For the past 20 years, one of the most common questions I have received from Aussie retirees, their advisers, and ‘FIRE’ warriors living off their long-term 'passive income' portfolios is: ‘How can we get more income from our investments?’

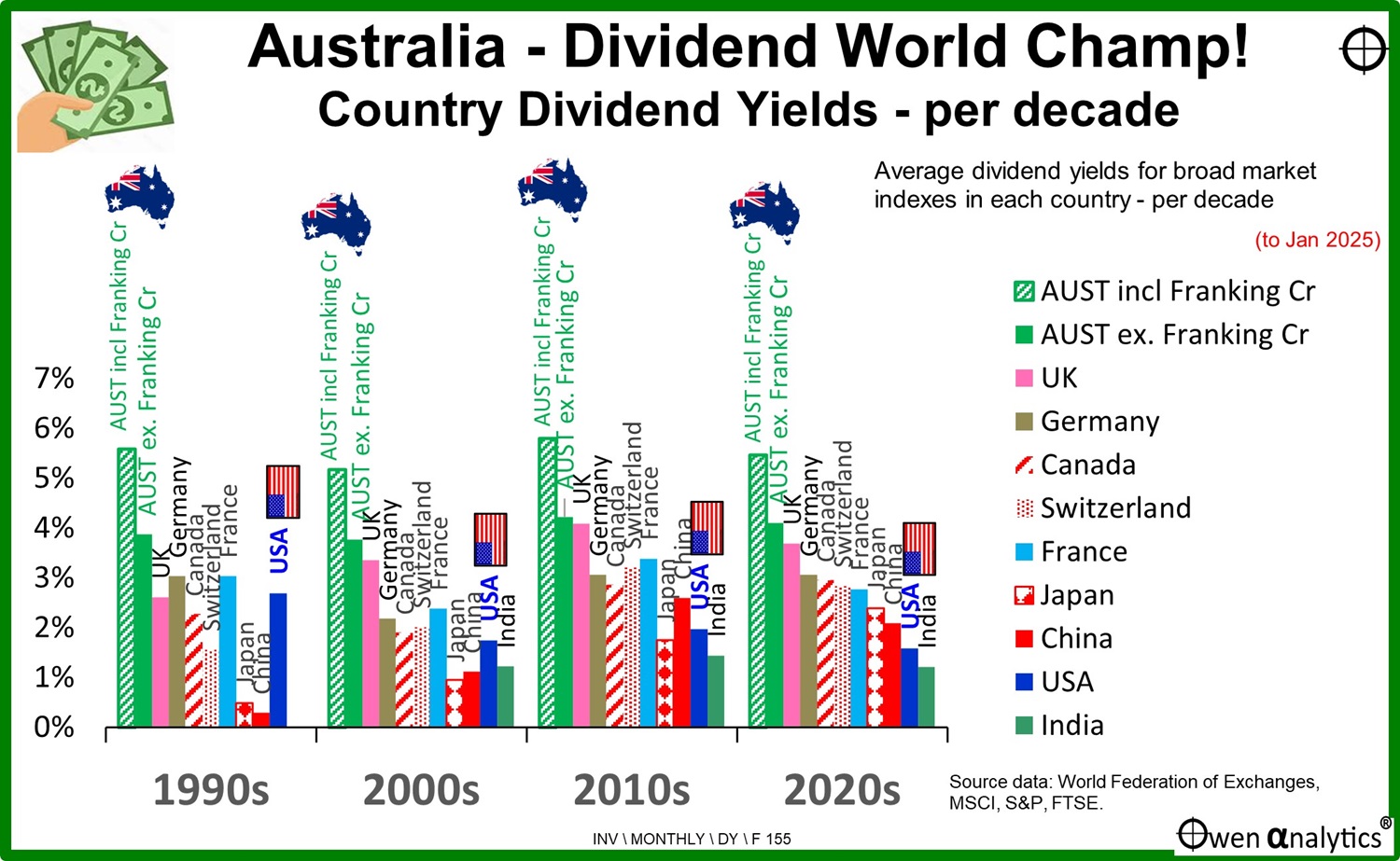

This obsession with boosting portfolio income has always struck me as a little strange because Australia has, for many decades, had the highest dividend paying share market in the world by far. Aussie investors are living in the best country in the world for dividend yields. And that’s BEFORE franking credits! When you add franking credits on top of the already very high cash dividend yields, our overall dividend yields (especially for tax-free retirees) are twice what they are in other major markets around the world.

