Since I looked at these five charts on investing for income two years ago, the Australian cash rate has halved, 10-year bond yields have fallen by two thirds and interest rates have resumed falling globally. Ever-lower interest rates and periodic turmoil in investment markets provides an ongoing reminder of the importance of the income (cash) flow or yield an investment provides.

The environment of low interest rates is challenging for those relying on investment income to fund their living costs and investing for income can seem daunting.

This article gives five lessons by looking at charts I find useful in understanding investing for income.

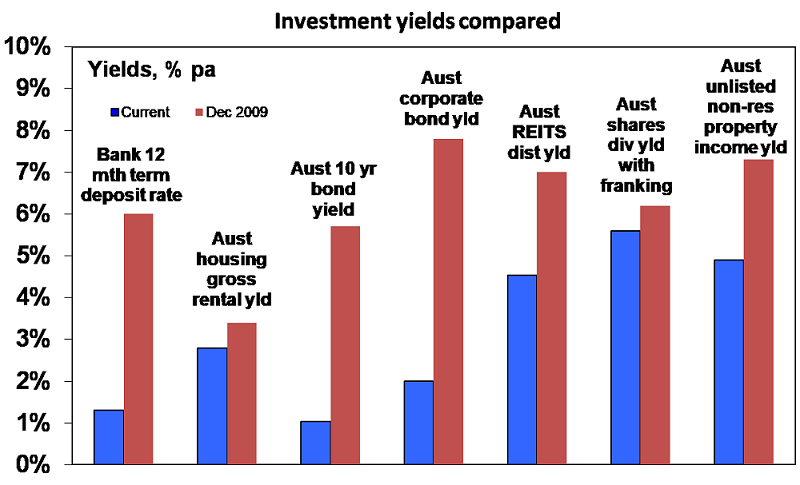

Chart 1: There are many alternatives to bank deposits

The income yield an investment provides is basically its annual cash flow divided by the value of the investment.

- For bank deposits, the yield is simply the interest rate, eg bank 1-year term deposit rates in Australia are about 1.3%.

- For 10-year Australian Government bonds, annual cash payments on the bonds (coupons) relative to the current price of the bonds provides a yield of 1% now.

- For corporate debt, it’s a margin above government bond yields and depends on the riskiness of the company but is currently averaging around 2% margin in Australia.

- For residential property, the yield is the annual value of rents as a percentage of the value of the property. On average in Australian capital cities it is about 4.2% for apartments and around 2.8% for houses. After allowing for costs, net rental yields are about 2% lower.

- For unlisted commercial property, yields are around 4.9%.

- Infrastructure investments average around 4% but franking credits could add 0.45%.

- For a basket of Australian shares represented by the S&P/ASX200 index, annual dividend payments are running around 4.3% of the value of the shares. Franking credits push this up to around 5.6%.

Source: Bloomberg, REIA, RBA, JLL, AMP Capital

Key messages: First, the yield on bank deposits and government bonds is woeful. Second, there are alternatives to cash when it comes to yield or income, notably shares, property and infrastructure but even here yields have generally trended down (albeit less so for shares). Of course, investors need to allow for risk. Bank deposits have close to zero risk but any move to higher-yielding investments must entail taking on risk.

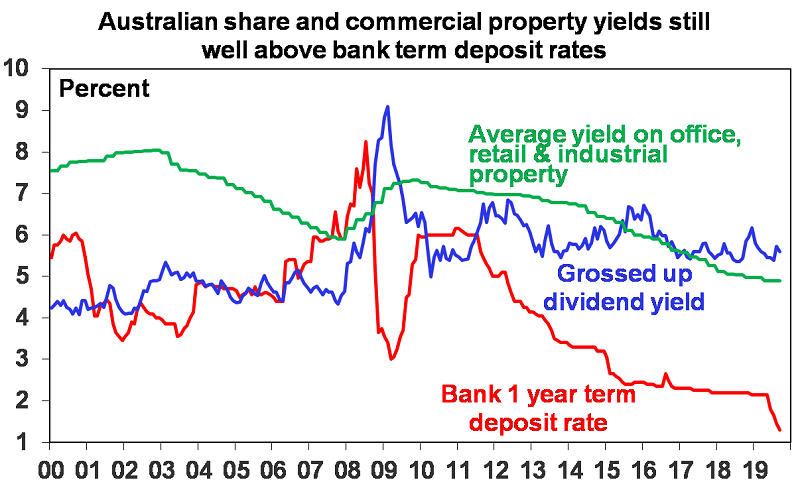

Chart 2: The gap between yields on different assets is a guide to value

The next chart shows average yields on Australian shares and unlisted commercial property relative to the one-year term deposit rate since 2000. With share and property yields not plunging to the same degree as bank deposit rates, the gap between the former and latter is extremely wide. In fact, the share yield is in its historic range. All things equal, this suggests commercial property and Australian shares provide better value, and the same applies to unlisted infrastructure.

