The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Investors have been surprised by the sharp pullback in markets. They shouldn’t be, as I’ve repeatedly warned in recent months about overblown talk of US exceptionalism and irrational exuberance developing in several areas including US and Australian tech, some large caps stocks such as CBA, Bitcoin, and private credit. That’s not to float my own boat but because all of this seemed obvious at the time.

And guess which parts of the markets have been hit hardest? The most exuberant, of course.

% Below 52-Week High

US Bonds: -2%

Gold: -2%

S&P 500: -9%

ASX 200: -10%

CBA: -13%

Apple: -15%

Russell 2000: -18%

Microsoft: -18%

Meta: -18%

Amazon: -19%

Google: -21%

Bitcoin: -24%

Nvidia: -29%

Palantir: -39%

MicroStrategy: -52%

Tesla: -53%

Ethereum: -53%

Dogecoin: -66%

Trump Coin: -86%

Fartcoin: -90%

As at midday 12/3/2025. Source: Creative Planning, Firstlinks

Some normally uber bullish investment banks are turning bearish. JP Morgan now thinks there’s a 40% chance of a US recession. Goldman Sachs macro trader Paolo Schiavone has switched into Jeremy Grantham mode, by saying "[t]he fragility of the current setup suggests that equity returns will remain challenged," with "the biggest risk ... not a financial crisis, but something arguably worse: a slow, grinding bear market that could persist for years. Without a major credit event to force a reset, the downturn could follow the 2001-2003 playbook - marked by weak rallies, multiple false bottoms, and lower lows as economic momentum fades." And: "While short-term relief rallies are possible, structural headwinds persist, making sustained upside difficult."

Should you buy into this gloom? And, what should you do with your own portfolio?

The challenge in market downturns like these is more emotional than intellectual. A good strategy is to zoom out from the short-term noise. To ‘reframe’ the situation, as psychologists like to call it.

By doing this, we can see the following:

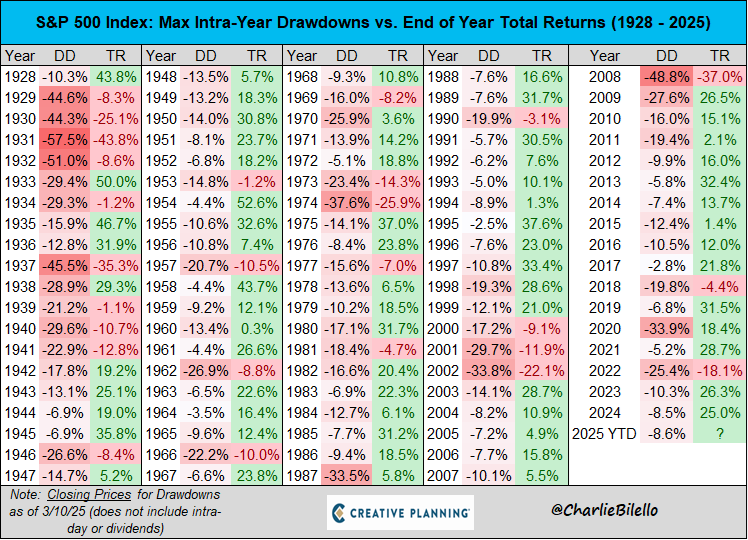

1. Market corrections like the current one are normal.

Since 2000, 15 out of the 24 years have witnessed double-digit intra-year declines. In other words, if the last 24 years are a guide, you can expect intra-year falls of 10% or more about 63% of the time.

2. Most of the time, market corrections reverse quickly.

The above chart also shows that if the market goes down by double digits in a year, there’s still a 60% chance that it will end up in the green for the entire year.

