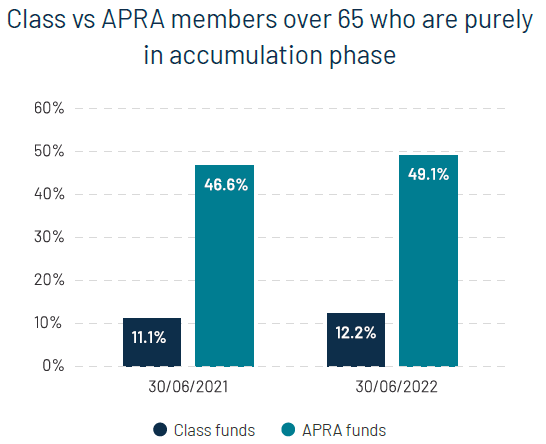

Over age 60, superannuation benefits paid as either a lump sum or pension are tax free and not assessable for income tax. Why doesn't everyone convert from accumulation to pension as soon as possible? In the recent Class Benchmark Report, one graphic stood out. While only 12% of SMSF members aged 65 and over remained entirely in accumulation, half of APRA fund members over 65 had not switched any of their super to pension. The amount not switched to pension by over 65s is estimated at $225 billion. They may be paying too much tax and should be advised of the choice.

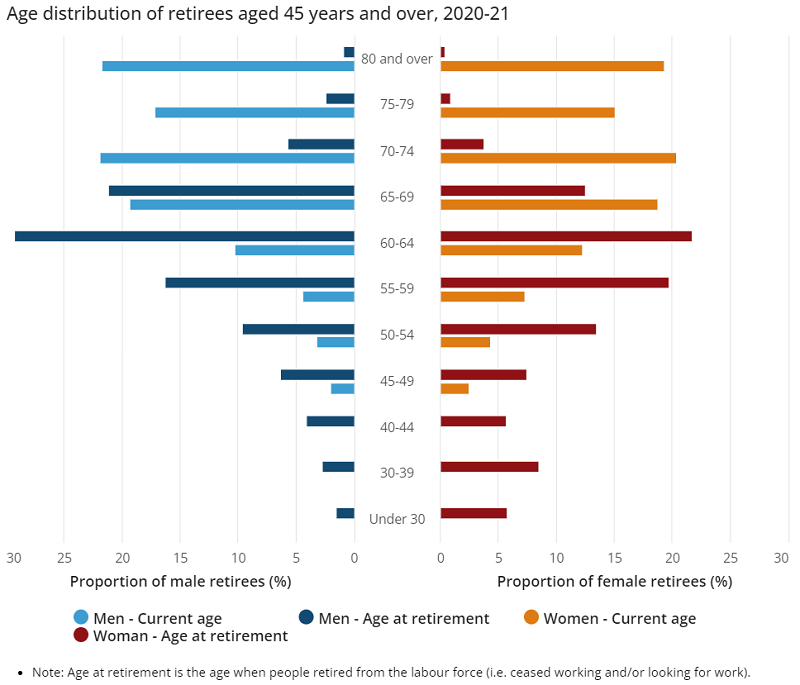

In the accumulation phase, investment earnings are taxed at 15%, whereas the tax rate is nil in pension phase provided certain rules are met. As the ABS data below shows, retirement from the workforce, and therefore eligibility for a super pension, is most common in the 60-64 age group for both men and women, with high numbers for age 65 and over. For some, the pension opportunity starts at 60.

What are the conditions to start a pension?

Starting a pension in superannuation is not complicated and it does not require a change in thinking from saving to spending. While withdrawals must be made from a super pension account each year, the money does not need to be spent and can be saved outside the pension account. Sometimes, the superannuant can continue working.

(A super pension should not be confused with the Age Pension from the government. There are also Transition to Retirement (TTR) income streams which do not carry the same tax benefits. Check your personal circumstances with a financial adviser before taking any action).

The Conditions of Release to start a super pension are:

- reach preservation age and permanently retire

- cease employment after the age of 60 even if later return to work

- age 65 years and over, even if not retired.

Preservation age varies between 55 and 60 depending on date of birth. There are other special circumstances which we won’t dwell on for the purposes of this article.

The opportunity from the age of 60 is probably less known than the eligibility for a super pension at age 65. Super pensions are flexible with a minimum of 4% of the balance drawn out each year, depending on age. New contributions cannot be made to a pension fund but an accumulation fund can operate at the same time and accept contributions.

Super of $400,000 earning say 8% a year generates $32,000 a year of investment income, which at 15% is $4,800 a year.

The maximum that an individual can transfer from accumulation to pension is determined by the personal Transfer Balance Cap (TBC), currently $1.9 million.

