This review is about asset classes, not individual funds or stocks. Getting asset class views right (or wrong) can gain (or cost) portfolios 20-30% or more in any given year. In contrast, managed funds tend to outperform or underperform their asset class benchmarks by only a few percent each year (most underperform in most years). The vast bulk of managed fund returns each year is due to the return from the asset class in which they operate (often called ‘beta’) and not from the skill of the manager in beating its asset class benchmark (‘alpha’). Good asset allocation is usually much more critical for overall portfolio performance than picking funds or stocks.

(The data used here is current as at 11 December 2015. Click on any of the charts to enlarge, as there is an enormous amount of detail in many of them).

Winners and losers

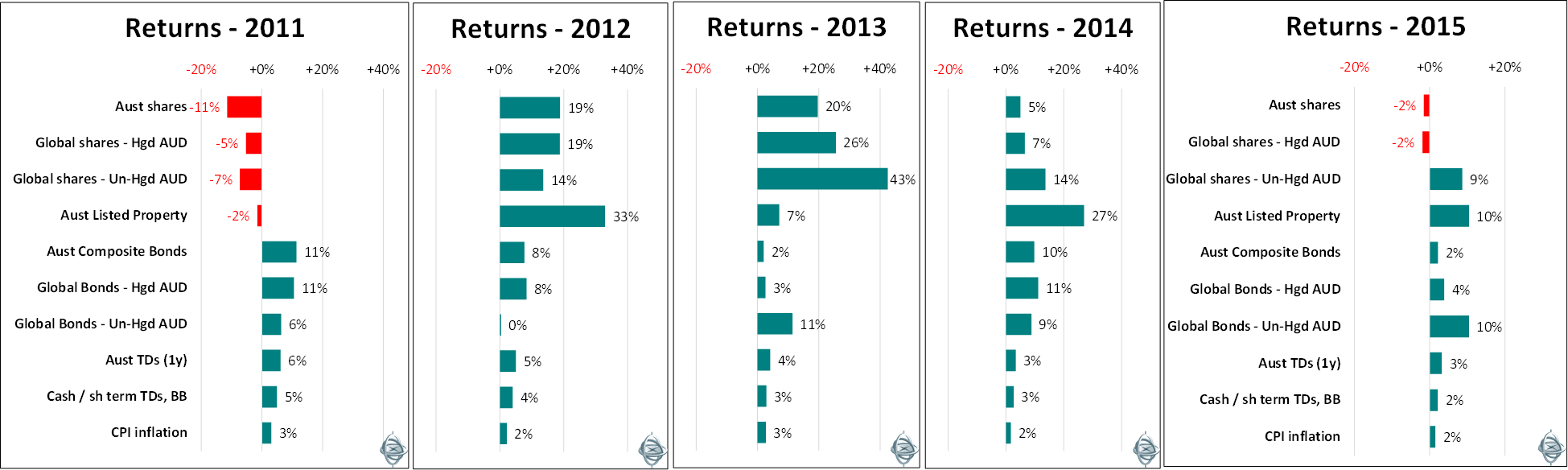

2015 was a year when all asset classes did relatively poorly relative to their long term expected averages.

We went into 2015 favouring Australian shares, Australian listed property and unhedged global shares (favouring developed over emerging markets) in portfolios. We were underweight Australian fixed income (but favouring short duration), global bonds, TDs and cash.

Our favoured asset classes performed well overall - Australian shares were down a little (-2% including dividends) but unhedged global shares (+9%) and property trusts (+10%) did quite well. Conversely the asset classes we were underweight returned less than their expected averages - Australian bonds (+2%), global bonds (hedged) (+4%), TDs (+3%) and cash (+2%).

