Over the past five years, the MSCI All Countries (AC) World index, representing equities for the global investor, has delivered a return of just 3.8% per annum, excluding dividends. Fortunately, the Australian share market offers partial compensation by offering the world's highest yield from equities, on average.

No wonder investor attention is so much focused on dividends and yield these days. It's what is required in order to achieve reasonable returns, or so it appears.

Dividends: the trend has been your friend

In the MSCI AC World index, the average dividend yield over the past five years has been 2.9%, implying a contribution to total returns of more than 40% over the period. In Australia, the average dividend yield is usually around 4.5% but recent cuts, predominantly by resource companies, have lowered average yield for the ASX200 to circa 4%.

For superannuants in retirement phase trying to live off annual income from investments, 4% probably is not enough, so they have gone searching for higher-yielding alternatives. 6%. 7%. 8%. To those hunting for yield, it's all available in the Australian share market. The key consideration is: can companies continue to pay at least the same dividends in years to come?

Despite high profile dividend cuts by the likes of BHP Billiton (BHP) and Woodside Petroleum (WPL), the answer in the overwhelming number of cases has been: yes, the company can deliver. Thus far, dividend-oriented investors have had the trend on their side. Faced with tougher growth and lower returns, companies have increasingly succumbed to satisfying growing demand for income by jumping on the bandwagon themselves.

Australia has a long tradition in this field, but, for example, in 1998 only 35% of companies in ASEAN countries paid out dividends to shareholders. Today the percentage is a whopping 95%. The average payout ratio throughout the region has steadily lifted over the period to 50% today.

But this is not an opportune moment to become complacent. There's a fair argument that the first cracks in the global dividend theme have started to appear. With growth tepid and payout ratios often at elevated levels, investor attention should focus on ‘sustainability’ and on ‘growth’.

While the absence of the latter might seem less important to income-only seeking investors, absence of growth can translate into capital losses in the short to medium term, and impact on sustainability in the longer term.

Why less is (often) more

Share markets are not always efficient or right, but they do have a sixth sense for separating the strong from the weak, in particular when it comes to dividend-paying companies. Remember when BHP was supposedly offering double digit yield? A few months later, after the board succumbed to the inevitable, BHP shares are trading on yield of circa 3%, ex-franking.

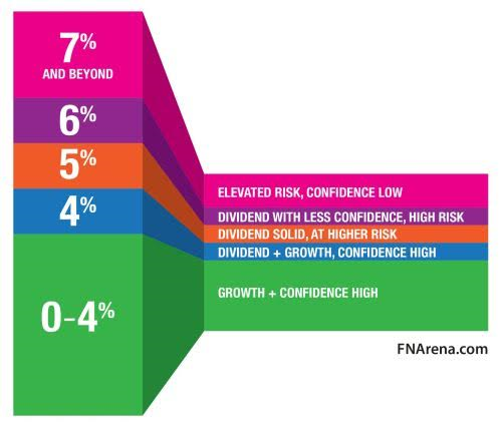

The share market provides investors with insights on a daily basis. Consider Graph 1 below, taken from my eBook "Change. Investing in a Low Growth World", published in December 2015. The number represents the forward-looking yield, excluding the value of franking.

Graph 1: Estimated dividend yield (ex-franking) and implied market risk assessment

When it comes to deriving yield or income from the share market, ‘more’ is seldom best while ‘less’ might generate a lot more in total return over time.

The practical application of this market observation is probably best illustrated through my list of personal yield favourites: APA Group (APA), Goodman Group (GMG), Sydney Airport (SYD) and Transurban (TCL). All offer yields between 3.5%-4.5%. All remain in positive territory thus far in 2016, dividends not included, and all generated positive returns in 2015 as well as in the recent years prior.

In contrast, ANZ Bank, whose implied forward-looking yield has now risen above 7% (franking not included), has not managed to add any capital gains on top of the annual payout in dividends both in 2014 and 2015. With the share price down significantly since January, 2016 might become the third year in succession that total shareholder return will be less than the yield on offer.

The principle also applies among the banks with both CBA and Westpac offering lower yield but significantly outperforming their higher-yielding peers ANZ Bank and National Australia Bank.

A smorgasbord of possibilities

Investing in yield stocks is not a static concept. Changes in the economic cycle lead to shifts in investor preferences, impacting on share price momentum and, ultimately, on total investment return.

Let's take a look at the alternative types of yield stocks and strategies investors can choose from:

Bond proxies - defensive stocks with plenty of cash flows (hence the potential to offer yield) but often with low to no growth. Think REITs and infrastructure owners and operators, and perhaps Australian banks at the moment.

Growth at a Reasonable Yield (GARY) - reasonable yield, backed by growth which is not yet priced at too high a Price-Earnings (PE) multiple. GARY often leads investors to industrial companies trading on mid-to-low teen PEs while offering 4-5% yield. In today's context, this could include the likes of Pact Group (PGH), Lend Lease (LLC) and Smartgroup (SIQ).

Dividend champions - companies which have a long history of not cutting dividends. In Australia, Telstra (TLS) would be such an example and arguably the major banks. The obvious warning here is the legacy from the past doesn't count for much when things turn dire. Companies including BHP, Metcash (MTS), Fleetwood (FWD) and GUD Holdings (GUD) that had an enviable track record have been forced to reduce or to scrap dividends.

Cash proxies - companies swimming in cash but with low ‘beta’. Genworth Mortgage Insurance Australia (GMA) just announced a special distribution of 34c per share plus consolidation of its outstanding capital.

Yield at low risk - see Graph 1 and my favourite yield stocks mentioned above (APA Group, Goodman Group, Sydney Airport and Transurban).

High dividend yield – companies such as Monadelphous (MND) and Duet Group (DUE) seem to have high yields but are they sustainable? Investors should be aware that share markets do not offer free lunches.

Low yield with strong growth - investors who bought Blackmores (BKL) shares three years ago are this year enjoying a forward yield of 6.7% on their original purchase, plus franking.

Current preferred strategies

As financial conditions tighten amid slower growth, payouts (including buybacks and dividends) will become unsustainable for many companies. My preference in the current market is for stocks with GARY and ‘Dividend champions’ characteristics when it comes to yield strategies.

For Developed Markets in general, GARY and ‘Yield at low risk’ are likely to generate the best results.

Rudi Filapek-Vandyck is Editor of FNArena. This article is for educational purposes and does not consider the circumstances of any individual.