings, the value of which have risen well beyond the company’s wildest expectations. To get this kind of luck though, you must be in the game, and Soul Patts has certainly done that.

Opportunities and challenges

Soul Patts has cash, connections, and a good reputation, which means it has the advantage of business deals coming to it, more than it having to go out to hunt for acquisitions. The company is keen to build out its private assets, as well as luxury aged care. Given recent moves with Perpetual, there’s also scope for more transactions in financial services.

There are some challenges for the company too. The first is that Robert Millner is 73 and that means someone else may soon take over as Chairman. Who that is will be decided by the Board, but the big question is whether the success of the company can extend to a fifth generation of the family.

The other challenge is one that’s less talked about, and that’s size. Soul Patts has a relatively small team overseeing $11 billion in assets. If it keeps growing, managing those assets will become more complex, which potentially increases the chance of errors.

Size tends to make it harder to generate returns. It’s easier to make $12 from a $100 investment than it is to make $120 million from a $1 billion investment.

James Gruber is Editor at Firstlinks and Morningstar.