This is an edited extract of an interview between Firstlinks’ James Gruber and Arvid Streimann, Head of Global Equities and Portfolio Manager at Magellan Financial Group.

James Gruber: Stocks have run hard over the past two years now, especially this year. Is there more to come in 2025?

Arvid Streimann: I think that there'll be further gains in equity markets, but not at the same pace as you've seen over the past couple of years, which have been quite extraordinary by historical standards. When I look at what's been driving the market, especially in the past couple of years, over half of the driver of returns has actually been improved sentiment. That's over and above improvements in the fundamentals - those fundamentals being better earnings or movements in interest rates.

It's really that sentiment piece which has driven markets higher to a large extent. It's very difficult to see that sentiment improving further from where we are already.

If I look at the proxies for sentiment and equity risk premiums in the market, they're all at very extreme levels by historical standards. Going forward, it's the fundamental pieces - earnings and interest rates - which are going to drive markets further.

So we’ll probably see positive market growth, but not to the extent seen over the past couple of years.

JG: Where do you see earnings growth coming from globally?

AS: Look, I think we're going through a cyclical upswing. I would say the economically cyclical parts of the market will do well. You've got a US administration which is going to be pro-growth. You've got the flow through impact of lower interest rates to spur growth, and that should improve earnings growth in a cyclical sense in North America, that'll trickle through to Europe as well.

We're still quite bearish when it comes to China. They have their own structural problems, and I wouldn't be looking at China as a source of cyclical earnings growth.

‘Growers’, say your big tech players and companies, should do ok in this environment, but it's the cyclical parts of the market that will probably have their time in the sun in the next year or so.

JG: So we're talking financials, consumer discretionary, those kind of areas?

AS: Yes, that's right. Financials usually do well in this type of environment. I would say that commodities in general should do ok in this type of environment.

JG: Donald Trump is the master of unpredictability. How do you navigate that unpredictability as a portfolio manager?

AS: This is an interesting one. Donald Trump - I think you can look at his first administration for some clues as to how he may act in his second administration. In that first administration, he liked to create a positive legacy. He likes to see the market going up as part of that. And in this administration, I think that he'll also try to get employment back to America. This is part of that decoupling theme, which I think plays against Chinese growth.

I think that what he's going to do is negotiate hard. We know that he's a strong negotiator, and the way that he does that is he tries to coerce people into coming around to his view, either by putting them on the spot publicly or running down the clock. He likes to negotiate hard, and people know that that's what he tries to do.

He's going to do even more of that this time around. And when you look back, he said he's going to raise tariffs on Mexico and Canada, and he's not even in the Oval Office yet! I think that he is undertaking a stronger form of negotiation than what people expected, which is all part of his negotiating tactic. As an investor, this type of negotiating tactic leads to market volatility and opens up opportunities for investors, so long as you know what he's doing and you have confidence in the underlying earning streams of the companies whose share prices have been impacted.

When I think about Donald Trump, his bark is worse than his bite. In his first administration, he did a lot of talking compared to many previous US presidents, but I don't think that he did as much policy change as many US presidents. You'll see a lot of talking, but perhaps not as much action as what that talking suggests.

JG: What are the key risks for markets then over the next year?

AS: There are a couple of risks that investors should be thinking about. The first is Donald Trump himself, and what we would call Trump inflation. He's clearly going to stimulate the US economy, and that is going to be putting upward pressure on inflation. And the one thing that's different in the Fed's latest rate cutting cycle is that it started cutting rates at a historically low unemployment rate. Normally, when the Fed starts cutting rates, there's a lot of spare capacity in the economy, which means that as the economy starts to pick up, a lot of that slack can be used before inflationary pressures start to come out.

