The impact of climate change and the need to move away from fossil fuels is infinitely nuanced. In the 2022 Federal Election, there was a swing to a faster climate change agenda with strong support for The Greens and 'teals'. Then AGL, the country's heaviest carbon emitter, was prevented from demerging its power generation assets by the judgement of Mike Cannon-Brookes and other shareholders that the move would slow the closure of its coal-fired sites. Into this mix comes a $100 billion fund manager, GQG Partners, saying the energy transition may take up to 60 years and it is immoral to underinvest in fossil fuels.

Many portfolio managers privately believe their businesses are too extreme in their anti-fossil stance. In the investment industry where everyone seems to fall over each other to show their green credentials, it is a refreshing change when someone is willing to go on the record to put the other side, not simply whisper in the corridors of their offices.

GQG has some support in Canberra and Perth. Both the new Resources Minister, Madeleine King, and Western Australian Premier, Mark McGowan, are backing the $16.5 billion Scarborough gas project. King said gas has an “important role in the transition to a decarbonised world” and the Government will not support a ban on fossil fuel projects.

It's all about the timing

The prevailing view is that immediate action is needed to prevent catastrophic climate change. The majority of fund managers have adopted strong ESG (Environment, Social and Governance) principles front and centre, and large superannuation funds compete to divest from fossil fuels the quickest. No doubt a motivation is to satisfy their investors and members, as most surveys show climate change is a major issue Australians expect leaders to act on.

An example of the policy intensity on fossil fuels soon surfaced after the election. Dr Monique Ryan, the conqueror of Treasurer Josh Frydenberg, said she wants a 60% emissions reduction target by 2030, much higher than Labor’s current 43% level. She said Anthony Albanese needs to be “… prepared to come to the table on effective and immediate action”. Maybe Mr Albanese is not quaking in his boots now he has a majority in the Lower House.

The reality of a long transition from fossil fuels

GQG Partners held its first Annual General Meeting on 27 April 2022 following its listing on the ASX in October 2021. Rajiv Jain is the Executive Chairman, Chief Investment Officer and Portfolio Manager at GQG. At the AGM, leading activist Stephen Mayne asked the following question:

“Executive Chair Rajiv Jain made some very strong comments at a forum in February saying that reducing investment in fossil fuels was elitist and immoral because of the impact it could have on developing economies ... can Rajiv update shareholders on what responses to these comments have been from stakeholders?”

Good question, so what exactly had Jain said? Speaking at a Portfolio Construction Forum on 23 February 2022, in a presentation with the provocative title of ‘Growth managers that lack energy may be left out in the cold’, Jain said (with some paraphrasing):

“We believe that investors have always made a bit of an ideological call not to invest in fossil ... Like so many times, there's a narrative that is convenient, but most of the time, the narrative takes a life of its own and becomes too strong a belief which ultimately tends to negatively impact returns. And I think if you look at the energy side, we believe that the narrative seems to be way too convenient.”

The devil is in the detail, said Jain, as the transition is much longer and more complex.

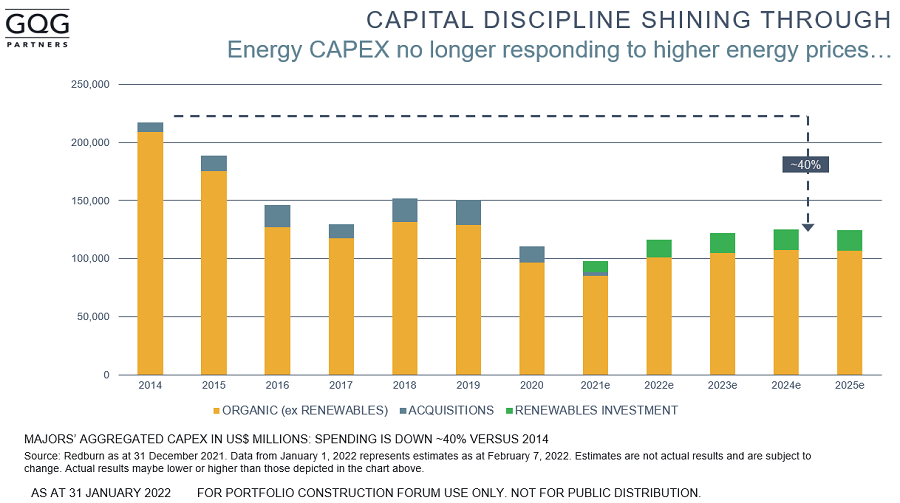

“Because if we choke off capital to fossil, whether it's oil and gas, coal, and so on, the narrative is that we would be better off. Well, it's ideological, there's no commercial merit to it. And the reason is that if you don't do anything with demand, choking off or reducing supply will only create a crisis ... The biggest problem on the energy front is capex, as the vast majority of banks are under pressure not to lend to the oil and gas industry. And capex has gone down by almost 40% over the last seven or eight years, which is very different to 2010 when everybody believed in the commodity supercycle, Chinese urbanisation and emerging market growth.”

(Published with the permission of GQG Partners and Portfolio Construction Forum)

Jain explained how the free cash flow from many high-quality energy companies, such as Exxon, has risen rapidly, but investors are missing the opportunity that will last a long time.