Asset class returns for the past five years

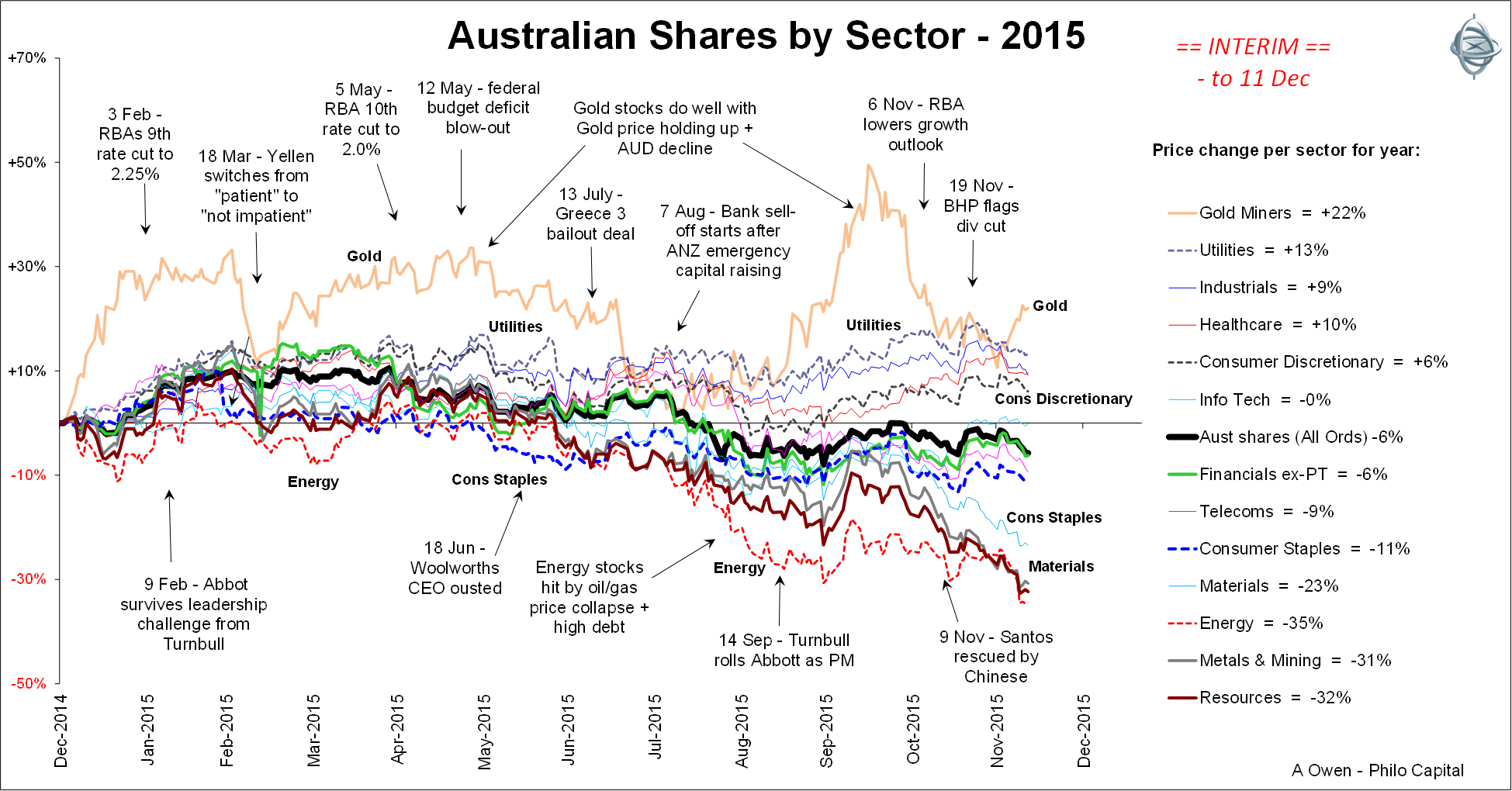

Australian shares

Returns diverged greatly across different sectors of the local market.

2015

- Miners were hit by falling commodities prices plus high debt loads. The only exception was gold mining stocks, with the gold price holding up relatively well due to lingering QE hyper-inflation fears.

- Banks were hit by high capital requirements plus fears of bad debt blow-outs from miners and property lending, and doubts over the sustainability of dividends.

- Revenue and earnings were weak overall but dividends were increased on higher payout ratios.

2016

- Miners are likely to cut dividends, with bank dividends under pressure too. But dividend yields are still attractive, assuming they are not cut significantly in aggregate.

- The overall market is around fair value on long term fundamental valuation measures, but we are relatively bullish in the short term as well.

