Here in Australia, and around the world, the United Nations Climate Change Conference in Glasgow (COP26) has brought decarbonisation to the forefront of today’s news agenda.

The event was the biggest Summit ever held in the UK, with world leaders, dignitaries, scientists and, the business community all discussing one primary question – how to address the challenges posed by climate change?

While the conference does have a set of predetermined goals, these events most often conclude with ambiguous outcomes. COP26 reinforces the relevance of decarbonisation, but for investors it is important to focus on the areas where real tangible action is taking place.

Decarbonisation, we believe, is a multi-decade investment super-cycle in power infrastructure and one of the most significant investment themes in global markets right now. To keep global warming to 1.5 – 2°C above pre-industrial levels, greenhouse gases need to be halved by 2050 and eliminated by 2100.

Another way to think about global warming is that 75% of greenhouses gases are related to the combustion of fossil fuels, and most of that is in carbon dioxide and methane. Fuel is combusted for kinetic energy (to create motion e.g., driving a car) or for heating and cooling.

In most cases we can replace fossil fuels with electricity from non-fossil sources like hydro, solar and wind, and nuclear. This technology already exists today, but investment is required to increase scale.

Unfortunately for Australian investors, while COP26 has thrust decarbonisation firmly into the national political agenda, it is a challenge to get exposure to this investment super-cycle via ASX-listed equities. Global equities, however, can provide real and material portfolio exposure.

Decarbonisation and the three major economic blocks

Decarbonisation is a central pillar of policy in Europe, China and the US.

Europe has some of the most aggressive ambitions as it is a net importer of fossil fuels, spending around €120 billion per annum on importing energy – decarbonisation is thus positive for Europe’s GDP.

The European Union has a legally binding target to reduce emissions by 55% by 2030 versus 1990 levels, and to be carbon neutral by 2050. To help achieve this, Europe has its European Green Deal, a €4 trillion commitment over the next decade to help achieve this target - which is equivalent to incremental investment of more than 2% of GDP p.a. This is significant relative to Europe's economic growth and could create 20 million jobs.

At the core of the European Green Deal is Europe’s Emission Trading scheme, which has put a price on the cost of reducing carbon emissions. The scheme, in existence since 2005, targets the power sector and other large industrial emitters. Power producers are required to purchase certificates to offset their carbon emissions. As the number of certificates available for purchase falls each year, the scheme is designed to force the power sector to switch to renewables. Further, the €40 – €60 billion generated each year from the sale of certificates is used to subsidise a reduction in fossil fuels elsewhere, such as subsidising EVs or replacing gas with green electricity to heat and cool buildings.

As electrification occurs in other sectors it leads to an increase in demand for electricity, which puts even more pressure on power companies to switch to renewables. On our forecasts, wind and solar could grow from around 20% of total European power generation today to 60% by 2030.

This has implications for the grid, given historical underinvestment – and we are seeing this play out in Europe’s power market today. An increase in renewable generation has made the grid unstable, and more investment is required - potentially as much as €35 billion per year across transmission and distribution.

Additionally, investment in storage is essential as the sun doesn’t necessarily shine or the wind blow at the same time as peak demand. Excess generation in periods of low demand need to be stored so the energy isn’t lost.

Europe is not alone

Despite the often-negative portrayal of climate action in China, the nation is making real progress, particularly when you consider its starting position – a huge reliance on coal.

China's goal is to achieve peak carbon emissions by 2030 and to be carbon neutral by 2060. To meet these goals, China is prioritising reducing emissions over adding capacity in high emitting sectors like coal, steel, chemicals and aluminium.

China also has some of the highest electric vehicle (EV) targets globally, with EVs to account for 20% of new vehicle sales in 2025. With this target, China is looking to become the global leader in EVs and could account for as much as 40% of total EV sales in 2025.

China is also moving towards more renewables, as the all-in greenfield cost of solar is the same as coal, without any subsidies. China has a target to double renewable capacity to around 1,200GW by 2025, with a focus on solar.