Now that's not the case in the labor market, and doubly so when you think about Donald Trump's deportations and the tightening up of the immigrant visas. I'd say that the labor market is going to be a source of inflationary pressures over the next little while, and that will put pressure not only on market interest rates at the short end, but also market interest rates at the long end. When we're thinking about Trump inflation, it's really that bond market impact that we're thinking about, because that can really disrupt investor sentiment, particularly if it happens very fast. If it happens slow, that's less of an issue. But if it's a quick move up over a matter of days or a week or so, then that has a more disruptive impact on markets.

What happens in China is also going to have a major impact on global share markets. It's our view that that stimulus will not be strong enough to trigger an upswing in the Chinese economy. It's more the Chinese authorities trying to manage the downside risk in that economy, because we all know that when housing markets have challenges, it takes a long time for economies to improve again.

JG: With AI, who will be the winners out of that, or is it too early to tell?

AS: I don't think it's too early to tell, but we're not able to have a perfectly clear crystal ball on this.

I would say that there are a couple of factors which the eventual winners will have. Number one is that they will be innovators. And we've seen this already. There have been some companies that have created innovation, and they're winning.

The second piece of that innovation is that there's going to be future innovation. Now, if we cast our minds back to the TMT bubble when the web was first invented, there were many companies that used the web to sell and there were many companies who used the web to innovate further. For instance, social media networks were innovation that was built upon the creation of the web, but when the web was created, no one knew that that was coming. Also put streaming video on demand services like Netflix in that same bucket.

We've been looking for companies that have a track record of innovation, and you can look at a lot of the big tech companies, because not only do they have the track record of innovation, they also have the size and the innovation budgets.

So the first thing is innovation, the second thing is what we would call the implementation of that technology which has been innovated. And there, we always tell people that it's much easier to implement these new technologies if you have one of two things, or maybe both:

- existing customers, because we all know it's easier to sell to existing customers, as opposed to find some new customers and then sell to them. It's magnitudes harder to do that.

- if you have a particularly complex company or processes which can be greatly helped by this new technology, we've seen that in the past. Here we think about companies like Microsoft and Intuit - those companies will be well placed to benefit from what's happening in AI right now.

JG: In terms of stocks, you mentioned a couple there, but are there other stocks that you're bullish on that you can talk about?

AS: Amazon (NASDAQ:AMZN) is the largest stock in our portfolio and there are a couple of reasons for that. Firstly, it's got a long track record of innovation, and we're going through a cycle of innovation at the moment. It also has a lot of customers in both its AWS or Cloud Services Division on the corporate side or on the retail side, on amazon.com, the shopping portal, so it's well placed to benefit from innovation that's occurring right now on our numbers. We see low double digit to mid-teens EBIT (Earnings Before Interest and Taxes) growth in the medium term in all of its operating divisions, and that is very attractive to us.

Source: Morningstar

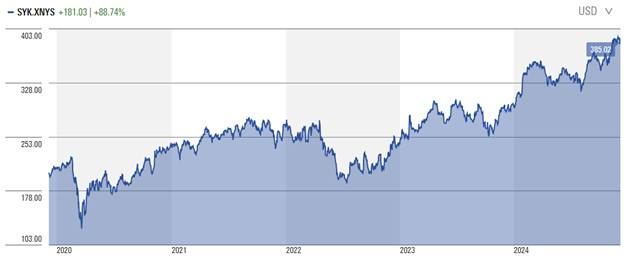

The second company which we think is really interesting is Stryker (NYSE:SYK), which is a leading orthopedics, medical and surgical equipment company. The reason why this is so interesting is not only because it's defensive characteristics. You often see that in the healthcare sector, but there is growth in there as well. We estimate that in the medium term, this company should grow its EBIT in the high single digit to mid-teens range, which is pretty good for a defensive health care company. And the beautiful thing about these types of health care companies, which involve surgeons, is that once you've trained the surgeon to use your equipment, they're very reluctant to move to something else, because quite frankly, instead of training, they'd rather be playing golf!

Source: Morningstar

That interview featured Arvid Streimann, Head of Global Equities and Portfolio Manager at Magellan Financial Group. Magellan Group is a sponsor of Firstlinks. For general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.