(There are, of course, always some tiny markets that have higher dividend yields from time to time for a variety of reasons – eg Kenya, Nigeria, Jordan, Kazakhstan, Bosnia & Herzegovina, Slovenia, Serbia, Lithuania at the moment.)

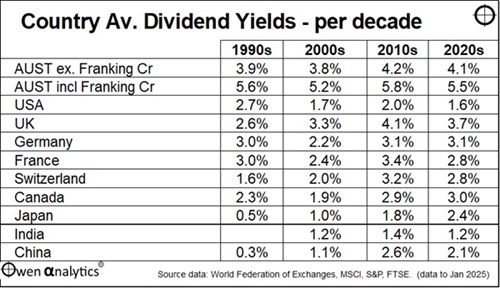

Today’s chart shows average dividend yields from the Australian share market (ASX200) versus other major global share markets for the past four decades. For Australia we have two types of dividend yields - the cash yield (as in other countries), and also the ‘grossed-up’ yield including franking credits (this is the yield for tax-free retirees).

For more on franking credits, how they work, and how much value they add, see '‘Frankly my dear...we need to include Franking Credits in reporting and portfolio planning’.

Even in the Covid years like 2021 when bank deposits were paying zero interest, and companies were cutting or cancelling dividends, the overall ASX market still paid a cash dividend yield of 3.7%, or 5% including franking credits. Then it jumped back up in 2022 to 4.5% cash yield (6.1% gross yield), then 5.8% gross yield in 2023, and then 5.2% gross yield in 2024.

Who would want more than that?

Envy of the world

American retirees generally use 2% as their mental benchmark for share portfolio yields, because dividend yields on the US share market have averaged around 2% for decades. (see table at the end of this story for all the numbers). 2% yields are ‘normal’ for Americans, and they are accustomed to thinking about a 2% yield for spending and aiming to leave the portfolio intact to grow. (Actually, US yields are just 1.3% in the current tech bubble.)

When I tell them Aussie investors complain about 4% yields from the Aussie share market, they respond with something like, “Wow, I could live off 2% and re-invest the rest for future growth!”, or “What do they do with all that extra cash?”

Portfolio heaven

Long-term retirement portfolios designed to fund inflation-indexed living expenses for decades, need to consist mainly of assets that offer inflation protection plus some real growth ahead of inflation. Typically, they have a total return target of ‘CPI+4%’, and this generally means mostly shares (plus perhaps some other ‘growth’ assets like commercial property).

(Why ‘CPI+4%’ target returns? So you can withdraw 4% of the balance each year, with withdrawals rising with inflation to maintain your living standard, and the balance after withdrawals also at least keeping pace with inflation. Why 4%? Because that has been found to provide a high degree of confidence you will never run out of money, or at least not for a couple of decades or so.)

A typical CPI+4% portfolio translates into a 25-times ‘multiple’ of your spending budget (1/25 = 4%) and this 25 times multiple is the standard starting point for ‘How much do we need?’ discussions when planning for retirement (or should be anyway). For example, if your spending budget is $100,000 pa, you would need $2.5 million if you are looking for financial freedom, not welfare dependence. (But that’s another story for another day!)

Australia’s Superannuation system is conceptually based on this ‘25-times multiple of spending’ idea. The ‘minimum withdrawal’ rules for Super accounts in ‘Pension’ phase start with a minimum withdrawal rate of 4% (for retirees below age 65). This 4% withdrawal rate = 25 times multiple of spending budget.

In every other country but Australia, dividend yields are well below 4%, so retirees generally need to sell down some of their shares each year to fund their 4% withdrawals (for a standard 25-times portfolio).

But not here! Australia is the only country in the world where the dividend yield on the broad share market is almost always HIGHER than the 4% withdrawal rate! To quote a raw onion eating former PM – ‘How good is that!’

It means a typical retiree portfolio invested mainly in broad ASX funds/ETFs, or in a wide spread of direct shares, can just live off the dividends without even thinking about selling shares.

Avoid the ‘big switch’ into bonds!

Portfolio management textbooks (all US based) are obsessed with people making the ‘big switch’ from shares to bonds when they retire in order to increase the portfolio yield to fund retirement living expenses. But in Australia, the share market is already yielding more than necessary to fund the withdrawals, and also usually higher than the running yield on bonds, so there is need for the ‘big switch’ into bonds!

