A useful exercise as an investor is to observe the media and pop culture for trends that are increasingly popular and others which are falling out of fashion. It can help identify sectors which may be overly hot and those that are being ignored, perhaps unjustifiably. For instance, many people like to look at auction listings to gauge the state of the Australian residential property market. Yet, I’ve found it just as helpful to watch how many pages there are in the Domain property magazine in the Australian Financial Review – more pages equal more listings and popularity. And the state of the property reality shows on TV – more shows and higher ratings normally equates to a hotter property sector.

Recently, I’ve noticed a trend in the investment world: the supremacy of growth investing and the obliteration of value investing, and investors. Now, you might say: that’s not news. We all know about the meme stocks which went to the moon in 2020-2021, and the ‘Magnificent Seven’ stocks which have driven most of the S&P 500’s gains this year.

Yet, the extent of investors’ love affair with growth investing has seeped into some intriguing areas. I’m a bookworm and one thing that’s struck me is that popular investment books in recent years are all about growth investing. Think of Terry Smith ‘Investing for Growth’, Christopher Mayer’s ‘100 Baggers’, Lawrence Cunningham’s ‘Quality Investing’, and anything about Warren Buffett and Charlie Munger because they’ve been adopted as growth investors too. On the flip side, how many books on value investing have become bestsellers over the past decade? I can’t think of one.

You can look elsewhere to detect this trend too. I’ve scrolled through podcasts, and my best guess is there’s at least 30 podcasts on growth investing versus one on value investing.

It’s not just reflected in the media either. The number of investment managers with a value investing style has plummeted over the past 15 years. In Australia, there aren’t many left.

I want to explore whether value investing is dead, or if it isn’t, whether there may be an opportunity for contrarian investors to exploit.

Value’s long period in the shade

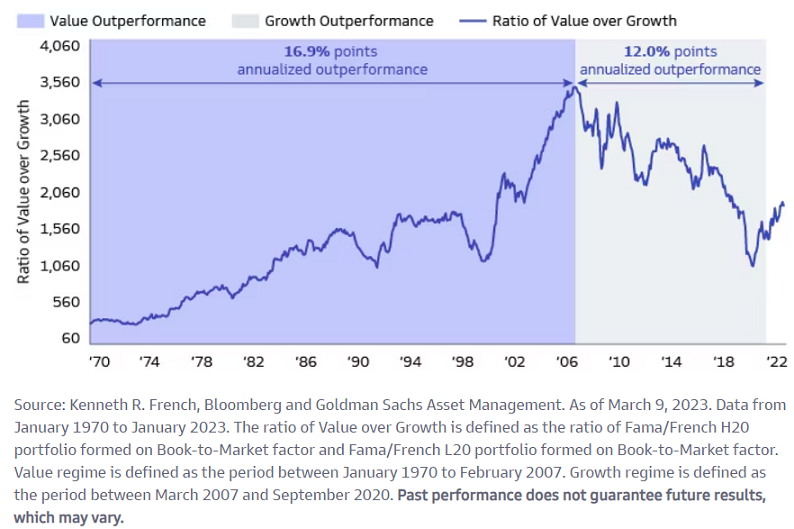

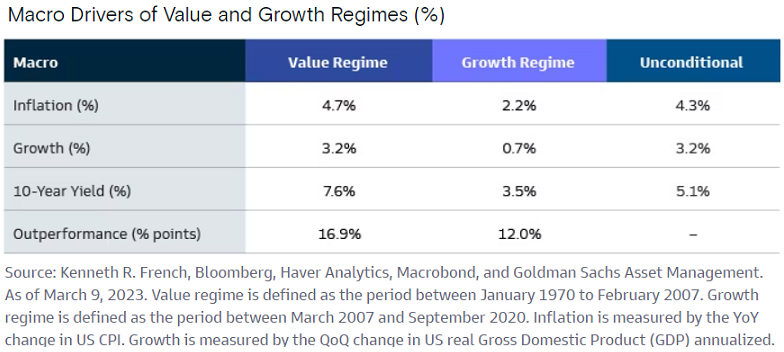

Let’s first look at the extent of growth investing’s outperformance versus value of late. The chart below of the US market provides some context. Over the past 16 years, growth has outperformed value by 12% per year. That’s enormous. The outperformance started in February 2007, it survived the GFC with many value stocks getting hammered, before value picked up in 2011-2012 as the commodities boom peaked, and then growth got rolling especially into 2021.