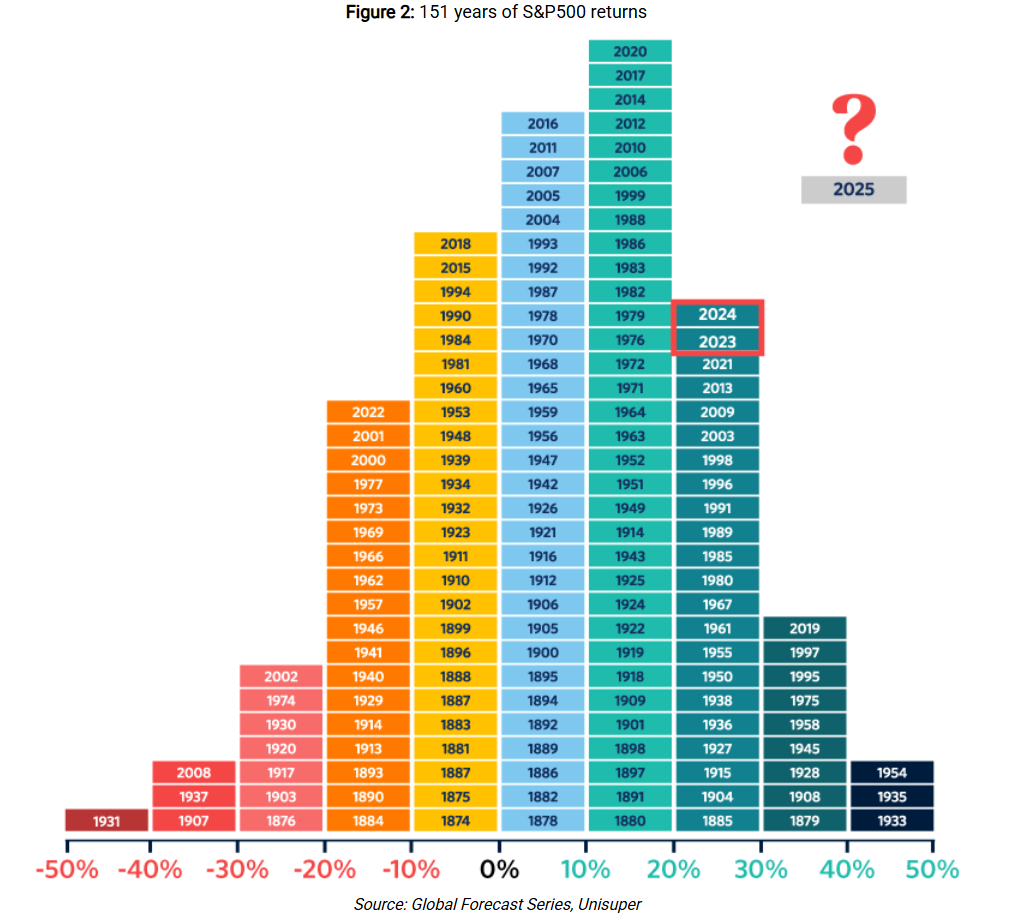

3. Just 1 in 5 years has losses of 10% or more.

This is different from the first chart because it measures yearly performance rather than intra-year. As you can see, years finishing with falls of 10% are reasonably rare. Of the past 151 years of the S&P 500, there have been 29 years of double digit losses. The odds of steeper declines are lower still. Only 11 times out of 151 has there been a market tumble of 20% of more.

So, while intra-year double digit losses are common, the chances that it’ll turn into a negative year are much lower.

