A question from Kevin:

Given the Government’s emphasis on promoting self-funded retirees and the likelihood of the pension getting harder to obtain in the future, it would seem prudent to plan on having our minimum (survival) needs covered by income that will not fluctuate with market waves, but will also adjust with inflation to provide continued long-term buying power.

I’m aware that Lifetime Annuities is one such vehicle, but actuaries are amongst the best mathematicians I know, so presumably the average person to take out a Lifetime Annuity will pay a premium for these products (only a very few will live longer than expected by the insurer) however what we get in return is peace of mind. However are there other ways to get the same peace of mind?

One alternate is Treasury Indexed Bonds, these are fairly easily traded now via the Australian Stock Exchange, presumably carry even less risk than Lifetime Annuities and have the added bonus of preserving your initial capital.

Would it be possible to do a comparison of the benefits/drawbacks of Lifetime Annuities vs Treasury Indexed Bonds from the perspective of providing a guaranteed income indexed for inflation over a 20-30 year period?

We asked Jeremy Cooper from Challenger to respond on lifetime annuities, and Elizabeth Moran from FIIG Securities to explain indexed bonds.

Response from Jeremy Cooper, Chairman, Retirement Income, Challenger

Kevin, in the space available, we are going to assume that a retiree needs a certain level of income, and is not solely focussed on expected investment returns. This secondary purpose can be served by the other (growth) assets in the portfolio.

As you note, a retiree should have minimum income needs covered by a cash flow (adjusted for inflation) that does not fluctuate with market gyrations. The age pension provides such a cash flow for life, but it’s not enough. Most Australians have a minimum income need higher than the age pension, but will not have enough wealth to secure every dollar of income they will want in retirement in this way.

What are the advantages of using a lifetime annuity compared to Treasury Indexed Bonds (TIBs) to fill this gap?

A retiree’s need for regular income lasts for their lifetime and won’t abate when a TIB matures, requiring reinvestment. A lifetime annuity provides a layer of income, which can be paid monthly, quarterly or yearly, for life. While TIBs provide coupon payments quarterly, these cash flows are only for the term of the bond, with capital paid back at maturity. A lifetime annuity, in conjunction with the age pension, can provide the minimum income required for the life of a retiree.

It should be no surprise that to receive an equivalent level of income from a TIB which returns capital at term, you need a much greater amount of capital to begin with. While you might leave a greater bequest with this strategy, it is an inefficient use of capital and moreover, will reduce your age pension entitlements.

Consider a retired couple who would like $40,000 a year to spend. The current full age pension for a couple is $32,417 a year, so there is a relatively small gap to cover (ie $7,583 a year).

As at 23 April 2014, the September 2030 Treasury Indexed Bond was yielding a real 1.82%. At this rate, generating $7,583 a year would require over $400,000, meaning a full Age Pension would not be available. Generating $40,000 a year would require $2,197,802, a figure well beyond the means of the vast majority of households and one which completely excludes you from any age pension entitlement.

A lifetime annuity can deliver income to fill the gap at a lower cost than TIBs. Using the latest payment rates (as at 23 April 2014 and posted on the Challenger website) a 65-year-old male would need $174,724 to generate the required $7,583 (indexed to CPI) through a Challenger lifetime annuity; a 65-year-old female, $181,368. Splitting the cost of the annuity between the genders, the income could be generated with $178,046, which is less than the means test so the couple would receive a full age pension.

Because the lifetime annuity is cheaper than the TIB strategy, you will have more money to invest and leave your children, if leaving a bequest is an important goal. Research by National Seniors Australia among retirees indicates that a bequest is not a key issue for many people, due to awareness about greater longevity and the rising cost of living. Hence for many, an annuity’s ability to blend a capital return with an income payment makes it an attractive, controlled way to consume your capital – which, after all, is what we’re meant to do with our concessionally-taxed superannuation.

As Kevin notes, government bonds are the lowest risk (and lowest return) investment available. The risks with annuities are also very low. The life company providing the annuity is subject to prudential supervision by APRA under one of the toughest regulatory capital regimes in the world which requires shareholder capital to back the promises made to you.

Until 2011, a key disadvantage of the annuity would have been the ‘hit by a bus’ scenario. That is, premature death would have seen your premium go into the life company’s insured pool for the benefit of those living longer. However, recent product innovation has introduced 15 year guarantee periods in which you, or your estate, can access your capital.

In conclusion, when evaluating guaranteed retirement income options, you need to consider not only the comparable fixed returns but also your opening capital amount, your willingness to consume all or some of that capital, your desire to leave a bequest and interaction with the Centrelink asset and income tests. For many people who don’t have enough capital to live on returns alone, a modern lifetime annuity can be an attractive option.

Response from Elizabeth Moran, Director of Education & Fixed Income Research, FIIG Securities

Kevin’s question is an intelligent one. Few investors recognise the need to protect enough capital to ensure a minimum standard of living for a longer period of 20 to 30 years, yet longevity is increasing.

Lifetime annuities do provide long term protection, but generally provide low returns and payments cease on passing of the investor. If an investor lives for a very long time, well past statisticians’ estimates, lifetime annuities are an excellent investment. If however, an investor does not reach the mean lifespan estimate, the issuer of the annuity benefits to the detriment of the investors’ estate.