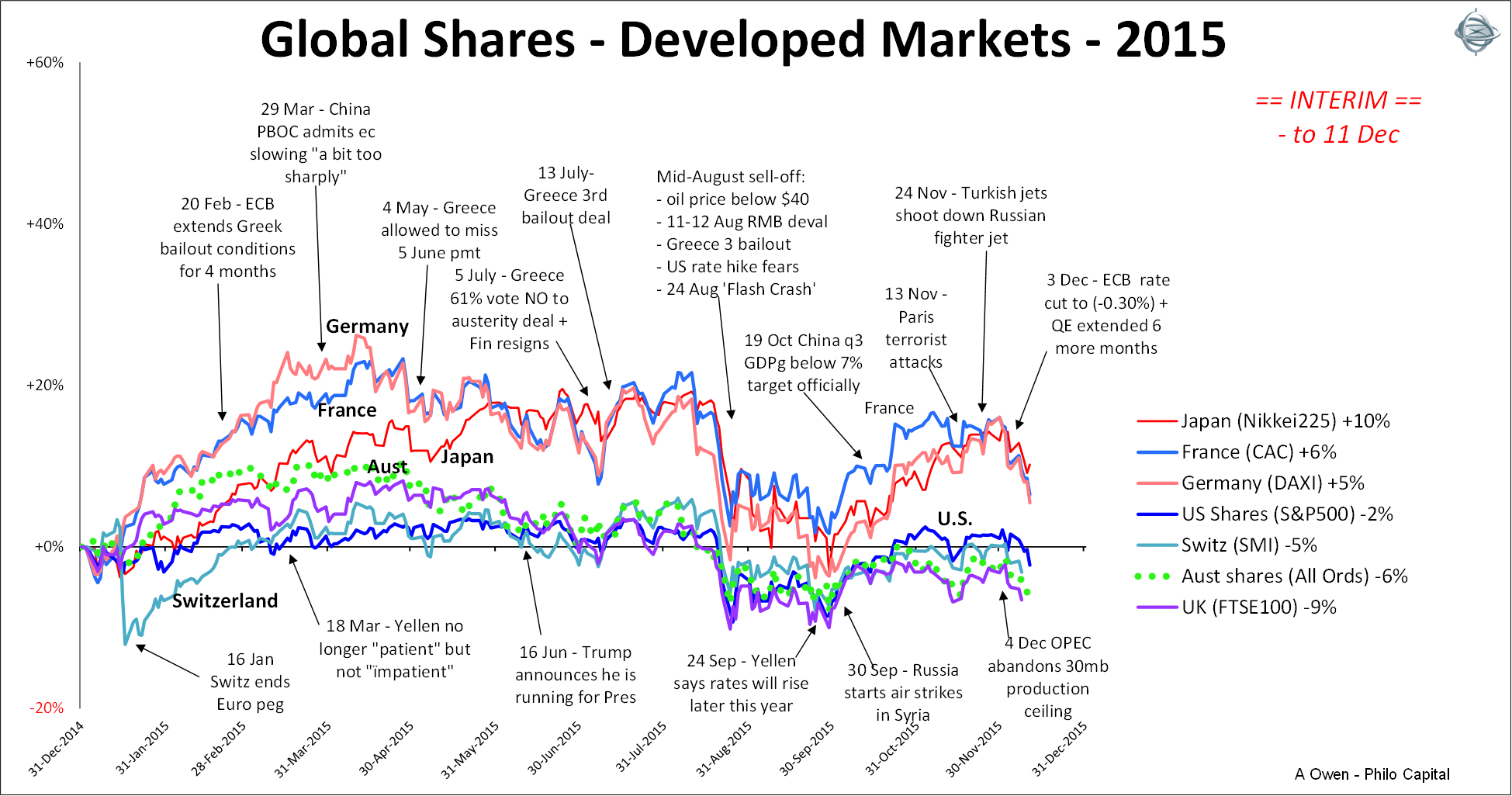

Global Shares – ‘developed’ markets

Many developed country stock markets delivered better performances than Australia in 2015.

2015

- Markets were flat overall, but being unhedged on the currency for Australian investors added 9% to returns for the year.

- US markets were flat. The rising US dollar plus the oil/gas collapse hurt not only oil/gas stocks but related manufacturing as well. Most tech stocks were up strongly except Apple which was flat. US revenues and earnings were weak but dividends and buybacks were strong.

- European and Japanese markets held up reasonably well despite stagnation & deflation in their local markets, but were assisted by weakening Euro and Yen.

2016

- US recovery and sentiment has a good chance of remaining strong enough to withstand slow rate hikes. The Fed has made it clear that rate hikes will be gradual and well-signalled.

- European markets are likely to be benign. Greek failure to stick to its repayment plan will be absorbed.

- The US market (which is half the overall global market) is overvalued on several long term fundamental measures.

