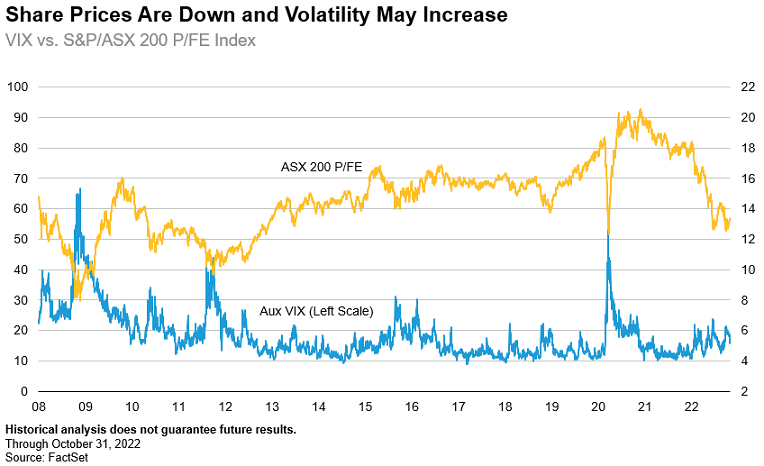

As equity markets in Australia and elsewhere whipsaw, the risk that volatility might undermine investors’ ability to achieve their medium-to-long-term return objectives looms large. What can investors do to mitigate that risk, and so limit the potential for falling short of their goals?

Several strategies exist for reducing volatility in investment portfolios. Some make use of derivatives to hedge against falling markets. But derivatives can be expensive, and reliance on them may unintentionally lead to other risks.

For example, using derivatives as a buffer may lull investment managers into paying less attention to a key source of volatility within the portfolio itself—stock selection. Failure to evaluate stocks carefully for low-volatility characteristics could offset some of the benefits of using derivatives.

Appropriate stock selection, in our view, is one of the keys to managing volatility risk. We know from experience that it can help to produce portfolio performance that’s 25% less volatile than the market over five years.

But investors need to think about risk-adjusted returns as well as volatility. That’s especially true in today’s markets where share prices have already fallen steeply, and volatility appears likely to continue and perhaps increase.

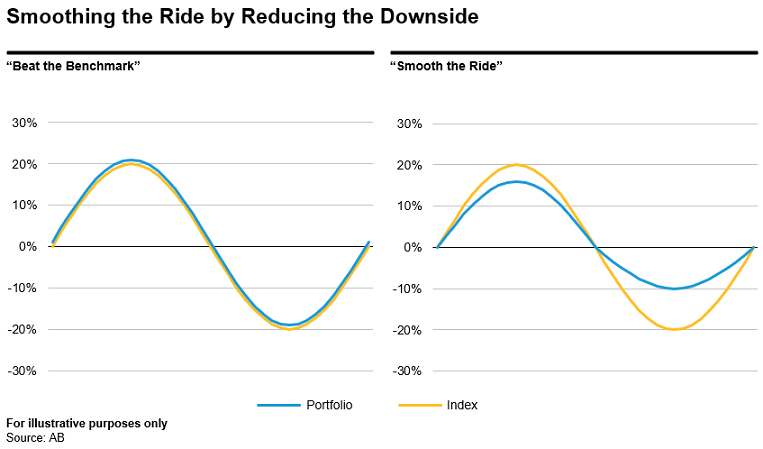

Our research and experience have shown that the right stock selection can result in lower losses when the market falls and positive (though not market-beating) returns when the market rises.

Over time, this trade-off—sacrificing a little upside gain in return for lower downside risk, or ‘less pain, some gain’—can give investors a smoother ride relative to the market as a whole, while still resulting in attractive returns.

The question is, how to select the right stocks and manage the portfolio appropriately?

Ignore the benchmark

The first step is to build a portfolio that consists entirely of low-volatility stocks. This means ignoring market benchmarks as a guide to which stocks should be in the portfolio, and in what proportions—an approach known as benchmark-agnostic investing.

While the idea of designing portfolios to meet specific investment objectives has become more widespread over the last few years, most active investment strategies—and, of course, index funds—continue to use market benchmarks as templates for portfolio construction.

