If a company made 600,000 cars over the last year, sold at around US$100,000 each, how much would you pay for a piece of that business?

It's a question that stirred a lively debate at this years' Morningstar Investment Conference in Chicago, where the company in question was Tesla.

For the opposing managers, Rob Arnott, the founder of Research Affiliates, and Catherine Wood, founder of ARK Investment, the answer comes down to how much they believe the company is going to grow, and how quickly. On this, they couldn't be farther apart.

For Arnott, a contrarian value-oriented manager, he acknowledges Tesla's incredible growth and the explosive potential of the electric vehicle market but asks 'at what price'? He believes investors are getting ahead of what's likely to happen and that Elon Musk’s shares are in bubble territory.

"To justify Tesla’s current price, you’d have to assume roughly 50-fold growth over the next 10 years," he says. "Is that impossible? No, anything is possible. Do you believe it’s plausible? I don’t. So I view it as a bubble."

For Catherine Wood, a disruptive technology-focused investor, Tesla is a technology pioneer that sceptics are massively underestimating and whose shares are still the buy of a lifetime.

Wood believes Tesla is primed to take advantage of falling costs having created four major barriers to entry for its competitors - battery technology, proprietary artificial intelligence chips, customer data collection and over-the-air software updates to improve performance.

She expects the average electric vehicle price will drop below that of the average gas-powered price in the next year or so and will continue to decline so that in the year 2025, the average electric vehicle will be 18,000 while a regular car will still be roughly $25,000.

Asked what her base price target would be for Tesla in five years, Wood answered $3,000. Today, the stock is trading around $750.

This spar over the specifics of Tesla makes for interesting watching, but it's their widely different approach to valuation and forecasting the future which gives me pause for thought.

Disruption is everywhere. Upstarts challenging the status quo, entire industries transforming overnight, disrupt or be disrupted. But for every Apple, there's a Blackberry. For every Facebook, there's a MySpace. For investors, the struggle to put a price on so-called blockbuster technologies is harder than ever.

Pricing the future

For the Rob Arnott's of the world, their assumptions about the future are informed by the past. They remember periods of wild market speculation and sudden dramatic declines. Of big, successful ‘disruptors’ like Cisco crashing in the 2000s tech bubble and shattering expectations. From the largest market-cap stock on the planet to a decline of 80%, Cisco's share price is still lower than it was at the peak in 2000 even though they've delivered double digital growth for the last 21 years. Where markets are pricing in stupendous growth, delivering impressive growth isn't enough, he remarks:

"Things that are expensive are always expensive based on a narrative of everything going amazingly well, of path-breaking disruption – and here's the trick: narratives are true," he says.

ARK Investment’s Cathie Wood and Research Affiliates Rob Arnott spar over Tesla’s future at the Morningstar Investment Conference in Chicago.

"The narratives that drive these companies to lofty valuation are for the most part true. But the important question to ask is not is this an amazing narrative, but what about this narrative isn't known to the broad market and isn't already reflected in the share price.

"Bubble stocks have to exceed the narrative that shapes their expectation and price in order to go up.

"I love growth, I love disruption, I love technological innovation. I agree that a brave new world in which technological innovation advances humanity in amazing and wonderful ways is our future. Where I would question is how much of this isn't already reflected in the prices when you have companies priced at multiples of aggregate revenues rather than multiples of profits.

"Those companies are pricing in extravagant growth that may be possible – but in many cases, there will be shortfalls, and they have to produce that growth just to justify where they are on price."

Arnott himself believes deeply in the theory of mean reversion - that asset prices and historical returns gradually move towards the long-term mean. When there is very rapid earnings growth, this tends to mean the price will revert downwards. Similarly, when earnings are tanking, they tend to revert up (except in the case of value traps). His job is to estimate the trading range for a security and purchase it below that range to pick up a bargain. As any value manager will tell you, the last decade has not been kind to this strategy.

