There has been heightened focus recently on different investment styles, with articles such as “Is value investing dead?” The analysis generally centres around the triumph of growth investing and the demise of value-style investing.

Investors looking for professionally-managed equity portfolios face a vast array of options, with the different portfolio managers building portfolios based on their individual investment philosophies or investment styles. This piece examines the foundations upon which these styles are built.

Index funds

An index fund manager attempts to match the return of the underlying index less a small management fee. The manager will automatically buy Fortescue to its current index weight of 1.3% and make no judgement on the company’s valuation, or whether iron ore will stabilise at US$120/tonne or fall back to US$60/tonne. If Fortescue’s weight in the index increases due to its share price outperforming, the weight in the portfolio rises automatically. Similarly, as AMP’s fortunes have declined over the past 18 months, its weighting in the index portfolio has fallen.

While index funds can be a cheap way to obtain exposure to the equity market, investors are exposed to all companies – good or bad, overvalued or undervalued. For example, in 1987 and 2007 the index contained companies such as Bond Corporation, Qintex, Allco, Babcock & Brown and Centro, all of which subsequently went into liquidation. I observed a more extreme example as a young analyst working in the Canadian market, where telecommunications equipment company Nortel in 2000 comprised 35% of the benchmark Toronto Stock Exchange 300.

It seemed clear before their fall that these were companies with shaky business models reliant on high levels of leverage, and in the case of Nortel, irrational market valuation. Not owning companies such as these caused many fund managers to underperform relative to the index, however their investors avoided the losses as these former high-flyers lurched into administration.

Growth funds

Funds managers using the growth style of investing tend to select securities based more on the brightness of the company’s prospects, rather than the company’s current profits and dividends. The growth manager builds a portfolio of companies such as accounting software company Xero or payments company Afterpay based on the assumption that the market is underestimating their growth prospects.

The rationale is that Xero’s earnings and dividend yield are expected (by the growth manager) to rise rapidly. This provides justification for buying a company that is trading on a price-earnings multiple of 246 times next year’s earnings per share (EPS) and does not pay a dividend. Unlike an index fund, analysts at growth funds spend many hours meeting with a company’s management team and industry contacts to understand why the company’s long-term profit growth is likely to exceed the market’s current optimistic assumptions. In 2009, CSL was trading at $31 per share and had earnings per share of $1.92 and the company was viewed as expensive, trading at a PE (price to earnings) ratio of 16 times. In August 2019, CSL is expected to deliver earnings per share of $6.05 which, based on an initial purchase price 10 years ago, puts the blood therapy company on a reasonable PE of 5.1 times with an 8.8% dividend yield.

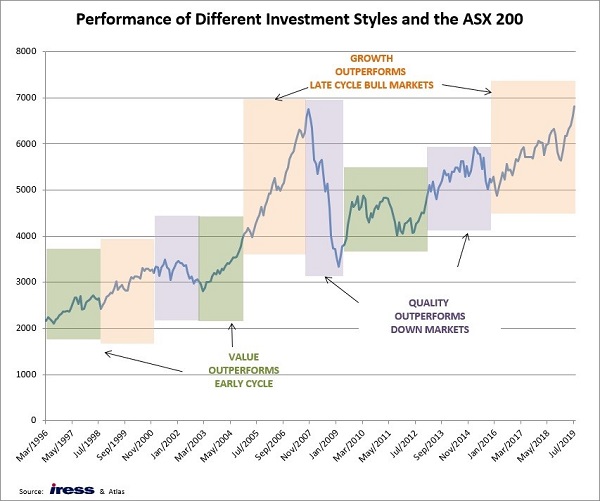

Growth as an investing style tends to outperform when the stock market is rising sharply as investors overestimate company earnings and minimise potential problems such as debt refinances and the entrance of new competitors. Also, in the case of growth companies such as Afterpay, when the company’s share price is up 63% in the past 12 months investors don’t care about not receiving a dividend.

Value investing

Value-style funds pick stocks that are trading below their net worth. Benjamin Graham and David Dodd famously developed this style in their seminal investing text from 1934, Security Analysis(not a light read by modern standards with 725 densely-packed pages and few graphs). Value investing is based on the concept that undervalued stocks will revert to their intrinsic value, thus allowing the investor to buy (for example) $1 worth of assets for 80c.

Characteristics of this investing style include buying companies that are trading on a low price to book value, low PE ratio, or companies whose liquidation or wind-up value is greater than their current market value. In July 2018, Telstra was trading at $2.60 which equated to 13 times its projected earnings per share and with a dividend yield of 7%. The market was concerned about increasing competition in the mobile phone market in Australia and the impact of the NBN on profit margins. Over the past year, Telstra’s share price has rallied to almost $4 due to a combination of decreasing price competition in mobiles and government decisions to block rival TPG from both building a 5G network (using Huawei technology) and merging with UK-based Vodafone. Telstra currently trades on a PE ratio of 25 times with a 4% dividend yield.

Typically, a value-style fund will have a lower price to earnings ratio, lower beta (a measure of volatility) and a higher dividend yield than a growth-style fund, with greater exposure to more mature companies. One of the dangers of value-style investing is being attracted to companies that are ‘value traps’, namely those that have a high but unsustainable historical dividend yield and low PE ratio as they operate in a declining industry. While department store owner Myer has recovered in 2019, this company is viewed by many as a value trap.

Quality investing

Following the Dot Com Bubble of the early 2000s and the aftermath of the GFC, investors paid more attention to the quality of a company, rather than just its raw earnings multiple or dividend yield. This approach focuses on hard factors such as the quality of a company’s earnings or balance sheet, along with softer factors such as the quality of corporate governance and transparency of information, while still buying undervalued companies. Quality-style fund managers tolerate paying more for companies with higher quality recurring earnings streams and tend to avoid cheap companies that are in the process of restructuring. This is the approach we use at Atlas Funds in managing our equity portfolios.

In the case of improving quality, the market may see a company as low quality when in fact the underlying fundamentals of that company are improving. For example, in early 2017 private health insurer Medibank was added to our portfolios. At this time, we considered that the market was not pricing the potential profit uplift that Medibank’s management could generate from cutting out costs and inefficiencies that crept in over the decades of government ownership. As the market recognised these qualities, the share price has moved steadily upwards. The Coalition’s election victory in May also improved the company’s prospects.

Hugh Dive is Chief Investment Officer of Atlas Funds Management. This article is for general information only and does not consider the circumstances of any investor.

(Thanks for reader comments on an earlier version, which has been updated).