We expect global mid-cap equities to continue generating healthy returns for investors, although at a more moderate and sustainable level relative to the gains since the bottom of the pandemic-induced crash of March 2020. The initial phase of a market upturn is usually driven by expansion, as investors anticipate the recovery. This period usually produces explosive gains. However, as the economy recovers and business fundamentals improve, the earnings recovery takes over as the primary driver of shareholder returns.

This is where we are now. There is usually some increase in volatility as we move into this phase and it is quite typical to have mild market pullbacks from time to time.

The benefit that the equity market still holds is its real earnings recovery and growth outlook relative to low-yielding bonds.

Potential surprises in 2022, positive or negative

In our 2021 outlook, we cautioned that inflation was likely to pick up, and it did. Some of this was due to temporary or transient factors that would subside over time once the lockdowns ended and manufacturing and global supply chains normalised. In recent weeks, company management teams have warned about rising labour costs, which tend to be sticky. Labour cost is a key component of inflation, alongside housing.

Bond markets have already anticipated that central banks will need to act sooner than they had previously communicated. However, equity markets have yet to adjust, as rising yields impact equity valuations, while increased labour costs can impact corporate profit margins. This could lead to some choppiness and volatility as the equity markets digest this new reality.

Our holistic investment approach in 2022 will consider the risk of broad-based inflation, higher debt costs, rising commodity and property prices, and tighter labour markets, as well as increasing wages and higher levels of competition.

The themes and sectors of opportunities and risks

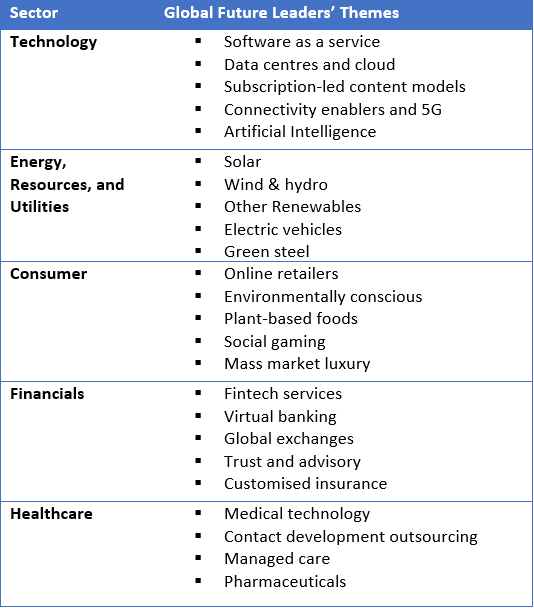

The Global Future Leaders strategy scans the global small and mid-cap universe for the leaders of tomorrow and explores a range of themes that are expected to experience structural growth.

The table below provides insight into the sectors and associated themes that we are exploring.

The highest levels of conviction and avoidance

The best opportunities lie in high-quality companies with competitive advantages in good industry structures. These are managed by competent individuals and bought at reasonable prices. Such businesses will have some inherent pricing power, allowing them to protect margins by passing on increases in labour costs to consumers.

Areas that we would deem vulnerable are loss-making businesses or those with valuations that exceed their peers. The former require access to outside capital to keep funding their aggressive growth ambitions at a time when this funding is becoming more expensive. At the same time, the latter may experience significant corrections in their stock prices as discount rates continue to increase.

The impact of sustainability factors on returns

Sustainability is one of the three key pillars we use to assess companies (the other two being viability and credibility). In looking for the future leaders of tomorrow, we are primarily interested in finding firms that operate under sustainable business models.

Businesses that harm the environment fail to respect their employees, customers or society at large. Furthermore, these companies do not honour the rights of minority shareholders and are filled with executives whose primary aim is to enrich themselves at the owners' expense. In our view, these names have a finite corporate life.

Within the context of the portfolio and at an individual stock level, we will refuse to invest in harmful corporations that include tobacco or cluster munitions whilst simultaneously investing in businesses that enable clean energy (e.g. solar). Our carbon footprint at a total portfolio level is a fraction of that seen in our benchmark.

The Global Future Leaders strategy scans the global small and mid-cap universe for the leaders of tomorrow and explores a range of themes that are expected to experience structural growth. We have an acute focus on sustainability, pricing power, market structures, brand strength, product differentiation and valuation discipline.

James Abela and Maroun Younes are Portfolio Managers of the Fidelity Global Future Leaders Fund at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2021 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.