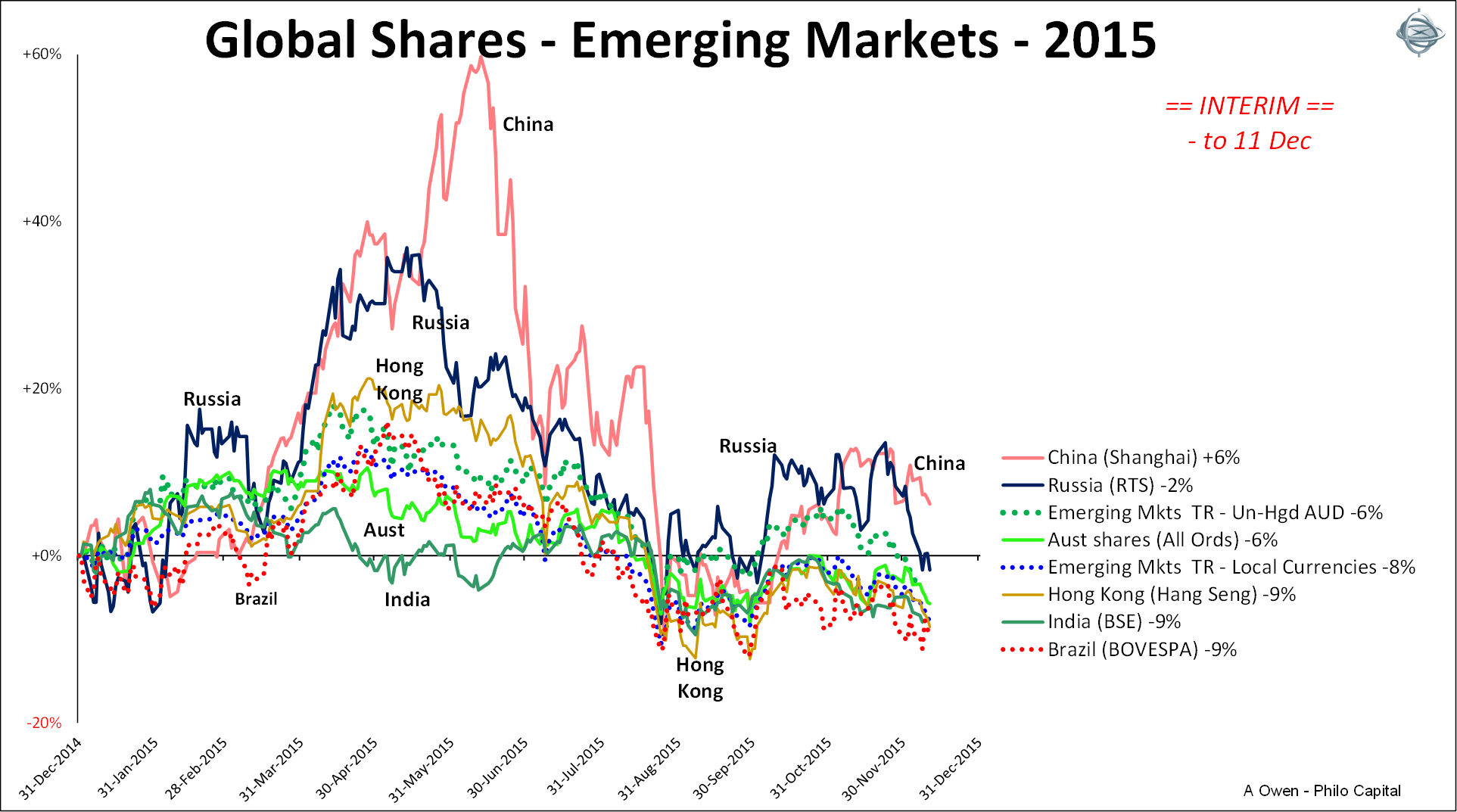

Emerging Markets shares

In contrast to the sombre performance of developed markets, emerging markets went on a wild ride during the year but still finished relatively flat overall.

2015

- Commodities price collapses affected many emerging markets.

- The Chinese stock bubble raged on until mid-June but then burst despite stop-start policy action to prop it up.

- Russia was up and down with oil price gyrations, India was the best BRIC economy but had poor returns and Brazil was in deep recession and plagued by widening corruption crises.

2016

- Corporate defaults likely to increase with rising US dollar and rising US interest rates.

- Emerging markets deficit / debt / currency crisis looming in Latin America, Middle East & South-East Asia.

- US rate hikes and credit market shocks likely to suck hot money out of emerging markets stock and bond markets.

