A ‘superannuation interest’ is unique to SMSFs and some government superannuation funds. Keeping track of each superannuation interest may be a nightmare for some accountants, financial planners and DIY clients, but failure to do the right thing may lead to catastrophe for the client or their dependants.

A superannuation interest is a concept invented for purposes of the income tax legislation as it identifies solely the taxation components of a member’s accumulation and pension benefits, and is relevant to how tax may be paid, including by dependants. The general rule in an SMSF is that a member has one only superannuation interest.

However, the exception to the general rule is that each pension account of a member has its own superannuation interest. It is therefore possible for a member to have superannuation interests supporting amounts in accumulation phase and a number of other superannuation interests, each supporting its own pension interest. This article is a summary, with more information available on the ATO website or my longer article.

Let’s start considering superannuation interests and look at a simple example, then move to more complex situations, particularly those where a surviving member may be in receipt of a death benefit pension.

Superannuation interest – one account only

Let’s assume Almira has an account in an SMSF and been contributing from her after tax savings for many years. In addition, her partner, Arthur, has made spouse contributions for her and she has also received the co-contribution on a number of occasions, both of these totalling $140,000. The value of Almira’s benefit in the SMSF is $350,000. Therefore the value of Almira’s tax free component is $140,000 and the value of her taxable component is $210,000 ($350,000 - $140,000).

40% of her superannuation interest ($140k/$350k) consists of the tax free component and the remaining 60% consists of a taxable component. If she were to draw part of her superannuation interest as a lump sum the tax free and taxable components would be split into the 40%/60% proportions. If Almira’s superannuation interest was used to commence a superannuation income stream, the taxable and tax free amounts of each income stream payment and any lump sum commuted from it would consist of the same proportions that were calculated at the time the income stream commenced.

Superannuation interest – two accounts

A member may have more than one superannuation interest with some of their super and commence a superannuation income stream with some of the accumulation balance. The amount remaining in the accumulation interest will be one superannuation interest and the amount that provides the superannuation income stream will be another.

As an example, let’s assume Bjoern’s superannuation interest in accumulation phase had a balance of $500,000 and included a tax free component of $100,000. If he commenced an account based income stream with $400,000, the proportioning rule would be used prior to the commencement of the income stream to work out the tax free and taxable components. Prior to transferring the amount from the accumulation account to the income stream account the proportion would be $100,000/$500,000 consisting of a 20% tax free component and an 80% taxable component.

Once the income stream commences the proportions stay with the income stream balance until it ceases. Therefore any amount received as an income stream or any lump sum received from the part or full commutation of the income stream will include the tax free and taxable components as determined when the income stream commenced.

In cases where the income stream has commenced solely from a tax free component it will always be tax free including income that is accumulated on the tax free amount.

Superannuation interest – three accounts

There is no limit to the number of superannuation interests a member may have in an SMSF. However, the use of multiple accounts needs to take into account the purpose for which each superannuation interest is maintained and the costs associated with their administration.

The calculation of the tax free and taxable components in the case of multiple superannuation interests is no different to the examples above where two accounts were involved. The only exception is that there are a greater number of superannuation interests for which information must be maintained.

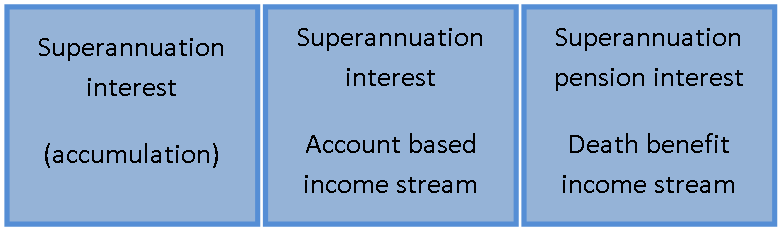

Death benefit pensions

On the death of a member a pension may commence or continue as a reversionary pension to a surviving dependant. A separate account must be established in the name of the survivor who will now be a member of the fund and is required to be appointed as a trustee or a director of the corporate trustee of the SMSF if they are not already at the time of death.

The reason to keep the death benefit superannuation pension interest separate is to ensure the tax free and taxable components of the deceased are retained. In addition, it is not possible to ‘mix’ the balance of any death benefit pension with other superannuation interests, even other death benefit pension interests as it results in the commutation of a death benefit which must be paid from the fund as a lump sum.

There is only one exception to the requirement that death benefits must be paid from the fund and are able to be retained in the fund or rolled over. This occurs in the case of a pension which was being paid to the deceased at the date of death and became payable to surviving spouse. In these cases the spouse is able to commute the pension and roll it over to another fund or to another superannuation interest after the death benefit period has been satisfied.

Conclusion

Taking an interest in the ‘superannuation interest’ is an essential part of managing an SMSF. By not taking an interest in the ‘interest’ a client and possibly their dependants could be exposed to paying more tax than they are required to. As the late Kerry Packer once famously said, “Pay your taxes, just don't tip them. They're not doing that good a job.”

Graeme Colley is Director Technical and Professional Standards at the Self Managed Super Funds Professionals Association of Australia (SPAA). Keeping track of super interests unabridged.