At the end of February 2023, the Government announced plans to introduce a new tax on superannuation account balances above $3 million. This threshold will not to be indexed for inflation, so it will impact more savers every year through bracket creep alone. Inflation is likely to remain above target for many years and inflation has historically been the largest component of share prices gains in Australia. However, there is an even more important impact of inflation with this tax, as we outline below.

Taxing unrealised capital gains is a profound change

This new tax captures unrealised gains from any rises in the value of shares or property or other assets every year, even if they are not sold. It is an extraordinary departure from the existing tax system in Australia. People with super balances above the threshold will be better off holding the same assets outside super, paying tax at the top personal marginal tax rate of 47%, than leaving them in super paying the new tax.

How can this be correct?

The reason is that the current tax regime in Australia only taxes capital gains when they are realised, that is, sold for more than the cost base. But under this new tax, a return ( 'Earnings') is defined as any increase in the super fund balances from the start to the end of each year (after adjusting for contributions in and payments out).

As most of the gains from shares and real estate are from inflation, fund members will pay tax every year due simply to rising prices. Governments create inflation by printing money and deficit spending, and now a tax on assets in super will arise from the resultant price inflation. Inflation is already a tax on the purchasing power of money but paying this tax will further erode purchasing power.

For assets with publicly-available prices (shares, managed funds, LICs, listed bonds, etc), the unrealised gains will be easy to track and tax each year. The ATO has kindly offered to do this. For unlisted assets like direct real estate, private assets and collectables, valuations will depend on the frequency, the basis and the valuer involved. Where an unlisted asset (like a property) is the main asset, a member may need to sell the asset if they can’t come up with cash from other sources to pay the tax every year.

Marginal personal rates versus the new tax

Let's return to the issue of how holding assets outside super and paying tax at the top personal marginal tax rate of 47% can incur less tax than holding the same assets in the new superannuation regime (taxable income at 15% plus 'Earnings' at 15% including unrealised gains).

Australian shares are the most common asset class in most super funds. Since the start of 2000, the broad Australian share market has generated total returns (ie share prices gains plus dividends) averaging 7.9% pa excluding franking credits and a grossed-up total return of 9.3% pa including franking credits for Australian shareholders.

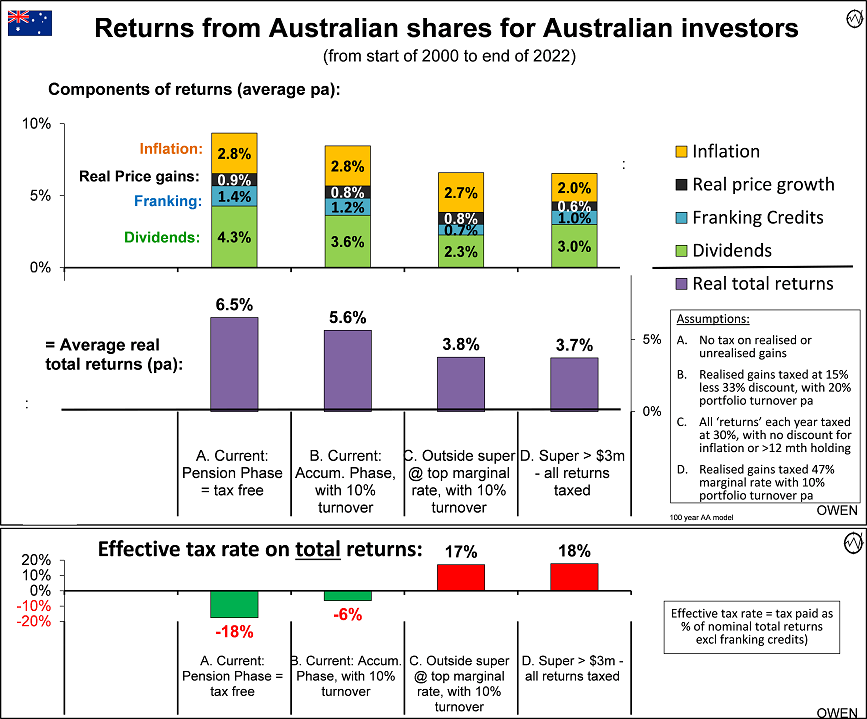

Where did these returns come from? Nearly half (4.3% pa) came from dividends, nearly one third (2.8% pa) was CPI-inflation lifting share prices, one sixth (1.4% pa) was from franking credits, and less than one tenth of the total returns (0.9% pa) was from real growth in share prices above inflation. It is important to break down the returns into these components because each component has different tax implications.