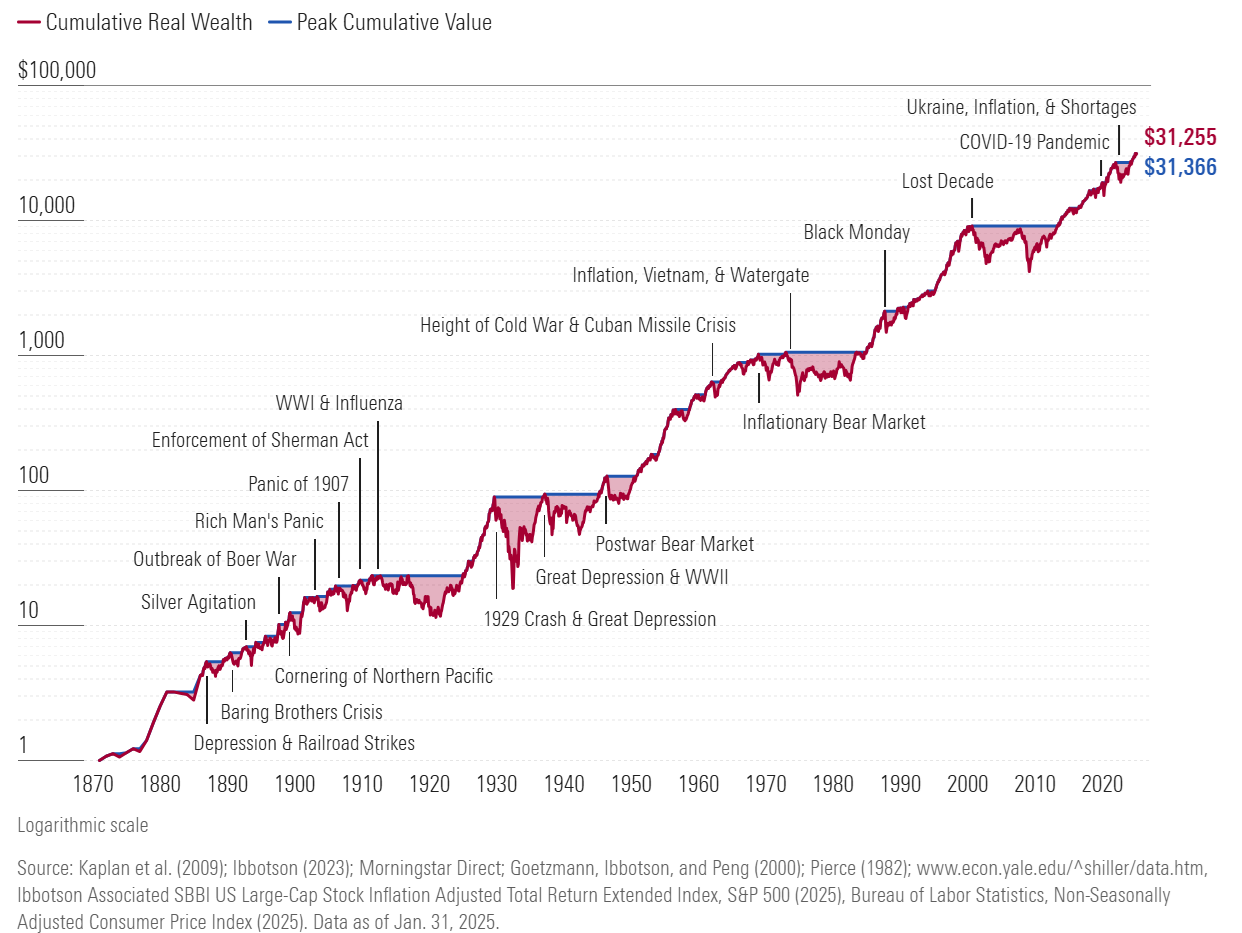

4. Zoom out far enough and market corrections look like small blips.

This chart shows one dollar (in 1870 US dollars) invested in a hypothetical US stock market index in 1871 would have grown to $31,255 by the end of January 2025 in real terms (inflation-adjusted).

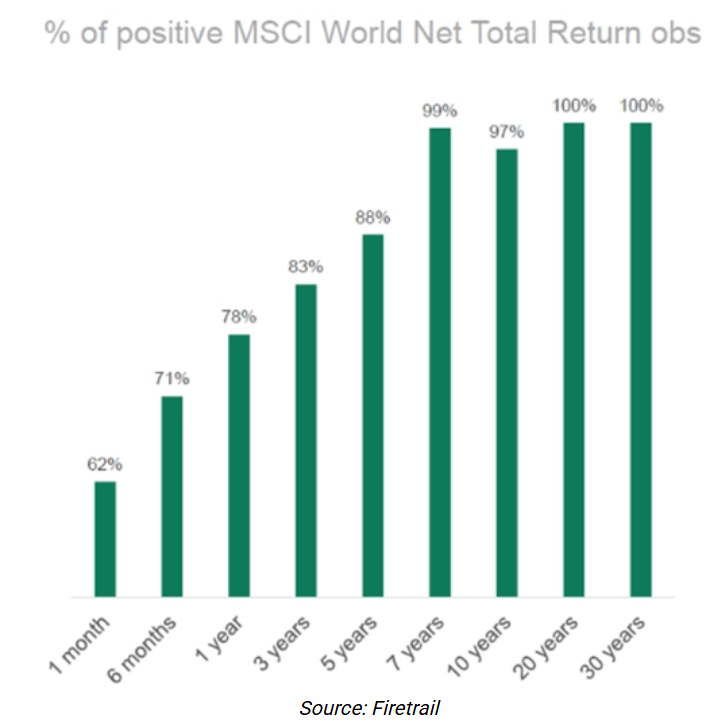

5. Holding periods matter. The chart below shows the chances of making a positive return on the MSCI World Index when investing for 7 year or more is at or near 100%. In other words, long-term investing almost always pays off.

