In the face of a terminal illness diagnosis, financial stability and support for the person impacted (and their family) is an important consideration.

Someone who is diagnosed with a terminal medical condition may be able to access their superannuation early, and if they have insurance within their superannuation fund, they may be able to claim a terminal illness benefit.

Early access to super

The eligibility requirements to access super under terminal illness require that:

- Two registered medical practitioners have certified that the person suffers from an illness or an injury that is likely to result in the death of the person within 24 months; and

- At least one of the registered medical practitioners is a specialist practising in an area related to the illness or injury suffered by the person.

There are no limits on the amount someone can withdraw from their super, subject to fund rules. When accessing super due to terminal illness during the 24 months following the medical certification, any lump sum payment is tax-free and does not need to be included on your tax return.

Balances remaining after the 24-month certification period ends can still be accessed but may not be tax-free as benefits that accrue after the certification period are not covered by the original terminal medical condition of release.

Terminal illness benefit

Whilst the requirements to claim terminal illness insurance are generally like those needed to access your super, it is important to note it is a separate process.

Policies may vary, but usually terminal illness cover is included with your life insurance policy and can be claimed when a doctor certifies you have between 12 and 24 months of life remaining.

If the insurance claim is accepted, the terminal illness benefit will generally be paid into the person’s super account.

There are different ways to access your super

Depending on the fund rules, a person who is terminally ill may have the option to take a pension, a lump sum payment or leave the funds in accumulation. The optimal decision will depend on their individual circumstances and financial needs including tax, social security and estate planning implications. Let’s look at the three options.

Taking a lump sum

A lump sum withdrawn during the certification period provides immediate and tax-free access to funds which may be needed prior to death, such as for medical expenses or renovations, a family holiday, or for repayment of debt.

Lump sum withdrawals are not assessable for Centrelink or Department of Veteran Affairs (DVA) means testing, although unspent proceeds may be assessable if maintained, for example, in a bank account. Any unspent funds held outside super also attract tax on earnings at the person’s marginal rate, which may be higher than the super maximum tax rate of 15%.

For estate planning purposes, there is no option for beneficiaries such as a spouse or child to commence a pension once the funds are removed from super. Once funds are withdrawn and invested personally, on death the amount will be included as an estate asset, and subject to the terms of the deceased’s Will.

Withdrawing funds from super does create the possibility of intergenerational wealth transfer prior to death and removes any tax payable on super death benefits.

Retain in accumulation

Retaining funds in accumulation means the person can maximise social security entitlements whilst below Age Pension age, as these funds are not assessable by Centrelink or DVA. They also maintain access to ad hoc tax-free lump sum withdrawals as required to meet expenditure needs. Earnings are taxed at a maximum of 15%.

On death, eligible beneficiaries may have the option to commence a death benefit pension within super. However, any lump sum payments to non-dependant beneficiaries may attract tax.

Commence a pension

Using super to commence a pension can provide regular income to fund expenses. Whilst there is no tax on earnings within the pension, pension income is subject to standard tax rates:

- Tax free if the person is age 60 or older

- Taxed at marginal rate if they are under age 60 (some special situations can apply, eg, a disability superannuation benefit)

Funds used to commence a pension are assessed under both the assets and income test for Social Security and could reduce any benefits received. Note pensions can be beneficial for estate planning, as they allow for reversionary or death benefit pensions for eligible dependants, such as a spouse or minor child.

Beware – rolling over during the certification period

Whilst super benefits can be cashed under terminal illness, there is restriction on rolling over benefits to another fund. Where such a benefit is transferred between super funds during the certification period, the transfer is treated as having been cashed out as a lump sum and then recontributed as a non-concessional contribution for tax and contribution cap purposes. A rollover could therefore inadvertently breach a contribution cap and trigger an excess contribution.

Claiming permanent incapacity instead

Once any claimable insurance proceeds have been paid into the super fund, the trustee can be informed of which condition of release the person wishes to apply for. In some situations, a person may be eligible to access super under either terminal illness or permanent incapacity. The implications of accessing under both options differ.

The permanent incapacity condition of release may be suitable for a terminally ill individual if they

- are under age 60 and wish to commence a pension, where they will be entitled to a 15% tax offset on the taxable component of income payments, or

- wish to rollover their benefit to another super fund, where they may also have access to a tax-free uplift that is applied to the entire rolled over amount.

Example

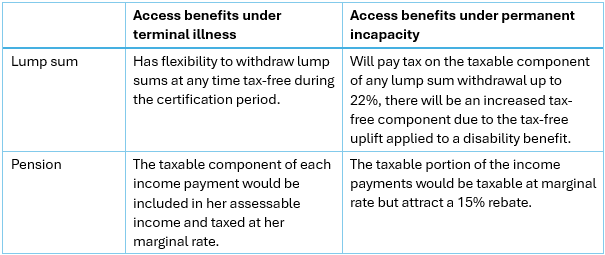

Claire, age 49, has a terminal illness. Her super fund has confirmed she is eligible to access her benefits via either the terminal illness or permanent incapacity condition of release. In either case she has the option to take a lump sum or start a pension.

Claire’s financial adviser explains the differences:

Given that everyone’s circumstances are different there is no right or wrong answer.

As always, one should seek financial advice before accessing superannuation due to terminal illness. A financial adviser can help you understand:

- the most appropriate condition of release under which to access your benefits;

- the difference between taking a pension, lump sum or leaving funds in accumulation; and

- the tax, estate planning and social security implications.

Brooke Logan is a technical and strategy lead in UniSuper's advice team. UniSuper is a sponsor of Firstlinks. Please note that past performance isn’t an indicator of future performance. The information in this article is of a general nature and may include general advice. It doesn’t take into account your personal financial situation, needs or objectives. Before making any investment decision, you should consider your circumstances, the PDS and TMD relevant to you, and whether to consult a qualified financial adviser.

For more articles and papers from UniSuper, click here.