Gold prices have been in a corrective pattern for the past 12 months, having fallen by approximately 12% in US dollar terms since hitting all-time highs in August last year.

This pullback was not unexpected given how fast gold had run up in recent times, with the precious metal rallying by almost 75% in the two years leading into its August 2020 peak. Bullish momentum had clearly run its course, while other factors contributing to the correction include:

- A strong rally in equities, with the S&P 500 now having doubled from its Q1 2020 lows.

- Confidence in vaccine rollout across most of the developed world.

- Stabilisation in real yields.

- The market’s belief that the current spike in inflation will prove transitory.

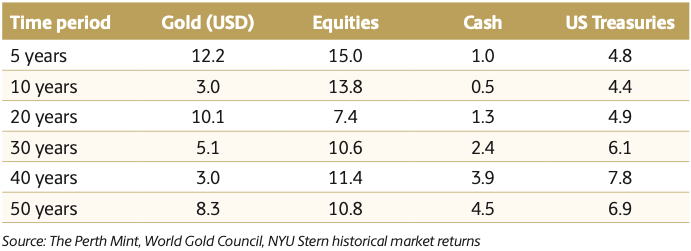

History may come to judge the last year’s gold price pullback as the culmination of a tough decade for precious metal bulls, seen in the table below highlighting the performance of gold and more traditional asset classes over the short, medium and long-term.

Asset class returns (% per annum) to end December 2020

We explore the primary factors that drove gold’s underperformance in the last 10 years and why the next decade may be profoundly different.

What has driven gold’s relative underperformance in the past decade?

It is now almost exactly 10 years since gold peaked in its last cycle, with the US dollar gold price still below the levels seen for that short period in Q3 2011. This period of underperformance was driven by:

1. Extreme outperformance leading into 2011

In the 10 years to August 2011, the gold price in US dollar terms rose by more than 550%, while the S&P 500 price index was essentially flat. Outside of the huge gold market rally seen at the end of the 1970s, the precious metal had never had a longer, or stronger run relative to equities.

2. Excess froth

By the start of the last decade, the macro case for gold was obvious. Volatile markets, an uncertain economic outlook, a blow out in budget deficits and fears over higher inflation as the US Federal Reserve crossed the Rubicon into money printing, meant that gold had returned to the mainstream.

There are multiple indicators from that period that highlight this, including a Gallup poll from August 2011 that found 34% of Americans thought gold was the best long-term investment.

3. Low inflation

CPI increases averaged barely 2% per annum in the 10 years to the end of 2020, the lowest figure for any decade going back 70 years. Whether the low inflation seen in the last 10 years ’should‘ have happened given the monetary environment we have been in is beside the point. It did, and it was a key factor holding gold back.

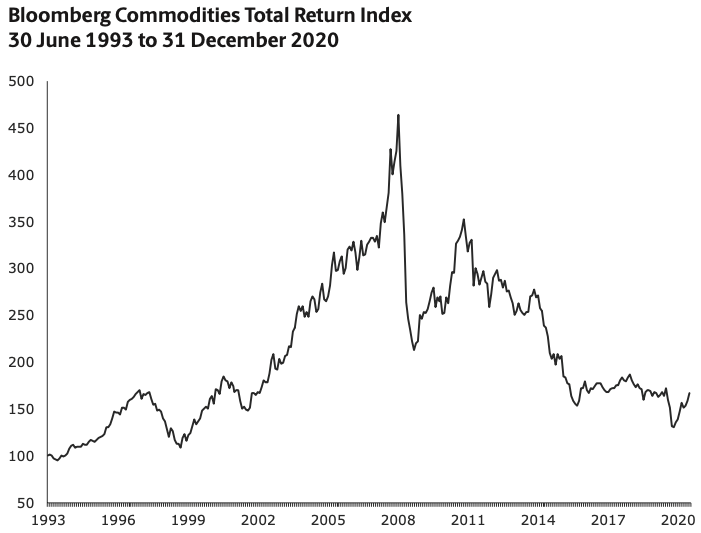

4. Commodity bear market

As we highlighted in an early 2021 research report for institutional investors, the past decade has been particularly unkind for commodity markets as a whole. This can be seen in the chart below, which tracks movements in the Bloomberg Commodity Index since the early 1990s. It fell by 60% in the nine years to April 2020.

Source: Bloomberg

While gold has historically delivered a range of portfolio benefits that a broader basket of commodities can’t replicate, a profound bear market in commodities still represents a headwind for the precious metal.

The decade ahead

While gold has been in a corrective pattern for the last year, a solid case can be made that the coming decade will be more favourable to the precious metal.