The US is also ‘going greener’

The United States’ south-west region is one of the richest solar resources globally, with more than 10,000MW of utility scale solar plants.

Further, the mid-west is relatively windy through the entire year. With investment in the grid connecting the north to the south, this could result in renewables-derived electricity year-round. So, even though the US has a lot of natural gas, it increasingly makes sense to invest in renewables, given the extent of wind and solar.

We think this will accelerate further during the Biden administration.

Decarbonisation and the economic cycle

In the context of the bigger picture for the outlook for global equities, decarbonisation is more than just a ‘hot theme’.

As we approach the end of 2021, growth in economic activity appears to be moderating, but moderating from an unsustainably high base given the extent of pandemic-driven fiscal stimulus. Even though growth in activity is slowing we are not looking at 2022 as a zero-growth world.

The cycle can be supported by the stimulus that’s already in the system and strength of household balance sheets.

Over the longer-term our view remains that policy makers globally will be reluctant to shift to austerity too quickly and attitudes around fiscal stimulus have fundamentally shifted.

Here is where a multi-decade, multi-trillion-dollar investment cycle around decarbonisation can shape market preferences in the years to come.

Along with other major investment cycles such as 5G adoption, infrastructure and catch-up spending in the health system, decarbonisation can lead to a shift away from viewing the world as in a permanently low growth, low-rate environment.

In this environment there will be low multiple stocks that could transition to secular growth winners, and this might further fuel a rotation in equity market preferences.

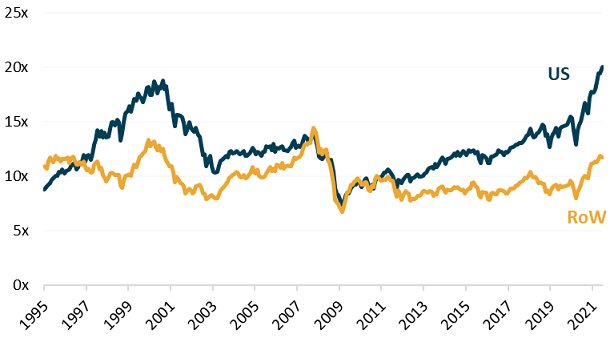

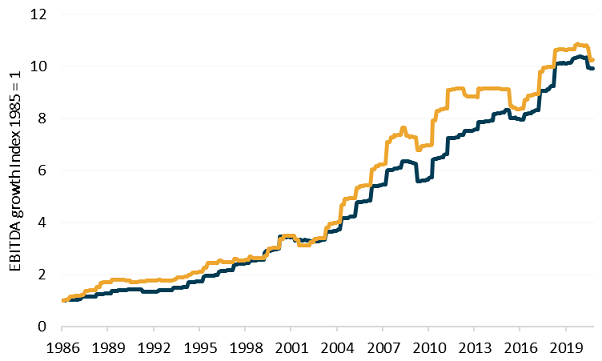

New investment cycles may also tighten the extreme valuation dispersion between US equities and the rest of the world; US equities are valued at a 65% premium despite very similar earnings growth through time. This premium has been driven by outsized stimulus in the US and recent investment cycles around software and the internet – which have been led by the US.

US priced at a 65% premium to the Rest of the World*, largest on record…

…despite similar EBITDA-growth through time

*Cyclically adjusted EV/EBITDA. Source: FactSet, Antipodes

This is unlikely to be sustainable. These emerging investment cycles benefit companies globally and the rest of the world is not being priced for success.

The global benchmark, with its 60% exposure to US equities, is unlikely to reflect the best opportunities today.

Global equity investors continue to focus on a narrow set of winners, many of which are valued at very high multiples. At the same time, there are global businesses at the forefront of a once-in-a-generation investment cycle, which are valued at highly attractive multiples.

You could be forgiven for ignoring the spectacle in Glasgow, but decarbonisation is a theme investors cannot ignore when it comes to portfolio positioning for the long term.

Alison Savas is a Client Portfolio Manager at Antipodes Partners. Antipodes is affiliated with Pinnacle Investment Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers from Pinnacle and its affiliates, click here.