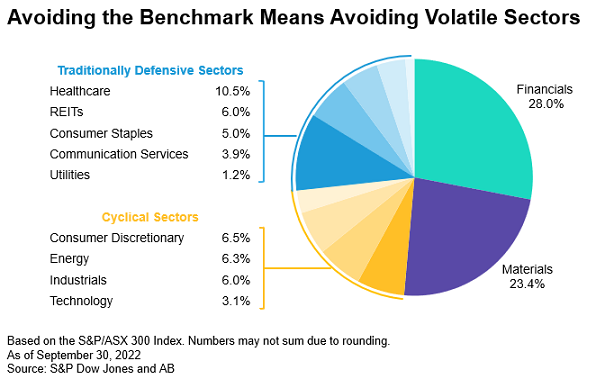

For investors seeking a low-volatility strategy in the Australian equities market, being benchmark-independent is particularly important because the local indices are dominated by volatile industry sectors such as banks and resources.

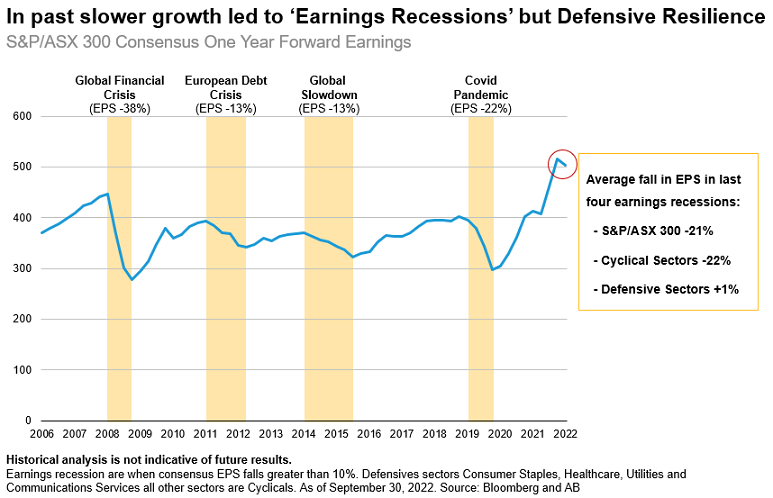

A benchmark-agnostic approach frees investors to focus on less volatile sectors, such as consumer staples, healthcare, utilities and communications services. These defensive sectors have outperformed on an earnings-per-share (EPS) basis during past slowdowns.

Narrowing the investment universe in this way helps to lay the groundwork for less volatile investment performance. But investors are interested in risk-adjusted returns, too—hence the importance of picking the right stocks within the low-volatility universe.

Look for stability, quality, and reasonable valuation

In our view, the best stocks will be attractive on three key measures—stability, quality, and valuation.

Low volatility stocks, by definition, tend to be more stable than the overall market. The degree of relative stability is likely to differ for each stock and may change over time. For investors seeking low-volatility performance over the medium or long term, this is an important point to consider.

It means that attention should be given to each stock’s price behaviour over different time periods—say, five years and 12 months—to see whether there’s been any change in the pattern of stability. The next step is to understand the factors that lie behind that pattern.

These are the stock’s quality attributes such as balance-sheet strength (for example, low net debt and high free cash flow to assets), high and stable profitability, and shareholder-friendly management of capital (which may include low asset growth or declining shares on issue).

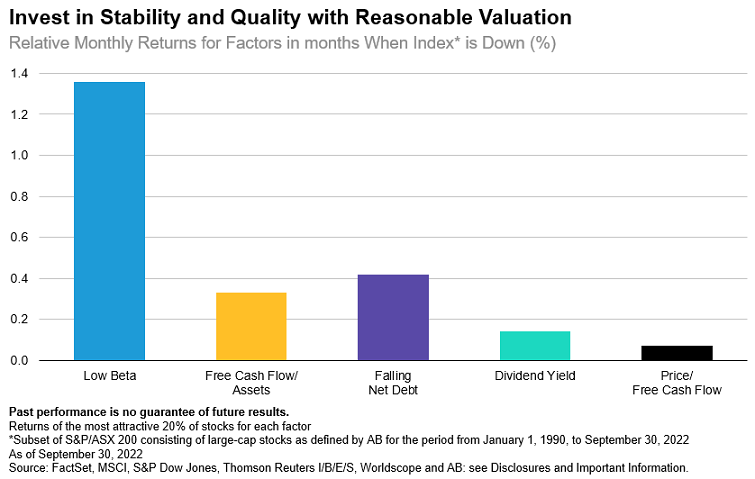

Stocks with these attributes and attractive valuations (low price-to-free-cash-flow ratio) have outperformed in down markets, as seen from the returns for the most attractive 20% of stocks for each factor during months when the S&P/ASX 200 was down.

