This is an edited transcription of an interview between Firstlinks’ James Gruber and Helen Mason, Fund Manager of Schroders’ Australian High Yielding Credit Fund (Cboe:HIGH) on April 7, 2025.

James Gruber: Can you outline what type of securities your fund invests in?

Helen Mason: We buy corporate and financial credit. Companies and financial institutions come to the Debt Capital Markets (DCM) to borrow money, when they have a general financing needs or there is capex that needs to be funded. Investment houses like Schroders assess the credit quality of these businesses and decide if we want to lend to them and if so, at what price. In return, we receive a regular coupon payment and expect to receive our principal back at the maturity of the bond. That's ultimately what credit is.

We define our credit universe for the Schroders Australian High Yielding Credit Fund as Australian companies issuing in any currency across the world. For example we can buy a CBA bond in USD, EUR or even GBP and offshore companies, such as Barclays Bank issuing into the Australian credit market in AUD. All currency risk is hedged back to AUD. The Fund does not take currency risk.

We don't buy structured credit in this fund because structured credit is just less liquid than senior and subordinated bonds. Liquidity is important to us because the fund offers daily liquidity to its investors. Furthermore, we do not allow any private debt holdings for the same reason. Transparency is important to our investors.

JG: How have Trump’s tariffs impacted credit markets?

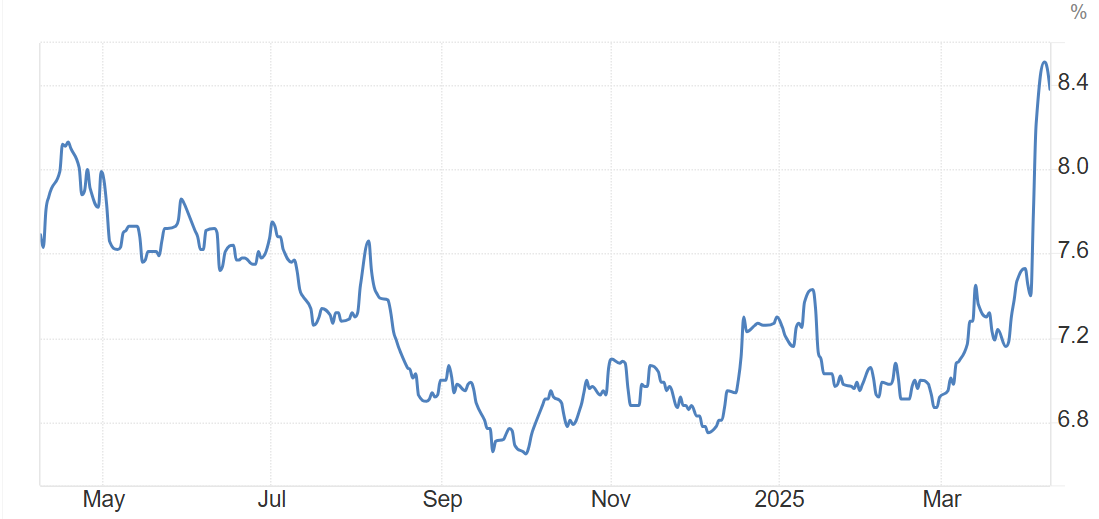

HM: High yielding US credit has underperformed the most significantly, however that was to be expected given valuations on US high yield have been extremely expensive for quite some time.

ICE Bofa US high yield effective yield

Source: Trade Economics

Australian credit has held up pretty well. Australian Major bank Tier Two (T2) paper in is out circa 40-45bps whereas Kanga T2 [Kangaroo bonds] is out 50-55bps. It could have been a lot worse. We're actually pretty comfortable with how the market has behaved so far.

It's not liquid at the moment; no one's really doing any deals. No corporates are coming to the market. It's very hard to price a new deal in markets like this, so you just get less liquidity. But overall, we haven't seen a capitulation.

JG: You've got some cash on hand. Where do you see the opportunities to put that cash to work?

HM: Wholesale tier one [bonds] for us had been trading above par over the last few months, and it really has been getting more expensive, but we've been able to transact in the markets now below par, and actually quite significantly below par. That's great from the perspective that firstly, they're very short duration - one and a half to two years left on these particular bonds - and we'll be repaid at par. But also the spread - the credit risk premium attached to those bonds - at the moment is extremely high, and we're waiting for more opportunity for those types of bonds to come out.

JG: A lot of investors have been switching out of hybrids into tier two, or unsubordinated bonds. How do you view these bonds?

HM: I really like tier two bonds. You're still getting an investment grade quality paper, but it's subordinated, and it prices significantly wider than other IG [investment grade] credit. There is an argument to say that Australian major bank tier two had become very tight prior to the events of the last week. This repricing that's happening now is actually going to create better value to get back into tier two.

JG: What would your advice be to those investors still holding onto hybrid securities?

HM: A paper that I wrote recently demonstrates that having a diversified allocation to credit is important, particularly in times like this when there is a lot of volatility in markets. The other point is that retail bank hybrids are still trading above par. So if you are looking to reallocate, probably now's the time, because they will end up at par - when you get repaid your 100 cents in the dollar.

JG: A lot of your fund is invested in Triple-B securities. Triple-B is down the pecking order in debt ratings - why do you like them?

HM: Ratings from triple A all the way through to triple B minus are still investment grade ratings. So the fund that we manage is still an investment grade fund.

We look at triple-B corporates because if you actually look at excess returns to per unit of risk, then the triple-Bs are delivering you a better return versus the risk over a long period of time.

But also in Australia, we have quite a unique setup for our triple B's, and that's because we're so dominant on heavy critical infrastructure in Australia. The airports, the ports, the toll roads, railroads - these are essential businesses, and they have very stable ownership.

What we like about them is that because a number of them are regulated, particularly electricity distributions and gas pipelines, we get a clearer view of cash flow transparency.

JG: Where do you think lie the greatest risks in credit markets?

HM: Globally, I would have said US high yield a couple of weeks ago as it was priced very tightly for the risk you're taking. If you think about the index in Australia, it's rated A plus, whereas the US high yield index, it's sub investment grade in the double-B space. You've got big differential in rating there. But also, even in US and European investment grade credit, they're rated two notches lower than Australian credit as well. We're just very high quality here versus other places in the world.

One of the areas that we had taken some risk off the table was the energy companies like Santos, for example. But not because we don't like Santos, but more because we just weren't getting paid enough of a risk premium. Prices were getting very tight on names like Woodside and Santos.

JG: Why do you think active management in the credit space is important?

HM: A lot of the ETFs that have come into this space are very much focused on tier one and tier two, which are just Aussie financials.

True diversification can come from investing in other great Australian companies - our critical infrastructure, utilities, and even some of our consumer staples, Coles and Woolworths, are triple-B companies.

Helen Mason is the Fund Manager of Schroders’ Australian High Yielding Credit Fund (Cboe:HIGH). You can find out more about the fund here. Schroders is a sponsor of Firstlinks. This material is general information only and does not take into account your objectives, financial situation or needs. Schroders does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this material.

For more articles and papers from Schroders, click here.