All developed countries are struggling to adequately support their aging populations. Increasing fiscal pressure on budgets due to ballooning health and pension costs means this is an increasing issue around the world.

The EY 2014 report, Building a better retirement world: insights for better outcomes in the global pension and retirement market, highlights how new challenges and opportunities exist for all participants in the global pension market. Their responses to these issues will have significant long term impacts for all governments, citizens and financial services providers.

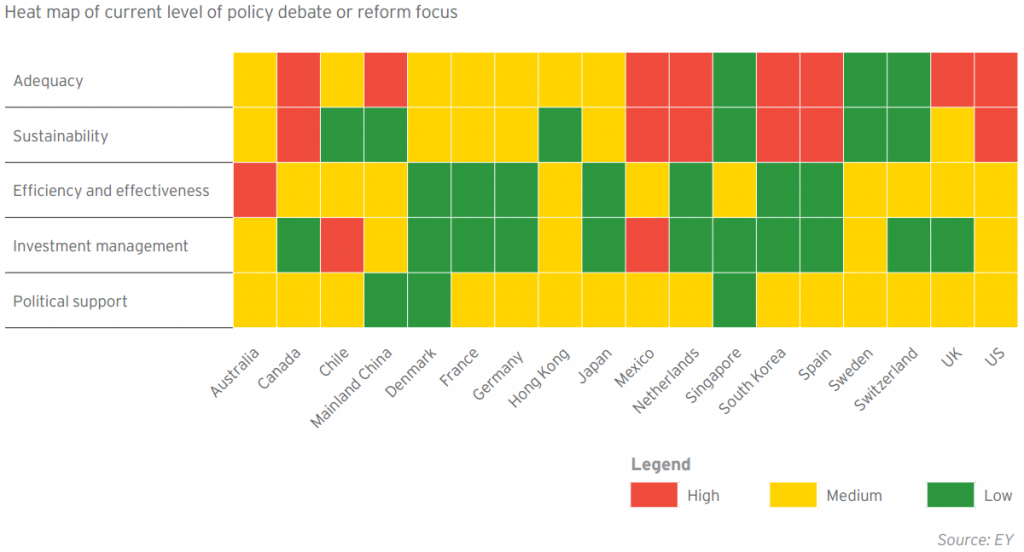

The report draws on more than 80 interviews in 18 countries across the Americas, Asia Pacific and Europe to develop a ‘heat map’ to assist policymakers and industry leaders to make informed decisions on policy reform, especially for pensions and retirement incomes.

The GFC acted as a catalyst for stakeholders to focus on the long-evolving financial challenges in retirement. While political and vested interests may impede necessary fundamental reform in many countries, there is general acceptance by industry experts, policymakers and governments that change is needed to rebalance pension retirement systems. Making long-term decisions in an uncertain environment with many moving parts requires significant experience, leadership, discipline and a vision of the big picture. Top policymakers, regulators and industry leaders want to learn about other countries’ insights and experience.

The heat map shows the importance of the five key components of a robust pension and retirement system in the 18 countries analysed.

- Financial adequacy. How much will different beneficiaries need for their financial well-being in retirement? How much will governments and public and private sector employers need to provide in retirement benefits to attract and retain employees?

- Financial sustainability. How much can governments, private sector plan sponsors, public sector entities and future beneficiaries afford to save over the long term to pay for pension and retirement benefits?

- Performance. How can we maximise outcomes and predictability of investments of pension and retirement assets?

- Efficiency and effectiveness. How can we deliver promises efficiently and effectively to all stakeholders while meeting their service expectations?

- Political aspects. What is our long-term pension and retirement vision? What short-term trade-offs must be made to secure political backing?

These five tenets are applicable to most countries but their relevance varies globally and over time.

The increasing importance of pension and retirement systems to ensure dignified long term retirement requires an improvement in the quality of regulation, supervision, governance and transparency to align to higher consumer expectations.

While Australia’s superannuation system is well positioned relative to many other countries, the local industry still faces challenges. Given the importance of superannuation to Australians, and the compulsory nature of the system, further regulatory change and focus is inevitable. This is evident in the release of the Financial System Inquiry’s interim report. The industry should be taking this opportunity to work with government and regulators to develop a strong framework that will ensure the future health of the system.

More work is still required to boost consumer confidence in the system. There is a need to see an improved focus on members to ensure their needs are being met both before and after retirement.

The report also identified seven key areas that present opportunities for superannuation and retirement providers across the globe:

- Rebalancing benefit expectations with financial resources. Increasing longevity, evolving demographics and pension and retirement system promises are creating a financial gap for consumers and opportunities and challenges for providers. Concerns about funding long-term liabilities are a major public policy issue that will only increase in the years to come.

- Local financial markets need to evolve concurrently with growth in pension assets. In many emerging markets, assets are increasing at a far greater rate than local capital markets are developing. To maximise and balance outcomes, different levers in the local market need to evolve and better align to limit further stress on the system.

- Acceptance of a new level of regulation, supervision, governance and transparency. In many countries, the pension and retirement industry is as large as the banking sector or the annual GDP. This growing market and inherent risk to social and economic stability will inevitably result in a higher level of political and public attention.

- An increasing focus on operational excellence. Lacklustre capital market returns have forced the pension industry to step up efforts to lower costs, improve customer delivery and service and enhance risk management. These initiatives come at a substantial cost and will require significant change in behaviour, infrastructure and delivery systems.

- A recalibration of investment functions and investment management. The GFC provided a wake-up call for systems and providers to re-evaluate their investment strategy, asset allocation policy and operating models. Focusing on short-term results has been a challenge at a time when there is a shift from often underfunded defined benefits to defined contributions or unfunded pay-as-you-go promises.

- Find simplicity in complex systems. Low voluntary savings rates, low participation of young savers and low take-up switching or voluntary superannuation and retirement solutions are indicative of a lack of engagement by ultimate plan beneficiaries. Improving buy-in, understanding and informed decision making among members is vital.

- Need to connect and become customer-centric. Through better customer engagement, governments and providers can influence persistency, reputation, understanding and action. Providers are seeing the value of pension and retirement systems as more than a balance of payments, assets, price and product features; instead they are focusing on delivering customers what they want and improving the experience.

Policy reform is never easy but all participants in the survey affirmed their acceptance of the need for change. They are interested in building a better working world in relation to the critical topic of pensions and adequate retirement savings.

Graeme McKenzie is the Global Pension Leader for EY.

The views expressed in this article are the views of the author, not EY. The article provides general information, does not constitute advice and should not be relied on as such. Professional advice should be sought prior to any action being taken in reliance on any of the information. Liability limited by a scheme approved under Professional Standards Legislation.