Attractive valuation is particularly important from a return perspective because a stock that’s fairly valued relative to its fundamentals is less vulnerable than an overpriced stock to a sharp price decline when the market falls.

Consequently, when the market recovers, a fair-valued stock has less ground to make up in price terms than a stock that was overvalued. This gives it a reasonable prospect of participating in the market upside. It’s important to note, however, that it’s unlikely to outperform a rising market.

The obvious reason for this is that it’s a low-volatility stock. With this approach to investment, it’s important to think differently from the usual ‘beat-the-index’ mentality. Overall returns come less from participating in the upside and more from lowering the downside risk.

A sensible objective, in our view, is to aim to capture 80% of market upturns over five years or longer, while limiting participation in market downturns to 50%. Over time, this should result in delivering attractive returns for investors with much lower volatility than the market.

Stock selection is not one-and-done, however. This approach to low-volatility investing is an active one, and portfolios need to be managed accordingly.

Avoid volatility traps

Active portfolio management involves continuously monitoring the portfolio, the economy and the equity market for risks and opportunities and adjusting the portfolio to take account of them.

Some risks, such as ‘volatility traps’, are particularly relevant for low-volatility portfolios. Even stocks that score highly on each of the factors discussed above can fall prey to unexpected developments that undermine their prices.

For example, a utility company in a sector that is undergoing a large-scale regulatory review may appear to be stable. But the stability won’t necessarily be permanent if the outcome of the regulatory review could hurt the utility.

Volatility traps usually result from stock-specific causes. Our research shows that cyclical downturns account for 50% of volatility traps, followed by balance-sheet stress and event risk.

Cyclical risk can manifest itself through a broad economic or business downturn, or changes in a company’s key markets. An indicator of balance-sheet risk may be the willingness of lenders to provide credit to a business, and the price they would charge for doing so.

Event risk can include a change in government or regulatory policy, the restatement of company earnings, an acquisition that falls short of expectations or a regulatory or legal ruling that could hurt the stock price.

The way to manage these risks is through fundamental, bottom-up stock research.

Concentration risk—the possibility that a portfolio will become overloaded with similar stocks, or stocks from sectors that are positively correlated—is another potential pitfall, especially for a specialised portfolio drawing on the relatively small universe of Australian stocks.

This can be mitigated by allocating part of the portfolio to carefully chosen international stocks.

Macro risks are important, too. A stock chosen for its stability, quality and price may be undermined by external factors such as adverse foreign-currency fluctuations, supply chain disruptions and geopolitical tensions. These risks should be taken into account when building the portfolio.

Roy Maslen is Chief Investment Officer of Australian Equities for AllianceBernstein Australia Limited. Its listed fund is AB Managed Volatility Equities Fund (Managed Fund) – MVE Class (AMVE). This article is general information and does not consider the circumstances of any investor.

Note to Readers in Australia and New Zealand (click to view):

This document has been issued by AllianceBernstein Australia Limited (ABN 53 095 022 718 and AFSL 230698). Information in this document is intended only for persons who qualify as “wholesale clients,” as defined in the Corporations Act 2001 (Cth of Australia) or the Financial Advisers Act 2008 (New Zealand).

Information, forecasts and opinions set out in this document are not personal advice and have not been prepared for any recipient’s specific investment objectives, financial situation or particular needs. Neither this document nor the information contained in it are intended to take the place of professional advice. Please note that past performance is not indicative of future performance and projections, although based on current information, may not be realised. Information, forecasts and opinions (“Information”) can change without notice and neither AllianceBernstein Investment Management Australia Limited (ABN 58 007 212 606, AFSL 230 683) (“ABIMAL”) or ABAL guarantees the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained in this report, neither ABIMAL or ABAL warrants that this document is free from errors, inaccuracies or omissions. For Investment Professional use only. Not for inspection by, distribution or quotation to, the general public. This document is released by AllianceBernstein Australia Limited ABN 53 095 022 718, AFSL 230 698.