In an environment characterised by low interest rates, yield-hungry investors are gravitating towards long WALE (weighted average lease expiry) property funds. The attractive long-term, sustainable and often inflation-protected income streams also enhance diversification in most investment portfolios.

Current long WALE property fund yields of 5.0%-6.0% show a 1.5% (150bps) plus spread to their funding costs (about 3.5%) and 4% (400bps) in excess of the long bond yield, which is below 1.0%.

Long WALE funds are increasingly viewed as a lower-risk, lower volatility property investment option, providing a bond-like alternative with the attraction of a relatively higher yield than most current fixed interest investments.

What is a long WALE property fund?

Long WALE funds have considerably longer lease terms with tenants, which reduces the near-term earnings risk of the fund. While a normal 'core' property fund might have an average lease length across the portfolio of circa three to seven years, a long WALE fund aims to have an average lease term of at least 10 years.

Funds with shorter WALE’s are more susceptible to a higher turnover of tenants, loss of income through vacancy and higher leasing costs due to the more frequent leasing required in a building.

Long WALE fund leases generally have built-in annual rent escalators, either inflation-linked or fixed uplifts (i.e. 2.5% to 4.0% per annum), allowing the cashflow to grow over time. In an environment where income growth is highly sought, this is an extremely appealing attribute.

It’s not just the length of lease that is attractive. Many corporates, in return for entering into long-term leases, want to retain control over the property they occupy for the duration of the lease. Hence, they usually enter into a 'triple net lease' whereby the tenant is responsible for:

- all outgoings including insurance

- payment of most rates, taxes, charges and utilities, and

- structural repairs and maintenance.

For the fund, this provides greater certainty of income than a typical gross lease where the tenant pays rent and the landlord is responsible for the costs of operating and maintaining the asset.

Tenant covenant is critical

Given the length of an individual lease in a long WALE fund can range between 10 and 30 years at lease commencement, and the property is typically single tenanted, the strength of the tenant covenant is critical to the security of cashflow. A tenant with a strong credit profile, similar to an investment grade bond issuer, decreases the risk of default over the life of the lease.

It is therefore critical to assess the risks relating to both the corporate (tenant) and the industry in which they operate. Consideration needs to be given to such factors as:

- the financial strength of the tenant, including the quality of its profit and loss statement and balance sheet, its past financial performance, its capital adequacy and ability to source capital to grow the business

- the quality of management

- their position within the industry

- industry demand and supply drivers

- government policies relating to the industry, and

- industry financials, including return on capital employed, margins and earnings stability.

Property selection is not just about the cashflow

Investing in properties with long WALEs does not mean the underlying property decision-making process is any less important. A long-term lease is in effect a long-term partnership between the tenant and the property owner. The focus should be on acquiring those properties that are strategically important to the long-term operations of the tenant customer.

The size and shape of the building, and the amount of surplus land (i.e.. is there sufficient space to allow the tenant to expand their operations down the track or can the surplus land be sold) will also form part of the functionality assessment when underwriting the property. While the near-term risk of vacancy is low, it is also important to take into consideration the alternate uses for the property and the value of the underlying land in the event that the tenant defaults or decides to leave the premises on/before the lease expiry.

Long WALE funds are not passive, and managers cannot take a set and forget approach. Recycling assets within the fund is also crucial to limit over-renting (where the market rental growth has not kept pace with rental growth of the asset), obsolescence and through time, the erosion of the asset’s, and therefore, the fund’s WALE.

How to access long WALE assets?

Government, education (childcare operators and universities), healthcare, logistics, pubs, big box hardware and food manufacturers, are just some of the tenants who are willing to take on long-term leases and occupy an entire building. For these tenants, their premises are either highly specialised and/or the location of the property is critical to their business operations.

Sale and leasebacks are a smart way for long WALE funds to access long-lease properties. When a higher rate of return can be generated from their primary businesses than from owning the property, many corporates are currently taking advantage of the strong demand for assets at historically low cap rates to monetise their property assets. A sale and leaseback transaction effectively unlocks capital which can be redeployed into the business, pay down debt or fund a special dividend to shareholders.

Recent examples of sale and leaseback transactions undertaken by Charter Hall with leading Australian corporates on long-term leases include:

- Telstra selling down a 49% interest in 37 telco exchanges with a WALE of 21 years

- Ingham’s selling down a portfolio of industrial assets related to the processing of poultry with a WALE of 24.6 years, and

- Bombardier Transportation’s Australian headquarters on a 20-year lease term.

Another way to access long WALE assets is to forward fund or forward purchase a pre-let property to a tenant on a long-term lease in advance of its completion. The tenant gets a purpose-built building and the owner receives substantial savings in acquisition costs and can generate a higher return on investment. Charter Hall secured Western Sydney University on a 40-year lease in return for developing and owning long-term, a start of the art vertical campus in the Parramatta CBD.

Benefits of long WALE funds

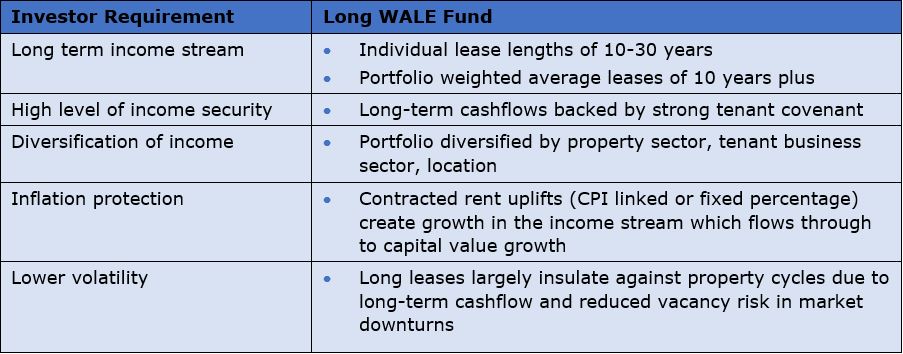

The table below summarises the benefits of long WALE funds:

We expect to see continued appetite for long WALE property funds from a broad range of investors, including superannuation funds and life insurance companies keen to match their long-term liabilities with long-dated cash flows with real assets.

Adrian Harrington is Head of Capital and Product Development at Charter Hall, a sponsor of Cuffelinks. This article is for general information and does not consider the circumstances of any investor.

For more articles and papers from Charter Hall (and previously, Folkestone), please click here.