Commodities

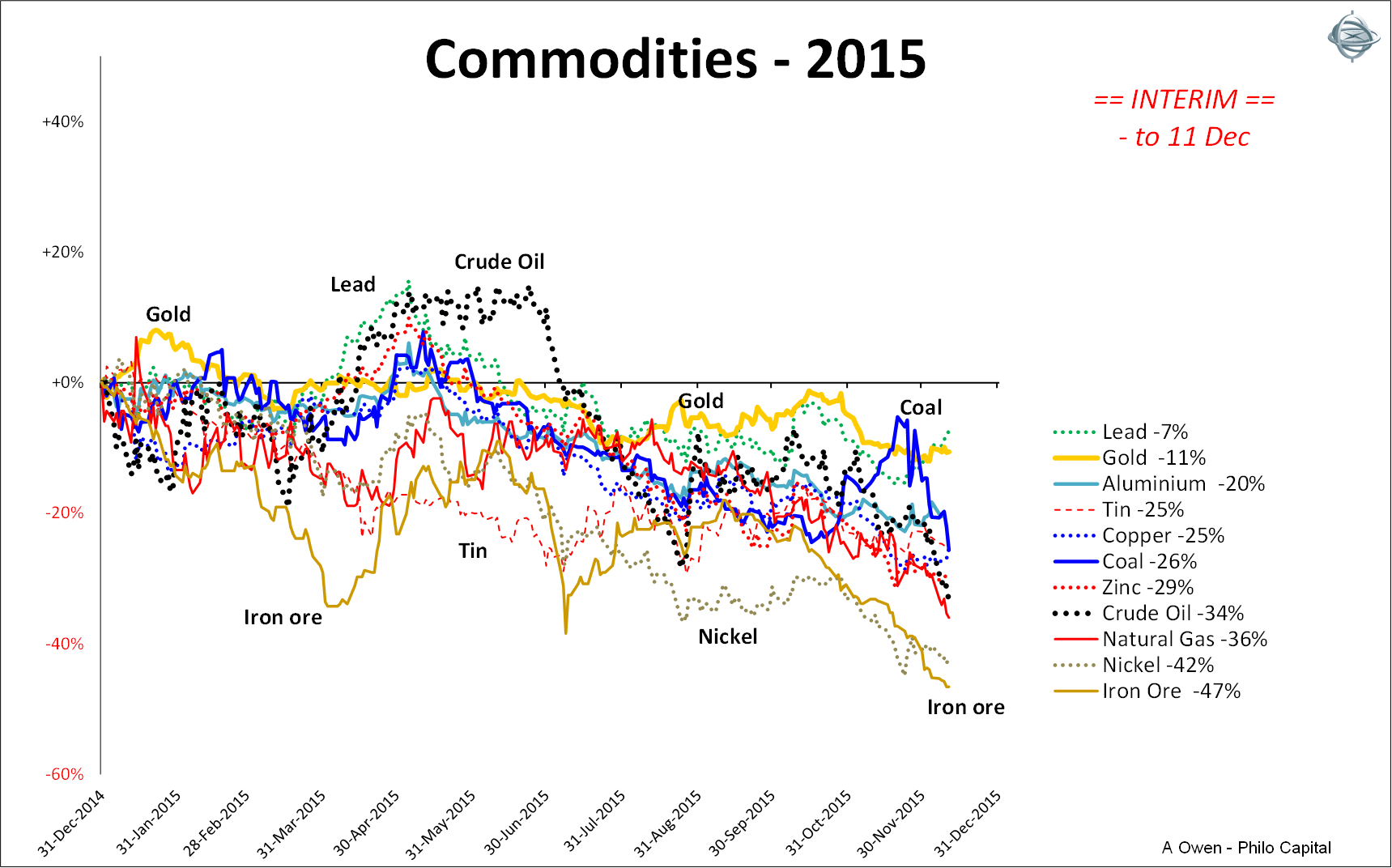

Commodities prices continued their long slide since the cycle peaked in 2011 with major impacts on developed and emerging stock markets.

2015

- All commodities were down heavily again.

- Global demand and growth outlooks were lowered progressively during the year.

- Over-supply worsened, with new production still coming on stream, swamping weak demand.

2016

- Demand remaining weak, with stagnant Japan and Europe, slowing China.

- Prices may stabilise if over-supply curtailed as mine closures accelerate.

- LNG over-supply to hit Australian LNG. Buyers may renege or renegotiate.

- Escalating Middle-East conflicts should support oil prices - good for markets.

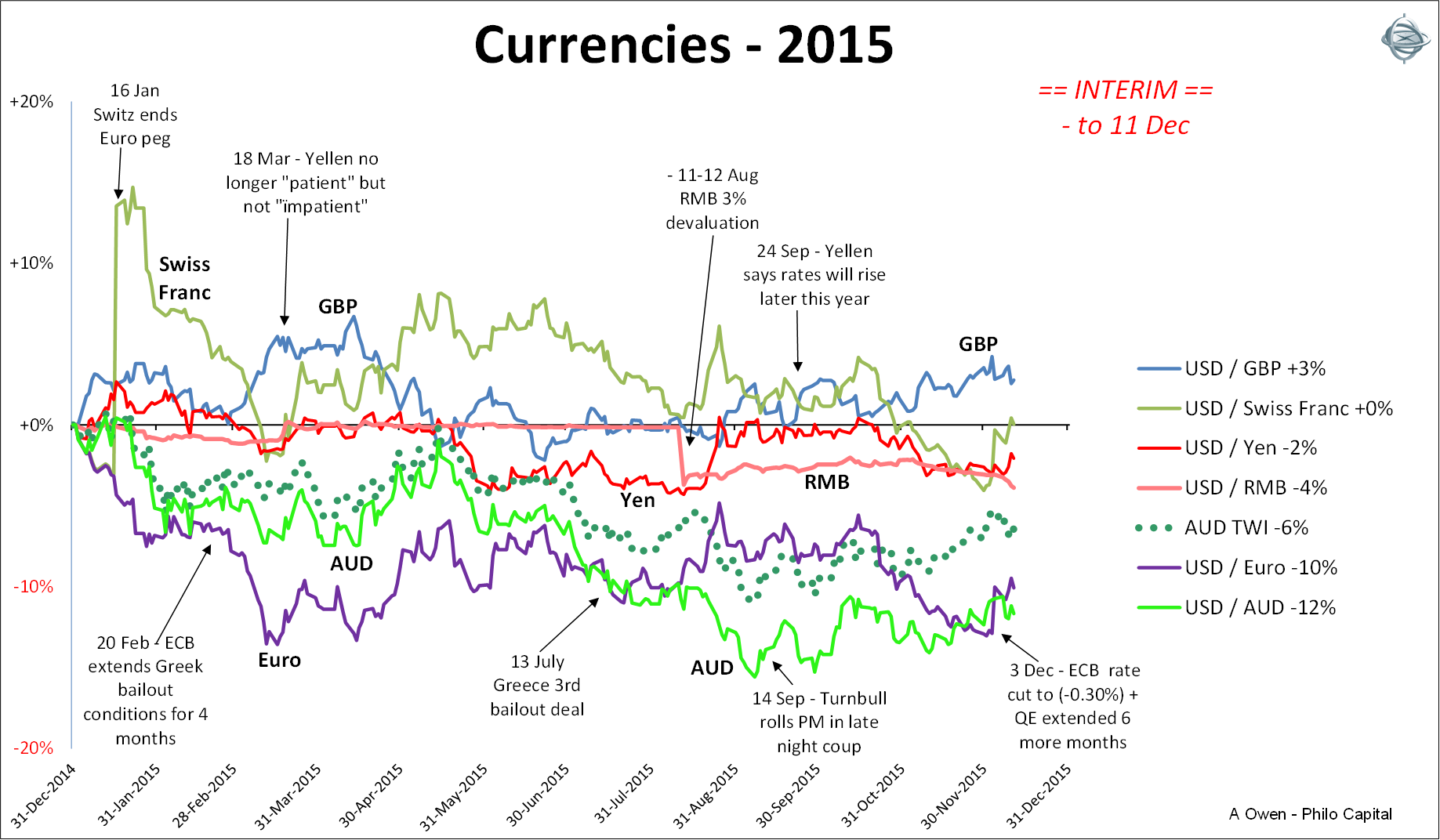

Currencies

Currency hedging decisions are critical and make a big different to portfolio returns.

