Every day, approximately 32 people in Australia turn age 85 and this population sector has grown by 133% over the last two decades. An industry survey conducted jointly by Aged Care Steps and Swiss Re reveals that aged care is an increasingly important topic for advisers and clients and should be an earlier part of retirement planning. The survey was done in October 2017 with results compiled from 173 respondents.

Consumer implications

Australians need to plan for the affordability of future care needs and understanding the options to make informed decisions with confidence.

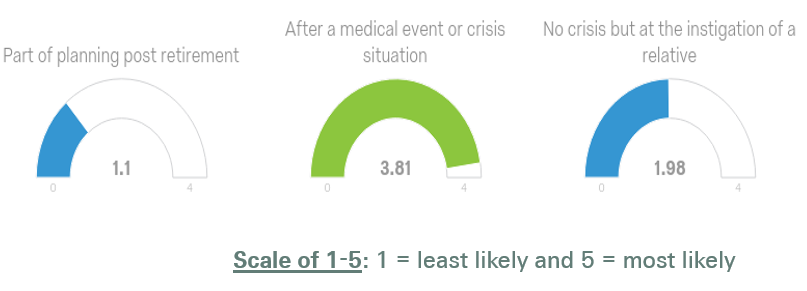

Chart 1 from the survey shows that Australians tend to seek aged care advice after a medical event or crisis, but often this is too late and their options are limited. They should deal with their aged care needs well in advance such as when planning for retirement.

Chart 1: When do people seek aged care advice?

Key issues include:

- how to fund aged care costs given the shift towards a greater user-pays

- willingness to access the equity in their home instead of a focus on inheritance

- the ability to rely on family and friends to provide care and financial support.

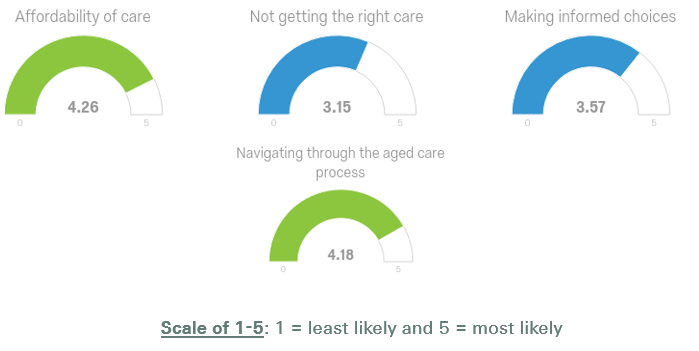

The survey explored the challenges and fears of people concerning care, and show Australians are grappling with the following issues when accessing the right care.

Chart 2: The challenges and fears of people dealing with aged care

Professional advice implications

The aged care survey revealed that professional advisers should be preparing for aged care to become a standard business focus in response to increasing client demands. Advisers who ignore the demand for aged care advice risk becoming uncompetitive and less relevant to their clients.

Other results from the survey include:

- 90% of surveyed advisers expect an increase in client demand for aged care over the next three years. About 85% of advisers report that clients are proactively seeking aged care advice with 29% suggesting this is happening frequently.

- 30% of advisers provide aged care to service existing clients. The remaining provide aged care services to attract family or friends of care recipients (25% of respondents), build their client base and attract new clients (22% of respondents) and to provide intergenerational wealth transfer advice (21% of respondents).

These results align with the trend of advisers exploring new revenue sources and opportunities to better align with their client base, and about 51% of surveyed advisers regularly promote aged care services and a further 27% offer it on a case by case basis.

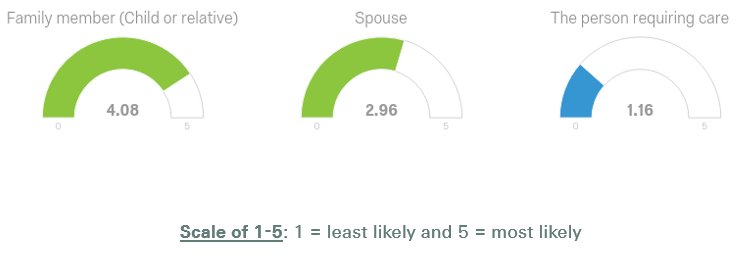

Advisers report that family members (children or relatives) and spouses approach them for aged care advice more than the person requiring care, as shown in Chart 3 below. ‘Target clients’ therefore tend to be clients aged 40–70 years who take responsibility for dealing with their ageing parents. This age group often already represents the bulk of an adviser’s client base.

Chart 3: Who approaches financial advisers for aged care advice?

These survey results reinforce the risk that advisers who do not include aged care solutions to address broader needs, risk losing clients and forgo the opportunity to capture new revenue sources. Clients need to be made aware that they can approach their professional adviser when dealing with aged care issues for themselves or their loved ones.

Adviser groups need a compliance framework for the delivery of aged care advice, accreditation training, access to practical tools and efficient planning software. They need to review their portfolio construction guidelines for retirement planning to adequately address clients’ aged care needs throughout the retirement phase.

People should not wait until there is a medical crisis before considering their alternatives, and nor should they leave it to family members who might not know what’s in the best interest of the person requiring care. The desire to minimise family conflict is obvious.

Assyat David is a Director of Aged Care Steps.