The practice where I work as an adviser has, for various reasons, predominantly attracted older senior clients over the years. While we do have a growing number of wealth accumulators, there has been a strong focus on retiree, seniors and ageing-related issues.

One would think then that we have been signing our clients up to annuities left, right and centre for a long time. However, until this year, this hasn’t really been the case. The recovering share market of recent years, strong franked dividend yields from ‘defensive’ market sectors and low interest rates have made annuities relatively uninteresting as a long-term investment option for most of our client base.

Until recently, that is. This year we’ve noticed a major shift in investment attitudes, and suddenly those in their advanced years are looking at annuities with increasing interest, even with current interest rates at record lows.

We’ve seen more global uncertainty in 2016 than at any time since the GFC. Brexit, falling fuel and oil prices, wars, political uncertainty, a slowing Chinese economy, and record low bond yields are contributing to a wary economic outlook and elderly investors are nervous about their share market exposure. Couple that with some innovative annuity enhancements over recent years and changes to the age pension assets test kicking in on 1 January 2017 and suddenly annuities are on the radar.

What is an annuity?

An annuity is simply a guaranteed income stream purchased from a life company with a lump sum. The payments are promised up front by quotation, so the investor knows what they’re signing up for from the outset. The ‘guarantee’ does not refer to a government guarantee that applies to bank accounts and term deposits. However, the life companies are closely regulated and their reserving requirements make their guarantees solid.

The annuity can be paid until the holder dies (a ‘lifetime’ annuity), or for a fixed number of years (a ‘term’ annuity). It can be linked to inflation, or not, and can have a residual amount paid back at the end of the term. The annuitant chooses the features that determine the income level.

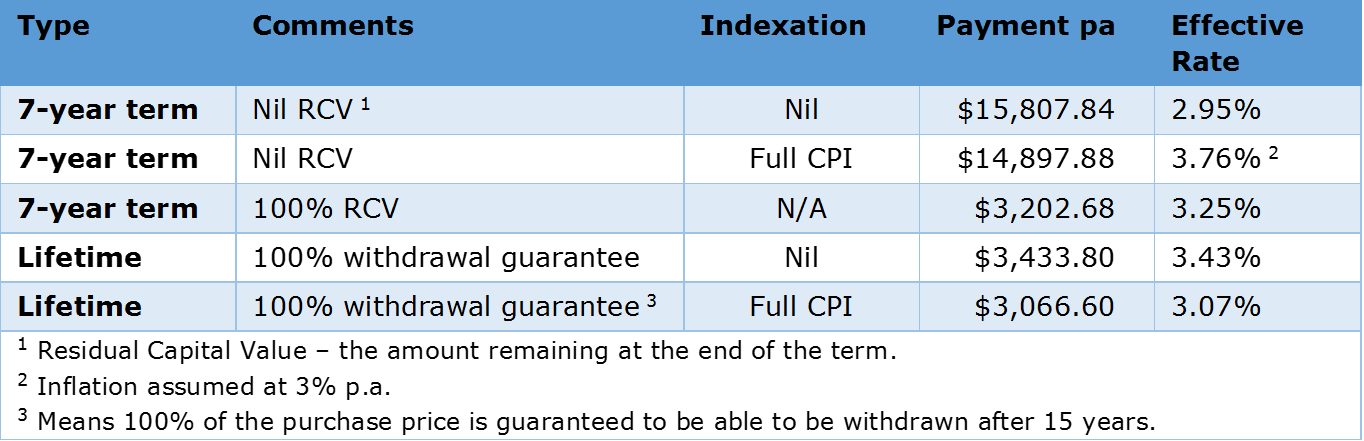

By way of illustration, let’s look at an investment amount of $100,000, and how the features selected change the income that it pays. The results in the table below are based on quotations received from a leading annuity provider on 5 September 2016 for a 70-year-old male with monthly annuity payments. Note for these quotes, I have not included upfront or ongoing Adviser Service fees – these can also be built in to the quotations.

What sets annuities apart from term deposits is their tax and social security treatment. Term annuities that only pay out the interest component (100% RCV) are basically the same as term deposits, but nil RCV and lifetime annuities have distinct advantages.

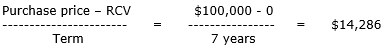

In the 7 year, nil RCV, nil indexation example above, the tax and social security rules recognise that a large portion of the $15,807 payment is in fact return of capital. That return of capital is calculated simply as:

With $14,286 of the $15,807 annuity payment considered return of capital, only $1,521 is assessed as taxable income and income-tested income.

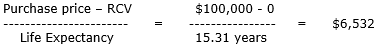

Life expectancy (taken from the Australian Life Tables 2010-2012) is the denominator when the calculation is on a lifetime annuity. So for the lifetime examples above, the return of capital amount is:

This is more than the actual income the annuity pays, so no income is assessed for tax or Centrelink purposes.

Under the Assets Test, the return of capital is deducted off the purchase price each year to determine how much counts.

Who wants annuities?

Jack and Mary are in their late 70s and in good health. They’ve sold their home and bought into a retirement village, leaving $360,000 of capital to invest. They have an existing share portfolio and are comfortably living off the dividends and their part age pension. However, the pension is set to halve as a result of Centrelink counting the capital released from the home as an asset, then halve again from 1 January 2017 with the new Assets test.

They are adamant that they do not want any further share market exposure, and term deposits are not appealing with their low rates. We showed them an annuity product that guarantees income for the life of the annuitant and has a ‘withdrawal guarantee’ that allows a guaranteed amount to be withdrawn after 15 years, if required.

Lifetime annuities of old lost their appeal as there was little or no guarantee that any capital would be repaid from it after purchase. But recent products have largely solved this problem and allows for a withdrawal amount along the way up to 15 years.

Annuities can also have generous tax, income and asset test treatments compared with term deposits, so over time Jack and Mary’s age pension may improve at a faster rate than if they had invested in term deposits, fixed interest or shares.

Suitable for older clients who dislike market volatility

Then there’s Keith and Leanne, each about 80 years old and utterly risk averse. They are attached to their age pension and, like Jack and Mary, have downsized and unlocked capital from their home that is going to eat into their pension now and from 1 January. They were looking for something with no market volatility that would also allow their pension benefits to increase over time.

They chose two 7-year annuities with nil RCV. Splitting the investment by half to give them an annuity each, they now have a known cash flow and optimised age pension. If one passes away before the 7-year term expires, the annuity continues to the survivor. If they both pass away, the estate will continue to receive the payments until the term is complete, or it can opt to get a lump sum payout.

Then we have Neville, who is single with $2 million in rolling term deposits. Shares (or managed funds) were never an option for him. While not a pensioner, Neville was equally determined to qualify for whatever government benefits he could, and his attachment was to the Commonwealth Seniors Health Care card. The interest on the term deposits was going to disqualify him from holding that card.

Neville had made provision for $500,000 worth of cash bequests and wanted to retain at least that much for his estate. In his words, he wanted an investment that provided the same or similar level of capital security as term deposits with a competitive return and tax efficiency.

Again, the lifetime annuity that provides for a withdrawal guarantee came into play, his taxable income was reduced so that he retains his CSHC card.

Annuities generally don’t make for lively dinner conversation. Those that remember the old products are surprised that, given global economic volatility and product innovation, they are more appealing now.

Alex Denham is a Senior Adviser with Dartnall Advisers in Berrima. Prior to becoming an adviser, she spent 20 years in senior technical roles with several financial services companies. This article is general information and does not consider the circumstances of any individual.