(Also, bonds have no inflation protection, no growth, and make very poor long-term investments with the return of inflation).

No sequencing risk or volatility worries

Another plus for Aussies is that the dreaded ‘Sequencing Risk’ also largely disappears! ‘Sequencing risk’ is the risk of having to sell shares at low prices in a bust, to fund regular withdrawals. Because yields usually exceed withdrawals, there is rarely a need to sell shares just to fund regular living expenses, as the rest of the world has to do.

When you do want to sell some of the portfolio to free up capital for some specific purpose (eg to help the kids buy a house, or go on a big trip, etc), you can usually choose your own timing – not be forced to sell when prices are low in a bust.

High dividend yields deliver all of these benefits to Aussies - it is unique in the world!

Diversified portfolios

Most diversified retiree portfolios have global shares alongside their Aussie share allocation (plus also some bonds – refer above!), and these do reduce the overall portfolio yield. However, I still find a large proportion of Aussie retirees have a (rather unhealthy) fondness for old favourites like the big bank banks, miners, Telstra, Woollies, etc – all of which pay dividends even HIGHER than the overall market average yield.

A typical long term diversified portfolio of say: 40% Aussie shares (5.3% grossed-up yield currently) + 40% global shares (2% yield) + 20% government/corporate bonds (say 4.5% yield) will be paying an overall portfolio yield of just under 4%, which is about double what US retirees get on their US-oriented portfolios.

The underlying problem

So, back to the question of why so many Aussie retirees are always asking how to increase their (already world beating) yields on their share portfolios?

Even with the broad Aussie share market routinely yielding 4%+ (or 5%+ with franking credits), many Aussies still can’t resist the temptation to chase even higher yields. Many are lured into all sorts of things like - ‘covered-call’ option schemes, high-risk mortgage funds, opaque structured ‘private credit’ funds stacked full of risky property construction loans, black-box trading schemes, and straight-out frauds dressed up as ‘safe’ high-yield investments.

I put their endless search for higher yields down to poor management of expectations at the outset. It’s all about planning, understanding markets, and communication.

Every retirement planning tool and calculator I have seen has fundamental problems. That includes retirement planners and calculators provided by government departments (eg moneysmart), industry groups like the Association of Superannuation Funds of Australia (ASFA), every industry fund (eg. Australian Super, HostPlus, etc), as well as investment platforms, financial planning firms, and a host of online retirement calculators.

From what I have seen (and I have seen hundreds) they all use very simplistic assumptions about critical variables like inflation, financial market returns, life span, etc. They use nice, neat, straight lines and smooth curves, they assume markets are always fairly priced, and they don’t allow room for volatility or changes in conditions, or changes in circumstances.

Even the more complex models use fancy terms like ‘stochastic distributions’ and ‘monte-carlo simulations’ which are nonsense because they assume returns are random and ’normally distributed’. In the real world, returns are demonstrably not random nor normally distributed! Never have been – never will be. (Why? Because markets are run by human emotions like fear and greed, not calm, considered, logical reason)

These simplistic retirement models are dangerous and create unrealistic expectations. When things don’t follow those nice, neat, straight lines and smooth curves, people lose confidence and start to worry. ‘Do we have enough?’ ‘Will we run out of money?’, ‘I can’t go back to work, I’m 86!’, and so on.

Better initial planning over the big questions like - ‘How much do we need?’, ‘What if inflation is higher?’, ‘What if returns are lower?”, ‘What if I live to 100?’, and so on - would set more realistic expectations and engender greater peace of mind for a long and happy retirement.

I will also leave for another day two very important issues related to high dividend yields –

- Why are Australian company dividend yields much higher than the rest of the world? Spoiler alert – it is NOT the Dividend Imputation (franking credit) scheme – our yields were higher than the US and the rest of the world decades before the introduction of franking credits in 1987.

- The downsides of high dividend yields have been low profit growth (because companies retain very little for further growth) and lower returns on equity.

Here is the data for today’s chart -

Ashley Owen, CFA is Founder and Principal of OwenAnalytics. Ashley is a well-known Australian market commentator with over 40 years’ experience. This article is for general information purposes only and does not consider the circumstances of any individual. You can subscribe to OwenAnalytics Newsletter here. Original article is here: Australia: Highest dividend yields in the world, so why the endless chase for even higher yields?.