The sixth annual BetaShares/Investment Trends ETF Report provides a unique snapshot of the key statistics and drivers in the Australian Exchange Traded Fund (ETF) industry, from the perspective of individual investors, SMSFs and financial planners. This year’s findings indicate a ‘coming of age’ in the Australian ETF industry.

Key findings of the Report

The insights gleaned from the research are based on responses from approximately 9,000 investors and 676 advisers, and include:

- The number of ETF investors in Australia grew at an annualised rate of 31% in the 12 months to September 2016

- Millennials are increasingly embracing ETFs, and newer ETF users are significantly younger than ‘early adopters’

- 38% of ETF investors invest via an SMSF with usage growing strongly

- Seven out of 10 financial planners currently recommend ETFs or intend to do so in the future

- Advisers exhibit strong appetite for actively managed ETFs.

Size and growth: the emergence of the millennial investor

The number of Australian investors using ETFs has grown to a record number of 265,000, up from 202,000 in the previous year.

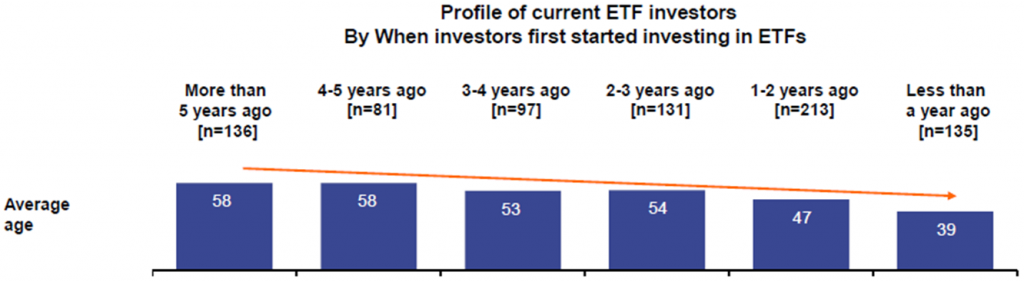

While ETF investors are on average 51 years old, including a third who are already retired, the average age of investors who invested in ETFs for the first time in the past year is 39 years, significantly lower than those who first started using ETFs five years ago at an average age of 58. This is a striking statistic and shows how mainstream the ETF industry in Australia is becoming, as well as how important the younger or millennial investor will be to the industry in the future.

ETF industry

Source: BetaShares/Investment Trends ETF Report

To further emphasise this, among the online share investor population, the appetite for ETFs is greater among the younger cohort. About 37% of millennials say they use or intend to use ETFs in the coming year, versus 31% for Gen X investors and 28% for baby boomers.

Strong demand from retail and SMSF investors

Repeat investment into ETFs is high, with 70% of investors indicating they would consider re-investing in ETFs in the next 12 months.

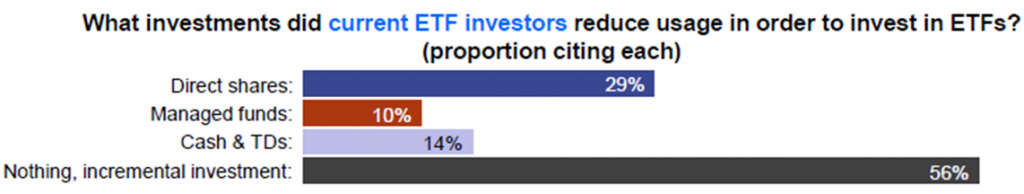

The majority of investments into ETFs represents new money into the industry, with 56% of ETF investors buying the products with incremental investment monies, rather than decreasing their allocation to direct shares or managed funds.

Source: BetaShares/Investment Trends ETF Report

The number of SMSFs holding ETFs has grown in line with the increase in the number of ETF users, with 38% of ETF investors holding ETFs through their SMSFs. This investor class continues to drive industry growth.

SMSFs who use ETFs typically cite a wider range of reasons for using them, especially access to overseas markets and for specific investment types.