The three golden rules of investing

Reframing markets in this way can hopefully lead you to bypass your emotions to consider the current markets in a more rational one.

And it leads me to my three golden rules of investing, which are especially applicable in any market downturn:

- Stay invested.

- Buy more if you can.

- Be patient.

Staying invested means that you don’t try to time markets. Doing this invariably leads to poor choices and inferior returns. Don’t believe me? Well, research has repeatedly shown that retail investors earn far lower returns than indices. The reason? They try to time markets. Don’t make the same mistake.

Buying more if you can means taking advantage of corrections to add to your portfolio. Rebalancing a portfolio is one way to do this. Another way is opportunistically adding to stocks that you already own or ones that you’ve earmarked to buy at certain prices.

Finally, being patient suggests holding onto stocks for as long as you can to let compounding can its course.

Following these three rules can enable you to build a sizeable portfolio and face any market corrections like this one with equanimity rather than fear.

****

In my article this week, I take a closer look at the $5.4 trillion intergenerational wealth transfer in Australia and suggest that while it may be good for those with the money and those inheriting it, it isn't so good for the country as a whole. I explain why that's the case, and offer some potential solutions.

James Gruber

Also in this week's edition...

As you might be able to tell from the endless spending promises from both sides of politics of late, a Federal election is set to be called at any moment. Shane Oliver outlines what the election will mean for investors.

Investment returns in super are a big focus – the media never fail to report on them. But UniSuper's Annika Bradley says that the chance of a comfortable retirement isn't just about investment returns, it's also about managing the risks along the way.

Meanwhile, most superannuation products offered to working-age Australians are now performance-tested, and there are calls to extend these tests to account-based pensions. Ron Bird isn't keen on the idea, for a host of reasons.

Tariffs are dominating the headlines and giving fright to fragile markets. But what does history tell us about the impact of tariffs on shareholder returns? VanEck's Anna Wu has the answers.

Amid a mini-market crash and a torrent of headlines, where are the best opportunities for investors? Fidelity International's Maroun Younes scours the globe and offers what he thinks are the next market winners.

Leigh Gant says there’s a peculiar irony in investing: the more aggressively you try to compress your timeline and chase that one massive windfall, the more likely you are to stumble. A better strategy is focus on minimising losses, rather than maximising gains, he believes.

Two extra articles from Morningstar this weekend. Joseph Taylor quizzes Shane Ponraj on whether IDP Education's problems are temporary, while Sarah Hansen asks if it is time to buy the Magnificent Seven.

Lastly in this week's whitepaper, VanEck does a deep-dive on quality investing and compares its performance and risk to other identifiable investing ‘factors’.

****

On Friday in the US, stocks staged a vigorous bounce, gaining 2.1% on the S&P 500 with the broad average finishing near session highs to claw back one-third of its year-to-date declines, while Treasurys came under modest pressure to wrap up a mixed week with 2- and 30-year yields at 4.02% and 4.62%, respectively. WTI crude ticked above US$67 a barrel to narrowly post its first winning week in nine tries, gold briefly scaled the US$3,000 per ounce summit before retracing to $2,982, bitcoin rebounded to US$84,000 and the VIX settled below 22.

From AAP:

The local bourse on Friday finished the week higher and ended a three-day losing streak, propped up by mining and utilities.

The benchmark S&P/ASX200 was up 0.52% to 7789.7 at the closing bell on Friday, while the broader All Ordinaries was up 0.59% to 8013.3.

Australian energy and bank stocks were the outliers in an otherwise positive session, with miners up a solid 1.7%.

Fortescue shares gained 2.7% to $16.27, BHP rose 1.1% to $38.65, and Rio Tinto lifted 1% to $117.10.

Goldminers shifted higher as investors flocked to safe-haven assets, with Newmont Corporation gaining 5.7% and Evolution Mining up 4.6%.

