While Australian equities have long played a key role for investors with a responsible investment approach, 2022 has created conditions that have placed the sector squarely in focus.

Managers offering funds with a responsible investment approach have had to navigate performance headwinds linked to rallying materials and fossil fuel companies in an environment of increased inflation and constrained energy supply.

At the same time, other key strategic areas have also emerged. Investors and other industry participants are placing more consideration on the importance of fund managers being true-to-label. From ethical to ESG (Environmental, Social and Governance factors), managers are subject to greater scrutiny on their delivery of stated product. We are seeing greater importance around company transitions to net zero emissions, and the recent change in Federal government and the new wave of elected independents has seen rejuvenated ambitions for the net zero journey in Australia.

How do Australian equity funds with a responsible investment focus deliver for clients from both a social and environmental perspective in the context of investment performance? For the responsible investor both elements matter, and for Australia and our pathway to net zero, the effective operation of responsible investment has never been more important.

Delivering on social and environmental outcomes

Responsible investors are seeking closer alignment between their expectations of the fund they invest in and the real-life outcomes of the investment activity of the fund.

There are two key metrics to assess a fund on its social and environmental focus:

1. Company holdings - which companies are included and which are excluded?

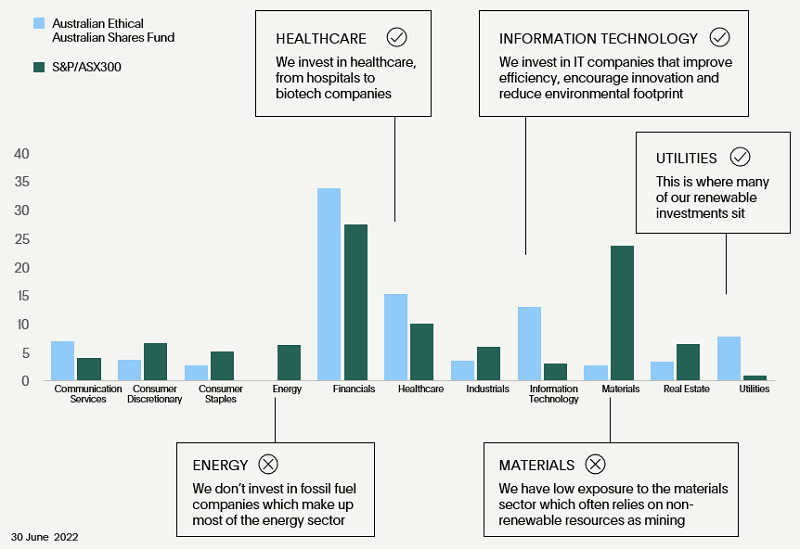

The Australian share market is characterised by relatively high concentrations to sectors like financials and materials. Add to that individual company performance on environmental and social issues ranges from leader to laggard, and company holdings can vary materially between each responsible investment fund provider.

A common strategy used by managers today is considering ESG factors as part of the financial analysis step of the investment process, known as ‘ESG integration’. In 2020, 57% of Australian fund managers cited they have at least 85% of assets under management assessed using ESG integration.

A pure ESG integration approach, in the absence of negative screens, won’t stop the fund investing in a business that offers products with harmful effects if the manager thinks the company share price accounts for the additional risk. ESG portfolios tend to also be more benchmark-aware through lack of strict fund exclusions.

In the case of ethical funds, where strict company, asset and sector exclusions are applied, there are clear differences in stock holdings with the scale of any difference dependent on the screening process, including materiality.

2. Creating an environment for positive change

The second element in selecting an ethical fund is how the manager supports creating an environment for positive change.

In 2022, there is much debate around effective ways to transition companies and their assets in the move towards net zero targets. A manager adopting an ESG-oriented approach can have a broad list of company holdings which can assist engagement with those companies, supported by dialogue with management and via proxy voting.

An ethical manager can direct capital to support a portfolio of companies that meets its social and environmental criteria, engage with businesses to raise their standard for inclusion and keep current companies accountable with an ability to divest. Also, there is proxy voting on those companies held, and opportunities for industry engagement.

From Australian Ethical’s perspective, we also employ a dedicated Ethics Research team, so we can encourage action in areas that matter most from a social and environmental perspective and adopt a public voice on key issues. Our transparent exclusions can have a signalling effect to conscious consumers and companies concerned about their brand. For example, our recent decision to invest our equity portfolios to line with net zero by 2040 also has the effect of seeking to encourage more rapid change from market participants.

Delivering investment performance faced with energy and inflation changes

Responsible Australian equity funds face additional challenges linked with the present inflationary environment that is driven by factors such as the Covid pandemic and supply chain restrictions, labour shortages, the war in Ukraine and spikes in energy prices. The recent rise in bond yields has also made for a more difficult environment.

We believe in adopting a patient approach to equity market investments with a focus on the long-term. Many of the better-performing ASX companies over the last year were from the materials sector or involved with fossil fuels, while the performance of smaller innovative companies has detracted from recent returns. Another way of stating this is that markets have been ‘voting’ for energy companies and against smaller growth-oriented businesses.

