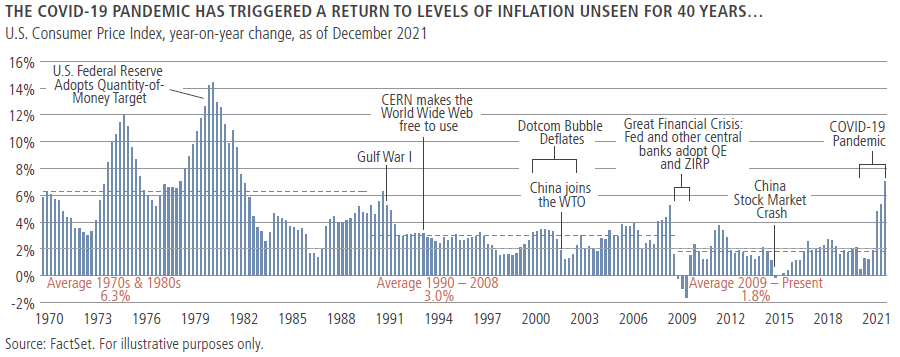

The Covid-19 pandemic, and the range of policies aimed at mitigating its impact, has triggered a return to levels of inflation unseen for 40 years. While inflation is likely to moderate from these very high levels during 2022, we believe it will settle and persist at a rate higher than we have become used to over recent cycles.

We believe that makes a strong case for thinking about inflation in the asset allocation process, but also about the broader objective of portfolio diversification and income generation. Many investors could be lacking sufficient inflation exposure after experiencing such a long period of stable prices. Moreover, such a major economic inflection, combined with such fragile markets, is likely to be characterized by the kind of heightened market volatility we have already seen this year.

30 years fighting inflation, 10 years fighting disinflation

Monetary authorities brought the high inflation of the 1970s under control by aggressively raising policy rates. This set off 40 years of disinflation, pushed lower by the technological advances of the internet age and the absorption of the labor forces of China and other emerging nations into the global trading community. When inflation tipped into negative territory during the Great Financial Crisis of 2008 – 09, fiscal and monetary authorities intervened in the opposite direction, with large economic rescue packages, zero and even negative policy rates, and quantitative easing. They were preparing to withdraw these measures when the coronavirus pandemic compelled them to return to them more aggressively than ever. The 2020 lockdowns were initially disinflationary. Consumers saved at unprecedented rates. The impetus quickly turned inflationary, however, as governments supported exposed businesses and workers. Reassured consumers began to spend before many factory workers, farm workers, ship crews, lorry drivers and shop assistants had returned to their jobs. Even in the aftermath of war, it is rare for such fragmented and under-resourced supply chains to be met with such a wave of pent-up demand. Across Europe and the U.S., inflation hit levels unseen since the 1980s. The Bank of England (BoE) has already started raising interest rates, the U.S. Federal Reserve (Fed) has adopted a much more hawkish tone, and as eurozone unemployment and inflation hit their lowest and highest levels, respectively, in the era of the single currency, the European Central Bank (ECB) has followed suit.

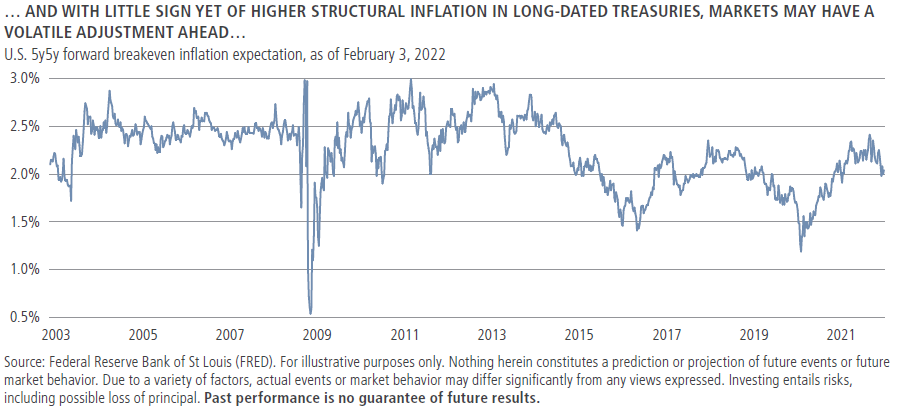

Transition to structurally higher inflation could heighten volatility

Much of the supply-chain disruption associated with the pandemic is likely to subside. The current, extreme inflation is unlikely to last. But we see four major reasons why this could prove to be a lasting inflection point, leaving us with inflation that is structurally higher than we have become used to over the past 20 years.

