Much has been written about Graham Turner’s career and how he grew Flight Centre from a single shop in 1982 to a global enterprise generating $3 billion of revenue in over 80 countries. But not many know about the proverbial mountains he’s climbed to get to where he is today. From these obstacles, he honed his uncanny business intuition. In my interview with ‘Skroo’ (as he prefers to be called), we delve into these experiences and the lessons he’s learned over decades in business.

Big businesses start small… but always differentiated

Introverted, Intuitive, Thinking and Prospecting. This is the combination of descriptors that make up Skroo’s Myer’s-Briggs personality type. In their natural state, INTP types are quiet thinkers with vigorous intellects. They enjoy seeking out unlikely paths and taking an unconventional approach.

It becomes abundantly clear these descriptors fit very well with all that Skroo has overcome in his business journey. It explains why he started a business on the other side of the world ‘just for fun’ with a few mates over 50 years ago.

Just as intriguing as the why, is how he scaled from one bus in 1973 to over 70 by 1980, running tours all over Europe. Skroo tells me the story of how he purchased the first bus and launched Top Deck Travel.

At the time bus tour companies were in great abundance throughout London. There was no shortage of competition. But when Skroo and his mates fitted out their first bus, he fitted them with a kitchen and bedrooms, capable of taking long-haul trips as far as Afghanistan. It came simply from the fact they wanted to see more countries on a shoestring budget, but in doing so had inadvertently stumbled across his first business lesson: in competitive markets, a subtle differentiation can open up new pockets of demand. Competitors at the time were focused on coach camping tours, not long-haul tours like Skroo’s bus. What Top Deck offered was unique and fun. Customers could cook, sleep and visit more countries, which made it an attractive and unique proposition.

A unique value proposition

The ease with which seats were filled gave Skroo and his business partner a taste of early success. Although the business concept of blue oceans would be popularised some decades later, Skroo had already discovered the advantages of creating new markets early on through the differentiation of the tour experience. The unit economics were prime for scaling. At a cost of £12 in weekly marketing costs (Skroo tells me the first ads were placed in a weekly travel newspaper published in London called the Australasian Express), Topdeck could confidently fill a bus which would deliver revenues of £1,650. Even accounting for other expenses, each trip was profoundly profitable.

Scaling became easy with the growing demand and self-generating cashflows. Two years into operations, Topdeck made £15,000 profit and had several buses touring all over Europe. Along the way, he enjoyed many free overland trips, including a 3-month drive from London to Kathmandu. Underneath Skroo’s thoughtful and calm demeanour was a strong desire for growth and success. He still enjoys winning in the game of business. As he says, “founders are generally empire builders. One bus was never enough for me. It had to be 2, 3, or 10.”

But how does a founder balance the investment required to scale, with the cash needs in the short-term? It was a question of balancing long-term growth and short-term liquidity. Initially, they developed a general rule: every bus purchase should only be made if they were confident it could be paid back in 2-3 trips. The model worked well for the first 10 years as they scaled but by 1980 the market changed. Skroo was about to learn his toughest lesson in business when Topdeck almost filed for bankruptcy.

Balancing liquidity and scalable unit economics

By 1980 Topdeck had 70 buses all over Europe and despite the strong growth trajectory, found itself short of cash when forward bookings in the winter were weaker than expected. And because it had a model that relied on rapid scaling and reinvestment of cash back into more buses, Topdeck became exceptionally reliant on forward bookings. It was the business’s first near death experience and taught Skroo a lesson in cash management. Its importance became abundantly clear as Skroo was turned down by banks who had no interest in financing a bus tour business. There would be no white knights. No one was going to save Topdeck in its most crucial time of need. As Skroo aptly puts it: “banks are more likely to loan money to those that don’t need it”.

They survived only because cash from bookings originating from Australia and New Zealand started flowing through in April of 1980. The southern hemisphere booking season had come through just in time. It was a close call. Survival had come from internal cash, not external. In business there is no such thing as a deus ex machina.

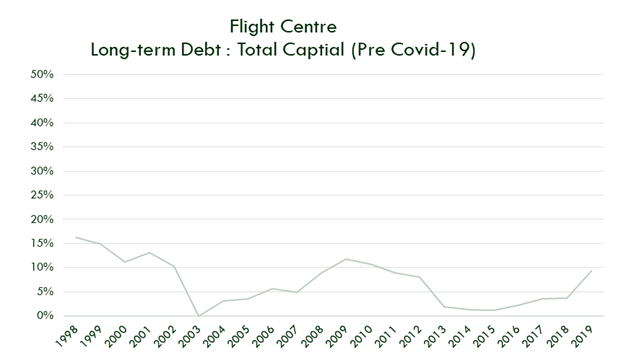

For Skroo, the importance of cash is a recurring lesson he sees over and over again. Forty years on, even after he left the Topdeck business in 1986 and returned to Australia to eventually start Flight Centre, his recollection of that moment is as visceral as ever. That moment shaped how Flight Centre would manage its cash position, and the amount of debt it would hold going forward.

Source: Lumenary Investment Management research; S&P Capital IQ

Finding a niche

Founders like Skroo always find a way to reinvent and adapt. Motivated by a return to Australia with his family, he looked to exit Topdeck but still had one eye on his next move. From his time in London, he noticed the travel market in Australia by comparison was relatively homogenous, controlled predominantly by big institutions who were happy selling exorbitant airfares with little competition. Skroo saw this environment as a ripe opportunity to build a niche - discount travel. He would have an edge sourcing flights from overseas airlines looking to offload tickets at the last minute given his connections in London.

The discount airfare retailers, known as bucket shops in London, was a concept not well known to Australia. At the time, airfare discounting was illegal. It was only a few years later that regulations would change and allow the market to open. As Skroo recalls, there were a few discount retailers who were prosecuted, but he was lucky to avoid this and flourish when the regulations were updated. He fondly remembers the deliberately handwriting messy promotions on shopfront blackboards as a tactic to attract the discount bargain hunters.

“Again we got into a niche that meant we could almost have as many customers as we wanted within reason” - Graham Turner

Taking the cash lessons from Topdeck, market entry was conservatively executed, preserving cash through the use of partnerships in the pursuit of an expansion strategy. When Flight Centre opened its first stores in Brisbane, Sydney and Melbourne, it did so via joint venture arrangements which minimised the amount of cash required. From those three domestic shops, they would eventually spread internationally not long after.

Part 2 of this feature story on Graham Turner is linked here.

Lawrence Lam is Managing Director and Founder of Lumenary Investment Management, a firm that specialises in investing in founder-led companies globally.

The material in this article is general information only and does not consider any individual’s investment objectives. All stocks mentioned have been used for illustrative purposes only and do not represent any buy or sell recommendations.