Looking at 2022, in the seven months to 31 July 2022, we saw the broad market (as represented by the S&P/ASX300) fall -5.1% while the energy sector returned +31.9%, which was the highest returning and one of the only three sectors delivering positive returns. And small industrials has had a negative return of -17.1%.

As an ethical manager, our nil holding in energy - largely driven by our fossil fuels exclusion - hurt returns, and a material overweight to those small industrial companies significantly impacted short-term relative performance.

Exclusions will remain in place regardless of company valuations and financials. We take a strategic view and back our expertise in selecting companies approved for investment. We believe our broader focus on company assessment will support better long-term investor outcomes.

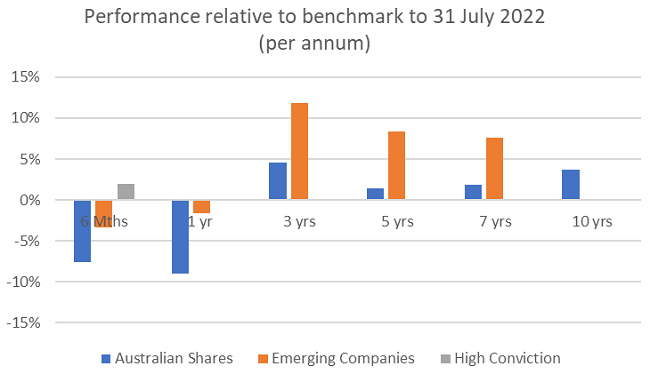

The chart below shows the performance across our Australian equity fund wholesale fund range after fees relative to their benchmarks. The chart demonstrates some significant headwinds over 6 and 12 months for our broad cap Australian Shares Fund (which has a material overweight vs benchmark in small companies), but it has delivered long-term competitive returns. (There is also a retail unit class of this Australian Shares Fund with a longer track, which has outperformed its benchmark by 2.7% p.a. after fees over 20 years to 31 July 2022, returning 10.2% p.a.)

Our additional Australian equity strategies – the long-standing Emerging Companies Fund (small cap) and recently launched High Conviction Fund (large cap) - have incurred less impact from key moves in 2022 relative to benchmark, in particular linked to not having the small cap overweight. We think having a blend of large and small cap-oriented strategies can also support outcomes for ethical investors across a range of market conditions.

Long-term value and divergence from indexes

Our expertise in small companies and in specific sectors - such as healthcare, IT and renewables - positions us to add long-term value. For example, we have followed a relatively unknown company called Cogstate for a long time. They are a global player in digital cognition testing technology relating to Alzheimer’s research. In 2019 we took a meaningful stake in their business at 17.5c. Despite recent falls in their share price, at the end of July 2022, shares were trading at $1.80 and we continue to see a bright future for the business.

In general, our active equities portfolios are underweight in classically cyclical companies such as resources and consumer discretionary names, which we think positions our funds well for any slowdown in economic growth. While resource companies have initially responded positively to inflationary concerns, given the inherent cyclicality of this sector, concerns around rising interest rates and impact on aggregate demand and commodity prices is starting to impact returns. Furthermore, in the case of fossil fuels, currently high prices are likely to incentivise more environmentally-friendly substitutes in the long term.

Our ethical framework can be evidenced from our different company and linked sector weightings. Only about 50% of companies in the S&P/ASX300 index earn environmental and social approval from our Ethics Research team. The diagram below shows the sector allocations of our Australian Shares Fund versus the benchmark S&P/ASX300 index.

Conclusion

Responsible investment in Australian shares is more critical now than ever. Clients want to ensure that funds are being true-to-label, delivering from both a social and environmental perspective, plus offering long-term competitive performance. Trends in 2022 have only re-emphasised the importance of this dual focus, for investors, financial and responsible investment industry participants, and our nation alike.

Angus Dennis is Investment Director at Australian Ethical, a sponsor of Firstlinks. This information is of a general nature and is not intended to provide you with financial advice or take into account your personal objectives, financial situation or needs.

View full disclaimer and other important information: Total returns are calculated using the sell (exit) price, net of management fees and gross of tax as if distributions of income have been reinvested at the actual distribution reinvestment price. The actual returns received by an investor will depend on the timing, buy and exit prices of individual transactions. Return of capital and the performance of your investment in the fund are not guaranteed. Past performance is not a reliable indicator of future performance. Figures showing a period of less than one year have not been adjusted to show an annual total return. Figures for periods of greater than one year are on a per annum compound basis. The current benchmark may not have been the benchmark over all periods shown in the above chart and tables. The calculation of the benchmark performance links the performance of previous benchmarks and the current benchmark over the relevant time periods.

Australian Ethical Australian Shares Fund benchmark is a composite S&P/ASX Small Industrials Accumulations Index till 12 August 2019 and the S&P/ASX 300 Accumulation Index thereafter.

Australian Ethical Emerging Companies Fund benchmark is the S&P ASX Small Industrials Index.

Australian Ethical High Conviction Fund benchmark is the S&P/ASX 300 Accumulation Index.

For more articles and papers from Australian Ethical, please click here.