De-globalization

- Supply-chain disruptions may not last forever, but they have been painful enough for companies to begin localizing and diversifying—leavening the “just-in-time” arrangements of the past 40 years with more “just-in-case” redundancy

- Governments are also encouraging re-shoring for security of supply, particularly in strategic goods such as semiconductors

China

- China’s population is aging, barely growing and as urbanized as it is ever likely to be; as a result, its government now prioritizes equality, good health, the environment, and the automation of the economy over jobs-generating growth

- Decades of China exporting disinflation as the workshop of the world are over

Fiscal and monetary policy

- We perceive an implicit and explicit expansion of central bank mandates, which deprioritizes price stability relative to social goals such as the financing of sustainable infrastructure, full employment, greater equality and fiscal liberality

- Responding to the ongoing impacts of both the Great Financial Crisis and the pandemic, fiscal authorities around the world also appear to be adopting more populist economic policies that could tip the balance in favor of labor over capital, which we consider to be inflationary

De-carbonization

- The transition to renewable energy and an electrified economy is necessary but costly: cutting investment in carbon-intensive energy, while demand continues to grow and the supply of renewables is still being built, is likely to generate “Greenflation”—in energy commodities and the metals that are likely to play an important role in the net-zero economy

What might this mean for fixed income portfolios?

Fixed income portfolios are arguably most at risk from an inflationary environment. Inflation and higher rates tend to lower the present real value of a fixed income stream. The longer-dated those income streams are, the more sensitive their present value is to changes in rates—they exhibit longer duration. Should a long-term real yield of 1% or even zero be required to make inflation settle between, for example, 2.5% and 3.0%, nominal yields will be substantially higher than they are today.

We think the priority is to MITIGATE the impact of inflation.

- Short duration: Minimizes the negative impact of rising rates: with the Fed, the ECB and the BoE turning more hawkish on inflation, we favor this positioning in both U.S. and European markets

- Non-investment grade credit: To maintain yield with shorter duration, we favor adding credit risk with U.S. and European high yield bonds, dedicated short-duration high yield strategies, tradable bank loans and securitized debt

- U.S. municipal bonds: Short-duration, with somewhat lower credit risk, in many cases underpinned by a strong housing market

- Currency hedging: As cyclical uncertainty and higher inflation raises the potential of higher currency market volatility, hedging can help isolate and manage risks

Although inflation is generally challenging for bond portfolios, there are ways to TAKE ADVANTAGE.

- Treasury Inflation Protected Securities (TIPS) and other index-linked bonds: Short-dated U.S. TIPS were one of the few bond markets where total returns matched the 7% U.S. inflation rate in 2021, but they are now expensive—we think it is prudent to watch real yields for a more attractive entry point

- Floating rate securities: Tradable bank loans, private credit, securitized credit tranches and municipal variable rate demand obligations have already been outperforming due to their short duration—rising floating-rate coupons may add to their total return once central banks embark on their projected rate hikes

- Subordinated financial securities: Strong credit quality and attractive yields combine with the potential for financial sector issuers to benefit from rising interest rates

Bond markets offer ample ways to DIVERSIFY risk: via duration, credit risk, currency risk, regional risk, fixed or floating rates, senior or subordinated positions in capital structures.

Flexible strategies: The high level of cyclical uncertainty makes the case for “go anywhere” strategies that are able to shift with economic data and investor sentiment.

Finally, we expect company and sector exposures to become more differentiated. For example, sectors that should see stronger revenue growth, such as travel and leisure, likely have better tailwinds for performance than sectors that could see pressure from rising interest rates, such as housing. Likewise, rising labor costs are not impacting all companies or sectors equally: we observe more pressure in consumer products areas, for example. Therefore, we believe security selection would be important in to identifying sectors and companies that are relatively insulated against, or even potentially beneficiaries of, this inflationary environment.

These ideas are discussed in more detail in The inflation inflection: Adjusting to the new paradigm white paper.

Ashok Bhatia is Deputy Chief Investment Officer for Fixed Income at Neuberger Berman, a sponsor of Firstlinks. This material is provided for general informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. You should consult your accountant, tax adviser and/or attorney for advice concerning your own circumstances.

For more articles and papers from Neuberger Berman, click here.