We could have opened with a quote from a famous value investor like Benjamin Graham, Warren Buffet, or Charlie Munger. But let’s take a more modern approach: Let’s use Chat GPT.

According to this AI tool, “Value investing is an investment strategy based on the fundamental analysis of stocks or other assets to determine their intrinsic value. The core principle of value investing is to identify and purchase assets trading below their intrinsic value, in the expectation the market will recognise and correct this undervaluation, leading to price appreciation.”

It is an approach we believe in at Morningstar. Figure out what something is worth, then invest with a margin of safety. Keep this front of mind.

Two things we hear from clients:

- Bank share prices are below where they were 10 years ago, why would I buy bank shares?

- People have said Commonwealth Bank is expensive for years, but it just keeps going up!

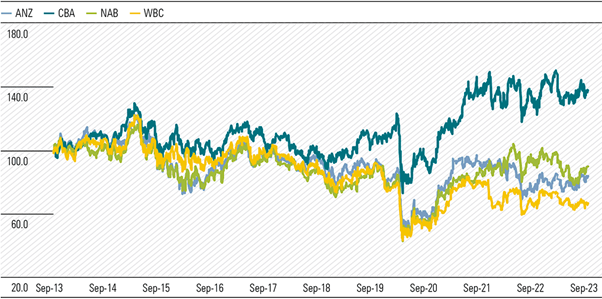

Exhibit 1: Only CBA share price is up in last 10 years

Source: Pitchbook data

Shares have gone nowhere, why invest?

Westpac and ANZ shares are down 33% and 17% respectively, in the last 10 years. With dividends, the returns are more respectable but still not great. Since August 2013, Westpac has paid fully franked dividends totaling $15.49 per share, ANZ not far behind at $15.19. This lifts 10-year total shareholder CAGR to 1.4% for Westpac and 3.6% for ANZ. National Australia Bank has done a little better with total shareholder CAGR of 4.3%. The S&P/ASX 200 total return index has returned around 8% per year for the period.

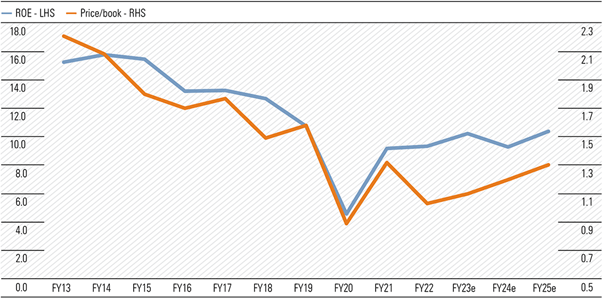

We forecast Westpac’s ROE to be 9.5% in FY24, down from 15% ten years ago. The financial services royal commission, anti-money-laundering breaches, asset divestments, and lower interest rates have driven the earnings decline. Net interest margins, or NIM, has weakened, asset divestments have halved non-interest income, and operating expenses have risen on risk, compliance and technology spend. Meanwhile, Westpac now holds an additional $24 billion in shareholder equity, a more than 50% increase. Not a pretty story and explains the share price weakness.

But we think the next five years will look different. Margins are recovering from FY22 lows and smaller banks and nonbank lenders are struggling to compete as funding costs rise. Cost savings look achievable given the bloated cost base while recent changes make it unlikely APRA will again lift capital requirements.

Market expectations are now low, which we think is an opportunity. At the current share price, the FY24 PE of 11x and price/book of 1.0x seem to imply no operational and profit improvement. By contrast, Westpac traded on a P/E of 13x and price/book value of 2.2x in 2012 and an average price/book of 1.6x for the 10 years to 2022.

Exhibit 2: Higher multiple expected on improved profitability

Source: Company Reports, Morningstar

Our fair value estimate of $28 for Westpac, which is 30% above the current share price, implies a FY25 PE of 12.7x and price to book value of 1.3x. National Australia Bank, for comparison, trades on a price to book of 1.5x, showing that if Westpac can improve profitability as we expect, a modest multiple rerate is likely and can deliver attractive shareholder returns. We only expect Westpac’s ROE to improve to 10.5% in FY25, still much lower from 15% in FY13.

Price matters and Commonwealth Bank looks expensive

Past performance does not equal future performance. Yes, Commonwealth Bank shares have outperformed peers, and materially since 2019, but there is no guarantee history will repeat. Commonwealth Bank has delivered an annual total shareholder return of 8.8% over the last 10 years. ROE is down from over 18%, but still at a respectable 14%. But current share price implies a FY24 price to book of 2.3x, above the 10-year average of 2.2x.

Commonwealth Bank shares trade on a forward PE of 17.5x and Westpac 11x. It seems valuation is being ignored by many investors. Index aware investors likely gravitate to the largest lender for bank exposure. It’s an easy argument to make—digital leader, most efficient, cheapest funding sources, strongest loan growth from direct channels (branches and mobile lenders), a sound balance sheet, conservative provision levels, and market share gains in home loans.