Source: JLL, Bloomberg, AMP Capital

Key message: comparing yields provides a guide to relative value, and shares and unlisted commercial property remain attractive relative to bank deposits.

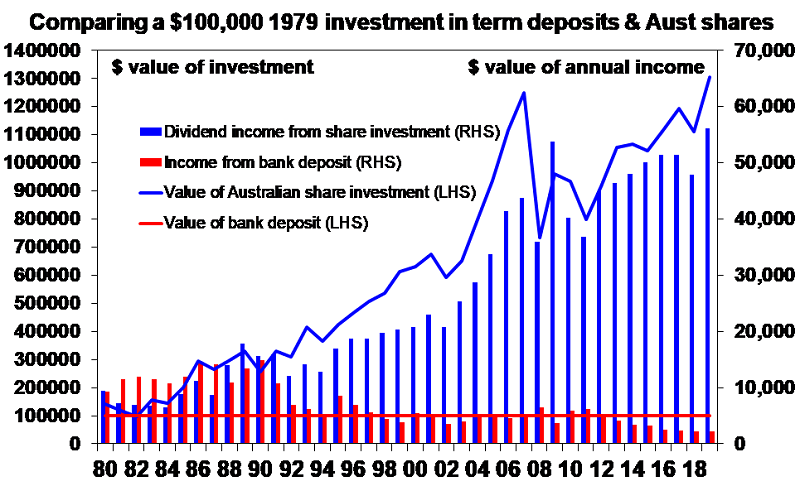

Chart 3: Shares can provide stronger growth in income with less volatility than bank deposits

Investing in shares gives the risk of capital loss but can offer a higher and less volatile income flow over time. The next chart compares initial $100,000 investments in Australian shares (S&P/ASX 200) and one-year term deposits in December 1979 and the income they have provided over time (before franking credits are allowed for in the case of shares).

2019 data is year to date/annualised. Source: RBA, Bloomberg, AMP Capital

The term deposit would still be worth $100,000 (red line) and last year would have paid roughly $2,200 in interest (red bars). By contrast the $100,000 invested in shares would have grown to $1.3 million (blue line) and last year would have paid $47,792 in dividends before franking credits (blue bars).

The point is that dividends tend to grow over time (because profits and hence an investment in shares tends to rise in value) and are relatively stable compared with income from bank deposits, which vary with interest rate settings. Over the period, the worst decline in dividend income from shares was a 32% decline between 2009 and 2011, whereas the income from bank deposits plunged 68% between 1990 and 1994 and by 65% between 2011 and this year. And it’s set to fall even more given the reductions in term deposit rates since June. Once franking credits are allowed for, the comparison would become even more favourable towards shares.

Key message: shares come with the risk of capital loss but a well-diversified portfolio of Australian shares can provide stronger growth in income with less volatility in that income than bank term deposits. The key question investors focused on income (or cash flow) need to ask is what is most important: stability in the value of their investment or a higher, more sustainable income flow than bank deposits offer?

If investors do go down the share path, it’s critical to have a well-diversified portfolio paying high and sustainable dividend yields. Look for stocks that have a reliable track record of growing those dividends and that have dividends that are not threatened by structures like excessive gearing.