While these were the average nominal total returns, the after-tax return varies in the hands of different types of entities. We look at four ways of holding the same basket of shares:

A. Pension accounts

Currently, super accounts in pension phase are effectively tax-free. However, because of the tax benefit of franking credits which refunds the taxes that the dividend-paying companies already paid on their profits, the after-tax total return was 9.3% pa, which is higher than the 7.9% pre-tax return. This amounts to an effective tax rate of minus 18% on the original 7.9% nominal total return from the share market since 2000 (the negative tax rate is due to the impact of franking credits).

B. Accumulation accounts

Currently, super accounts in accumulation phase pay 15% tax and realised gains are taxed at 15% (less 33% discount for sold assets that were held for more than 12 months). Assuming 10% portfolio turnover each year, taxes reduce the after-tax return to 8.5% (For this estimate, we need to assume some portfolio turnover as it creates taxable capital gains. Such turnover occurs even in relatively passive long-term funds.) This equates to an effective tax rate of minus 6% on the original 7.9% nominal total return.

C. Personal (non-super) accounts

An individual holding the same portfolio outside super and paying tax at the top personal marginal tax rate pays 47% tax on dividends and franking credits and realised gains are also taxed at 47% (less a 50% discount for sold assets that were held for more than 12 months). Again assuming a 10% portfolio turnover each year, taxes reduce the after-tax return to 6.6%. This equates to an effective tax rate of 17%, which is a lower overall tax rate than the new 30% super tax.

D. Super above the new threshold

Super accounts above the new threshold will incur an additional tax, the existing 15% plus 15% on the balance above $3 million, with the expanded definition of ‘Earnings’ applied. There is no discount for inflation or assets held more than 12 months. Despite the 15% plus 15% headline tax rates, the effective tax rate is actually 18% due to the impact of franking credits.

[Note that D applies to investors in the top marginal tax rate. However for people in lower tax brackets, the position is even more favourable outside super as they can earn up to $170,000 pa before their average tax rate is more than 30%, and importantly, taxable income outside super does not include unrealised gains.]

This chart shows the components of returns from the broad Australian share market from 2000 to 2022, and also shows the effective tax rates in the four tax scenarios:

The set of purple bars in the middle show the average after-tax real (ie after inflation) total returns for each entity. This the most important number for building long-term portfolios that aim to generate cashflows that keep rising for inflation, and also keep the capital base (after withdrawals) rising so that future incomes also grow for inflation. Retirement funds need to generate at least CPI+4% and most of this comes from shares. We can see here that this is not achieved in scenarios C and D.

It is similar with other types of long-term assets. Foreign shares are even more favourable outside of super when the new tax hits because less of the total return pie comes from dividends and more comes from capital gains.

Impact of eventual sale and realising capital gains

It is true that, if or when the asset is eventually sold, capital gains tax would be paid at that time, but there would be several benefits of doing this outside of super:

- the tax on the increase in capital value would be deferred until the eventual sale, instead of being taxed each year of unrealised capital growth.

- the capital gains tax would be reduced by the 50% discount on sold assets held for more than one year.

- the sale could be done at a time when the owner s marginal tax bracket is much lower (eg in retirement), reducing the tax further.

- Holding inside super may result in having to sell other assets to pay the yearly tax on unrealised gains, but if holding outside of super, you only pay tax when you have the cash from the eventual sale.

The new tax punishes investments that rely on capital gains

As most of the gains from long-term investment assets come from long-term value gains (most of which is simply inflation), rather than cashflows (rent, dividends, etc), this new super tax amounts to a heavy tax on long-term investment. But savings is the source of capital for investment, which creates jobs, funds innovation, which is the source of increased productivity and living standards for the whole nation.

This is only draft legislation at this stage, although it does spell out the plan to tax unrealised gains for the first time, with worked examples to show how it will operate. Once the broader implications are fully understood, it will struggle in parliament. If it gets through, it is likely to add complexity. This, and other mooted plans for super, like commandeering super funds to invest in government agendas like renewables and social housing (however well-intentioned), would appear depart further from the goal of simplifying super.

To share your views on the merit of the new super tax, please see our current Reader Survey.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is for general information purposes only and does not consider the circumstances of any individual, and is based on an understanding of the current proposal to change the way large balances in superannuation are taxed.