It’s not uncommon to find conglomerate businesses in Korea and Japan with a large dominant shareholder (often a family), cross shareholdings, inefficient balance sheets with loads of cash or investments weighing on returns on equity, and low payout ratios.

In Korea, the Chaebols (a handful of family run conglomerates) dominate the business landscape, and cross shareholdings amongst the family’s business interests can resemble a Jackson Pollack painting.

Japan's moves to lift company returns

Japan has been on a pathway of reform for the last decade, but the pressure to lift corporate governance intensified in 2023 when the Tokyo Stock Exchange (TSE) set its sights on companies with an ROE of less than 8% and valuation of less than 1x book – almost half the stocks listed in Japan. These companies have been told to provide a plan of how they will, amongst other things, increase capital efficiency, returns and shareholder value via distributions – and lift price to book above 1x.

There’s no legal enforcement but Japanese companies are responding to the TSE’s threat to ‘name and shame’.

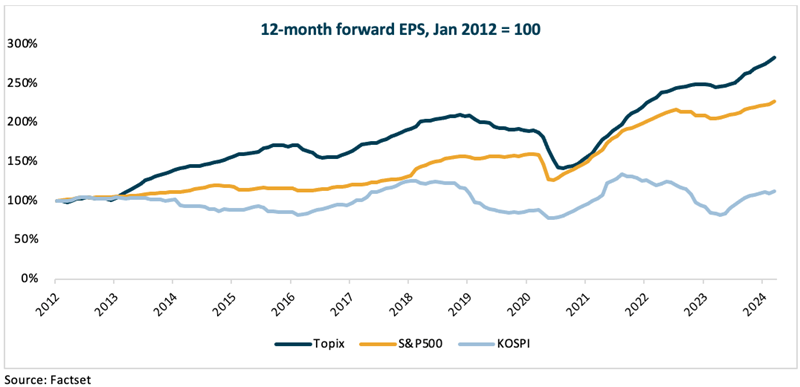

Today, more companies are communicating shareholder return targets, introducing return on capital and excess return KPIs, and are increasing diversity on their boards. The earnings growth of Japanese companies has been building for some time (Figure 1 – even outperforming US equities!) and now dividends and buybacks are also increasing.

Figure 1: TOPIX EPS growth has outperformed S&P over the last ten years

But Japan has had a phenomenal run in the 12 months since the TSE announced its carrot and stick policy – up 45% in local currency at writing.

The Nikkei has finally breached its previous all-time high set 35 years ago!

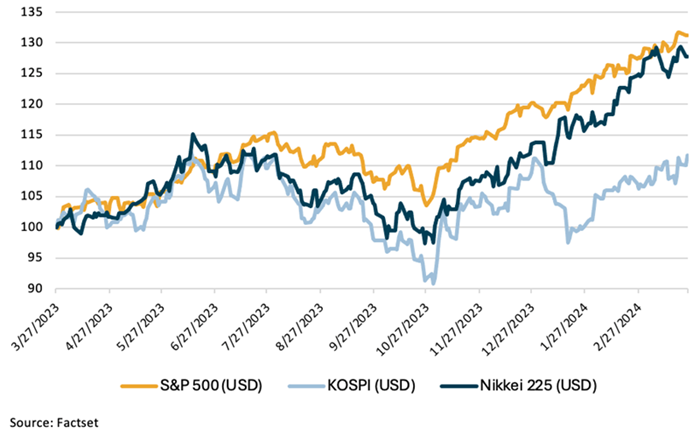

And even removing the benefit of the weak Yen, the Nikkei’s performance is only a whisker behind the S&P 500’s in USD-terms, without the benefit of Nvidia (Figure 2).

Figure 2: Pressure on corporate governance reform has driven Japanese equities

As Figure 2 shows, Korea (the KOSPI index) is being left behind its neighbour. And it’s not just the last 12 months. The KOSPI has underperformed the Nikkei over the last decade despite a higher economic growth rate.

Is Korea set to follow the Japanese playbook?

With 70% of KOSPI constituents priced at less than 1x book, Korean regulators look like they may be following the path carved by Japan with the recent announcement of their Value Up program.

In a similar vein, the rationale is to incentivise better use of capital, reduce cross shareholdings and improve shareholder returns. Korea’s Finance Minister has indicated tax incentives for corporates that increase dividends and/or cancel treasury shares will be implemented in 2024, as well as potentially cutting income tax on dividends for investors – another powerful incentive for the formidable Chaebols to increase distributions.

Also in discussion is a reduction in inheritance tax, which is known to be a key impediment to unwinding complex family crossholdings within the Chaebols. Any progress here, along with evidence that the National Pension Service is putting its weight behind the scheme, would be significant positive catalysts - The National Pension Service owns 10% of the Korean equity market.

Like Japan, Korean regulators have suggested they may publish a list of friendly and unfriendly companies, and non-compliance may ultimately risk de-listing – but time will tell how this policy unfolds, and how it will be enforced.

We must acknowledge there have been false starts around corporate governance reform before, and while it’s dangerous to think this time is different the regulator appears to be acting more forcefully. And maybe the performance of the Nikkei over the last 12 months is the kindling to start the fire.

A stock example: Hyundai Motor

We look for companies that are mispriced relative to their business resilience and their growth profile and we assess a company’s resilience based on 'Multiple Ways of Winning' – the more ways we can win from owning an investment, in all likelihood, the better the quality of the business franchise. Business resilience is a spectrum - some of our investments have more ways of winning than others – but we do have a minimum threshold. We won’t buy stocks with binary outcomes because that risks capital destruction.

To be blunt we’re not putting all our eggs in the Value Up basket. Instead, we’re focusing on companies with solid investment cases where Value Up represents another way we can win.

Hyundai Motor is a good example of this.

Source: Morningstar

The first element to consider for any global cyclical is where we are in the cycle. Demand for autos has been strong, and assuming no negative macro shocks we remain constructive around the cycle. As economies reopened after COVID we saw consumers, flush with fiscal transfers, wanting to buy cars but unable to do so due to supply chain constraints. On our forecasts, auto demand was curtailed by up to 30 million units, a material figure compared to pre-COVID global auto sales of around 90 million units. This supply-driven consumption deferral can continue to support auto demand, and autos are typically beneficiaries of falling short-term rates as financing becomes more affordable.

Hyundai with its strong mass market brand has taken market share over the last few years and is strengthening the brand further via new product launches (such as pushing into SUVs) and attractive designs in the premium segment. The company is well-positioned for decarbonisation with competitive EV technology and a compelling hybrid offer. This is important as hybrids today are proving more popular with consumers as they are more affordable than full battery electric vehicles without the anxiety over driving range. EVs and hybrids account for around 15% of Hyundai Motor’s total volumes giving them one of the highest electrified mixes of the incumbent automakers. The company derives around 40% of its profits from the US and has relatively little exposure to China, where domestic supply has significantly increased.

We expect some normalisation in price and mix across the industry as supply chains have fully normalised, but this is already discounted into valuations across the sector. At 5x earnings and 0.5x book, Hyundai Motor is cheap relative to peers.

Finally, Hyundai Motor shareholders will benefit from any enforcement of the Value Up initiative given the idle assets on the balance sheet. The company has more than 25% of its market cap in cash as well as investments in related entities and property assets. Any progress here would lift the company’s ROE (currently 7% through the cycle) and with it, the valuation. The company can also easily lift distributions to shareholders from the current 25% payout ratio.

Alison Savas is Investment Director and a Portfolio Manager at Antipodes Partners. Antipodes is affiliated with Pinnacle Investment Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers from Pinnacle and its affiliates, click here.