There’s a school of thought in parts of the investment community that the increasing focus on corporate sustainability is the ultimate win-win. This group contends that if employers pay their people more, it will result in higher sales and productivity and will ultimately reduce costs. They reason that cutting emissions will not only help the planet, but also bolster companies’ bottom lines.

Unfortunately, the reality couldn’t be further from the truth. Sustainability isn’t free, and in our view, efforts to become more sustainable will challenge many companies and perhaps even bankrupt some of them.

Accelerating trends

The pandemic accelerated many well-documented secular trends such as digital media, cloud computing and work-from-home. But it also hastened less obvious ones, such as loneliness, wealth inequality and interestingly, investor demand for changes in corporate behaviour.

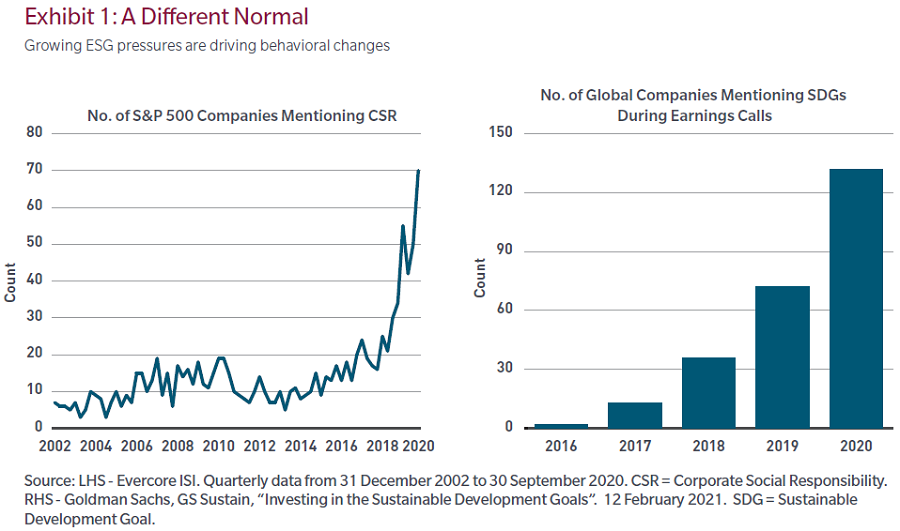

While we can point to numerous data points to illustrate mounting investor interest in ESG (Environment, Social and Governance) through fund flows, to us, what’s more noteworthy is the growing recognition by management teams of the need for more sustainable business practices.

For instance, as shown on the left-hand side of Exhibit 1, there was a jump in the number of S&P 500 companies that referenced corporate social responsibility (CSR) in quarterly earnings calls during 2020. The right-hand side of the exhibit looks at the number of global companies that referenced, during earnings calls, any of the 17 Sustainable Development Goals (SDGs), a set of global objectives agreed to by the UN General Assembly in 2015 to improve the quality of life worldwide. It shows a similarly large year-on-year increase.

Why sustainability matters

There is a long list of reasons why civil society, governments and special interest groups are concerned with ESG issues. The most notable one, of course, is that addressing them is critical to the long-term success of our global community. The ramifications, for example, of issues such as runaway climate change or rising income inequality, if left unresolved, are likely to be profoundly negative.

Our point of emphasis, however, is the changing reaction function of companies. Now that investors are focusing on sustainable business practices, management teams have begun to pay attention. And that matters. A lot.

Materiality is key

Sustainability will drive new business opportunities for some while exacerbating risks for others, leading to substantial divergences in the long-term enterprise value of many companies. But what is largely lost in the current ESG narrative is financial materiality. Which of course affects financial asset prices.

A sharp rise in the US minimum wage, for instance, would no doubt challenge a number of business models. Certain retailers would face particular challenges. If companies in this sector are going out of business at an alarming rate while paying the US federal minimum wage of $7.25 an hour, how can they possibly hope to survive if the wage increases to $15?

Some retailers will be able to adapt due to their competitive positioning or other strengths, and in fact some already have, with bonuses and salary increases since the pandemic began, but many will find that sustainability concerns pose major challenges to their profitability.

Producers of fossil fuels and companies reliant on their use will also face high hurdles. Many in the oil industry are banking on a growing middle class in emerging markets to underpin demand and help maintain the status quo. However, over two-thirds of oil demand is tied to automobiles powered by internal combustion engines, and we believe that mode of propulsion will become antique in the not-too-distant future. Cumbersome organisations that are slow to recognise and adapt to this change are unlikely to survive.

Many incumbents will struggle

Looking back over the past 100 years, one thing is clear: Industry incumbents don’t fare well in the face of disruptive technologies. And the move toward sustainability is a disruptive force akin to the industrial revolution or the advent of the internet. It will define society and the investment landscape for decades.

But it won’t be free. There will be winners and some very big losers. This new paradigm is unfolding during a period in which risk premia are at all-time lows, underlining the importance of allocating capital responsibly.

Robert Wilson is a Research Analyst, and Robert M. Almeida is a Global Investment Strategist and Portfolio Manager at MFS Investment Management. This article is for general informational purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.