Welcome to the Firstlinks Edition 315

Graham Hand

If you want to know what financial markets absurdity looks like, here is a screenshot from a Bloomberg terminal for a bond priced last week. It shows:

- Issuer: Bundesrepublik Deutschland (Federal Republic of Germany)

- Maturity: 15 August 2029 (10 years)

- Coupon: 0.000000% fixed (zero, zip, zilch, nada ... any way you cut it)

- Issue Price: 102.64 (yes, pay 102.64 now and receive 100 in 10 years)

Don't bother checking your bank account on each interest date. The yield-to-maturity on this bond is minus 0.26% for 10 years, and you're worried about term deposit rates of 2%!

Source: Bloomberg

It brings back memories of when I did the first-ever zero coupon Australian dollar Eurobond issue for the Commonwealth Bank back in December 1989 (the three Number 1 hits of that month were by Phil Collins, Billy Joel and the infamous Milli Vanilli). However, there is one massive difference over 30 years. The issue price of our bond was $55, with $100 repaid in five years. No wonder it quickly sold out to tax-avoiding 'Belgian dentists'. Yield-to-maturity, 12.7% pa. Those were fun days, traveling the world with a AAA borrower in my pocket.

Many investors think of the listed market to buy company shares, but in recent years, the ASX has introduced a wide range of ETFs, LICs, LITs, notes and hybrids to meet fixed interest demand. While these do not have the security of a government-guaranteed term deposit, we review some listed investments that can meet income needs without equity risk. See also the excellent comment by bond expert, Warren Bird.

Continuing from last week's 'gone viral' article on fund managers failing, Rudi Filapek-Vandyck shows the big winners and losers among large cap stocks, which explains why so many professional investors had poor years.

We are only beginning to learn how the Internet-of-Things (IoT) will use real-time data to drive decisions, and MFS International explains how it will change companies and consumers.

The debate on franking heightened investor awareness of the benefits, which may encourage some to chase franking at the expense of other factors. Raewyn Williams issues a warning.

The latest Investment Trends/Vanguard Reports on SMSFs show changes in asset allocation and potential for substantial movements between different types of super vehicles. Graeme Colley then gives another five common mistakes he sees in SMSFs.

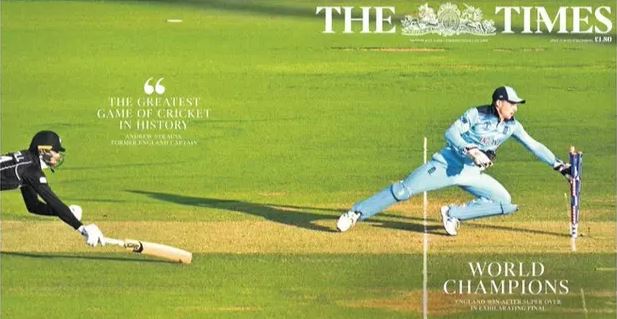

After the high drama of the World Cup Final, Benjamin Chong uses a cricket analogy to explain taking a swing in Venture Capital. It just needs one big winner. And while on the subject, I sat up until 5am watching the final in a nine-hour emotional rollercoaster. It was also fascinating watching real-time betting, as New Zealand started at $3.50 outsiders, gradually clawed their way to $1.50 favourites, then blew out to $6 during the super overs.

For all those people arguing about 'decisive' moments, 'decisive' means 'producing a definite result'. This photo shows the only decisive moment of the entire game, although the Kiwis were desperately unlucky. Have Your Say if you wish to comment on this extraordinary sporting event.

This week's White Paper from BetaShares is the 2019 Half-Yearly Review of the ETF sector, showing which types of funds are in inflow and outflow and which performed the best. IIR's Monthly Report on LICs highlights recent mergers, issues, option exercises and activity.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.