Retirement village (RV) life is great. Like living on a cruise ship, staying in a luxury resort, visiting a health spa, or driving a premium car.

But what about the costs? And what are you getting for your often multi-million-dollar investment?

The retirement village contract

A retirement village contract is a loan agreement where the borrower sets the terms. The retiree does not have title to the property they live in. In a retirement village contract you lose all control over your money - and premium retirement living means big dollars.

More than 10 retirement villages in NSW now have units that require residents to hand over more than $3.5 million to move in, and a few are asking for amounts higher than $10 million.

What are you giving up? At a minimum, you are missing out on income on the money you hand over. You could compare it to the income you may get having the money in the bank at the RBA cash rate of 4.35%.

But hang on a minute: money held by a retirement village operator is not money in the bank. You are lending money and the risk is different. As an example, the cost of money for a developer may be closer to the Maximum Permissible Interest Rate of 8.42% used in aged care. So the operator saves this amount when you loan them money for free. That’s a great deal. For them.

Or should you expect a better deal on the money handover when signing a retirement village contract, as you are lending your money to an operator, with no guarantee of repayment?

To get out of your free loan to the operator, another resident needs to take over your loan. This can take time. This is another risk.

As an example, imagine the challenge of trying to get some money back from Ardency Trebartha in Elizabeth Bay with an average time to sell a unit of 406 days, to pay a Refundable Accommodation Deposit (RAD) of $914,000 up the road at St Lukes Nursing Home. 406 days paying the interest rate of 8.42% on an unpaid RAD is $210.90 per day - that’s a cost of $85,600 incurred by having to wait for your money. Big numbers and set to get higher as Residential Aged Care costs go up from 1 July 2025.

When your children or loved ones are working out aged care options for you, what are they going to be up against to get the money? And how much money will be left after fees, charges and commissions? And how long will they wait for the money?

The takeaway here: know exactly what you are getting into.

Looking at the numbers more closely

Many residents confuse the offer of ‘100% Share in Capital Gain’ with owning a property. The truth lies buried in the numbers.

At Later Life Advice, we cut through the noise by calculating an ‘effective’ Deferred Management Fee. This is a measure used to include all the costs to the resident upon leaving as one easy to understand percentage.

A ‘100% share in Capital Gain’ is just one part of the calculation. You cannot make a profit living in a retirement village.*