Why members do not start super pensions

On the surface, a tax rate of nil versus 15% looks like a no-brainer, but half of APRA fund members do not lower their taxes after the age of 65. Some may be eligible for a pension account from the age of 60.

What’s happening?

1. Many members do not know about the tax treatment, especially those in APRA funds. They do not focus on their superannuation, the rules are too complicated, their super fund has not informed them or they haven't opened the mail. Tax is deducted at the fund level so the tax payment is not apparent. It’s more likely that SMSF trustees are advised by either a financial adviser or accountant.

Liam Shorte of Sonas Wealth said:

"From experience, the biggest reason is that people who have not received advice think you cannot move in to pension phase until you stop working.

The second biggest reason is that those working often put it in the too hard basket as they have enough from employment income to meet their living expenses and just leave super until they need it as they do not understand or know about the tax benefits of pension phase.

No matter how many letters the industry funds send them, if they don’t open the letters or feel it is advertising, they just ignore the call to action.

Last year I took over a client who was 84 and finally retired, closing his business, and had super that he was told 20 years ago he could access when he stopped working and so he never did anything about it until he actually retired!"

Large super funds must accept some blame for not identifying their members at the age of 60 or 65 more actively and explaining the options. AustralianSuper has proposed a scheme where all members over 65 are automatically converted to pension with an opt out, in coordination with the Age Pension.

As ASIC and APRA said in their July 2023 Review on the Implementation of the Retirement Income Covenant (RSE=Registrable Superannuation Entity).

“Overall, there was a lack of progress and insufficient urgency from RSE licensees in embracing the Retirement Income Covenant to improve members’ retirement outcomes.”

2. Some members do not want to draw down their superannuation preferring to build the balance within super for retirement spending when needed. Perhaps they do not realise that the money does not need to be spent and can be invested in another vehicle.

3. An account-based pension may affect entitlement to social security benefits, although this is unlikely to impact most SMSF trustees. Lyn Formica of Heffron advised:

"In terms of the social security income test, there can be an incentive not to start a pension but only when an individual is below Age Pension age. This is because no amount is counted as income in respect of accumulation account balances (ie there is effectively no deemed income) for individuals below Age Pension age. But when an account-based pension is commenced, whilst actual pension payments are ignored for income test purposes, a deemed amount of income is counted.

Once an individual reaches Age Pension age, the income test treatment of leaving monies in accumulation phase or commencing an account-based pension is effectively the same."

Again from Liam Shorte:

"For some, when they meet a Condition of Release like retiring after age 60 or reaching 65, they deliberately delay the move to pension phase if they are part of a couple where the older one is getting the Age Penson or Disability Pension. They may lose or receive a lower benefit if the younger partner moved to pension phase earlier than when accumulation is counted as an asset at 67."

4. According to the Class Report, far more APRA fund members withdraw lump sums in larger amounts after satisfying a Condition of Release (including reaching 65) than the number of members who commence a pension and withdraw progressively. Their evidence suggests many retirees are withdrawing the entire balance after they become eligible rather than opening a pension account.

This may be financially appropriate where, for example, paying off a mortgage allows higher eligibility for an Age Pension while reducing or eliminating mortgage payments (and the value of an own home does not count in the assets test whereas a superannuation balance does). Says Joshua Williams, writing in the Class Report:

“The total number of members between 60 and 64 (1,573,352) drops to less than half that number 10 years on, in the 70 to 74 cohort (707,353). Most are choosing not to preserve their benefits in the superannuation environment at all. It wouldn’t be fanciful to imagine that, after repaying the mortgage on the family home, splurging on a new car and a cruise, most of us will end up relying on the Age Pension after all!”

The need to educate on tax benefits

While it is worthwhile reviewing individual circumstances against this list of reasons, for the most part, the failure to switch to a pension fund is due to a lack of familiarity with the opportunity.

In the 2023 Intergenerational Report, withdrawals from superannuation are estimated to increase from about 2.4% of GDP per annum in 2022-23 to 5.6% of GDP in 2062-63. There is a big incentive for millions of older Australian to realise the tax advantages of pensions.

It’s surprising that only one APRA fund member in every eight over the age of 65 has converted their superannuation entirely from accumulation to pension, and educating members on the opportunities is essential. They could save thousands a year in tax.

For more information on pensions, especially in SMSFs, see this paper from Heffron, "The Ins and Outs of SMSF Pensions in 2023/2024".

Graham Hand is Editor-At-Large for Firstlinks. This article is general information. My thanks to Lyn Formica of Heffron and Liam Shorte of Sonas Wealth for input to this article but any mistakes remain mine and are based on my understanding of current legislation. Check your personal circumstances with a financial adviser before taking any action.