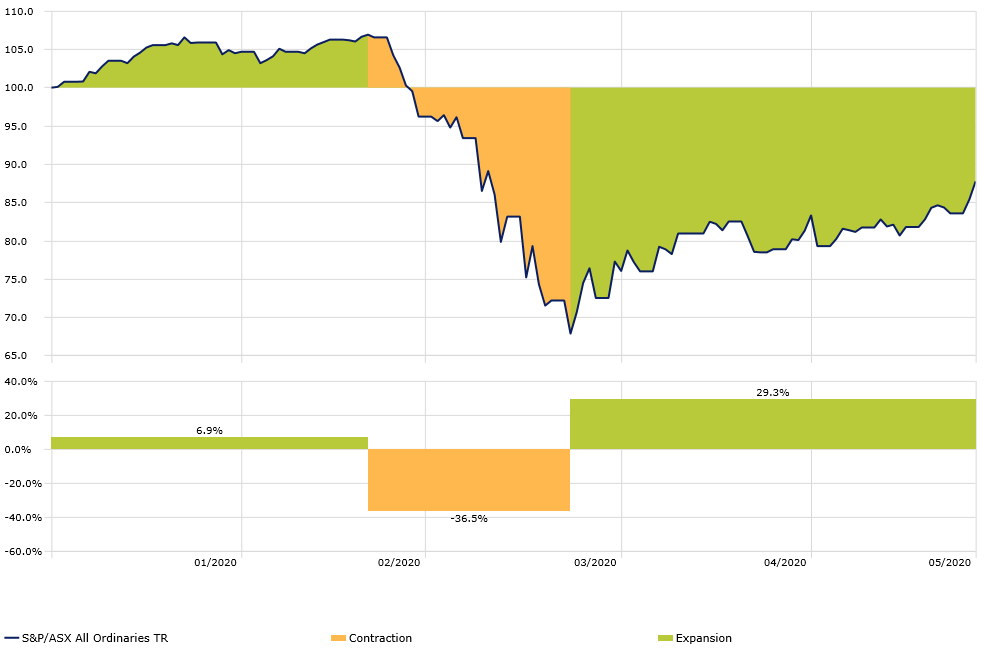

April 2020 was a month of recovery. The All Ordinaries Index enjoyed a strong monthly gain after COVID-19 struck the market in February, rallying 9.5%. This represented the best monthly performance on record since March 1988, and so far, it has continued in May.

The All Ords has now risen almost 30% since its March 23 nadir, leaving it just 16% down from its February 24 peak. The 5% plus rally in two days earlier this week showed a lot of confidence among investors.

Investment growth | S&P/ASX All Ordinaries TR, YTD

Source: Morningstar Direct. Define drawdown as decline by 10% or more. Time Period: 2/01/2020 to 26/05/2020

However, the economic outlook remains uncertain and analysts are urging caution. April job figures showed the extent of the damage to the economy. The unemployment rate jumped to a seasonally-adjusted 6.2% but it was limited by an 'unprecedented' drop in the participation rate to 63.5%.

This means that of the 594,300 people that left employment, only 18% of these people become unemployed - that is, actively searching for work and applying for jobs - with 80% of people leaving the labour force.

In this environment, it's difficult to predict companies' future earnings and cash flows with any kind of certainty. Many are throwing their guidance out the window, slashing dividend payouts, or rushing to secure additional equity or debt to shore up their balance sheets.

Companies offering value and lower uncertainty

Morningstar analysts say there are almost 100 companies currently trading below their intrinsic value. However, only a handful of those have carved out solid (and in some cases growing) competitive advantages that will allow them to thrive for many years with low or medium fair value uncertainty ratings - meaning companies analysts feel they can estimate future cash flows with a higher degree of confidence.

These include stock transfer company Computershare (ASX:CPU), superannuation administration services provider Link Administration Holdings (ASX:LNK) and funeral home operator InvoCare Ltd (ASX:IVC).

To find stocks to fit the bill, we screened for the following:

Economic moat: First, they need to boast wide Morningstar Economic Moat Ratings - and their Morningstar Moat Trend Ratings must be stable or positive. In other words, these companies have competitive positions that are steady or even improving.

Discounted: Second, the stocks of these companies must be trading at a decent discount to our fair value estimates - selling at Morningstar Ratings of 4 or 5 stars.

Fair value certainty: Third, we need to have a high degree of certainty in our fair value estimates for the stocks of these companies, limiting our search to stocks with fair value uncertainties of medium or low. This rating represents the predictability of a company's future cash flows.

Top notch steward: Finally, we tossed out companies with Poor stewardship ratings, preferring to ride along with management teams that have a proven record of being good stewards of investor capital.

Don't think of this as a list of ‘buys’, though. Instead, think of it as a collection of names to investigate further. Morningstar Premium members can see the individual stock pages for full analysis. Morningstar Director of Equity Research, Johannes Faul, says:

"A 5-star rating does not suggest that the stocks won't drop further. Our aim is not to pick the bottom, but to highlight to investors that they can pick names up at a discount."

Quality stocks trading at a discount

This is a snapshot of how these stocks stand at the time of writing on 26 May 2020. Given the current market volatility, the valuations could jump around.

Source: Morningstar Direct

Morningstar Premium subscribers can access the full list of undervalued Australian stocks here. The latest Australian and New Zealand Best Stock Ideas list can be found here.

A free trial is available on the link below, including access to the portfolio management service, Sharesight, and a series of eight webinars that Morningstar will run during June 2020.

Emma Rapaport is an Editor for Morningstar.com.au

Try Morningstar Premium for free