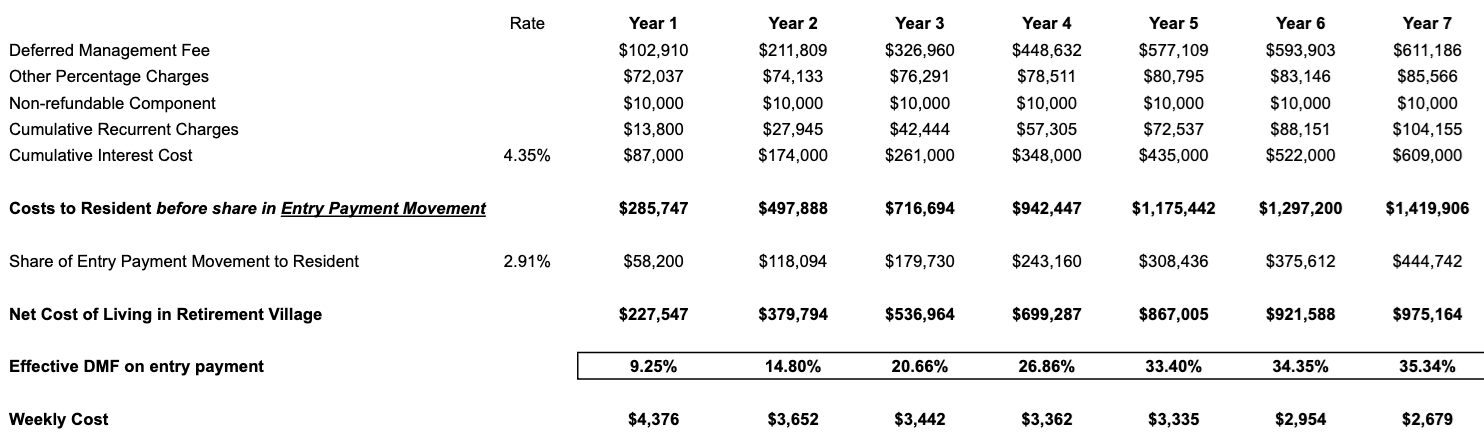

Consider this contract for a $2 million retirement village unit in Sydney’s north shore. This contract has complex mechanics - and also includes a ‘100% share of capital gain’. Taking into account all the costs, including 4.35% as ‘opportunity cost’ for tying up money, and a property growth rate of 2.9% as recommended by NSW Office of Fair Trading, a one year stay would cost about $4,400 per week, and if the stay lasted 7 years, the weekly cost would reduce to about $2,700.

The ‘effective’ Deferred Management Fee works out about the same as less complex contracts: the resident loses 35% of their upfront loan after 7 years. This includes a '100% Share in Capital Gain'.

Click to enlarge

The only difference between this contract with the old-style retirement village contract is the starting number. That is now in the millions of dollars.

Don’t get caught by the clever terminology. It’s the same old deal.

Don’t rely on Government oversight

Government mandated risk disclosures ascribe no value to handing over your money.

This is a glaring omission of the Average Resident Comparison Figure, a compulsory disclosure Retirement Villages need to make about costs that is a result of a change in retirement village laws introduced in 2021.

It is no surprise that almost all of these new higher entry payment villages have been developed since these laws and disclosure regime were struck. These rules were written before the boom in luxury retirement villages. There is no scrutiny on what it means to get no income from your money.

Losing access to your money is something you need to include as a cost in these contracts. Any reasonable professional valuation would include this. Why is it different here? And don’t forget to ask who has your money.

For the aged care sector, the Government has a guarantee scheme to make sure you get your money back. If an aged care home fails, the rest of the industry has to stump up and make good on the payment. This is not the case with retirement villages.

Commission-based sales teams selling complicated contracts

The ‘entry payment’ is just one part of a complex series of inputs that residents need to determine the cost of living in a retirement village.

The inputs to the ever more complex financial modelling that needs to be completed to understand the financial implications of entering into a contract will be found in a document known as the ‘Disclosure Statement’. This document is extremely hard to get.

Basic pricing information is guarded by old school sales teams working on commission who are celebrated by the Property Council of Australia, home of the Retirement Living Council, when they crack big sales numbers.

This would be fine if they were selling real estate - they are not. They are selling complex contracts, often valued in millions of dollars, and the retirement industry’s own survey last year confirms half of retirement village residents don’t know what they are getting into. Commissions still get paid.

No pesky Royal Commissions, Financial Complaints agency, fee disclosure, or licensing like with financial products. Your savings in super have mandatory reporting. Your savings in a retirement village contract do not. This must be taken into account before you sign a contract and hand over your millions.

Know what you are signing up for

To recap: contracts are complex, salespeople are highly skilled, and Government regulation is out of date. Meanwhile, watertight contracts put the onus on you the resident to understand the deal, and an army of bankers, developers and operators are tooling up to cash in on your free money.

With NSW Clubs getting a greenlight to convert their sites to villages, Governments looking for ‘seniors housing’ solutions and a silver tsunami coming, billions of dollars are flowing into this sector.

By all means make the move - but do it with eyes open. And make sure you see the all-in costs as well as the benefits.

Brendan Ryan is a Director of Later Life Advice. He has more than 30 years’ experience in financial analysis, modeling, and valuation, starting with his time in Macquarie Bank’s research team in the 1990s. He holds a Certified Financial Planner qualification and have spent more than 20 years specialising in financial modeling for moves into residential aged care.

These are independent views informed by experience, inquiry, and feedback. They highlight critical issues facing a vulnerable demographic, as aged care costs rise and new developments seek significant financial commitments from older Australians.

Retirement Village contracts vary widely. While my observations are based on specific examples, they underscore the importance of doing thorough research and due diligence before committing. One experience doesn’t define all, but the need for careful consideration applies universally.

* If you don’t agree with my numbers or methodology - let’s talk. Professional scrutiny of the retirement village deal for residents is woefully lacking - the more robust debate, the better.