Inflation linked or indexed bonds are an excellent alternative. There are two main types of inflation linked bonds. The first is called a capital indexed bond where the capital you invest is linked to inflation and each quarter (assuming inflation is positive), the capital value of this bond increases, protecting the value or purchasing power of your capital. Income is fixed but paid on the growing capital value of your investment, thus also increasing with inflation over time. These bonds are issued by the Commonwealth and state governments and also by banks and corporations. Commonwealth government inflation indexed bonds are the lowest risk, thus have the lowest returns.

Below is a table comparing Commonwealth, state government and territory bonds to a corporate indexed bond. I have assumed an investment of $100,000 face value, for ease of comparison but these bonds are available in smaller parcels.

CE Snip1 020514

Reading across the columns, and using the Commonwealth bond as an example, this particular bond matures in September 2030, when investors can expect a lump sum that has risen with inflation. The interest rate at first issue was 2.50%. The current estimated yield to maturity, which includes the premium paid for the bond over and above its value, and income assuming inflation remains at the Reserve Bank’s target mid-point of 2.50%, is 4.18%. The interest rate based on the current price of the bond (running yield) is slightly lower than when first issued as investors are willing to pay $122.45 for a current value of $110.22, so income has fallen slightly to 2.25%. Demand for these bonds is high and investors are prepared to pay a premium of $12,237 over its current worth of $110,220. The next interest payment is $689.

The ACT and Queensland Treasury Corporation (QTC) bonds over similar time spans pay higher projected yield to maturity of 4.83% and 4.86% respectively, roughly 0.65% higher than the Commonwealth bonds (yield to maturity is the main comparator).

Income of $971 is higher on the ACT bonds, due to a higher initial interest rate at first issue over $859 for QTC; investors must pay a higher premium for the ACT bonds, which then smooths the overall yield to maturity.

The NSW bond is longer dated with a November 2035 maturity date. The longer term to maturity is generally less attractive to investors and the likely reason this bond trades at the lowest premium of the state government bonds shown. Yet yield to maturity is lower than ACT and QTC, probably due to NSW being perceived as a slightly lower risk.

The Sydney Airport 2030 bond, again with a similar maturity date pays a higher return and is trading at a substantial discount of $19,970 or a current price of $102.73 for a current value of $122.64. Yield to maturity is 7.00%, over 2% higher than the other bonds and significantly higher return than the average lifetime annuity.

While these indexed linked bonds are attractive, they are best used in accumulation phase. For those investors in retirement looking for income to pay the bills, the other type of inflation linked bond, an index annuity bond, may be more effective. These bonds are better to compare to lifetime annuities given principal and interest repayments. The difference being investors know the maturity date of the bond and should they pass, the bond remains part of their estate and payments continue until maturity.

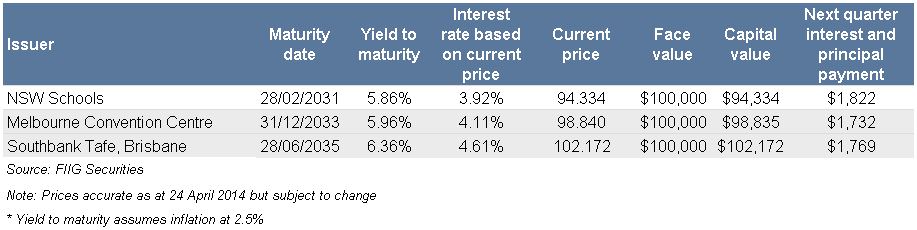

An index annuity bond works like a reverse mortgage. Investors pay a lump sum up front which is then returned over the life of the bond in quarterly interest and principal repayments. The repayments are linked to inflation, which is particularly valuable to retirees wanting steady income with the added inflation protection. The value of your investment is paid down over the life of the bond, so there is no lump sum at maturity. These bonds are more like a lifetime annuity and provide higher quarterly payments compared to the capital indexed bonds. The majority of issuers are highly rated (see some examples in the table below).

Importantly, the two inflation linked bonds only continue until they are sold or mature. There are no ongoing or management fees despite being up to 30 year investments. The bonds can be acquired through a bond broker, who takes a one-off brokerage fee between the buyer and the seller of the bonds, much the same as the foreign currency market. The projected returns shown on the bonds are what we project the investor will receive (assuming inflation at 2.5%, the mid-point of the Reserve Bank target range of between 2 to 3%). The bonds do not have to be held until maturity and can be sold if funds are needed.

Importantly, the two inflation linked bonds only continue until they are sold or mature. There are no ongoing or management fees despite being up to 30 year investments. The bonds can be acquired through a bond broker, who takes a one-off brokerage fee between the buyer and the seller of the bonds, much the same as the foreign currency market. The projected returns shown on the bonds are what we project the investor will receive (assuming inflation at 2.5%, the mid-point of the Reserve Bank target range of between 2 to 3%). The bonds do not have to be held until maturity and can be sold if funds are needed.

While there hasn’t been a period of high inflation for some years, should inflation again spike to over 10 per cent as it did in the 1980s, the capital value and interest payments would also spike, offering very useful protection to investors in either the capital indexed or the indexed annuity bonds.

Some Australian Commonwealth government bonds are available through the ASX. State government bonds may be purchased from the individual states and territories, while corporate inflation linked bonds are available in the over-the-counter bond market and can only be transacted via a bond broker.