The Retirement Income Covenant (RIC) was introduced in July 2022 and requires all super funds to develop a retirement income strategy to assist their members in meeting their retirement needs. However, progress made by funds in developing their retirement income strategies has been slow and uneven, as highlighted by two joint reviews by APRA and ASIC found here and here.

Our own discussions with super funds finds something similar. We are observing high dispersion in the progress in developing retirement offerings and the quality of those offerings across funds. Some are well-advanced, while others are lagging badly. No super fund has everything in place to assist all their members with all their retirement needs.

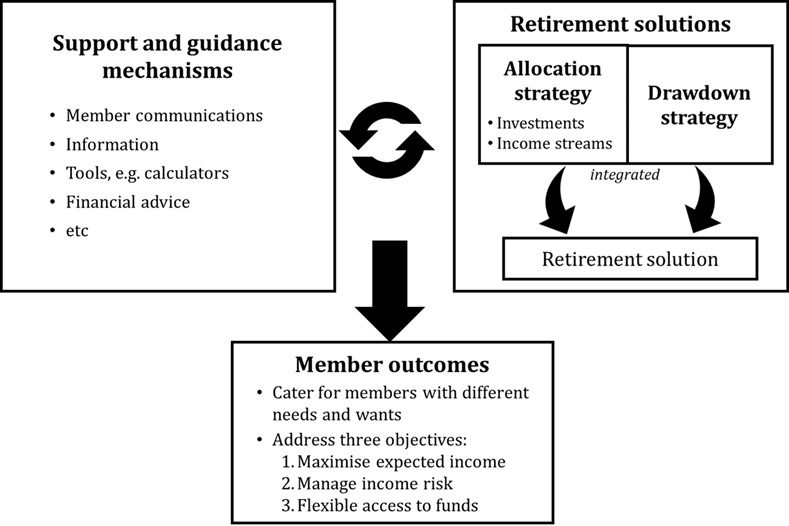

A super fund retirement income strategy should assist fund members through a range of retirement solutions that convert assets into income plus support and guidance mechanisms (see diagram below). However, no super fund yet has the capability to offer bundled solutions comprising investments, lifetime income products and a drawdown plan that are tailored to the needs of the member (or member cohorts). Support and guidance mechanisms are also still being built out. Members have to either seek personal financial advice on how to combine these building blocks or do it for themselves. Many fund members are left floundering as a result.

Components of retirement income strategies offered by super funds

What’s going on here?

Assisting retirees is tough as their personal circumstances can differ in significant ways. Retirees vary in their available assets, access to the Age Pension, household situation, and more. They differ in how they engage with financial decisions. Both the type of retirement solution and support and guidance they need can thus vary greatly. Super funds have to develop a capacity for ‘personalisation’ to cater for these differences. Developing the products, processes and systems takes time and effort, and is quite costly.

However, something else is happening other than development lags. The commitment to delivering a quality retirement offering varies considerably across funds.

Some super funds have a very low portion of members and assets in the retirement phase. For example, APRA data for June 2023 reveals that 27 of the top 50 funds had less than 5% of member accounts in retirement products. And as mentioned above, retirement is costly. There is also uncertainty over how the regulations around retirement might evolve. And super funds have other pressing priorities to deal with, e.g. mergers, organic growth, cybercrime. In effect, some funds face a weak business case to commit a lot of resources to pushing ahead on retirement.

Meanwhile, the RIC only requires super funds to have a retirement income strategy, not necessarily to produce a good one. In this context, the variable progress across super funds is not all that surprising. The problem that arises is that retired or retiring members of laggard funds may be left behind.

Retirement licensing would help move the industry forward

Establishing a retirement licensing regime would help get the super industry progressing in the right direction. It is important that super funds are effective players in retirement, especially as it is unlikely that every retiree will be able to access personal advice from a financial planner. We set out our case in a ‘green paper’ that can be found on the Conexus Institute website here, and welcome any comments. A licensing regime would basically work as follows.

Super funds would be required to meet licensing conditions before being permitted to offer retirement solutions to their members. The licensing conditions could be based around having in place the range of capabilities needed to supply suitable retirement solutions and guidance services to their members, including meeting their individual needs. The regime would formally commence at some future date, allowing funds time to prepare.

Super funds would then face a choice. They could undertake to commit to building the required capabilities within the specified time frame. Or they could decide not to participate in the retirement market, or perhaps defer participation to a later time.

Retirement licensing can offer a number of benefits:

- Licensing would get funds that do commit to expeditiously push ahead in delivering on retirement.

- Funds that do not want to commit can opt-out. One issue with the RIC is that it requires all funds to develop a retirement income strategy regardless of whether or not it makes sense for them to do so. Giving funds a route out will reduce the risk of some funds moving forward with low-ball offerings.

- The licensing conditions could be used to establish minimum standards. This helps overcome another issue with the principles-based RIC – it is silent on required standards.

- Regulatory uncertainty over what is expected of super funds would be reduced. We envisage that the licensing conditions might be linked to how funds will be assessed by the regulators.

There are of course some issues. One is that procedures would be required for non-licensed funds to ‘hand-off’ members as they approach and then enter retirement. Some early comments we have received are around increased regulatory burden on the industry. While there will be cost involved in administrating the licensing regime, our view is that licensed funds will only be asked to do what they should be doing anyway, while regulatory burden is actually reduced for funds that opt-out. Finally, retirement licensing should help reduce the overhang of regulatory uncertainty.

A retirement licensing regime would be a powerful mechanism for ensuring that only super funds that are committed to delivering a retirement income strategy to a satisfactory standard are operating in the retirement market. We see this as important for ensuring that the needs of all retirees are adequately served, given that many will probably be relying on their super fund in retirement.

David Bell is the Executive Director of The Conexus Institute. Geoff Warren is a Research Fellow with the Conexus Institute, and an Honorary Associate Professor at the Australian National University.