Last week, German payments giant Wirecard filed for insolvency, owing creditors almost $5.8 billion. The company’s collapse came a week after its auditor, Ernst and Young (EY), found a massive $3.1 billion hole in its books. EY refused to sign off on the company’s 2019 accounts, saying there were indications of an “elaborate and sophisticated fraud involving multiple parties around the world”.

Markus Braun, the firm’s CEO, resigned and was subsequently arrested on suspicion of misrepresenting the firm’s finances.

Wirecard’s implosion is a stunning fall from grace for a company that was once seen as a champion of the European technology industry. So how is the demise of a German fintech company relevant to Australian investors?

While it’s likely that relatively few Australian investors will have had direct exposure to Wirecard, it’s possible that significantly more had exposure via a managed fund or ETF. The holders of broad sharemarket funds may be relatively sanguine about an event such as this, accepting that broad sharemarket exposure inevitably involves ‘taking the bad with the good’.

However, for one rapidly-growing class of people, investing their money in businesses whose environmental, social and governance (ESG) standards are beyond reproach is non-negotiable. For these investors, a true-to-label ethical exposure is one of the most important factors to be considered in their investment choices.

What do we know about Wirecard?

Wirecard offers products and services in the areas of mobile payments, e-commerce, digitisation and finance technology. It is also one of the popular options consumers can use to gamble online. Once an account is set up with Wirecard, it can be loaded with funds from a credit or debit card, or from a bank account. Account holders can use Wirecard to move money to and from online casinos, without having to disclose their banking information.

In a report by the Financial Times, Wirecard acknowledged that up to 10% of its payment volumes “relate to lottery, gambling, dating, adult entertainment and associated business models”.

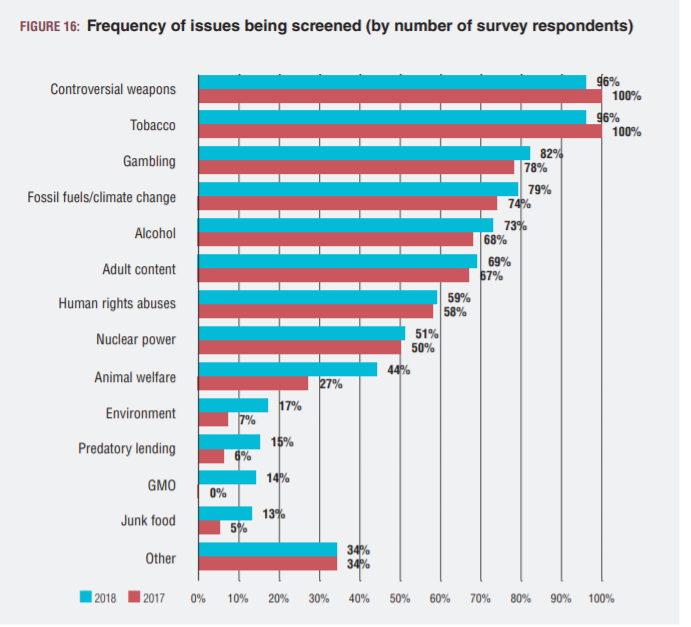

In its Responsible Investment Benchmark Report 2019, the Responsible Investment Association Australasia (RIAA) found that 82% of the responsible investment managers surveyed said they screened investments for gambling (see figure below).

Source: Responsible Investment Benchmark Report 2019, RIAA.

True-to-label ethical exposure?

For investors who are concerned about the true-to-label exposure of their ethical investments, it’s essential to have confidence that an ethical fund is screening out investments that do not align with their values.

Our global equities-focused ethical ETF (ASX:ETHI) aims to track an index that applies limits to the percentage of a company’s revenue that can be derived from activities deemed inconsistent with responsible investment considerations. These exposure limit guidelines include a limit of 0% for casinos and manufacture of gaming products and 5% for distribution of gambling products.

Due to its involvement in gambling, Wirecard did not pass ETHI’s index screening process and was not included in its portfolio. It was estimated that well over 5% of Wirecard’s revenue was derived from providing payment services to online gambling, poker tournaments, and sports betting platforms.

Wirecard was also excluded from other ASX-traded ethical ETFs, but not all.

The performance of a number of ethical equity-focused ETFs has been strong, inclduing ETHI. However, we believe that one of the primary reasons that investors (both institutional and individual) have favoured our ethical funds is the integrity and quality of the investment methodology our funds employ.

In addition, the Betashares Responsible Investment Committee may, applying the ESG-related screening criteria, exclude a company exposed to significant ESG-related reputational risk or controversy, if it considers that its inclusion would be inconsistent with the values of the underlying index.

The strictness of screening processes can vary between ethical ETFs, and many ethical ETFs rely on off-the-shelf indices without additional oversight. This can result in stock inclusions that may not pass the ethical ‘smell test’ and would be out of place for many investors seeking an ethical exposure.

For example, the French beauty giant L’Oréal is currently a constituent in some ethical ETFs trading on the ASX. This company conducts animal testing for cosmetic purposes and has received a “Fail” grade from the influential Ethical Consumer Guide. L’Oréal was screened out of ETHI’s portfolio based upon its record on animal welfare.

In the last two years, other stocks screened out of ETHI but included in the portfolios of other ethical ETFs traded on the ASX include Halliburton, Schlumberger, Barrick Gold, Valero and Kering. We believe ethical investors may not be comfortable with these companies for reasons such as environmental degradation, fossil fuel exposure, animal cruelty, junk food, bribery, fraud, tax evasion and breaking trade sanctions.

Not all ethical funds are created equally

The Wirecard episode demonstrates the importance of understanding what lies ‘under the hood’ of an ethical ETF. There can be significant differences between fund methodologies, and as a consequence, in the ability of different funds to deliver on their promise of offering ethically screened portfolios that align with the values of ethical investors.

Richard Montgomery is the Marketing Communications Manager at BetaShares, a sponsor of Firstlinks. This article is for general information purposes only and does not address the needs of any individual. Past performance is not indicative of future performance. Investment value can go down as well as up.

For more articles and papers from BetaShares, please click here.

*ETHI is certified by RIAA according to the strict operational and disclosure practices required under the Responsible Investment Certification Program. The Responsible Investment Certification Program does not constitute financial product advice. Neither the Certification Symbol nor RIAA recommends to any person that any financial product is a suitable investment or that returns are guaranteed. Appropriate professional advice should be sought prior to making an investment decision. RIAA does not hold an Australian Financial Services Licence. www.responsibleinvestment.org.