2015

- The US dollar and UK pound rose on expectations of rate hikes by the Fed and Bank of England.

- The Aussie dollar was weakest despite having the best economic growth.

- Chinese RMB mini-devaluation in August.

2016

- Further RMB devaluation is likely, but expect retaliation from US, especially with US election rhetoric.

- Emerging market currency crises (like 1997) may be triggered by commodity revenue collapse.

- Aussie dollar sell-off likely if budget blow-out continues to worsen, without credible plan to return to surplus.

- The AUD is still over-valued on fundamentals, and likely to be sold off in EM debt / currency crisis, so still more potential gains to be had from being un-hedged.

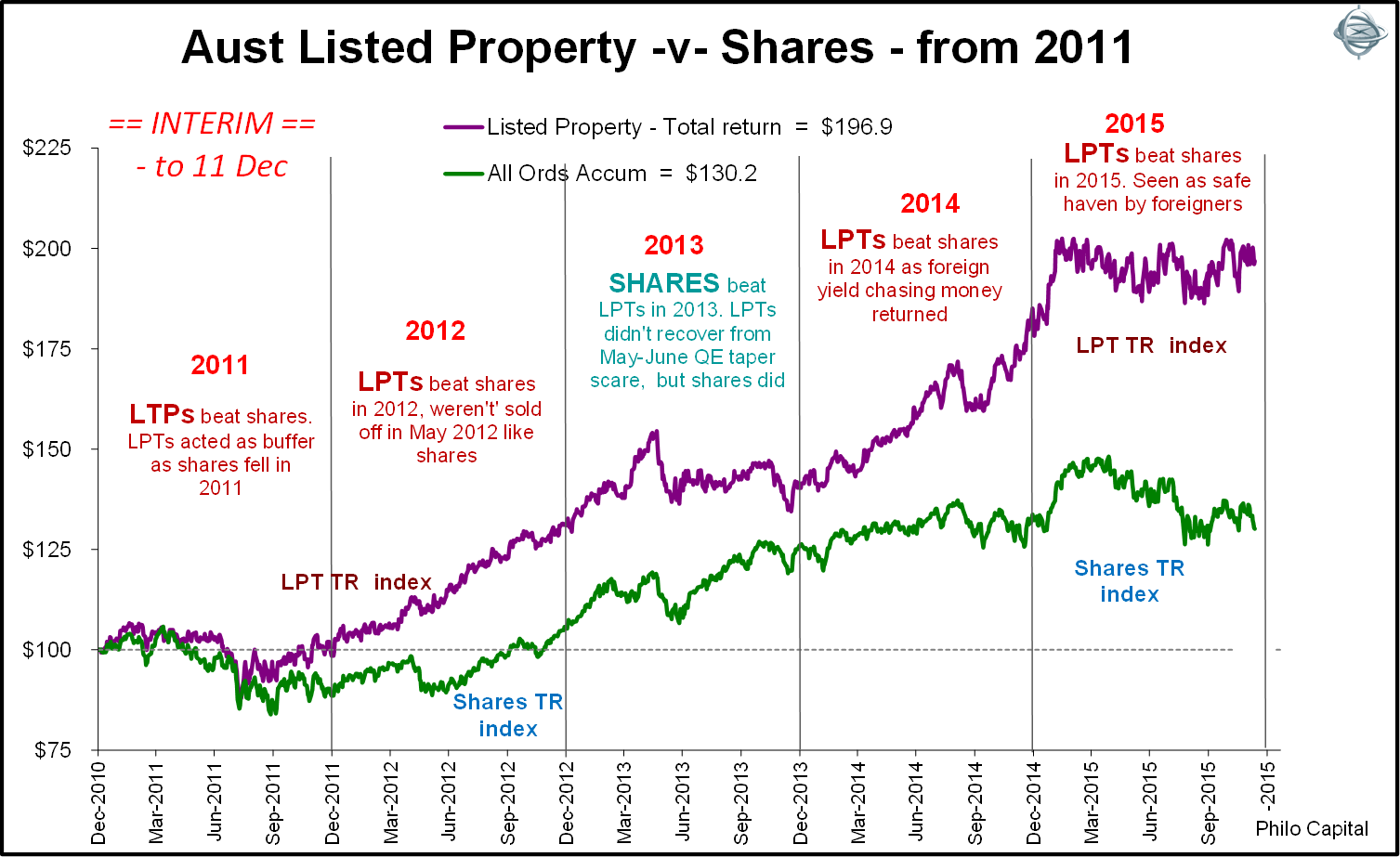

Australian real estate

2015

- Good returns from listed property which beat shares again.

- Listed returns have been better than direct property over the past four years but the gap is now gone, and both are overpriced.

- Returns have come from yield/cap rate compression plus gearing rising at ultra-low interest rates (neither is sustainable) rather than from rent rises.

- Listed trusts returned as ‘safe haven’ after 2013 QE taper sell-off.

- Mergers and acquisitions activity boosted prices.