Diversification remains the primary driving factor, with 72% of investors citing this as a reason for using ETFs.

Financial planners can tap into client demand for ETFs

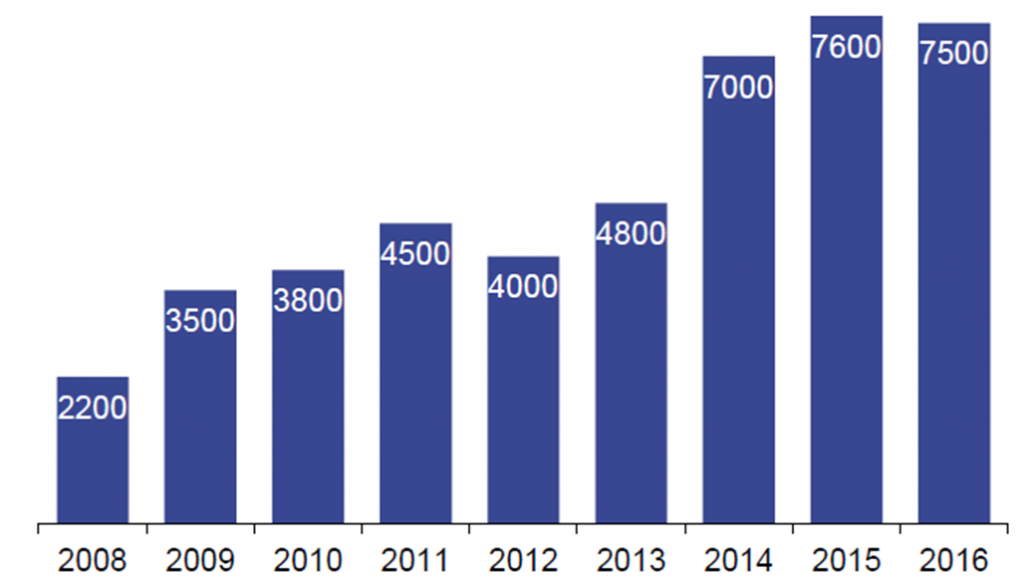

Use of ETFs is widespread among financial planners, with 7,500 or 43% of Australia’s financial planners currently recommending ETFs. This number looks set to grow with seven out of 10 either already recommending ETFs or intending to do so in the future.

Number of financial planners using ETFs in Australia

Source: BetaShares/Investment Trends ETF Report

Financial planners who recommend ETFs are using them more extensively for new inflows, and plan to further increase their use. In terms of motivations for using ETFs, financial planners predominantly cite low cost, with diversification the second most commonly cited driver.

There remains significant opportunity for advisers to tap into consumer demand for ETFs, with only 21% of current ETF investors saying an adviser played a role in their most recent ETF investment.

Advisers also have a strong interest in actively managed ETFs, with 52% indicating they would like to use these products in the next 12 months if available to them.

Outlook for the sector

The Report projects a record 315,000 Australians will be invested in ETFs by September 2017.

The ETF sector in Australia is following in the footsteps of more mature ETF markets around the world. Recent research conducted by Blackrock indicates that 52% of individual investors and 94% of financial advisers in the US expect to invest in ETFs in the next 12 months (research from February 2017). While easy to gloss over, consider the significance of those figures - most individual investors and virtually every financial planner in the US expect to start or are already allocating to ETFs in the coming year. Contrast this to Australia where we estimate that approximately 4% of individual investors are currently using ETFs. That’s a lot of potential growth!

Investors will continue to tap into ETFs for a broader range of investment needs. In line with the growth we are seeing, we project the industry will grow from the current $25 billion and reach $30-33 billion in funds under management, with approximately 250 exchange-traded products, by the end of 2017.

Ilan Israelstam is Head of Strategy & Marketing at BetaShares, a sponsor of Cuffelinks. A summary copy of the Report is available on request from betashares.com.au. This article is general information and does not address the needs of any individual.

Latest editions of BetaShares’ monthly ETF Review can be accessed here.