Ask most investors about gold and irrespective of whether they have exposure to the precious metal, most will acknowledge that it’s a store of value over the long term and that it’s a good inflation hedge. Gold has maintained its purchasing power across the centuries.

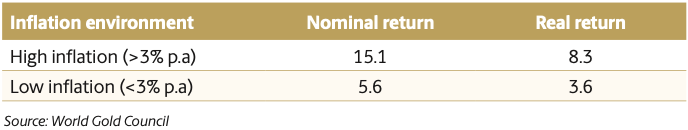

In more modern times, gold has also served to protect wealth through periods of higher inflation, most notably throughout the 1970s. The following table highlights the average annual returns for gold in high (>3% p.a.) and low (<3% p.a.) inflation environments across the past 50 years.

Average annual US dollar spot price performance of gold (%)

Despite this track record, some are now questioning whether gold has lost its status as a trusted inflation hedge. Gold has experienced a close to 15% correction since August 2020, despite consumer price inflation (CPI) rates hitting 6.2% p.a. in the United States.

Why hasn’t gold moved higher with inflation in 2021?

There are several factors that have held gold back in 2021.

Global economic growth has surprised to the upside, with the OECD September economic outlook suggesting global growth will register 5.7% this year. Going into 2021, they had forecast growth of just 4.2%.

Equities have also enjoyed one of their strongest runs on record, with the S&P 500 essentially doubling since the March 2020 low. Equities have attracted net inflows of almost USD1 trillion in 2021. That’s more than the past 19 years in total, highlighting how strong investor risk appetites have been for most of the year, and explaining why portfolio hedges like gold have fallen out of favour, for now at least. The US dollar has been firm, with the dollar index (DXY) up around 7% this year.

Gold made a huge move last year

Perhaps a bigger part of the reason gold has disappointed investors in 2021 is that it made such a big move in the first nine months of last year.

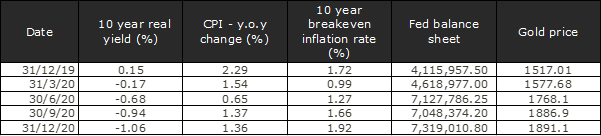

This can be seen in the table below, which shows a handful of key variables at the end of 2019 and each quarter of 2020.

Market indicators during 2020

Source: Federal Reserve, World Gold Council, Cleveland Federal Reserve, US Treasury, St Louis Federal Reserve

The table highlights that:

- The Federal Reserve balance sheet increased by more than USD 3 trillion across the first six months of 2020.

- Real yields on 10-year US treasuries fell by more than 1% in the first three quarters of 2020.

- 10-year breakeven inflation rates bottomed out in Q1 2020, well ahead of short-term CPI numbers.

Given this backdrop, the gold price was up by more than 30% at one point in 2020, even though the official year-on-year change in headline inflation was below 1.5% for most of last year.

So, while it can be argued gold hasn’t been a good inflation hedge in 2021, that’s coming off the back of a year that the precious metal recorded one of its strongest gains on record.

Ultimately, perhaps the data is telling us is that if you have to wait for the official statistician to tell you inflation has arrived, then you’ll pay a much higher price to buy inflation-protecting assets.

Gold and the inflation backdrop today

An argument can be made that the market’s view of inflation today looks somewhat similar to just over 10 years ago, in the period leading into the GFC.

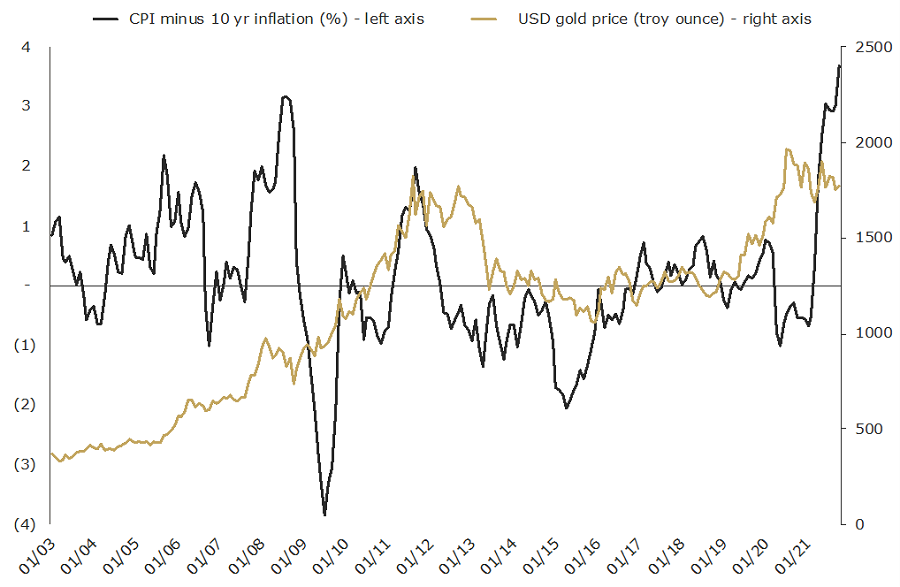

This can be seen in the chart below, which shows the gold price, as well as the percentage gap between annual headline CPI growth and the 10-year breakeven inflation rate expected by the market.

US inflation and gold prices

Source: Cleveland Federal Reserve, St Louis Federal Reserve, World Gold Council, data as at end October

At present, there is a 3.7% gap between current annual CPI (+6.2%) and the 10-year breakeven inflation rate (2.5%). The last time this kind of divergence was seen was back in Q3 2008, though it is wider today than it was 13 years ago.

Gold prices fell by approximately 20% back then, from just below USD1,000 per troy ounce, to about USD750 per troy ounce. The precious metal then went on to rally for the next three years, with the market ultimately topping out more than 150% higher at close to USD1,900 per troy ounce in 2011.

This time around we’ve seen a similar pullback, with gold dropping by approximately 18% between August 2020 and the low from this cycle seen in April 2021, when gold temporarily traded back below USD1,700 per troy ounce.

And while no one can be certain if history will repeat or even just rhyme, there is a range of factors suggesting gold could be supported going forward, including:

Central bank and fiscal largesse: The post GFC environment was characterised by central banks reluctantly adopting QE, ZIRP and other forms of unconventional monetary policy, and promising to walk it back at the first opportunity. Despite the likelihood of a Fed taper, the post COVID-19 environment sees central banks largely reticent to abandon expanded stimulatory measures.

There is now a much greater focus on full employment, an embrace of average inflation targeting, and the adoption of MMP (modern monetary practice) through the de-facto monetisation of federal deficits.

Trimmed mean inflation rising: While headline inflation rates may ease, there is clearly an increase in underlying pricing pressure building, with the trimmed mean CPI measure now sitting above 4% per annum in the United States.

Supply side shocks: Whether it’s a shortage of fuel in the UK and across Europe, industry shutdowns in China, or continued bottlenecks in global supply chains, issues on the supply side may continue to add upward price pressure well into 2022.

For most of 2021, markets expected the current spike in inflation to be transitory, and had priced this in.

Even if headline CPI rates decline in the months ahead, it is unlikely to meaningfully hurt precious metal prices. If, however, this inflation spike proves to be more sustained, as even Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen have recently acknowledged, then there is a good chance the gold price may surprise to the upside.

Jordan Eliseo is Manager of Listed Products and Investment Research at The Perth Mint, a sponsor of Firstlinks. The information in this article is general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.