2016

- Continued strong foreign demand for direct and listed property, M&A activity to continue.

- Likely to suffer along with shares in EM debt scare (like in QE taper scare).

- Although we have favoured listed over unlisted property, unlisted is less prone to flight of hot foreign money in panic sell-offs which may hit markets in the coming year.

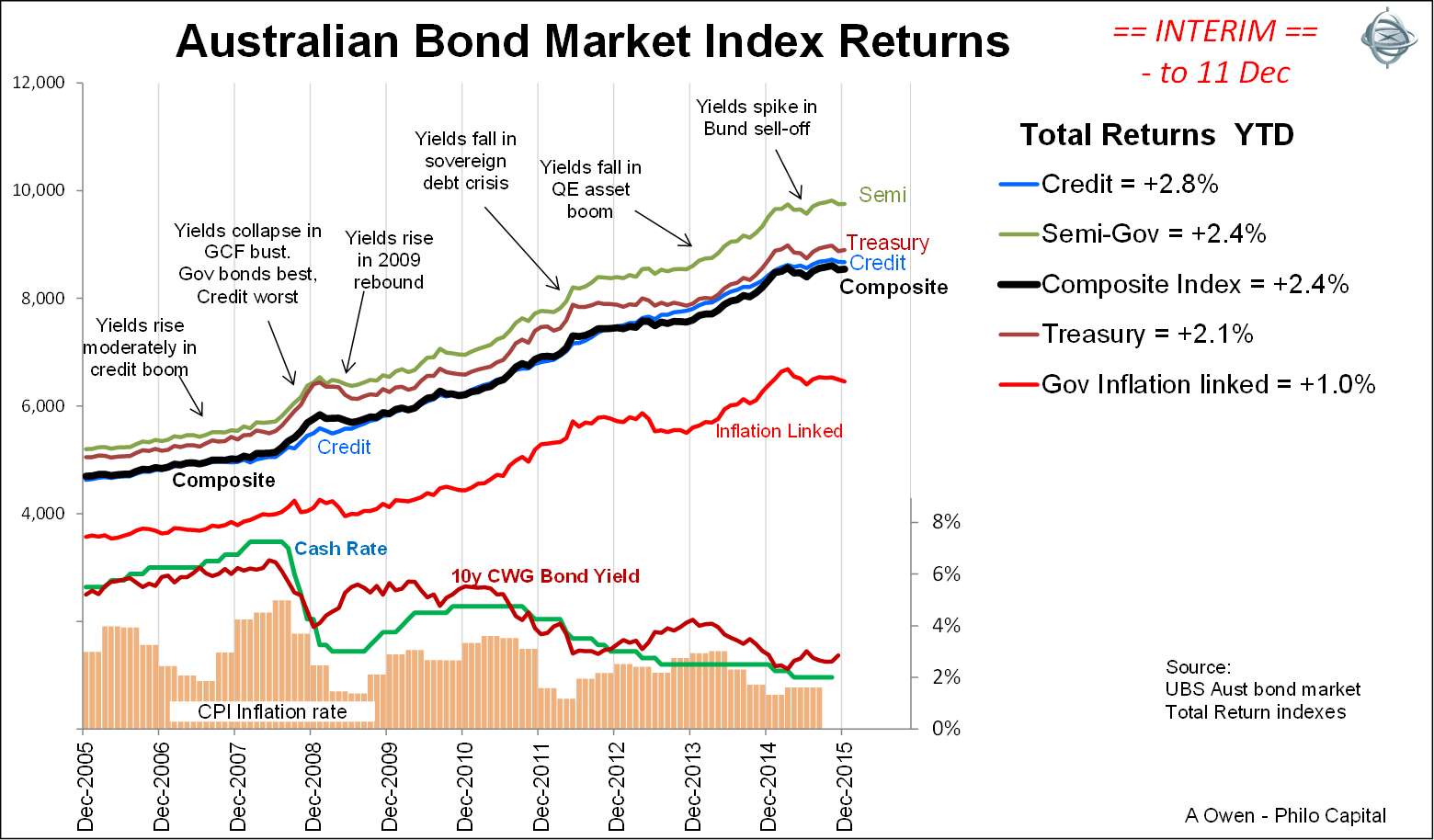

Australian fixed income

The next chart shows returns from the main sectors of the domestic bond market over the past 10 years.

2015

- Below average returns from all sectors this year.

- Yields spiked in the April-May German Bund crisis.

- Short yields finished lower with the declining cash rates but long yields ended flat or a little up.

- Credit did best, but spreads are still vulnerable to sharp sell-offs in credit market scares.

- Strong foreign demand supported prices.

2016

- Long term returns likely to be below average.

- Short term returns likely to be benign, with yields staying relatively low.

- Australian bonds likely to be sold off by foreigners in emerging markets debt scare. There is also an increasing risk of Australia losing its AAA credit rating with the budget blowout continuing. This would scare some foreign investors and cause yields to spike.

- Short duration likely to perform better than long.