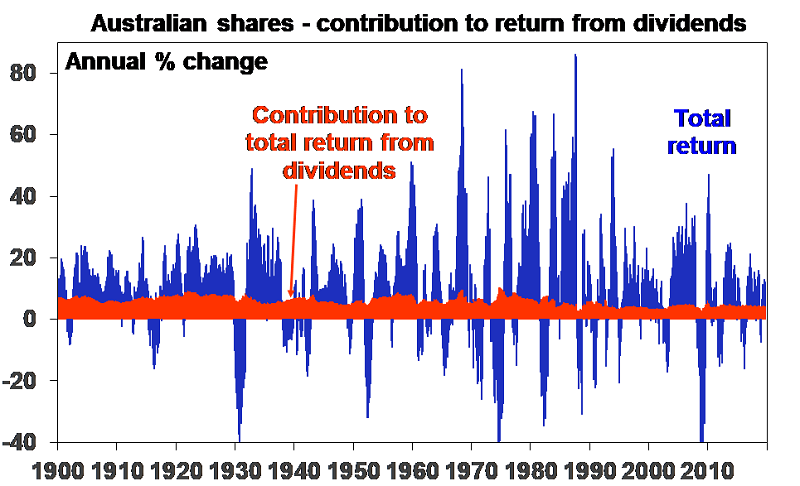

Chart 4: A bird in the hand is worth two in the bush

A high and sustainable starting point yield provides some security during volatile times. Since 1900, dividends (prior to allowing for franking credits) have provided just over half of the 11.8% average annual return from Australian shares and as can be seen in the next chart their contribution has been stable in contrast to the capital value of shares.

Source: Global Financial Data, Bloomberg, AMP Capital

Dividends are relatively smooth over time because most companies hate having to cut them as they know it annoys shareholders, so companies prefer to keep them sustainable.

Key message: a high and sustainable income yield for an investment provides some security during volatile times. It’s a bit like a down payment on future returns.

Chart 5: Yield provides a guide to future returns

The income yield an investment provides is a key building block in its total return, which is determined by the following.

Total return = yield + capital growth

Generally speaking, the higher the yield an investor invests at, the higher the return their investment will likely provide. This is self-evident in the case of bank deposits because the yield is the return (assuming the bank does not default on its deposits, which is highly unlikely in Australia given government protections).

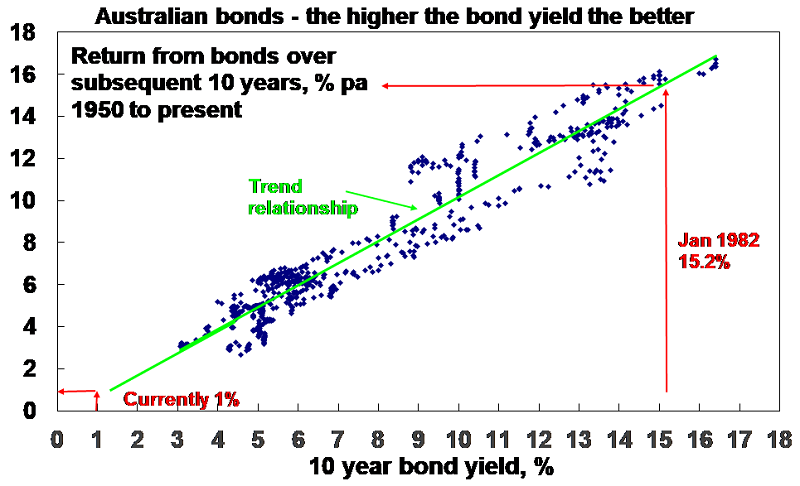

It can be seen in relation to bonds in the next chart, which shows a scatter plot of Australian 10-year bond yields since 1950 (along the horizontal axis) against subsequent 10-year bond returns based on the Composite All Maturities Bond Index (vertical axis). Over short-term periods, bond prices can move up and down and so influence short-term returns, but over the medium term the main driver of the return a bond investor will get is what bond yields were when they invested. If the yield on a 10-year bond is 5%, then if you hold the bond to maturity your return will be 5%.

Of course, a portfolio of bonds will reflect a range of maturities and so the relationship is not perfect, but it can be seen in the next chart that the higher the starting point bond yield, the higher the subsequent return.

Source: Global Financial Data, Bloomberg, AMP Capital

When bond yields are high, they drive high bond returns over the medium term and vice versa. At 1% now, we are off (the bottom of) the chart meaning record low bond returns for the next decade.

Similar, albeit less perfect, relationships exist for other asset classes: the higher the yield, the higher the subsequent return.

As always, there are some risks investors must watch out for. At the individual share level, a very high dividend yield may be a sign of a 'value trap', where current profits and dividends may be fine but there is an impending threat to the company and so the share price is low. High distributions may also be unsustainable if they are being paid for out of debt and reflect excessive gearing or high-risk investments. There is no free lunch.

Key message: while returns have been solid lately, low investment yields do warn of lower returns ahead, most notably from government bonds.

Dr Shane Oliver is Head of Investment Strategy and Chief Economist at AMP Capital, a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any investor. Subscribe to AMPC's Insights here.

For more articles and papers from AMP Capital, please click here.