It’s the investment trend that has quietly been growing as equity markets continue to capitulate, and active managers make missteps. Smart beta is a broad and rapidly-expanding category of exchange traded products (ETP) that seeks to target outcomes beyond market capitalisation passive approaches, similar to active management.

It’s been called 'strategic beta', 'alternative beta' and 'quantamental indexing'. Whatever the name, there is no denying smart beta’s appeal.

What is smart beta?

Smart beta ETFs (part of the ETP sector) allow investors the opportunity, with a single trade, to exploit investment objectives which seek to enhance returns, improve diversification, or reduce risk. Whereas most indexes are weighted by the market value of companies, smart beta ETFs are based on one or more predetermined factors or investment methodologies.

It is a type of investment that combines the benefits of passively managed funds, such as lower costs, with the advantage of selecting investments based on certain formula-based rules, adding an active element. Smart beta strategies differ from actively managed funds, where a manager chooses individual stocks or sectors in an effort to target an outcome. Instead, smart beta ETFs track an index with rules but there is little or no human element.

For example, some smart beta strategies include equal-weight (where companies carry the same weight in the portfolio regardless of size), high-dividend, low-volatility, value, or high-quality investment approaches. They are transparent and rules-based, often aiming for increased diversification and lower costs compared with active managers.

In 2018 there were 27 products offered in the smart beta space in Australia. Today, there are 57, an increase of almost 200%. The trend reflects a broader global movement, with over 1,000 smart beta products now offered worldwide.

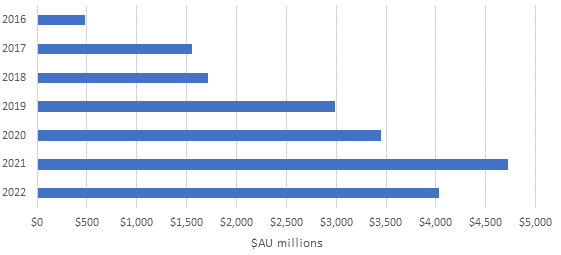

Chart 1: Australian Smart Beta Net Flows

Source: ASX, VanEck. 2022 is the annualised figure using data as at 31 August 2022.

Survey of Australian demand

The results of VanEck's seventh annual Smart Beta Survey point to the continued growth of the sector. The largest survey of its kind in the world, this year almost 650 financial professionals working in an advisory capacity in Australia took part.

The results show the proportion of net flows going into smart beta strategies rose to 26.6% of total YTD ETP flows in Australia at 31 August 2022, up from an increase of 20.2% a year ago. That gain outpaced both active and market capitalisation index strategies. Smart beta strategies now make up 15.2% of the total ETP industry, up 8% from the prior year.

Many financial professionals (46%) are now using smart beta strategies in client's portfolios according to the survey, compared with only a third (37%) in 2016. Moreover, about 42% of finance professionals are currently using two or three smart beta strategies, with almost 1 in 2 of those currently using smart beta considering an additional allocation to the space.

Most financial professionals surveyed said they use smart beta ETFs for international equities (70%) and Australian equities (69%) exposure.

This is the first time the Survey has been conducted during a sustained bear market. The positive results are indicative of the resilience of smart beta strategies in the face of market volatility.

Two in three financial professionals have increased usage of smart beta ETFs over the last 12 to 18 months, and the main driver for the uptake - reduced total portfolio costs. The Survey also reveals high levels of satisfaction among smart beta users, with almost 99% of advisers using smart beta strategies recorded as very satisfied or extremely satisfied.

Over half of those surveyed, or 56%, said they are using smart beta products as a replacement for active management. Active managers can no longer afford to ignore the popularity of smart beta ETFs. Diversification, performance, reduced volatility and lower costs were also cited as major motivating factors for financial professionals when selecting smart beta strategies.

According to Morningstar, Australian strategic or smart beta ETPs gathered $1.4 billion of net inflows during 2021, a 12.7% jump from 2020. Smart beta investment is continuing to grow this year, notwithstanding the volatility in global markets. According to the ASX in the year to 31 August 2022, $2.7 billion has flowed into Australian smart beta ETFs, surpassing the thematic and ESG categories.

Popularity of 'quality' smart beta factor

The most popular smart beta listed strategy is 'quality', that is, ETFs targeting the quality factor. Quality companies have low leverage on the balance sheet, a high return on equity, and stable earnings. In listed funds, $838 million flowed into this category in Australia by August 2022. While it remains to be seen whether the global economy is headed for a soft or hard landing, investors anticipating a hard landing could consider a quality-focused smart beta ETF.

Companies such as Microsoft and Google which play a key part in many of our day-to-day lives, are by and large considered quality companies. The share prices of such companies have been hit this year, due to a difficult macroeconomic environment rife with geo-political risks, rising inflation, and increasing interest rates. However, it is hard to imagine a world where companies such as Microsoft and Google do not play a fundamental role in the global economy in future. .

While short-term underperformance can be disappointing to investors, no investment portfolio can always deliver positive returns. Legendary investor Benjamin Graham famously said:

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

He was explaining that trends and fashions (the voting) will drive short-term prices, but eventually a company’s share price will come to reflect the quality and substance (the weight) of the business. Historically, those companies with quality characteristics have been more profitable, generated higher earnings and tended to outperform their peers over a long period of time.

Smart beta ETFs have grown to encompass a huge array of investment choices, but based on funds under management, the largest smart beta ETF (as opposed to unlisted managed fund) listed in Australia is the VanEck MSCI International Quality ETF (ASX: QUAL). Since inception, QUAL has outperformed the benchmark by 2.27% p.a.*

Arian Neiron is CEO and Managing Director - Asia Pacific at VanEck, a sponsor of Firstlinks. This is general information only and does not take into account any person’s financial objectives, situation or needs. Investors should do their research and talk to a financial adviser about which products best suit their individual needs and investment objectives.

For more articles and papers from VanEck, click here.

*Source: VanEck, Morningstar. QUAL inception date is 29 October 2014. The table below shows past performance of QUAL and of the MSCI World ex Australia index. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. QUAL results are net of management costs and expenses, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of future performance.