“We feel that investors are making non-commercial decisions, because these energy transitions last, if you look at human history, they last decades. And in those transitions, you need companies that are part of the solution, not part of the problem. So we should squeeze out bad players, bad actors, but some of the good actors are needed because otherwise you'll get an energy crisis. In fact, you're seeing demand for coal going up and coal prices have gone up because ironically, there's a gas shortage when the wind didn't blow (in Europe), and we were having power shortages. They've been forced to actually import more coal and so we might be having a perverse outcome if we're not careful. Our job is to find companies that are good that are truly part of the solution, which will allow us to make the transition to clean a better world. We feel a lot of growth managers have become too complacent. In fact, 65% to 70% of global growth managers have no energy.”

Jain argues that forcing fossil fuel companies into private equity hands is the worst outcome as their business practices will move away from the gaze of active managers in the listed, regulated space. Aspirations for 2030 are ahead of what is technically possible to meet energy demand.

“I think that's the sad part, that it'll take a long time to truly transition. This transition could last 40, 50, 60 years. And the question is, to what extent will it be successful, because we need to find a lot of other commodities to make that transition. As you know, electric vehicles are six times more copper-intensive. Well, we need to find a lot of copper to be able to make the transition. We feel buying better companies, trying to lean on management to get their act together and be better corporate citizens, we actually can make a much bigger difference.”

What about the morality?

In what started as a potential ‘gotcha’ question, Jain was asked, “Taking this position in energy, do you feel it's morally the right position to take?”, he replied somewhat indignantly:

“Look, I think it's actually immoral not to invest in energy. Unless we're willing to live by burning candles or willing to walk rather than drive. In fact, one could argue that reducing supply is a bit elitist with a third of the world still making the transition from wood to something else. We need cheap enough energy for the world to make the transition to get a certain level. You know, 25% of the world doesn't have a power supply yet. If you raise prices too much, you'll have perverse outcomes. I believe it's morally wrong to reduce supply. Go to India, go to Africa, go to parts of China, and saying the oil price should double is not a realistic argument.”

Would Jain duck the issue in a more public forum? No, as he expanded at the AGM.

“If you stop producing fossil fuels, 80% of the world will not be able to drive a car. So I think if you look at it realistically, globally, we do need fossil to make the transition to a greener, better world and from a client perspective, our clients understand and appreciate our investment processes and I think we feel pretty comfortable in terms of our core investment proposition.”

Jain answered the question about whether institutional clients are moving away from GQG.

“There’s not enough copper for Europe to switch to EV, let alone the world to switch to EV. It’s kind of fascinating, in fact, we are getting quite a bit of interest and attraction because the majority of global managers have decided not to invest in fossil, which is why a lot of them are struggling. In fact, one could argue the problem with aggressive growth managers is they have no energy … I think there’s always two sides and look, the world is a big enough place. I’m sure some investors don’t want to invest in fossil while others do want to invest in fossil. Our job is to find like-minded investors who agree that for the world to transition to a greener world, we need energy to allow us to transition.”

ESG definitions and principles are far from settled

It would fair to expect that a company such as Tesla, the market leader in electric vehicles and the move away from gas-guzzling internal combustion engines, would be a priority name for ESG investing. However, Standard & Poor’s Dow Jones recently removed Tesla from the S&P500 ESG index while oil companies remain. Hector McNeil, co-CEO and Founder of HANetf, explained why this happened:

"On the surface, Tesla’s deletion from the S&P500 ESG index looks shocking. Tesla is a real pioneer of climate solutions. Meanwhile, big oil names like Exxon are in there ... If you read the reasoning of SPDJI, it’s quite clear why Tesla was excluded. It doesn’t have a low carbon strategy and has questionable labour practices ... But the key is that there’s no inherent right of Tesla or other EV or battery makers to be in the index.”

Not surprisingly, Elon Musk was unimpressed, tweeting:

The investment industry and regulators are still attempting to define ESG principles, with the US Securities and Exchange Commission announcing proposals to manage the trend to ‘greenwashing’ to take advantage of ESG demand. Investors struggle to know whether a company or fund really values ESG principles, or treats it as ‘table stakes’ to win money. The regulations extend to the ‘Names Rule’, or what a fund or fund manager can call itself. SEC Chair Gary Gensler said,

“A fund’s name is often one of the most important pieces of information that investors use in selecting a fund.”

In Australia, Dugald Higgins, Head of Responsible Investment & Real Assets at Zenith, said:

“We are essentially at the point where any company or fund that cannot demonstrate deep environmental, social and governance credentials, which naturally spans a wide range of sustainability and social issues, will simply be ‘uninvestable’ to institutional investors.”

Try telling that to Warren Buffett. In 2022 to date, Berkshire Hathaway has acquired 14.6% of Occidental Petroleum costing US$10 billion and invested US$26 billion into Chevron, making it one of his Top 5 holdings. Analysts say Berkshire has placed a US$40 billion bet on the oil sector.

This article will not venture into the vexed questions of whether adoption of strict ESG principles enhances portfolio returns or the anthropogenic contribution. People want action and ESG investing clearly has a strong future. However, uncertainty about definitions, voluntary nature of ESG disclosures, limited enforcement and need to allow the underprivileged of the world a chance to access cheap energy show the debate about speed of reducing fossil fuel use is far from settled.

In the meantime, some fund managers are benefitting from fossil fuel companies enjoying a surge in prices, and every investor needs to decide whether this fits with their personal morality and understanding of the broader issues.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any investor.