I made a personal submission to the Financial System Inquiry, based on several articles written for Cuffelinks, on the subject linked here: Should SMSFs be allowed to borrow?

My conclusion was:

"Leverage increases risk, and when this is widespread across an asset class, financial crises can be exaggerated by forced sellers. The best example is margin lending, where banks have the right to force investors to sell assets to maintain margin ratios. In troubled times, assets look for buyers but everybody is trying to preserve liquidity.

Given so much leverage in our system outside of superannuation, do we need to add more potential risk and volatility into the system generally, and superannuation in particular? Our retirement savings are supposed to reduce the future drain on pension payments, and an investor who loses money from a poor leveraged investment may become a long-term drain on public resources.

Property differs from shares as it is usually a single indivisible asset, which cannot readily be sold brick by brick. The sole purpose of superannuation, and the reason it is given favourable tax treatment, is to fund a retirement, and to do this, it must generate income. Leveraged investments usually carry an interest cost, and unless the revenue exceeds this cost, there is a net cash outflow. What happens when interest rates rise, or the property has a long vacancy period, or a major repair is required? What if the SMSF trustee loses their job and is not making other contributions to super? The SMSF trustee may be forced to sell the apartment at the worst time in the property cycle.

This paper has demonstrated:

- the dramatic downside of leveraged returns in a falling market

- the low net yields generated by many residential properties when all costs are considered

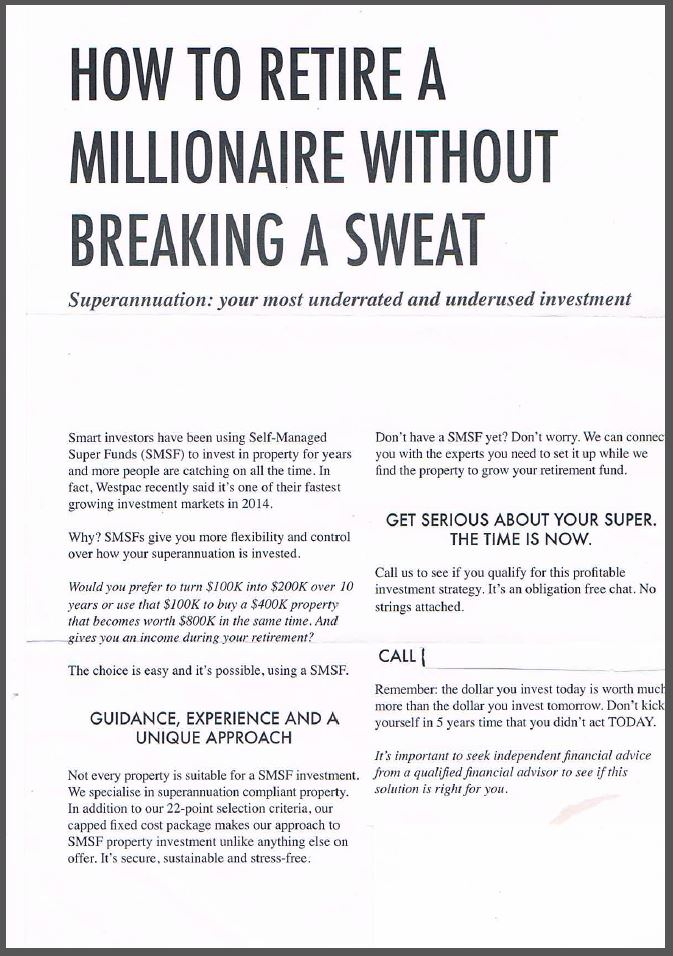

- the spruiking techniques some agents use to target SMSFs

- the role that superannuation plays in funding a retirement.

Many highly leveraged SMSFs would lose all their own equity if there is a decent residential property price correction. Anyone who doubts the potential problems should attend a property seminar aimed at SMSFs and listen to the techniques used."

And as if to emphasise the point that SMSFs will be targeted for property, this leaflet arrived unrequested in a direct mail drop to everyone in my suburb on 'How to retire a millionaire without breaking a sweat' (sic - it should be 'breaking into a sweat'). Thank goodness the Reserve Bank Governor, Glenn Stevens, issued a warning this week that house prices can fall as well as rise.