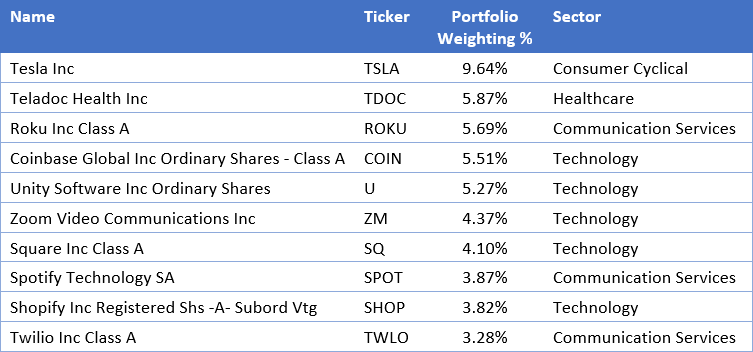

ARK Innovation ETF (ARKK) | Top 10 Holdings

Data as at 07/10/2021

Source: Morningstar Created with Datawrapper

For the Catherine Woods of the world, they believe markets are entering a new era. Her firm believes the world is on the cusp of transformations in every sector globally, the likes which we have not seen since the early-1900s. She likens innovations like DNA sequencing, adaptive robotics, energy storage, artificial intelligence and blockchain technology to the telephone, electricity and the automobile. She says the full potential of these technologies is only just beginning to be understood, and that dramatic and accelerating declines in costs will deliver outsized growth.

"We’re looking forward, not backward. We are looking at exponential growth opportunities that have evolved as these innovation platforms have started to mature and move into prime time," Wood says.

"These seeds were planted in the 20 years that ended in 2000. The power of the exponential growth rates that we're going to see is a function of how long they've gestated. When I throw out a number like 88% annual growth in units, that sounds preposterous, but Wright’s Law gives a very nice guide – here's how the costs should decline, if you pass those costs down in prices, the uptake will be there."

She adds:

"We got a glimpse of exponential growth during the internet – it turned so many people off because it was so wrong. The costs were too high, the technologies weren't ready. Now, technologies are ready and not only are we seeing these five innovation platforms evolving, [artificial intelligence, robotics, energy storage, DNA sequencing, and blockchain technology], we are beginning to see them converge."

To value exponential growth opportunities, Wood projects out a company's cash flows based on Wright’s Law and ARK's cost trajectories to arrive at an EBITDA in year five. This Law says that for every cumulative doubling in the number of units produced, the costs associated with new technologies decline at a consistent percentage rate. Then, she'll slap a FAANG-type multiple (a mature innovation company multiple) on the projection to reach a price – implying she believes today's multiples are sustainable.

Wood believes the book values some analysts rely on to assess a company's value include "bloated figures". Many sectors, she says, will be forced to deal with "stranded assets" due to the pace of innovation and the "creative destruction that will cut them in half". She's on record saying that almost half of the S&P 500 index is threatened by technological disruption.

Courage of your convictions

Where you sit in this debate defines you as an active investor today – between waiting for the "big crash", cash in hand, or doubling down on any dips in the market, no matter how small. Watching on, I was sceptical of Wood's brand of technophilia but could not help being irked by value's long stretch of underperformance. Some of Wood's bolder predictions for Bitcoin and Tesla have come true, to the dismay of analysts who called them out as ridiculous. What I am impressed by is their unwavering commitment to their investing philosophy. Both Wood and Arnott will have good years and bad, but it's the courage of their convictions in the face of great criticism which will keep investors sticking with them for the long term. Chasing short-term performance is no recipe for success.

Emma Rapaport is Editor Manager at Morningstar, owner of Firstlinks. This article is general information and does not consider the circumstances of any investor.

Read the transcript: The Tesla 'bubble or not' debate

A Morningstar Premium free trial is available on the link below, including access to the portfolio management service, Sharesight.

Try Morningstar Premium for free