The chart tells us a few other things. Over the long term, value has tended to outdo growth. And it’s true that value itself got bubbly heading into 2007, and again later in 2012. Since then, though, it’s been one-way traffic and value investors have been hammered.

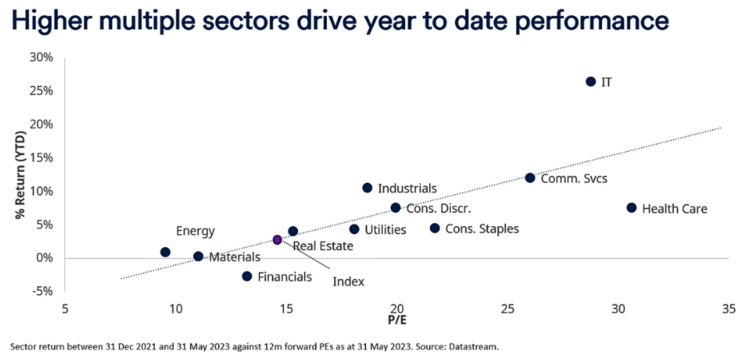

The trend started to reverse last year, although this year, growth investors have regained the ascendancy. For instance, the ASX has seen stocks valued on higher earnings multiples performing markedly better than those with lower valuations in 2023.

Where are all the value managers?

The ascendancy of growth investing was brought home to your author at an investor update from Talaria Capital, a global value firm based in Australia.

Co-CIO Hugh Selby-Smith spoke of how few value investing stablemates are left in Australia. He says most independent investment firms with a value investing bias have either switched to being ‘pragmatic’ investors or they’ve gone out of business. Selby-Smith says he has some value investing friends at funds within large institutions, but these funds are often ignored, and are certainly less resourced than their growth counterparts.

The question I put to Selby-Smith is how Talaria has managed to sidestep the carnage of other value investment funds. And he talked extensively about process and discipline. For 17 years, Talaria has largely adopted the same process. For them, it’s all about finding stocks that generate substantial free cashflow, have rock-solid balance sheets, and can be purchased at discounts to fair value.

Much of Talaria’s investment process is about eliminating behavioural biases in generating stock ideas and even for stocks that are currently in the portfolio. The firm conducts ‘anti-mortems’ that involve taking the opposite side of a stock idea to make sure the team view it through an objective lens.

Selby-Smith argues this process has helped the firm to largely avoid so-called ‘value traps’. These traps are the bane of value investors as they involve stocks that normally have fallen in price and seem cheap though are of questionable quality and, for a variety of reasons, decrease in price further after purchase.

I think there are two other reasons for Talaria’s success as a value manager. It’s had consistent performance over short-and-long-term periods. It’s also had retail investors who’ve hung around as they’ve understood the company’s investment philosophy and process.

Talaria has been the rare exception where others have fallen on harder times.

Time for a value comeback?

Historically, investment styles run in and out of favour, about every 10 to 15 years. Currently, growth is the top dog. Yet, there may be signs that we might be nearing a top. The decline in numbers of value funds/managers, the rise and rise of books and investment letters on growth investing, the number of ‘star’ fund managers topping performance rankings who are growth managers (which probably peaked in 2021), and the bifurcation in stock markets where 7 stocks on the S&P 500 dominate returns yet are on forward price-to-earnings ratios of double the rest of the market (30x vs 15x).

A turn in the fortunes of value investing would have significant implications for listed companies and investors. What could be the trigger for a turnaround? One candidate could be inflation. Historically, value stocks have handsomely beaten growth stocks during periods of high inflation.

It’s impossible to accurately forecast the future though if history is any guide, any turnaround in value stocks is likely to prove both sharp and long lasting.

James Gruber is an Assistant Editor for Firstlinks and Morningstar.com.au. This article is general information.