The 4.5% dividend yield for Commonwealth Bank is not overly attractive either, you can get 4.8% in a Commonwealth Bank term deposit. Granted, it is not like-for-like comparison, given the dividend yield grossed up is 6.9%, and income of term deposits has no franking credits. But the equity risk premium in Commonwealth Bank shares looks slim.

Total return is ultimately what investors should focus on. Our fair value estimate of $90 per share for Commonwealth Bank implies a FY24 dividend yield of 5.1% and price/book ratio of 2.1x. The capital loss if the share price falls back to our fair value estimate, would essentially offset two and a half years of dividends.

What’s in the price?

A simple answer is what’s the implied cost of equity based on the current stock price. We use a 9% cost of equity in our valuation for all the major banks, given their similar exposures, business models and the common regulatory environment. If we lower the discount rate on Commonwealth Bank to 8%, our fair value estimate increases around 15% to the current share price. All else equal, lifting the discount rate to 10.5% gets our Westpac fair value close to the current Westpac share price. We don’t think such a large difference is warranted though.

Alternatively, to justify the current stock price, we need to assume Westpac loses more market share, its cost base blows out further, and profitability remains sub-par with a return on equity of just 8% in five years. For Commonwealth Bank, we’d need to assume significantly stronger loan growth, further substantial cost efficiencies and the return on equity grows back up to 17% from 14% now. This seems unrealistic longer-term given the competitive landscape and similarities in the big four banks’ business models.

What about regulation?

Politicians and media talking heads love to pop up when Commonwealth Bank hands down earnings. They like to express outrage at such large profits from a single company. This populist view is shared by many. I for one prefer profitable and well-funded banks with low risk of failure, unlike Silicon Valley Bank, First Republic Bank, and Credit Suisse which all recently imploded.

However, government may see record profits as a green light for levies and taxes. This seems unfair given profitability has fallen materially over the past decade. Commonwealth Bank’s return on equity of 14% compares to 18.5% ten years ago, and it is expected to fall more in the short-term on weaker margins and bad debts. We forecast the other major banks to make returns on equity of 10.5-11.5% in FY23, solid but not spectacular. When the bank levy was introduced in 2017, the average major bank return on equity was at least 13.5%.

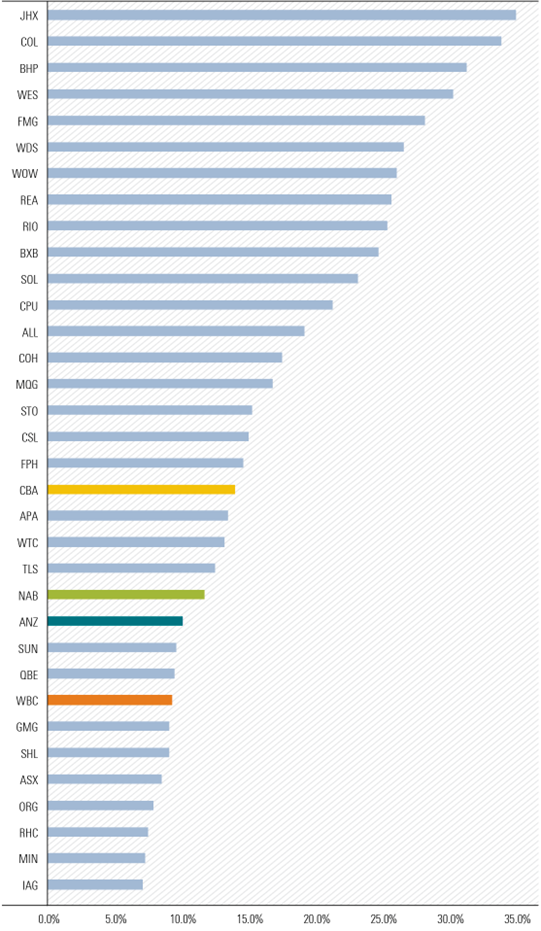

Australia’s biggest retailers, Wesfarmers, Woolworths and Coles delivered ROE’s of 30%, 26%, and 34% respectively, in FY23. There are a host of other big corporates across many sectors making very large profits and attractive returns—generally a good thing and a sign those businesses are performing well. Against that backdrop, we think any additional bank specific regulations and tax are hard to justify. That is the base case assumption for our bank sector fair value estimates.

Exhibit 3: Banks slipping down the ranks of the highest ROE firms

Source: Morningstar

Nathan Zaia is a Morningstar equity analyst, covering the banking and insurance sectors. This article is general information and does not consider the circumstances of any investor. Please consult a financial adviser before making investment decisions. This article was originally published by Morningstar.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free trial below:

Try Morningstar Investor for free