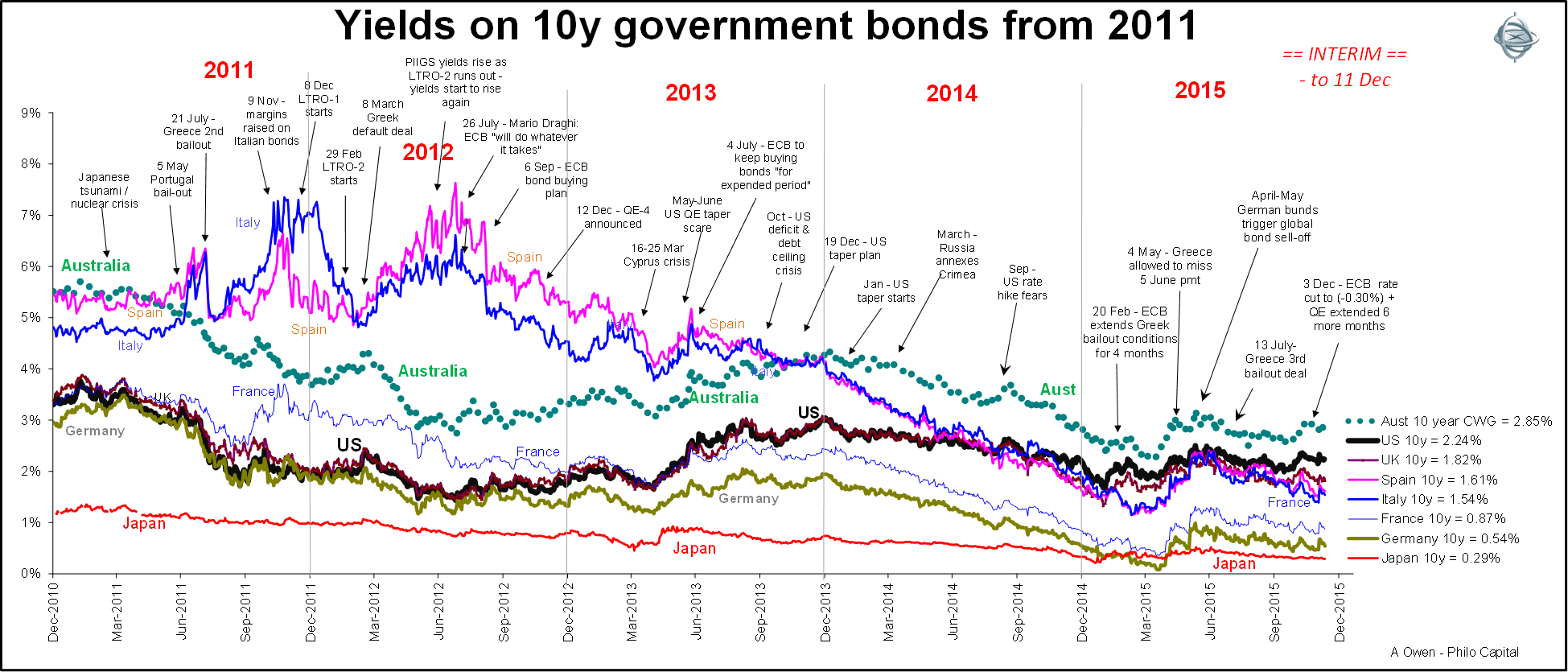

Global bonds

After the yield declines across the board in 2014, bond yields in most markets edged a little higher in 2015, leading to below average returns.

2015

- Negative yields across much of Europe. Almost all of Europe is below US yields.

- Broad global bond sell-off in April-May triggered by snap back in German Bunds which had been pushed down to ultra-ultra-low levels by mid-April.

- Japanese yields remained virtually flat all year supported by QE, with deflation and stagnation persisting.

- US and UK yields rose with their economic recoveries and expectations of very slow rate hikes.

- The global government bond benchmark returned 4% in hedged AUD, but 10% unhedged due to the falling Aussie dollar (but few investors use unhedged global bonds, preferring the ‘safety’ and much lower volatility of hedged bonds).

2016

- We expect benign returns for global government bonds with yields staying low, especially in the big markets of Japan and Europe. No sign of serious inflation for years.

- US rate hike programme should keep US yields relatively low. The quicker the rate hikes, the lower the yields will remain.

Likely shocks

Every year there are usually one or more general sell-offs in global markets, but most are not serious and markets recover quickly.

The most likely source of a general market shock in the coming year would appear to be from the combined effects of collapsing commodities prices, high debt levels (particularly US dollar debt), unsustainably low credit spreads, and rising US dollar and US interest rates. The most likely candidates would be high indebted emerging market corporates and governments, especially those with budget deficits and weak reserves.

Chinese corporate defaults will probably continue to escalate but should be manageable due to China’s huge reserves and government ownership of the banking system.

The problem is likely to be more serious in smaller emerging markets with wide deficits and dwindling reserves. There are likely to be sharp currency collapses as capital is withdrawn rapidly from some markets. Another Russian default (like 1998) is not out of the question. The Australian dollar, shares and bonds are usually sold off quickly in such circumstances.

In the developed markets there will probably be some losses and collapses in credit funds and commodities hedge funds, including perhaps even some commodities or credit ETFs.

Wishing all readers a safe and prosperous 2016.

Ashley Owen is Joint CEO of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund. This article is for general education only and is not personal financial advice. It does not consider the financial circumstances of any individual.