Lithium miner Liontown rose 4.9% after reporting narrowed first-half losses after the first shipment departed in September from its new Kathleen Valley mine in Western Australia.

Banks were mixed with CBA down 1.1% to $142.36, Westpac ticked down a minor 0.1% to $29.61 and NAB picked up 0.3% to $33.30.

ANZ was down a modest 0.2% to $28.29, with the bank striking a deal with the Federal Government to guarantee financial services in the Pacific as part of Australia's efforts to stop commercial banks vacating the region.

Infant milk formula supplier a2 Milk jumped 8.8% as northern Chinese city Hohhot announced subsidies for couples having children to help boost the birth rate.

From Shane Oliver, AMP:

Global share markets had another rough ride over the past week as ongoing uncertainty about Trump’s tariffs and the gathering global trade war added to fears about a hit to growth and profits. Despite a 2.1% bounce from oversold levels helped by a government shutdown being averted and a one-day absence of Trump trade noise, US shares fell another 2.3% over the week making it their fourth week of losses and taking its total top to bottom fall to 10.1%. Eurozone shares also bounced on Friday and have been far more resilient falling just 0.8% in the past week and having had just a 3.4% fall from their recent high to their low reflecting better valuations and optimism regarding significant fiscal stimulus in Germany. Japanese shares and Chinese shares bucked the trend though with Japanese shares up 0.4% and Chinese shares up 1.6% helped by reports of a press conference by government officials to be held on Monday on measures to help consumers. Reflecting the negative US lead Australian shares fell another 2% with falls led IT, health, retail and financial shares. This takes its fall from the February high to its recent closing low to 9.4%. US bond yields were unchanged, but yields rose a bit more in Europe on fiscal stimulus plans and they rose in Australia and Japan.

More mayhem from Tariff Man. The past week saw Trump’s 25% tariffs on all steel and aluminium imports to the US start as scheduled with no exemptions. This in turn saw the global trade war ramp up with the EU and Canada announcing retaliatory tariffs, Trump threatening a 200% tariff on EU wine and briefly pushing up the tariff on Canada to 50% after Ontario briefly imposed a 25% tax on electricity exports to the US. There is a long way to go though, with 2nd April shaping up as the big day: with exemptions scheduled to be removed from some of the tariffs on Canada and Mexico along with the start of “reciprocal tariffs” presumably on all countries and tariffs on various industries including semi-conductors, autos, pharmaceuticals, copper and agriculture.

A big risk for the US is that other countries get to a point where they have had enough and refuse to negotiate with Trump. While he thinks the rest of the world is “ripping us off” other countries may see it the other way round with America’s dominant culture and big companies “ripping them off” and so conclude that they don’t really want to negotiate if it involves having to give up things that are reasonable (like Australia’s GST and biosecurity laws). Just as people have turned off Tesla (with its shares halving in value) the same could happen more broadly for US companies.

Rising risk of recession. Trump’s erratic tariff announcements combined with DOGE’s manic cuts to the Federal workforce and service delivery at a time when the US labour market has cooled down and households have run down their pandemic savings buffers are increasing the risk of a US recession. The uncertainty is already becoming apparent in confidence which in time risks showing up in spending. Trump’s refusal to rule out a recession and others in his administration saying a recession might be “worth it” and referring to a “detox period” are adding to investor concerns.

No exemption for Australia on the steel and aluminium tariffs – at least not yet - and it’s hard to see Australia avoiding many of the other tariffs Trump is proposing from 2nd April. President Trump’s trade adviser Peter Navarro’s claim that Australia was “killing the aluminium market” makes no sense as last year only 2% of US aluminium imports came from Australia. And Australia’s trade deficit with the US meant that we had a strong case for an exemption but its clearly about more than that given the Trump administration’s desire to return more production to the US and irrational perceptions that the rest of the world – which presumably includes Australia – is “ripping us off.” Next in the firing line are our pharmaceutical exports to the US (worth $2.1bn and more than double our US steel and aluminium exports) and meat (worth $6.1bn) and more broad based “reciprocal tariffs” on all our exports which he might “justify” by taking a dislike to the GST, bio security laws, the news media bargaining code and our spending of only 2% of GDP on defence when the US spends 3.4%. The key is to put this in perspective though – compared to other countries we are a small exporter to the US with a total value of $24bn last year or 0.9% of our GDP.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website