Factors supporting this conclusion include:

1. Sentiment toward gold has shifted

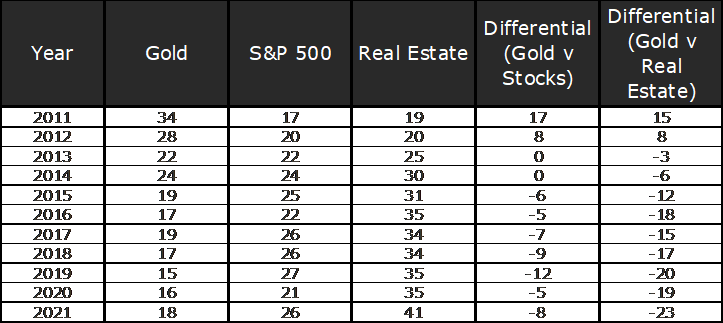

In a complete reversal of the situation gold found itself in as it was heading towards USD 1,900 per troy ounce in 2011, the precious metal is now largely unloved by investors, who are far more convinced that stocks and real estate are the safer long-term bet. This can be seen in the table below, which is drawn from Gallup poll data from 2011 to 2021.

Table: Which asset do Americans think is the best long-term investment (%)?

Source: Gallup polls

On a relative basis, gold is as unloved as it has ever been compared to real estate, while it is still far less popular than equities are today.

Data like this doesn’t prove anything per se, but these are the kind of signals one would expect to see when a market is close to bottoming. By way of reference, gold today is essentially as popular as equities were back in 2011. The S&P 500 has rallied by more than 230% since then.

2. Extreme equity market outperformance

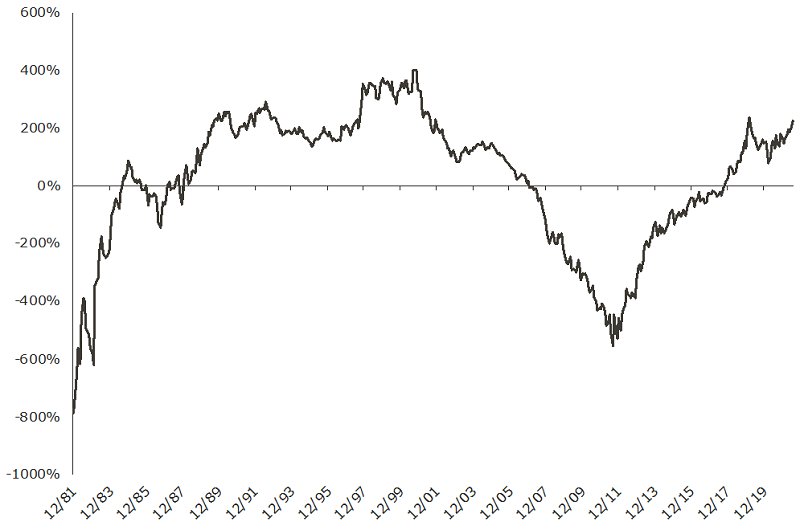

The relative performance of equities versus gold is the complete opposite today as compared to late 2011, when gold hit its last peak. Back then, gold had outperformed the S&P 500 by more than 500% on a 10-year basis.

By the end of July 2021, gold was underperforming the S&P 500 by more than 225%, with the rolling 10-year performance differential between the two seen in the chart below.

Chart: Rolling 10-year performance – S&P 500 (price index) minus US dollar gold

Source: The Perth Mint, World Gold Council

Good things happen to cheap assets, as the saying goes. Relative to equities, gold is about as cheap as it’s ever been on a rolling 10-year basis.

3. Traditional asset returns are likely to be constrained

The coming decade is unlikely to be anywhere near as rewarding for investors with portfolios concentrated in equities and fixed income assets.

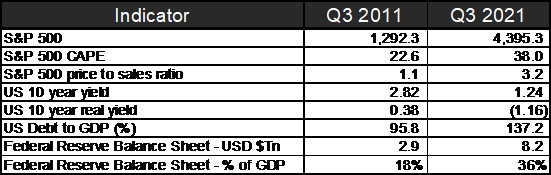

This is something that institutional asset managers have openly acknowledged. The table below, which highlights a range of US financial market and economic indicators, illustrates how different the situation is today relative to Q3 2011.

Note that some data is taken from the date closest to Q3 in either 2011 or 2021 - for example, federal debt to GDP ratios are from end 2011 and the forecast for end 2021 from the Office of Management and Budget.

Table: US financial market and economic indicators

Source: US Office of Management and Budget, US Federal Reserve, Yardeni Research, Robert Shiller Online Data, Standard and Poor’s, United States Treasury.

Investors are now paying almost double the amount of money to purchase a dollar of company earnings and almost triple the amount of money to purchase a dollar of company sales relative to a decade ago. Meanwhile, zero credit risk US Treasury bonds are now guaranteed wealth destroyers if held to maturity.

At a macro level, debt to GDP ratios are now far higher, as indeed they are all over the developed world, while the Federal Reserve balance sheet, both in dollar terms and as a share of the economy, has doubled relative to a decade ago.

Given these factors, gold is positioned to outperform or at least match the return delivered by equities in the decade to come, despite the fact sentiment toward the precious metal remains lukewarm at best today.

Jordan Eliseo is Manager of Listed Products and Investment Research at The Perth Mint, a sponsor of Firstlinks. The information in this article is general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.